401(K) BLUNDERS TO AVOID

By MacKenzy Pierre

The estimated reading time for this post is 294 seconds

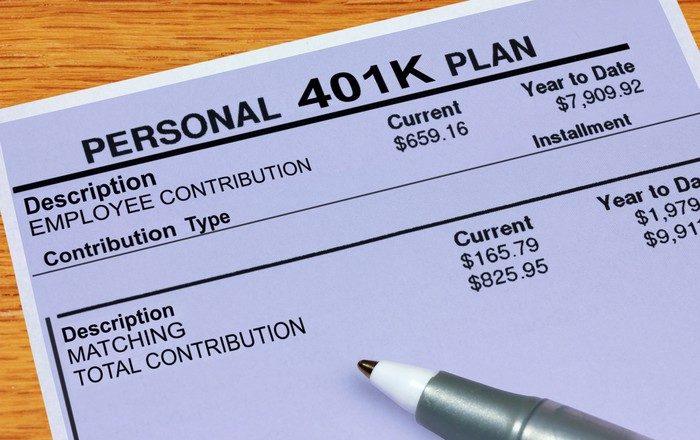

401(k) blunders to avoid to ensure a comfortable retirement. With the disappearance of defined-benefit pensions in the workforce, employers switched another obligation to workers. That obligation is not something that they can take lightly because their lifestyle in retirement depends solely on how serious they take it. Employees need to know how to manage their 401(K) efficiently and effectively.

The Old Days: Defined-benefit Pensions

Reagan and Thatcher’s years brought with them the deregulation of everything and assault on labor unions. Ronald Reagan was the president of the United States from 1980 to 1988, and Margaret Thatcher was the prime minister of the United Kingdom around that same period.

Corporations stopped investing in their communities, seeing their employees as capital, and filing full tax returns and paying taxes to their local government. They convinced themselves that their responsibility is solely to maximize shareholder values.

Defined-benefit pensions were one of the first employee benefits that employers replaced with defined-contribution plans. The latter is cost-saving for the employers and makes every single employee Chief Investment Officer of their retirement accounts.

Pension Plans

The majority of big employers used to provide pensions to their employees. Employers such as Sears Roebuck, General Electric (GE), and AT&T used to contribute to the plan, and employees would receive a monthly installment when they retired for the rest of their life. Corporations were responsible for the asset allocations, assumed the investment risks, and guaranteed a return.

A small percentage of Fortune 500 companies are still offering defined-benefit pensions. However, the overwhelming majority of employers now provide defined-contribution plans, including 401(k) and 403(b), to their employees. Those plans are cost-savings for the companies, and they switch the responsibility from the employer to the employee.

Defined-contribution Plans

In 1978 congress passed, and President Jimmy Carter signed the Revenue Act, which created 401(k) and allowed employees a tax-free way to defer compensation. Employees are no longer guaranteed a flat amount for life after retirement.

Employees have their accounts. The employer may or may not have a matching principle, which the employer can contribute to that account as well. However, unlike the defined-benefit pension, the employer’s contribution is not mandatory. The 401(k)-employer match can come and go.

Employees have now assumed the investment risks and are responsible for the asset allocations of their retirement account. They often make serious blunders while managing their 401(k) and other qualified and non-qualified retirement accounts. Here are the four 401(k) blunders to avoid:

Not Participate in the Plan

Defined-contribution plans are the most popular employer-sponsored retirement plans in the United States, but more than a third of corporate employees don’t even join their plans according to Fidelity.

Most companies follow the matching principle, which means the employer contributes a certain amount or percentage to every dollar that the employee defers to the plan. When eligible employees don’t participate in their employer’s defined-contribution plan, they are technically leaving free money on the table.

According to Glassdoor, Google offers a 401(k) plan that matches 50 percent of the employee contribution, up to $8,250, meaning that Google will give you $4,125 ($8,250×0.50) in free money if you contribute the maximum amount.

Google’s employee who chooses not to participate in the plan would leave $4,125 free money on the table. You need to figure out the maximum amount your employer is willing to match and contribute that amount to your 401(K) or your current profit-sharing plan.

Do Not Diversify

With just three investment options, 401(k) administrators comply with ERISA. The Employee Retirement Income Security Act of 1974 (ERISA) sets minimum standards for most voluntarily established retirement and health plans in private industry.

According to Fidelity, one-quarter of all plan participants have their entire account in a single investment option. Diversification is the cardinal rule of investment. If you want a decent return and reduce investment-specific risk, you have to invest your retirement funds in more than one investment vehicle.

Hold too many of Your Employer’s Stocks

Too many employees hold too many of their employer’s stock. Enron’s employees who invested most of their retirement funds in Enron’s stock lost everything when the company collapsed and filed for bankruptcy.

