4 TYPES OF BAD CREDIT REPORTS AND HOW TO FIX THEM

By MacKenzy Pierre

The estimated reading time for this post is 500 seconds

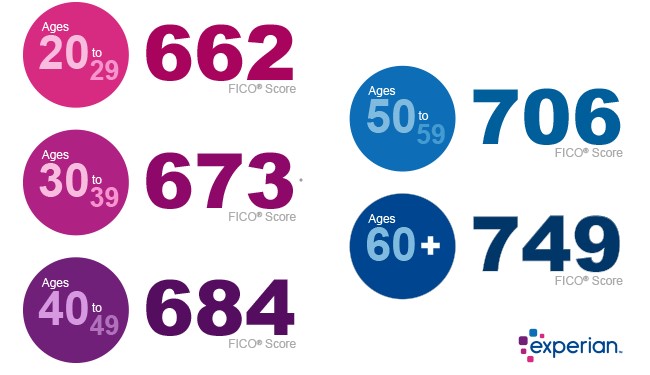

According to data from Experian, the average credit score in America is 688, which is one of the big 3 credit agencies. Equifax and Transunion are the other two bureaus. Baby boomers tend to have the highest credit score, while younger millennials often have the lowest. The FICO score ranges from 300 to 850. The screenshot below shows the main components of your credit score calculation.

Despite the average good credit score, more than half of Americans are either credit invisible or have poor credit, according to a study by Prosperity Now.

The median American credit score, not the average, shows the financial struggles of many consumers. Below are 4 types of bad credit reports and how to fix them:

- Bad Credit Report Due to Bankruptcy and Public Record

- Bad Credit Report due to Collections and Past-due Accounts

- Bad Credit Report Due to High Credit Utilization

- Bad Credit Report Due to Insufficient Credit

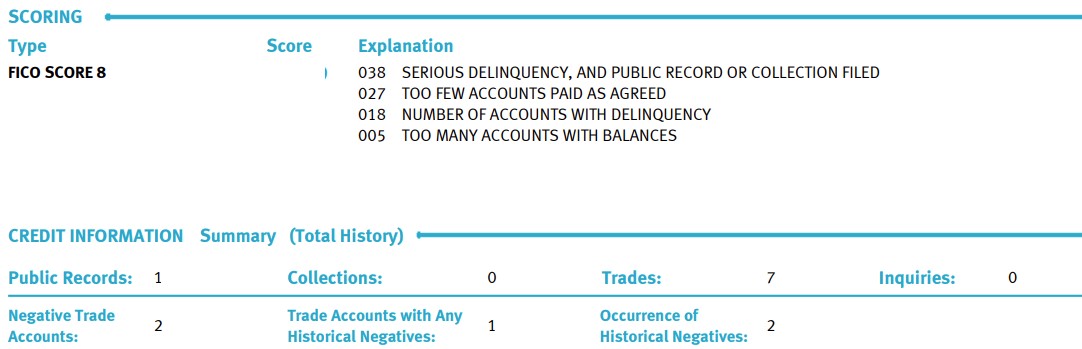

Bad Credit Report Due to Bankruptcy and Public Record

Civil judgments and tax liens are no longer factored into credit scores. The only derogatory public record that should appear on your credit report is bankruptcy.

Chapter 13 or 7 Bankruptcy will show on your credit report and negatively impact it for 10 years. As a result, your credit score can drop to as much as 250 points due to bankruptcy reporting.

Although civil judgments no longer appear on your credit report, they can be sources of your bad credit report.

The creditor that gets the judgment against you would probably report the account being 30, 60, and 90 days past due, charge it off and send it to a collections agency before they decided to sue you.

Fix Bad Credit Report Due to Bankruptcy and Public Record

With a bankruptcy on your credit report, engaging in the credit market will be costly. For Example, People fresh out of bankruptcy pay an average 22 annual percentage rate (APR) on car loans.

It would be best if you started building your credit the moment that the bankruptcy is discharged. The best way to start this process is to get a secured credit and signup for a reputable self-lender.

