Investors Need to Netflix and Chill

By MacKenzy Pierre

The estimated reading time for this post is 181 seconds

Investors need to Netflix and chill and cancel all the noise coming from Wall Street analysts. The company announced yesterday that it lost net subscribers for the first time in its 2 ½ decades; its shares plunged 20% in after-hours trading.

However, unlike many analysts and investors, I don’t think the company’s best days are behind it.

The streaming media giant is down nearly 35%, trading at a 52-week range low.

Net subscribers decline, geopolitical problems ( it has to exit Russia), and password-sharing are great reasons for investors to be wary, but their reaction might be exaggerated.

The world’s leading entertainment service company has an outstanding balance sheet, excellent operating margin, free cash flow, and nearly $1.3 billion in deferred revenue, meaning that many subscribers opt to pay for their membership yearly.

Analysts Concerns

Wall Street analysts are concerned that net subscribers decline and missed revenue expectations might signal that Netflix’s growth, which has been going on by leaps and bounds since 2011, has seen its best days.

They might be correct, but that does not mean you should abandon the stock. You might miss out on excellent future dividend yields and long-term capital appreciation if you decide to sell.

Netflix has become a staple for most consumers, and it has a wide moat; its days of stratospheric growth might be over, but the company will create excellent shareholder value in years to come.

With 222 million paid memberships in over 190 countries, slow growth should be expected as the incremental subscriber is getting thinner and thinner.

During the earnings call, the company CEO, Reed Hastings, said the following,

“We’re working on how to monetize sharing. We’ve been thinking about that for a couple of years, but when we were growing fast, it wasn’t the high priority to work on. And now we’re working super hard on it. And remember these are over 100 million households that already choose to view Netflix. They love the service, we just got to get paid,” Hastings told investors on the earnings call. “And then two, it’s really, we got great competition. They’ve got some very good shows and films out. And what we got to do is take it up a notch.”

To resolve the problems that Mr. Hasting outlined above, the company must move its focus from growth to value investors. Otherwise, the stock volatility will continue.

Why You Should Not Worry

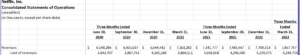

Revenue Growth

Netflix missed its Q1 2022 revenue expectations, but revenues have grown consistently for the past nine quarters. The 2.5% revenue growth from Q4 2021 to Q1 2022 is way above the Global Entertainment and Media market’s projected growth of 5.9% compound annual growth rate (CAGR).

Most importantly, the pace of revenue growth is consistent with what value investors expect.

Reed Hastings talked about the ‘great competition and very good shows and films out” during the earnings call. The CEO is correct. The streaming service competition is brutal. Netflix can allocate nearly $1B towards content creation next quarter without hurting the operating margin. I was surprised to see an 18.2% decrease in the cost of revenue for the quarter.

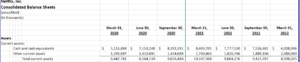

Balance Sheet

The firm has a sound balance sheet with more than $6 billion in cash and cash equivalents. It has no short-term debt. Its total current assets can cover its current liabilities more than 1x.

Balance Sheet

I find the early $1.3 billion in deferred revenue fascinating. Moreover, more than 100 million households view Netflix for free through password-sharing. Consumers love this company, and value investors might be too.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this year. Then Newsmax, the right-wing media outlet, gave it a shot in the arm...

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that when the new gross domestic product (GDP) number is released later this month, it...

Leave Comment

Cancel reply

What’s Going on with the U.S. IPO Market?

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Gig Economy

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this...

By MacKenzy Pierre

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that...

By MacKenzy Pierre

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

Latest Reviews

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write...

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said...

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...