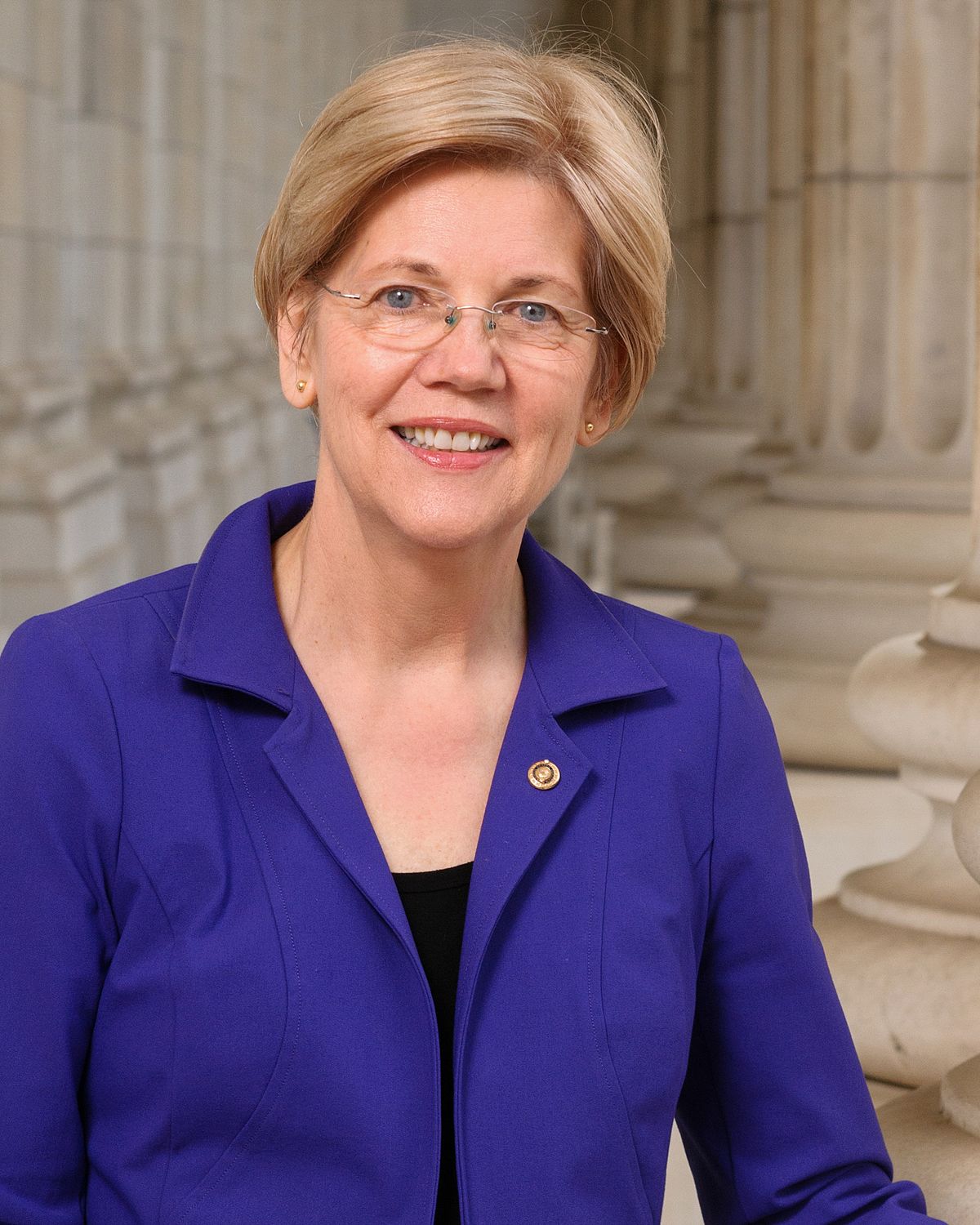

The Middle-Class Needs to Support Elizabeth Warren’s Bankruptcy Plan

By Article Posted by Staff Contributor

The estimated reading time for this post is 174 seconds

-

The middle class needs to support Elizabeth Warren’s bankruptcy plan because they can benefit significantly from it. The proposed new bankruptcy laws will revert the corporate-friendly bankruptcy provision that the House passed, and President George W Bush signed in 2005.

-

The 2005 Bankruptcy law made it harder for consumers to file chapter 7 or liquidation bankruptcy and required a higher percentage of disposable income to be allocated toward chapter 13 bankruptcy three-to-five-year repayment plan to repay all or part of the debt.

-

Senator Elizabeth Warren wants to make the bankruptcy process cheaper and less painful for most Americans. Her plan will let people protect their homes and cars and discharge student loan debt in bankruptcy.

-

Visit the Financial Middle-Class homepage for more stories

The middle class needs to support Elizabeth Warren’s bankruptcy plan because they can benefit significantly from it. The proposed new bankruptcy laws will revert the corporate-friendly bankruptcy provision that the House passed, and President George W Bush signed in 2005.

The 2005 Bankruptcy law made it harder for consumers to file chapter 7 or liquidation bankruptcy and required a higher percentage of disposable income to be allocated toward chapter 13 bankruptcy three-to-five-year repayment plan to repay all or part of the debt.