Secured credit is a refundable security deposit. The limit does not matter much. You need to get a secured credit card and maintain a balance of no more than 30% of the approved amount.

For example, if you deposit $200 for a credit line for the same amount, the outstanding balance you keep on the card cannot be higher than 60 dollars or 30% of the available credit limit.

A self-lender provides credit-builder loans without money upfront. You choose your desired payment.

Let’s say $30 each month. You send the monthly payment to the self-lender, which deposits it in an FDIC-insured bank. The self-lender reports your tradeline or account to all three of the credit agencies each month.

At the end of your agreed terms, you will get all your deposits back minus the self-lender’s fees.

Between the secured credit card and the self-lender, you will have two new revolving trades reporting positive remarks to your credit reports.

You need to sign for UltraFICO score and Experian Boost; the latter factors how you manager your checking and savings accounts, and the former factors your on-time utility payments.

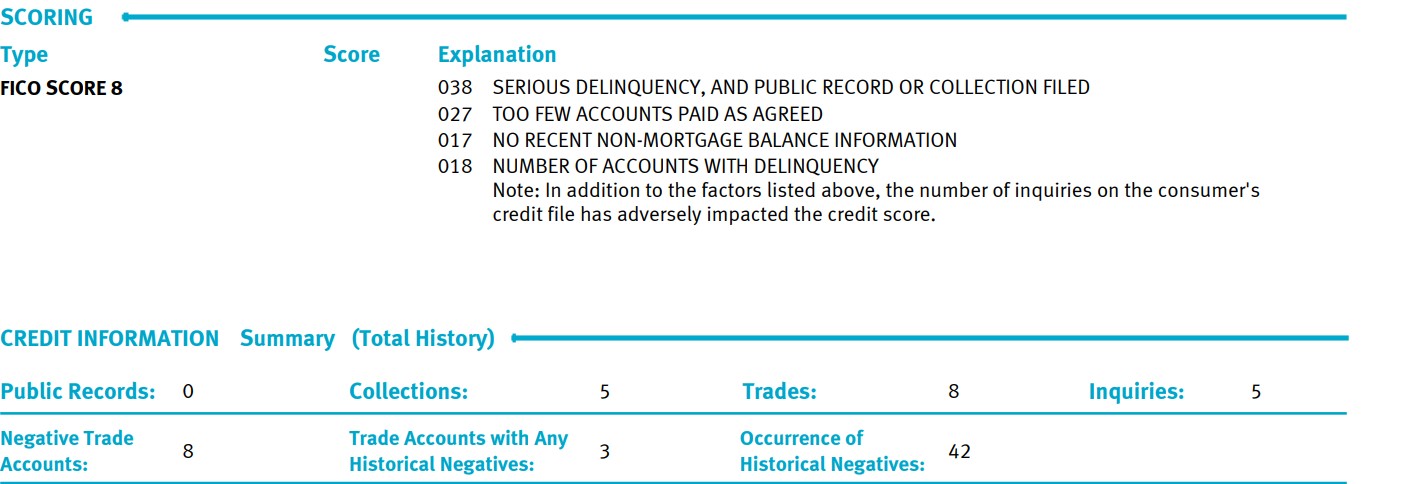

Bad Credit Report due to Collections and Past Due Accounts

Your payment history is the biggest factor in calculating your FICO® Score 8. As a matter of fact, payment history is 35% of your credit score calculation. Missing payments and defaulting on accounts will definitely damage your credit report.

Most bad credit reports are due to payment history. People overextending themselves, then they get into trouble.

Fix Bad Credit Report due to Collection and Past-Due Accounts

The first thing you need to do if your credit report is bad due to collection and past-due accounts is to draft a personal budget, which will force you to get intimated your cash inflows and outflows.

Second, you have to reach out to your creditors and inform them of your intention to meet your obligations. You can’t escape that.

Some people waste their money on credit repair agencies. Improving your credit is simple. You have to pay what you owe and dispute erroneous information.

When it comes to collection accounts, you have to call the agency and verify its validity. After verifying the validity of the debt, ask them for a settlement.

Most collection agencies settle for 70 cents or less on a dollar. Before making any payments, you need to request a letter with the details on the settlement offer.

As far as the past-due accounts, you have to let your creditors know about your financial struggles and ask for forbearance or deferment. You can also ask them to reduce your interest rate. Not talking to your creditors when you are experiencing financial hardship is the worst thing you can do.

A secured credit and signup for a reputable self-lender can also add positive remarks to your credit report while dealing with your collection agencies and lenders.

Secured credit is a refundable security deposit. The limit does not matter much. You need to get a secured credit card and maintain a balance of no more than 30% of the approved amount.

For example, if you deposit $200 for a credit line for the same amount, the balance you keep on the card cannot be higher than $60 or 30% of the available credit limit.

A self-lender provides credit-builder loans without money upfront. You choose your desired payment.

Let’s say $30 each month. You send the monthly payment to the self-lender, which deposits it in an FDIC-insured bank. The self-lender reports your tradeline or account to all three of the credit agencies each month.

At the end of your agreed terms, you will get all your deposits back minus the self-lender’s fees.

Between the secured credit card and the self-lender, you will have two new revolving trades reporting positive remarks to your credit reports.

You need to sign for UltraFICO score and Experian Boost; the latter factors how you manager your checking and savings accounts, and the former factors your on-time utility payments.

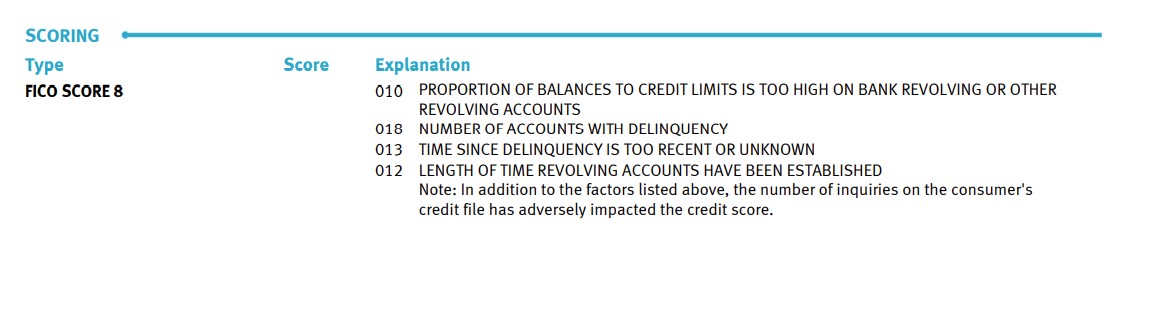

Bad Credit Report Due to High Credit Utilization

Forty percent of Americans don’t have $400 in the bank for an emergency. That factor is really affecting their credit report.

How you use revolving credit and how much of it you use can impact your credit report tremendously. The fact that 30% of your credit score calculation is how you use your credit cards and other revolving debts.

To have the best positive impact on your FICO® Score, your overall credit utilization rate has to be around 30% or less.

For example, if you have two credit cards with a $1,000 credit limit each, the outstanding balance you keep on both cards cannot be higher than $600 ($2,000 x 0.30) dollars or 30% of the available credit limit. It’s perfectly okay to have a $600 outstanding balance on one card and $0.0 on the other card.

Fix Bad Credit Report Due to High Credit Utilization

A high credit utilization rate means that you rely on your credit cards and other revolving accounts to live. So, the best way to see what’s going on and develop a solution is to draft a personal finance budget.

While drafting a personal finance budget, you will see what areas you need to cut back on. Sometimes, your cash inflow is just too low that you need to get a better-paying job, a side hustle, or both.

Reach out to your credit card companies and ask them to reduce the APR on your cards, which will reduce your interest expense.

You can draw down an emergency fund to pay down debts if your job is secured.

If you realized that there is no way that you can reduce your outstanding debts after you work on your personal finance budget, bankruptcy might be your best option.

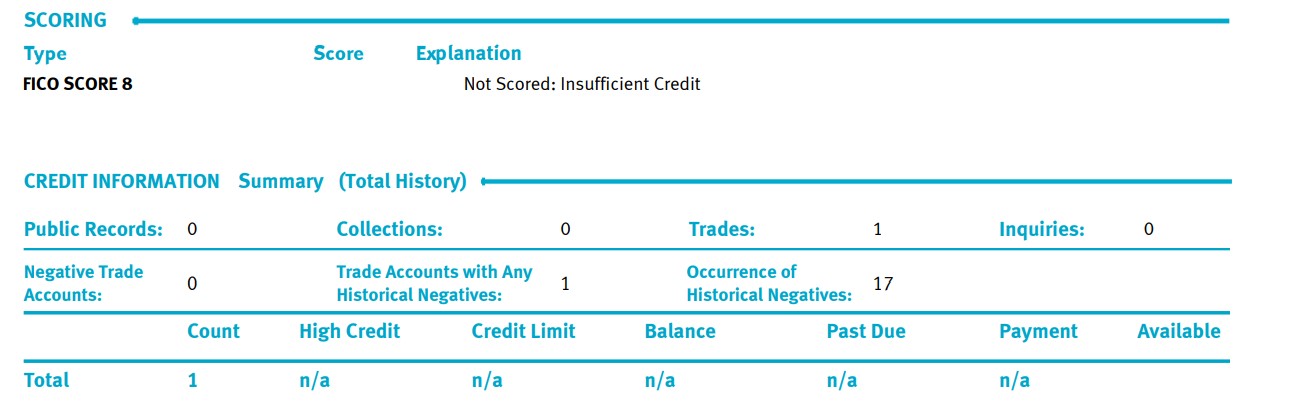

Bad Credit Report Due to Insufficient Credit

Building great credit is part of the wealth-building strategy. It would help if you had an excellent credit score to access cheap capital, which will allow you to fund your financial goals and dreams.

Without a credit history, you will struggle to get a mortgage, car loan, and even business loan from the Small Business Administration (SBA)

Fix Bad Credit Report Due to Insufficient Credit

You can have a life without credit, but you need an excellent credit score if you want to start a business and build wealth. There are ways to improve your credit score without debt:

It would be best to have a secured credit and signup for a reputable self-lender to add positive remarks to your credit report while dealing with your collection agencies and lenders.

Secured credit is a refundable security deposit. The limit does not matter much. You need to get a secured credit card and maintain a balance of no more than 30% of the approved amount.

For example, if you deposit $200 for a credit line for the same amount, the balance you keep on the card cannot be higher than $60 or 30% of the available credit limit.

A self-lender provides credit-builder loans without money upfront. You choose your desired payment.

Let’s say $30 each month. You send the monthly payment to the self-lender, which deposits it in an FDIC-insured bank. The self-lender reports your tradeline or account to all three of the credit agencies each month.

At the end of your agreed terms, you will get all your deposits back minus the self-lender’s fees.

Between the secured credit card and the self-lender, you will have two new revolving trades reporting positive remarks to your credit reports.

You need to sign for UltraFICO score and Experian Boost; the latter factors how you manager your checking and savings accounts, and the former factors your on-time utility payments.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing to Chinese Real Estate, there have been about nine notable global asset bubbles since the Great Depression. The most recent was the Special Purpose Acquisition...

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing market continues to navigate a complex landscape shaped by fluctuating interest rates, varying home prices, and evolving buyer behavior. Understanding the potential mortgage costs is...

20 Comments

Leave Comment

Cancel reply

In Search of the Next Asset Bubble

Biggest Financial Crimes: Washington Mutual Financial Scandal

How Much is a Mortgage on a $700,000 House

Gig Economy

American Middle Class / Jul 20, 2024

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing to Chinese Real Estate, there have been about nine notable global...

