10 BIGGEST COMPANIES IN AMERICA AND WHO OWNS THEM

By MacKenzy Pierre

The estimated reading time for this post is 294 seconds

The presumptive Democratic candidate Joe Biden called for an end of the era of shareholder capitalism last week. He said, “I’ll be laser-focused on working families, the middle-class families I came from here in Scranton. Not the wealthy investor class. They don’t need me.”

It has been a long belief that it’s only a small percentage of Americans who own stock. There are multiple ways that Americans can own shares. They can own individual stocks in their Robinhood brokerage account, and exchange-traded funds (ETFs) or mutual funds inside their 401(k) or any retirement savings accounts.

Mr. Biden’s statement suggests that the working and middle-class families don’t have any exposure to the market’s financial risks and rewards. To test the democratic candidate’s suggestion, we review the stock ownership of the ten biggest companies in America based on revenues:

Wal-Mart

Wal-Mart is the most dominant retailer in the world. The company’s economic strength allows it to compete with Amazon on a one-for-one basis. Wal-Mart’s stock last closed at $131.74. If you want to become part of the owner of Wal-Mart and you have at least $132 in your pocket, you can.

In 2019, Wal-Mart’s revenues were nearly $515 billion, more half-a-trillion dollars in revenues.

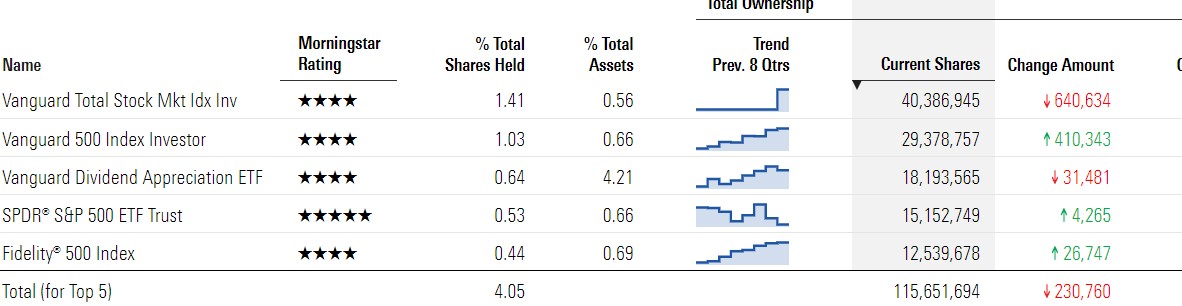

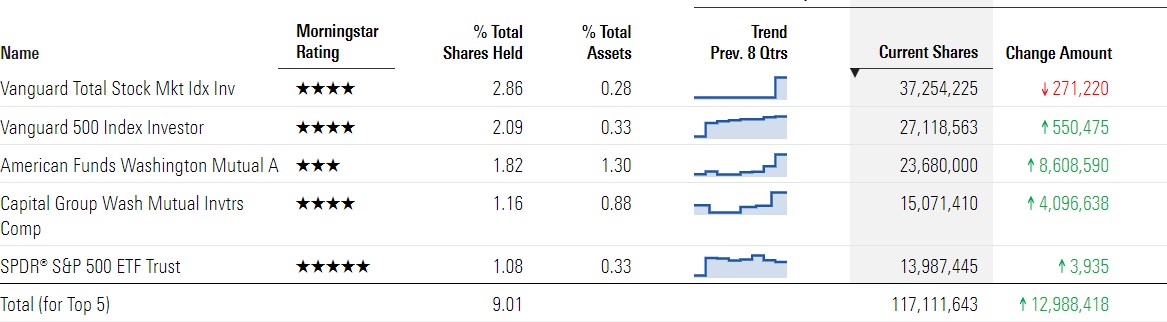

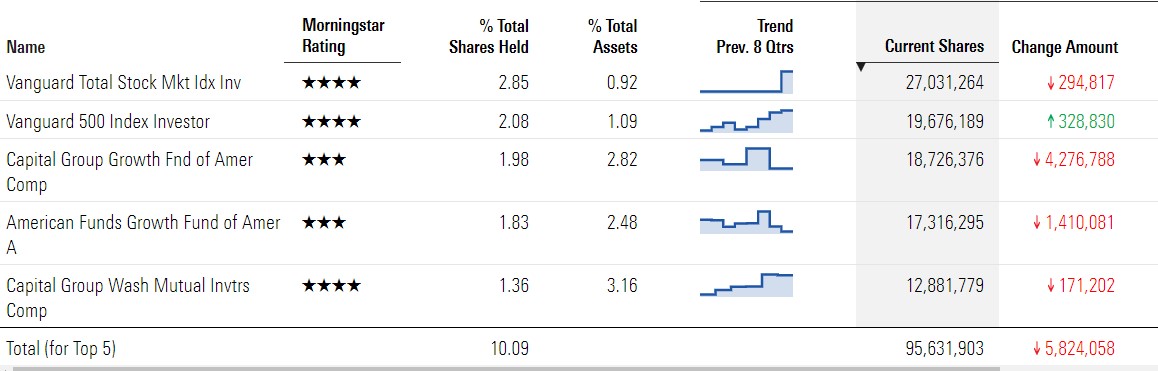

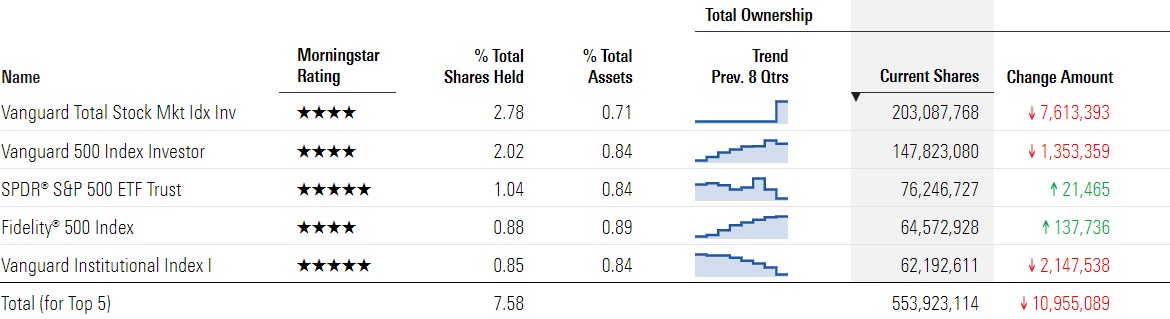

Who Owns Wal-Mart

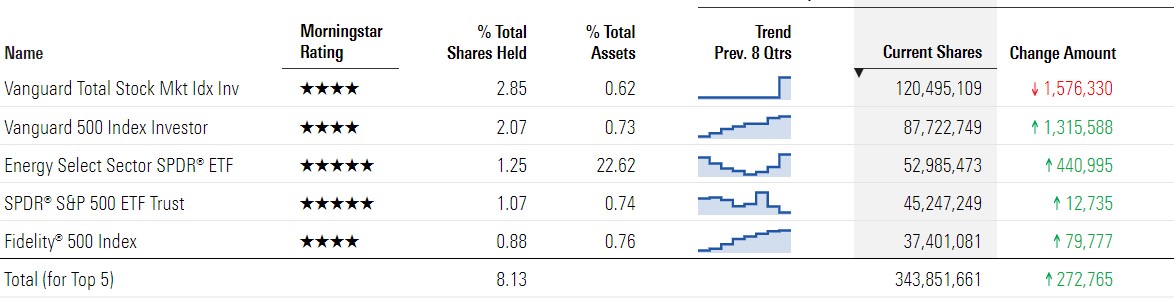

Top 5 Funds

Top 5 Institutions

How about the Waltons’

The 5 Waltons’, the sons, grandson, and the in-law of Wal-Mart founder Sam Walton are worth more than $180 billion combined, according to Forbes. The Walton family via the Walton Family Holdings Trust, the Walton Enterprises LLC, and other individual stakeholders do own a majority of Wal-Mart’s shares.

Amazon.com

Amazon.com is the disruptor. The company’s operational efficiency has allowed it to enter markets with the highest barriers to entry, including streaming, cloud computing, and supermarket. Amazon’s stock last closed at $2,961.97. Investors are paying a ridiculous premium for the company’s long-term cash flow potential. If you want to become part of the owner of Amazon.com and you have at least $2,961.97 in your pocket, you can.

In 2019, Amazon.com Revenues were nearly $281 billion.

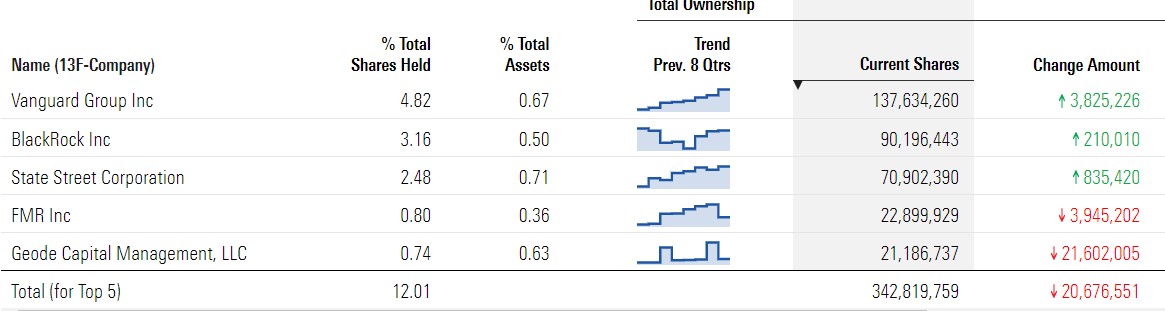

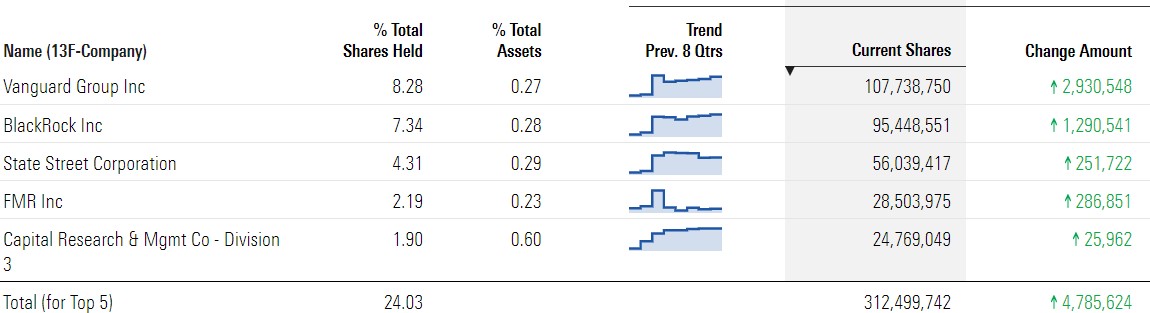

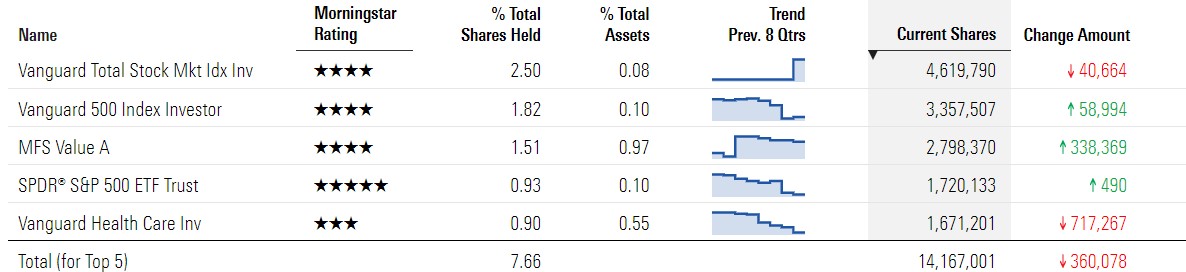

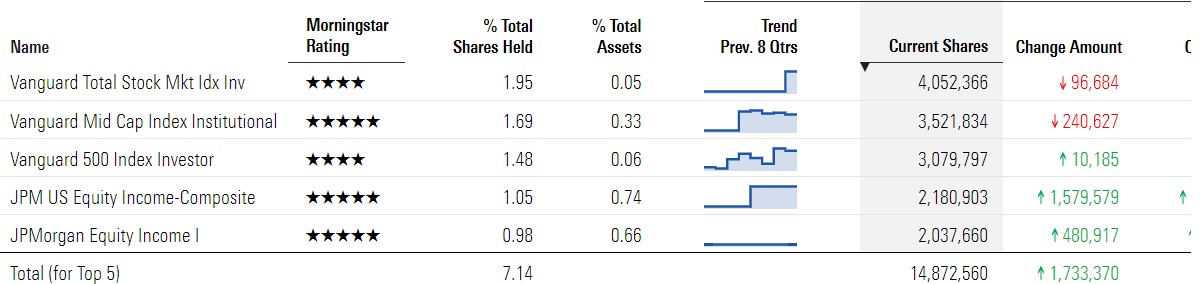

Who Owns Amazon.com

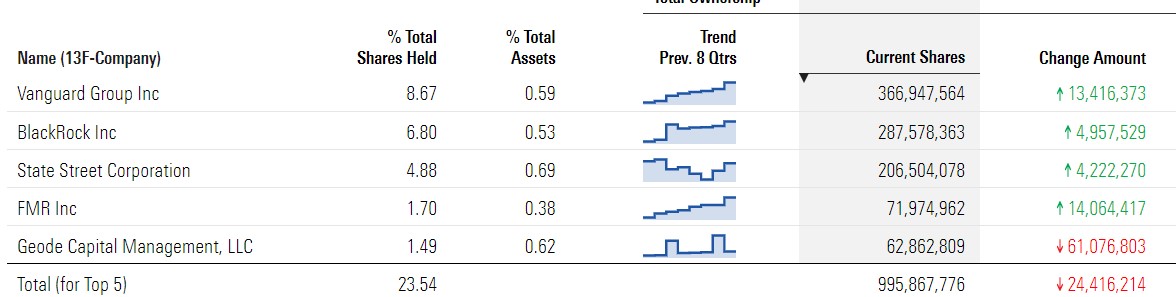

Top 5 Funds

Top 5 Institutions

How About Jeffrey Bezos

Jeff Bezos is the wealthiest person on earth. His 11.1% of outstanding shares in Amazon.com is near twice the percentage of the top 5 funds holdings.

Exxon Mobil

Exxon Mobil is the highest-quality integrated firms. Oil price went negative back in April, but Exxon leaned on its contingency plans. Exxon Mobil’s stock last closed at $43.52. If you want to become part of the owner of Exxon Mobil and you have at least $44 in your pocket, you can.

In 2019, Exxon Mobil’s Revenues were nearly $256 billion.

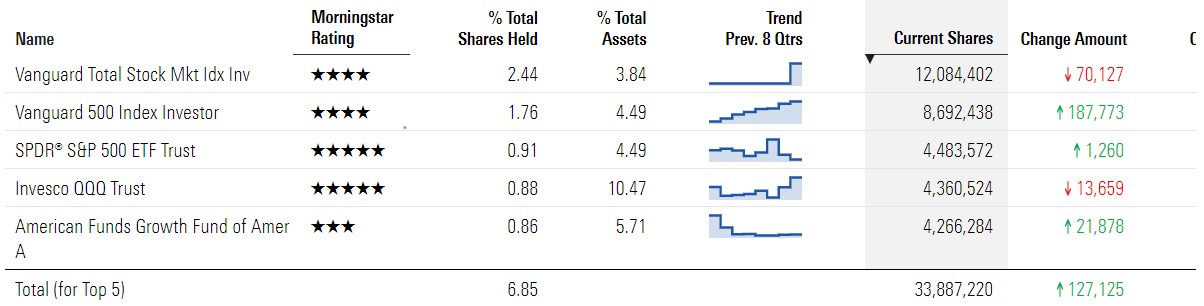

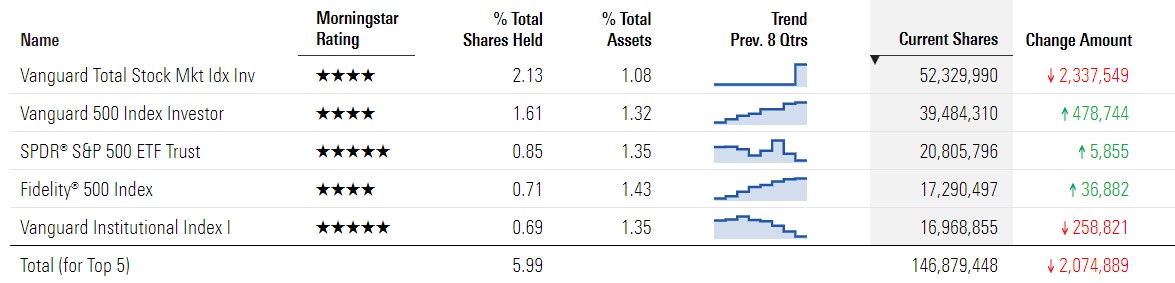

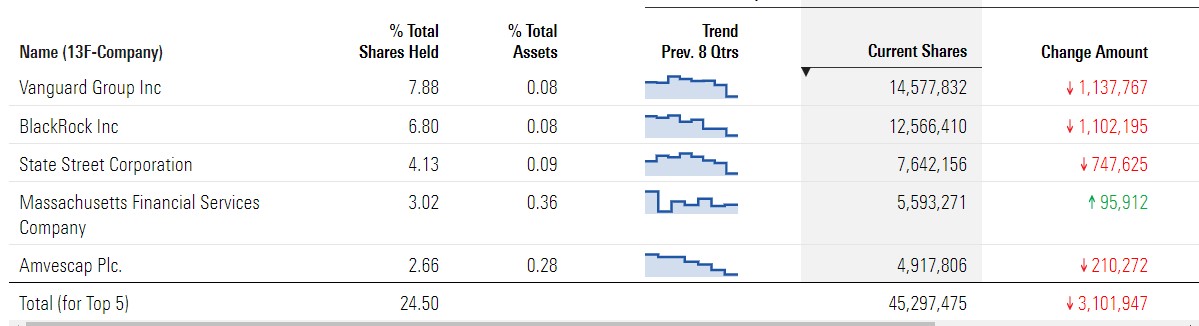

Who Owns Exxon Mobil

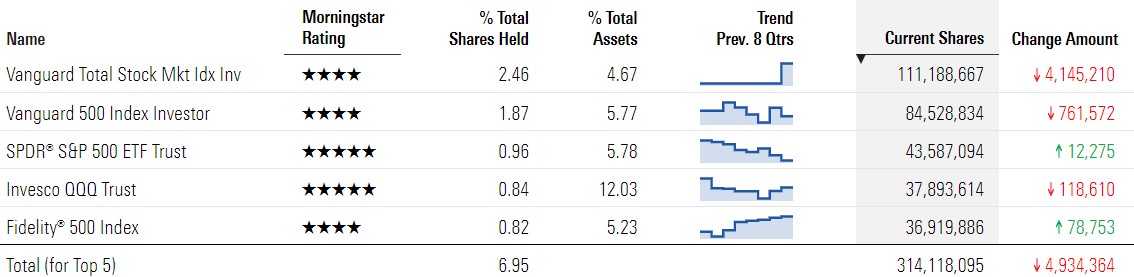

Top 5 Funds

Top 5 Institutions

Apple

Consumers across the globe love this multinational technology company sleek, intuitive, and appealing device. They often wait in line for hours at Apple retail stores for the arrival of new products. Apple’s stock last closed at $385.31. If you want to become part of the owner of Apple and you have about $400 in your pocket, you can.