Even if you are bullish on your company and love what you do, the cardinal rule is still applied. You should never put all your eggs in one basket. Diversification protects you against idiosyncratic risk; you should always diversify.

Cash Out after Leaving the Job

401(K) is your account, which you can take with you if you end up leaving your job for whatever reason. Too many people cashed out their 401(k) after they left their job. Defined-contribution plans let you contribute pretax income to the plan.

When you cash out the plan before you turn 59 ½, you have to pay regular income tax and a 10% penalty. So, if you are in the 25% tax bracket, you have to pay a 35 percent tax on the amount being withdrawn from the profit-sharing plan.

If you have $50,000 in your 401(k) plan and decide to cash it out early, you will pay $17,500 ($50,000×0.35) in taxes and penalties. You have 60 days to rollover your employer-sponsored retirement plans without paying any taxes, penalties, or both.

Don’t Repay 401(k) Loan

If you need cash and don’t want to cash out your 401(k) due to taxes and penalty, you can reach out to your 401(k) administrator or HR Department and get a loan. You are borrowing from yourself. The loan charges interest around 8%, and you have five years to pay it back.

Many borrowers failed to pay back the 401(K) loan within five years. The loan becomes a withdraw, and you have to pay income tax and penalty on the outstanding amount.

Sometimes, you can withdraw from your defined-contribution plan (s) without income tax and a penalty for a down payment on a home. Check with your 401(k) administrator or HR Department before making the withdrawal.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing to Chinese Real Estate, there have been about nine notable global asset bubbles since the Great Depression. The most recent was the Special Purpose Acquisition...

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing market continues to navigate a complex landscape shaped by fluctuating interest rates, varying home prices, and evolving buyer behavior. Understanding the potential mortgage costs is...

Leave Comment

Cancel reply

In Search of the Next Asset Bubble

Biggest Financial Crimes: Washington Mutual Financial Scandal

How Much is a Mortgage on a $700,000 House

Gig Economy

American Middle Class / Jul 20, 2024

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing to Chinese Real Estate, there have been about nine notable global...

By MacKenzy Pierre

Fraud & Financial Crimes / Jul 16, 2024

Biggest Financial Crimes: Washington Mutual Financial Scandal

The estimated reading time for this post is 249 seconds Biggest Financial Crimes: Washington Mutual Financial Scandal Washington Mutual, once the largest savings and loan association...

By Article Posted by Staff Contributor

American Middle Class / Jul 16, 2024

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing market continues to navigate a complex landscape shaped by fluctuating interest...

By MacKenzy Pierre

American Middle Class / Jul 14, 2024

Financial Literacy: Building a Foundation for Financial Well-being

The estimated reading time for this post is 206 seconds Financial literacy is a critical skill that empowers individuals to make informed decisions about their financial...

By Article Posted by Staff Contributor

Stock News / Jan 02, 2024

Re-Drafting the 2023 IPO Class

The estimated reading time for this post is 147 seconds The Initial Public Offering (IPO) market is a significant barometer for economic health and investor sentiment. ...

By MacKenzy Pierre

Stock News / Dec 29, 2023

2024 IPO Draft Class

The estimated reading time for this post is 151 seconds 2024 IPO Draft Class: Ranking the Top Prospects Following the pattern of last year’s tumultuous market...

By MacKenzy Pierre

Stock News / Dec 22, 2023

Build Wealth with Boring Investments

The estimated reading time for this post is 314 seconds Due to their boredom, long-term, low-cost, and passive investing strategies have lost ground to more speculative...

By MacKenzy Pierre

Finance / Dec 10, 2023

Yes,Bitcoin Is a Financial Asset

The estimated reading time for this post is 239 seconds Yes, Bitcoin is a financial asset, but it’s not ready yet to be inside your 401(k),...

By MacKenzy Pierre

Business / Nov 24, 2023

Cash Management for Growing Businesses

The estimated reading time for this post is 147 seconds Cash Management for Growing Businesses: Navigating the Waters of Growth and Liquidity In the early stages,...

By MacKenzy Pierre

Fraud & Financial Crimes / Nov 21, 2023

Biggest Financial Crimes: Adelphia

The estimated reading time for this post is 255 seconds Biggest Financial Crimes: Adelphia Adelphia Communications Corporation, once a titan in the cable industry, became synonymous...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jul 20, 2024

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing...

Fraud & Financial Crimes / Jul 16, 2024

Biggest Financial Crimes: Washington Mutual Financial Scandal

The estimated reading time for this post is 249 seconds Biggest Financial Crimes: Washington Mutual...

American Middle Class / Jul 16, 2024

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing...