Rise of the Global Middle Class: Opportunities and Challenges

By MacKenzy Pierre

The estimated reading time for this post is 436 seconds

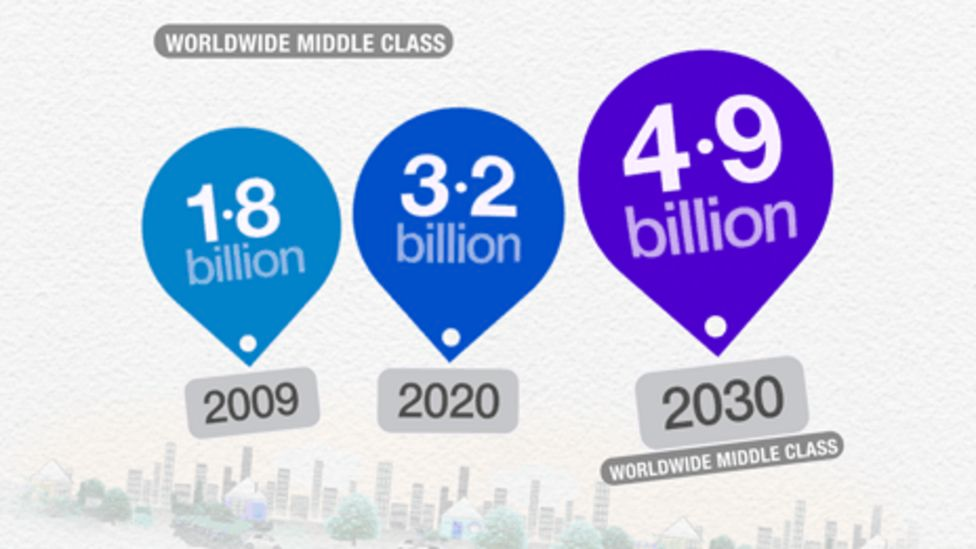

In recent years, there has been an unprecedented expansion of the global middle class. According to the World Bank, between 1990 and 2015, the percentage of people living in extreme poverty fell from 36% to 10%, and the global middle class grew from 1.8 billion to 3.2 billion.

This expansion has been driven by economic growth, urbanization, and rising education levels in developing countries.

At the same time, the middle class in Organization for Economic Co-operation and Development (OECD) countries has been experiencing stagnation or even decline.

In this article, we will explore the reasons behind the contrasting fortunes of the global middle class and the OECD middle class and what this means for the future of the world economy.

What is the Middle Class?

Before we dive deeper into the topic, let us first define what we mean by the middle class. The middle class refers to people with a certain income level, education, and social status. This group is typically characterized by financial stability, access to healthcare, education, and social mobility.

In most OECD countries, the middle class is defined as households with between 75% and 200% of the median income.

However, the definition of the middle class varies widely depending on the country and context. For example, a family living on $10 a day may be considered middle class in developing countries. This income level would be regarded as below the poverty line in OECD countries.

The Expansion of the Global Middle Class

The global middle class has been growing unprecedentedly over the past few decades. Several factors, including economic growth, urbanization, and rising education levels, have driven this.

Economic Growth

Economic growth has been the most significant driver of the expansion of the global middle class. Over the past few decades, developing countries have experienced rapid economic growth, leading to increased incomes and improved living standards.

According to the World Bank, between 1990 and 2015, the number of people living in extreme poverty fell from 36% to 10%, and those in the middle class grew from 1.8 billion to 3.2 billion.

Some of the countries that have made significant progress in reducing extreme poverty during this period include:

- China: China’s economic growth and poverty reduction programs have been instrumental in lifting hundreds of millions of people out of poverty. According to the World Bank, China’s poverty rate fell from 66% in 1990 to 0.6% in 2016.

- India: India has also significantly reduced extreme poverty over the past few decades. According to the World Bank, India’s poverty rate fell from 45% in 1993 to 13.4% in 2015.

- Bangladesh: Bangladesh has made remarkable progress in reducing poverty since the 1990s. According to the World Bank, Bangladesh’s poverty rate fell from 60% in 1990 to 24.3% in 2016.