By MacKenzy Pierre

Fraud & Financial Crimes / Jul 16, 2024

Biggest Financial Crimes: Washington Mutual Financial Scandal

The estimated reading time for this post is 249 seconds Biggest Financial Crimes: Washington Mutual Financial Scandal Washington Mutual, once the largest savings and loan association...

By Article Posted by Staff Contributor

American Middle Class / Jul 16, 2024

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing market continues to navigate a complex landscape shaped by fluctuating interest...

By MacKenzy Pierre

American Middle Class / Jul 14, 2024

Financial Literacy: Building a Foundation for Financial Well-being

The estimated reading time for this post is 206 seconds Financial literacy is a critical skill that empowers individuals to make informed decisions about their financial...

By Article Posted by Staff Contributor

Stock News / Jan 02, 2024

Re-Drafting the 2023 IPO Class

The estimated reading time for this post is 147 seconds The Initial Public Offering (IPO) market is a significant barometer for economic health and investor sentiment. ...

By MacKenzy Pierre

Stock News / Dec 29, 2023

2024 IPO Draft Class

The estimated reading time for this post is 151 seconds 2024 IPO Draft Class: Ranking the Top Prospects Following the pattern of last year’s tumultuous market...

By MacKenzy Pierre

Stock News / Dec 22, 2023

Build Wealth with Boring Investments

The estimated reading time for this post is 314 seconds Due to their boredom, long-term, low-cost, and passive investing strategies have lost ground to more speculative...

By MacKenzy Pierre

Finance / Dec 10, 2023

Yes,Bitcoin Is a Financial Asset

The estimated reading time for this post is 239 seconds Yes, Bitcoin is a financial asset, but it’s not ready yet to be inside your 401(k),...

By MacKenzy Pierre

Business / Nov 24, 2023

Cash Management for Growing Businesses

The estimated reading time for this post is 147 seconds Cash Management for Growing Businesses: Navigating the Waters of Growth and Liquidity In the early stages,...

By MacKenzy Pierre

Fraud & Financial Crimes / Nov 21, 2023

Biggest Financial Crimes: Adelphia

The estimated reading time for this post is 255 seconds Biggest Financial Crimes: Adelphia Adelphia Communications Corporation, once a titan in the cable industry, became synonymous...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jul 20, 2024

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing...

Fraud & Financial Crimes / Jul 16, 2024

Biggest Financial Crimes: Washington Mutual Financial Scandal

The estimated reading time for this post is 249 seconds Biggest Financial Crimes: Washington Mutual...

American Middle Class / Jul 16, 2024

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing...

Pingback: HOW TO FINANCE A CAR - Personal Finance - %

Pingback: What Is a Bad Credit Score and How Do You Fix It - FMC

Pingback: You Can't Build Generational Wealth If You Are Broke - FMC

Pingback: Are You a Deadbeat If You Have Bad Credit - American Middle Class

Pingback: Credit Card Sign-Up Bonus or SUB - Credit Cards

Pingback: 4 types of bad credit reports and how to fix them - ArticleCity.com

Pingback: All You Need to Know about Buy Now Pay Later companies - FMC

Pingback: How to Build Credit as a College Student - FMC

Pingback: Build Your Credit for Free - Personal Finance

Pingback: Do You Know the Interest Rate On Your Credit Card - Credit Cards

Pingback: Credit Card Fixed-Interest Loans: Explained - Credit Cards

Pingback: The Complete Home Buying Guide - Real Estate

Pingback: How to Overcome Intergenerational Poverty - Personal Finance

Pingback: Charge Offs, Collections, & Judgments - Personal Finance

Pingback: We Should Teach Financial Literacy to All Americans? - FMC

Pingback: Debt collection - Personal Finance - FMC

Pingback: 10 Ways Black Entrepreneurs Can Access Capital - FMC

Pingback: What Is Money Management - FMC

Pingback: Refinance Your Mortgage and Save - Real Estate

Pingback: Foreclosure Filings Increasing Across America - Real Estate