Predatory lenders use the protection of the U.S. bankruptcy courts to exploit vulnerable Americans. They felonious tactics to promote toxic financial products to consumers at tremendously high-interest rates. Companies are willing to abandon their risk management because they know consumers, specifically middle-class consumers, would have a hard time to discharge their debts.

Senator Elizabeth Bankruptcy Plan

Senator Elizabeth Warren wants to make the bankruptcy process cheaper and less painful for most Americans. Her plan will let people protect their homes and cars and discharge student loan debt in bankruptcy.

During the debate to revamp bankruptcy laws in 2005, lobbyists claimed that most families who filed for bankruptcy were reckless or irresponsible or both. We know that’s not the case

Anemic wage growth, high rents, student loan debt, and medical bills have been squeezing the middle class. Payday lenders and subprime credit cards issuers and auto lenders draw new business strategies to exploit middle-class financial despairs.

Based on St. Louis Fed’s calculation, payday lenders charge their customers annual percentage rate (APR) as high as 400%. The Wall Street Journal reported a few weeks ago that subprime auto lenders are pressuring and falsifying their customer loan applications to get them approved. Those criminal loan terms and toxic financial products put and keep the middle class into a vicious economic cycle.

If private companies such as credit card issuers, payday loan companies, and subprime auto lenders want to take an unlimited risk and exploit the middle class in the process, the federal government should not protect them when their consumers get into major financial crises and want a fresh-tart.

What Happened to Creative Destruction

Companies should not be able to advocate for the deregulation of capital markets and the reduction of state influence in the economy while demanding protections in the U.S bankruptcy courts. The preceding sentence is the definition of crony capitalism.

Subprime auto lenders are falsified borrowers’ applications to get them approved for loans and extended loans terms to as long as 96 months to give them the illusion of affordability. When those borrowers lost their job or had other financial emergencies, Mrs. Warren’s plan would facilitate the process of starting over.

Her proposed bankruptcy plan will stop incentivizing non-reputable companies that promote toxic financial products to the middle-class.

RELATED ARTICLES

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing to Chinese Real Estate, there have been about nine notable global asset bubbles since the Great Depression. The most recent was the Special Purpose Acquisition...

Yes,Bitcoin Is a Financial Asset

The estimated reading time for this post is 239 seconds Yes, Bitcoin is a financial asset, but it’s not ready yet to be inside your 401(k), 403(b), and Traditional IRAs. If you know me, then you know that’s breaking news. ...

Leave Comment

Cancel reply

In Search of the Next Asset Bubble

Biggest Financial Crimes: Washington Mutual Financial Scandal

How Much is a Mortgage on a $700,000 House

Gig Economy

American Middle Class / Jul 20, 2024

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing to Chinese Real Estate, there have been about nine notable global...

By MacKenzy Pierre

Fraud & Financial Crimes / Jul 16, 2024

Biggest Financial Crimes: Washington Mutual Financial Scandal

The estimated reading time for this post is 249 seconds Biggest Financial Crimes: Washington Mutual Financial Scandal Washington Mutual, once the largest savings and loan association...

By Article Posted by Staff Contributor

American Middle Class / Jul 16, 2024

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing market continues to navigate a complex landscape shaped by fluctuating interest...

By MacKenzy Pierre

American Middle Class / Jul 14, 2024

Financial Literacy: Building a Foundation for Financial Well-being

The estimated reading time for this post is 206 seconds Financial literacy is a critical skill that empowers individuals to make informed decisions about their financial...

By Article Posted by Staff Contributor

Stock News / Jan 02, 2024

Re-Drafting the 2023 IPO Class

The estimated reading time for this post is 147 seconds The Initial Public Offering (IPO) market is a significant barometer for economic health and investor sentiment. ...

By MacKenzy Pierre

Stock News / Dec 29, 2023

2024 IPO Draft Class

The estimated reading time for this post is 151 seconds 2024 IPO Draft Class: Ranking the Top Prospects Following the pattern of last year’s tumultuous market...

By MacKenzy Pierre

Stock News / Dec 22, 2023

Build Wealth with Boring Investments

The estimated reading time for this post is 314 seconds Due to their boredom, long-term, low-cost, and passive investing strategies have lost ground to more speculative...

By MacKenzy Pierre

Finance / Dec 10, 2023

Yes,Bitcoin Is a Financial Asset

The estimated reading time for this post is 239 seconds Yes, Bitcoin is a financial asset, but it’s not ready yet to be inside your 401(k),...

By MacKenzy Pierre

Business / Nov 24, 2023

Cash Management for Growing Businesses

The estimated reading time for this post is 147 seconds Cash Management for Growing Businesses: Navigating the Waters of Growth and Liquidity In the early stages,...

By MacKenzy Pierre

Fraud & Financial Crimes / Nov 21, 2023

Biggest Financial Crimes: Adelphia

The estimated reading time for this post is 255 seconds Biggest Financial Crimes: Adelphia Adelphia Communications Corporation, once a titan in the cable industry, became synonymous...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jul 20, 2024

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing...

Fraud & Financial Crimes / Jul 16, 2024

Biggest Financial Crimes: Washington Mutual Financial Scandal

The estimated reading time for this post is 249 seconds Biggest Financial Crimes: Washington Mutual...

American Middle Class / Jul 16, 2024

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing...