How to Pick Investments for Your 401(k)

By Article Posted by Staff Contributor

The estimated reading time for this post is 328 seconds

The modern world shows a higher degree of uncertainty. You can’t anticipate what might happen the next day that could jeopardize your financial position. In such a bleak situation, it becomes necessary to channelize your retirement funds in safe investment vehicles. Enrolling in the 401(k) turns out to be the best plan for your future. Pick investments for Your 401(k) is the most vital part of your investment planning.

However, choosing the right investments is vital. While the current economic time warrants wise investment decisions, it offers the best options. You may now choose between various options to multiply your earnings. Many people get worried about the wide variety of investments. If this is your situation, don’t fret. Picking your 401(k) is more straightforward than it appears. The following guide will help you select investments for your 401(k).

Tips for picking investments for your 401(K)

Most people get pressed when making their choice. To avoid such a scene, do away with fear. Remember that you’re taking a big step – investment. At this point, don’t bother where you should invest. You don’t want the best fund. Instead, you need one or a few funds that may kick-start your investment process. You could always change your investment vehicles. However, you won’t get back those years of growth you could miss by not choosing any investment.

Step 1 – Figure out your allocation.

Fund or asset allocation involves the proportion of bonds, stocks, and other options you’ve in your portfolio. Allocation is significant as it dictates your portfolio’s risk level.

Two ways to assess investment risk exist – How much risk you could bear without making huge losses or the amount of risk you should take to earn the desired return on investments.

As a general rule, the longer the time frame, the more the risk you can take. For instance, if there are 25 or more years for your retirement, you could retain more stocks to maximize your earning potential. However, if you can’t assume risks and sell stocks prematurely due to market volatility, stay clear of an aggressive portfolio even if you wish to earn higher returns.

According to Chad Parks (the CEO and founder of ubiquity retirement and savings), if you’re a smart person and understand that the market will move up and down without worrying, you can easily tolerate risks. On the other hand, investing conservatively might be your better bet if you worry more about your money and get panicked even with small unfavorable market movements.

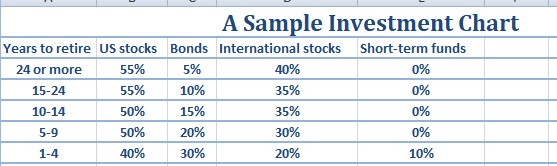

No matter how much risk you can bear, scaling back your aggressiveness is highly advised. This is more so when you’re nearing your retirement age. Such a move will protect your investment and let you cut down unnecessary losses due to higher risks. Keeping this point in mind, your 401(k) investment allocations might look somewhat similar to this chart.

A sample investment chart

Note that the above strategy is a general allocation of assets. When you get closer to your retirement age, you need to customize your strategy as per the situation.

Step 2 – Pick the investments for your 401(k) account.

Once you figure out the investment amount for bonds versus stocks, you could choose the investments for an ideal portfolio. Of course, your investment options largely depend on the amount of money you have. If you’ve enough money, here are your options.

Adopt a set it and forget strategy for the one-fund – Target-date funds were mainly initiated for 401(k) investors. These funds gradually get more conservative when the target date gets closer. Just pick the fund that aligns with your needs and retirement year. The fund manager will handle the rest.

Mike Lynch (the vice-president of Hartford funds for strategic funds) endorses target-date funds for 401(k) investors. When you get close to your retirement age, consider replacing your existing fund, or add other options for a more customized strategy.

The don’t-forget strategy for the one-fund – Asset allocation funds or target-risk mutual funds make a perfect choice for a target investment allocation. As opposed to a retirement date, the fund maintains a 60 percent exposure for stocks and 40 percent for bonds.

The biggest plus of these funds is you don’t have to monitor your funds. Someone else does it for you. However, there’s a red flag with such funds as they don’t change the allocation. In case your situation changes, you ought to find another fund or add more money to your existing fund. Since these funds won’t become more conservative toward your retirement, you may want to switch to another fund to balance your risk-reward ratio.

The simple DIY portfolio

If you’re a smart investor, you may go for a DIY portfolio. Just check the various 401(k) investments out there. Review each option in accordance with your needs and fund availability and pick the best option.

Embracing a three-fund approach could be a better choice for you. Such a strategy includes an index fund in the US stock market, an index fund in the US bond market, and an index fund in the international stock market. By allocating your savings in each of these funds, you enjoy a better, diversified portfolio.

If diversification is your primary intent, you may add a commodities fund, real estate fund, or an alternative fund to your allocation.

When finding an index fund, sort each fund by the expense ratio (the fee you pay to get one unit in each fund) from lowest to highest. The cheapest fund ought to be your index fund. Select one fund for each of the categories and allocate the money you wish (mentioned in the first step).

If you want to earn higher returns, make the portfolio more aggressive. On the flip side, go for a conservative portfolio for low risks and low reward investment options.

Step 3 – Keep costs low.

No matter which funds you choose and what approach you apply, try to keep the costs low. You can’t control the performance of your investments. However, you can easily control the fees you pay for each allocation. Keeping the expense ratio below 0.5 percent is highly recommended by most experts.

Bottom line

Channelizing your retirement savings in suitable 401(k) investments could be a demanding task. However, you may do away with this challenge easily. Follow the above steps to pick investments for your 401(k) account to accumulate a significant sum for your old age.

RELATED ARTICLES

The Hidden Costs of Financial Procrastination

The estimated reading time for this post is 354 seconds You might think delaying your financial decisions isn’t a big deal. But let me tell you, financial procrastination can cost you more than you realize. It’s time to face the...

What to Do If You Are Underwater on Your Car Loan

The estimated reading time for this post is 386 seconds Being underwater on your car loan can feel like you’re sinking financially, but you’re not alone. According to the Federal Reserve Bank of New York, auto loan balances increased by...

2 Comments

Leave Comment

Cancel reply

The Hidden Costs of Financial Procrastination

What to Do If You Are Underwater on Your Car Loan

Household Debt Is Rising: What This Means for You

Gig Economy

American Middle Class / Oct 18, 2024

The Hidden Costs of Financial Procrastination

The estimated reading time for this post is 354 seconds You might think delaying your financial decisions isn’t a big deal. But let me tell you,...

By Article Posted by Staff Contributor

American Middle Class / Oct 17, 2024

What to Do If You Are Underwater on Your Car Loan

The estimated reading time for this post is 386 seconds Being underwater on your car loan can feel like you’re sinking financially, but you’re not alone....

By MacKenzy Pierre

American Middle Class / Oct 16, 2024

Household Debt Is Rising: What This Means for You

The estimated reading time for this post is 255 seconds In the Federal Reserve Bank of New York’s second quarter of 2024, household debt in the...

By FMC Editorial Team

American Middle Class / Oct 15, 2024

A Plan to Grow Your FICO Score

The estimated reading time for this post is 290 seconds You can’t build a solid financial future if your FICO score is holding you back. It’s...

By Article Posted by Staff Contributor

American Middle Class / Oct 14, 2024

Is Bankruptcy the Right Move for You?

The estimated reading time for this post is 439 seconds Bankruptcy is often considered a last resort, a drastic measure for those struggling under the weight...

By Article Posted by Staff Contributor

American Middle Class / Oct 13, 2024

What Matters to Middle-Class Voters

The estimated reading time for this post is 572 seconds Introduction Middle-class voters are the backbone of the American electorate. Their votes decide elections, and their...

By MacKenzy Pierre

American Middle Class / Oct 08, 2024

Jumbo Residential Mortgages: Your Jumbo Mortgage Guide

The estimated reading time for this post is 362 seconds If you’ve been looking at buying a luxury home or property in a high-cost area, you’ve...

By MacKenzy Pierre

American Middle Class / Oct 06, 2024

Does Paying Off Collections Improve Your Credit Score? Here’s What You Need to Know

The estimated reading time for this post is 170 seconds The answer to whether paying off collections will improve your credit score is: it depends. If...

By MacKenzy Pierre

American Middle Class / Oct 05, 2024

How to Remove Late Payments from Your Credit Report: Practical Steps to Reclaim Your Score

The estimated reading time for this post is 263 seconds Late payments are the kryptonite of a good credit score, and too many of you have...

By MacKenzy Pierre

American Middle Class / Oct 03, 2024

Tax Loss Harvesting Can Transform Market Losses Into Tax Savings for Investors Like You: How to Make This Strategy Work for You

The estimated reading time for this post is 382 seconds If you’ve been investing for a while, you’ve probably experienced some market losses. It’s not something...

By MacKenzy Pierre

Latest Reviews

American Middle Class / Oct 18, 2024

The Hidden Costs of Financial Procrastination

The estimated reading time for this post is 354 seconds You might think delaying your...

American Middle Class / Oct 17, 2024

What to Do If You Are Underwater on Your Car Loan

The estimated reading time for this post is 386 seconds Being underwater on your car...

American Middle Class / Oct 16, 2024

Household Debt Is Rising: What This Means for You

The estimated reading time for this post is 255 seconds In the Federal Reserve Bank...

Pingback: Financial Literacy: How to Be Smart with Your Money - Personal Finance

Pingback: Get Your Social Security Personal Accounts - FMC