In 2019, Apple’s revenues were nearly $261 billion.

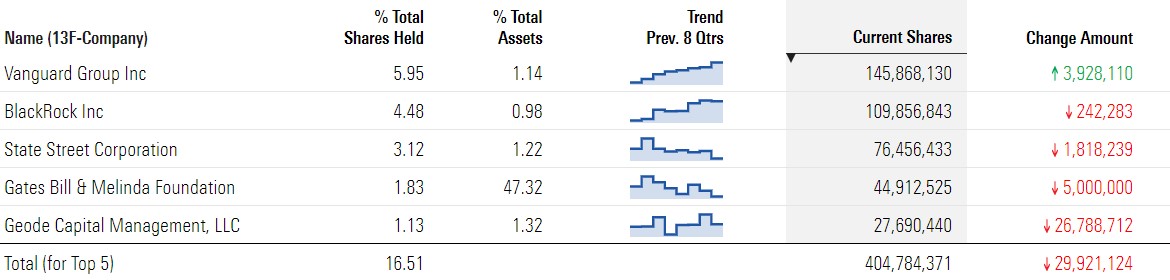

Who Owns Exxon Mobil

Top 5 Funds

Top 5 Institutions

CVS HEALTH

CVS Health is a customer-centric health company. It has nearly 10,000 stores throughout the United States. It provides excellent and convenient healthcare services to its customers. CVS Health’s stock last closed at $65.36. In 2019, CVS Health’s revenues were nearly $257 billion.

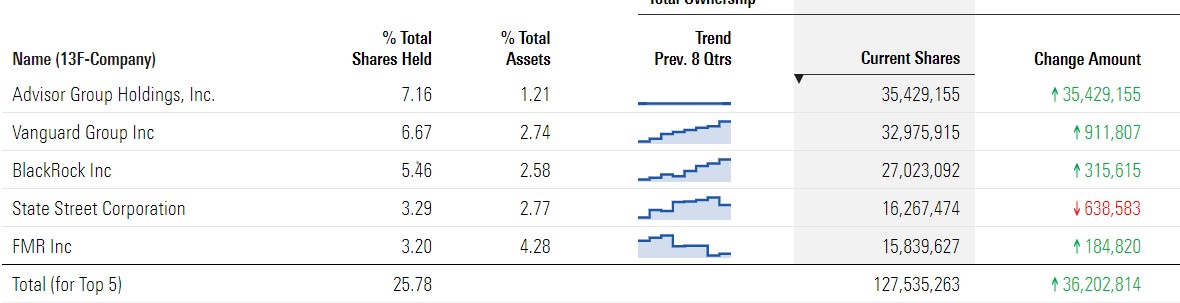

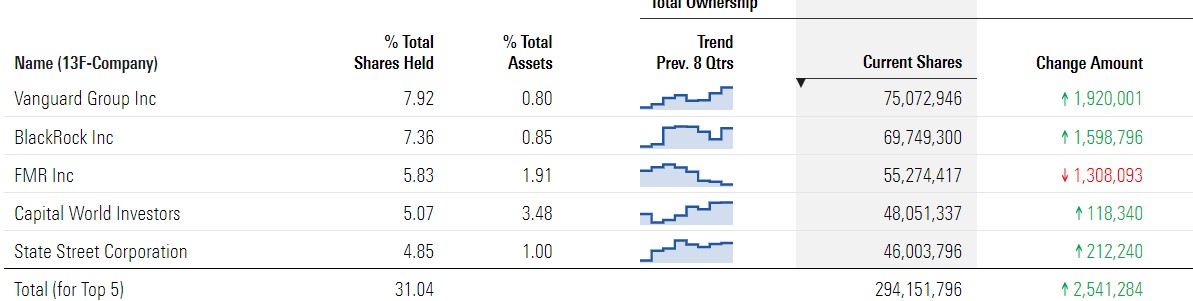

Who Owns CVS Health

Top 5 Funds

Top 5 Institutions

Berkshire Hathaway

Berkshire Hathaway is a well-diversified conglomerate with numerous holding companies, including GEICO insurance, Dairy Queen, Duracell, and many more. The company is also amongst the top 5 institutional investors in countless big firms.

Berkshire Hathaway’s Class A & B stocks last closed at $286,140 and $190.76, respectively. The class B stock carries lower voting rights as well, but it allows people who don’t have access to $300,000 to be part-owner of the firm. In 2019, Berkshire Hathaway’s revenues were nearly $327.22 billion.

Who Owns Berkshire Hathaway

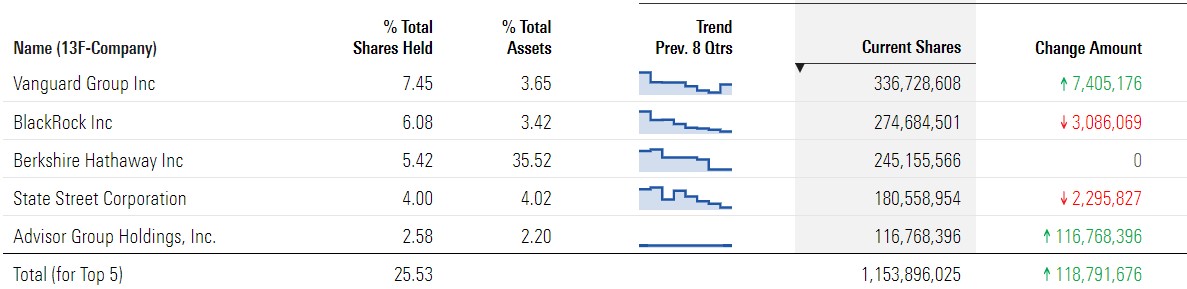

Top 5 Funds

Top 5 Institutions

How about Warren Buffet

Combining his class A & B shares, Warren Buffet owns about 16% of Berkshire Hathaway.

UnitedHealth Group

UnitedHealth Group It is the largest healthcare company in the world by revenue. UnitedHealthcare, the largest private health insurer, OptumHealth, a large service provider, OptumInsight, a healthcare analytics franchise, and other subsidiaries are all part of the Group.

UnitedHealth Group’s stock last closed at $306.53. In 2019, UnitedHealth Group’s revenues were nearly $241 billion.

Who Owns UnitedHealth Group

Top 5 Funds

Top 5 Institutions

McKesson

McKesson is the largest and oldest global pharmaceutical and medical distributor with 27 distribution centers, three redistribution centers, and two repackaging facilities serving customers across the 50 states, Puerto Rico, Europe, and Canada.

McKesson’s stock last closed at $154.81. In 2019, McKesson’s revenues were $231 billion.

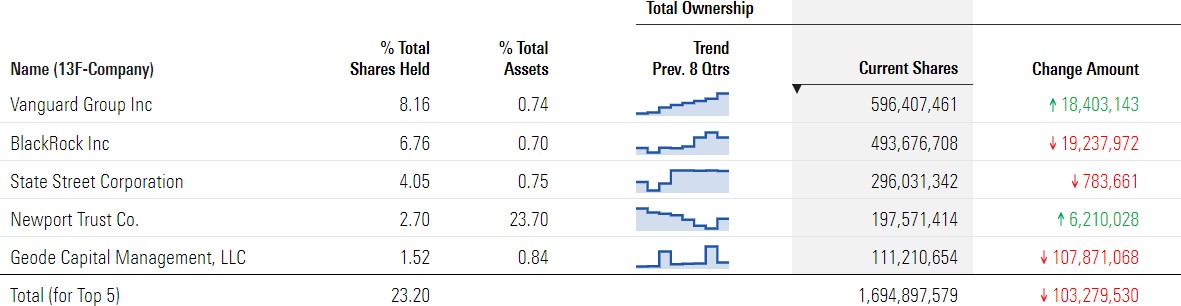

Who Owns McKesson

Top 5 Funds

Top 5 Institutions

AT&T

AT&T was one of the 10 biggest companies in America before the mega acquisitiion. It bought Time Warner for $85 billion a couple of years. Now, the company has nearly 100 subsidiaries, including DIRECTV, Home Box Office (HBO), and Warner Bros. Pictures.

AT&T’s stock last closed at $30.25. In 2019, AT&A’s revenues were $181 billion.

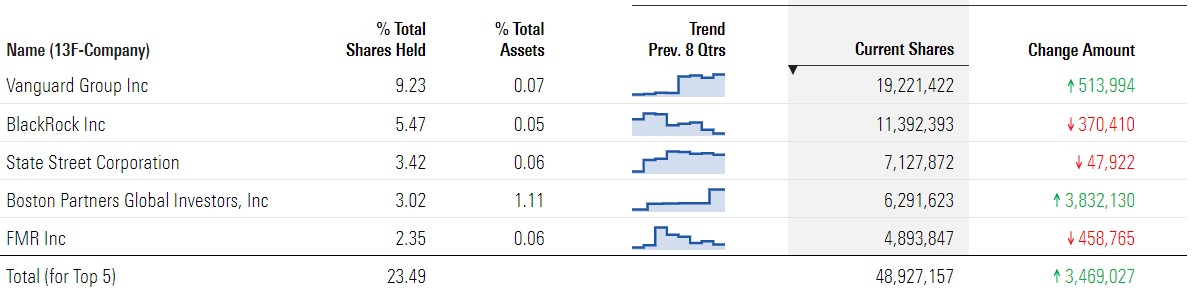

Who Owns AT&T

Top 5 Funds

Top 5 Institutions

AmerisourceBergen

AmerisourceBergen is a massive drug wholesale company. It connects its manufacturer partners to sites of care, including healthcare systems, physician practices and clinics, pharmacies, and many more. AmerisourceBergen’s stock last closed at $104.45. In 2019, AmerisourceBergen’s revenues were nearly $180 billion.

Who Owns AmerisourceBergen

Top 5 Funds

Top 5 Institutions

In Conclusion

Mr. Biden’s statement is a half-truth. The wealthy Americans have a higher exposure to market financial risks. As a result, they reap greater rewards. However, as the Morningstar‘s screenshots show, institutions own a significant percentage of those ten biggest companies’ stocks. Those funds are inside the 401(k), 403(b), or individual retirement accounts (IRAs) of all Americans, including the working and middle-class families.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that when the new gross domestic product (GDP) number is released later this month, it...

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even 35 years old, spent a considerable amount of time in line at a Caesars...

1 Comment

Leave Comment

Cancel reply

What’s Going on with the U.S. IPO Market?

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Gig Economy

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this...

By MacKenzy Pierre

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that...

By MacKenzy Pierre

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

Latest Reviews

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write...

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said...

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...

Pingback: Walmart to Give Workers Half-Billion Dollars Bonus - FMC