- Indonesia: Indonesia has also seen a significant reduction in poverty over the past few decades. According to the World Bank, Indonesia’s poverty rate fell from 32% in 1999 to 9.4% in 2020.

- Vietnam: Vietnam has achieved remarkable progress in reducing poverty since the 1990s. According to the World Bank, Vietnam’s poverty rate fell from 58% in 1993 to 2.7% in 2020.

Urbanization

Urbanization has also played a significant role in expanding the global middle class. As more people move to cities, they are more likely to find jobs with higher wages and better benefits. This has led to an increase in disposable income, which has enabled many people to move up the income ladder.

Disposable income is the amount of money a person or household has available after taxes and other deductions are taken from their income. The income is left over to be spent or saved as the individual or household sees fit. In other words, disposable income is the money a person or household has to spend on goods and services, investments, or to save for the future.

Rising Education Levels

Rising education levels have also contributed to the growth of the global middle class. As more people access education, they can find higher-paying jobs and improve their living standards.

This has also led to a rise in social mobility, as people can move up the income ladder through education and hard work.

The Stagnation and Decline of the OECD Middle Class

While the global middle class has been expanding, the middle class in OECD countries has been experiencing stagnation or even decline.

OECD comprises 38 member countries, including many of the world’s most advanced and prosperous economies; its purpose is to promote policies that will improve people’s economic and social well-being worldwide.

OECD provides a forum where member countries can share their experiences and work together to address common economic, social, and environmental challenges.

The organization conducts research, provides policy advice, and facilitates cooperation among member countries in various areas, including Economic growth and development, International trade, Environmental sustainability, and more. Several factors have driven the decline of the OECD Middle Class, including technological change, globalization, and changes in labor markets.

Technological Change

Technological change has been one of the most significant drivers of the decline of the middle class in OECD countries.

As automation and artificial intelligence continue to advance, many jobs previously done by humans are becoming automated.

This has led to a decline in the demand for middle-skill jobs, such as manufacturing and administrative jobs traditionally held by the middle class.

Globalization

Globalization has also played a significant role in the decline of the middle class in OECD countries. As more jobs are outsourced to developing countries, many workers in OECD countries have lost their jobs, particularly in manufacturing industries.

This has led to a decline in wages and job security for many middle-class workers, making it more difficult for them to maintain their middle-class status. The world has become flatter since Tom Friedman published his mega-bestseller book, “The World Is Flat,” in 2005. It’s easier for individuals and businesses to compete globally.

Changes in Labor Markets

Changes in labor markets have also contributed to the decline of the middle class in OECD countries. The rise of the gig economy and the prevalence of part-time work have made it more difficult for workers to find stable, full-time jobs with benefits.

This has led to a decline in job security and a rise in income inequality, which has made it more difficult for many people to maintain their middle-class status.

The Impact of the Contrasting Fortunes of the Global and OECD Middle Class

The contrasting fortunes of the global middle class and the OECD middle class have significant implications for the future of the world economy. On the one hand, expanding the global middle class represents an important market opportunity for businesses worldwide.

As more people in developing countries move up the income ladder, they will have more disposable income to spend on goods and services, creating new markets for businesses to explore.

At the same time, the decline of the middle class in OECD countries represents a significant challenge for policymakers. As more people fall out of the middle class and into poverty, they may require additional support from the government in the form of social welfare programs, which can strain public finances.

Additionally, the decline of the middle class can lead to political instability and social unrest as people become frustrated with their economic situation and demand change.

The Brexit Referendum in the United Kingdom, Gilets Jaunes or the Yellow Vests and current pension protests in France, and Occupy Wall Street in the United States are political movements that show the level of economic anxiety of the OECD Middle Class.

Policy Implications

To address the challenges facing the middle class in OECD countries, policymakers must take a holistic approach that addresses the underlying drivers of economic insecurity. This may include investing in education and training programs to help workers acquire the skills they need to succeed in a changing labor market.

It may also include policies that support small businesses and entrepreneurship, which can create new jobs and stimulate economic growth.

In addition, policymakers may need to address the rising levels of income inequality, which can undermine social cohesion and lead to political instability. This may include implementing progressive tax policies, increasing the minimum wage, and providing additional support to low-income households.

Conclusion

The expansion of the global middle class represents a significant achievement for the world economy, as more people worldwide can enjoy a higher standard of living.

However, the contrasting fortunes of the global and OECD middle class also represent a significant challenge for policymakers as they seek to address the underlying drivers of economic insecurity and promote long-term economic growth.

By investing in education, training, and entrepreneurship, policymakers can help workers acquire the skills they need to succeed in a changing labor market.

Additionally, by addressing income inequality and providing additional support to low-income households, policymakers can promote social cohesion and help ensure that the benefits of economic growth are shared more equitably.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing to Chinese Real Estate, there have been about nine notable global asset bubbles since the Great Depression. The most recent was the Special Purpose Acquisition...

Yes,Bitcoin Is a Financial Asset

The estimated reading time for this post is 239 seconds Yes, Bitcoin is a financial asset, but it’s not ready yet to be inside your 401(k), 403(b), and Traditional IRAs. If you know me, then you know that’s breaking news. ...

Leave Comment

Cancel reply

In Search of the Next Asset Bubble

Biggest Financial Crimes: Washington Mutual Financial Scandal

How Much is a Mortgage on a $700,000 House

Gig Economy

American Middle Class / Jul 20, 2024

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing to Chinese Real Estate, there have been about nine notable global...

By MacKenzy Pierre

Fraud & Financial Crimes / Jul 16, 2024

Biggest Financial Crimes: Washington Mutual Financial Scandal

The estimated reading time for this post is 249 seconds Biggest Financial Crimes: Washington Mutual Financial Scandal Washington Mutual, once the largest savings and loan association...

By Article Posted by Staff Contributor

American Middle Class / Jul 16, 2024

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing market continues to navigate a complex landscape shaped by fluctuating interest...

By MacKenzy Pierre

American Middle Class / Jul 14, 2024

Financial Literacy: Building a Foundation for Financial Well-being

The estimated reading time for this post is 206 seconds Financial literacy is a critical skill that empowers individuals to make informed decisions about their financial...

By Article Posted by Staff Contributor

Stock News / Jan 02, 2024

Re-Drafting the 2023 IPO Class

The estimated reading time for this post is 147 seconds The Initial Public Offering (IPO) market is a significant barometer for economic health and investor sentiment. ...

By MacKenzy Pierre

Stock News / Dec 29, 2023

2024 IPO Draft Class

The estimated reading time for this post is 151 seconds 2024 IPO Draft Class: Ranking the Top Prospects Following the pattern of last year’s tumultuous market...

By MacKenzy Pierre

Stock News / Dec 22, 2023

Build Wealth with Boring Investments

The estimated reading time for this post is 314 seconds Due to their boredom, long-term, low-cost, and passive investing strategies have lost ground to more speculative...

By MacKenzy Pierre

Finance / Dec 10, 2023

Yes,Bitcoin Is a Financial Asset

The estimated reading time for this post is 239 seconds Yes, Bitcoin is a financial asset, but it’s not ready yet to be inside your 401(k),...

By MacKenzy Pierre

Business / Nov 24, 2023

Cash Management for Growing Businesses

The estimated reading time for this post is 147 seconds Cash Management for Growing Businesses: Navigating the Waters of Growth and Liquidity In the early stages,...

By MacKenzy Pierre

Fraud & Financial Crimes / Nov 21, 2023

Biggest Financial Crimes: Adelphia

The estimated reading time for this post is 255 seconds Biggest Financial Crimes: Adelphia Adelphia Communications Corporation, once a titan in the cable industry, became synonymous...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jul 20, 2024

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing...

Fraud & Financial Crimes / Jul 16, 2024

Biggest Financial Crimes: Washington Mutual Financial Scandal

The estimated reading time for this post is 249 seconds Biggest Financial Crimes: Washington Mutual...

American Middle Class / Jul 16, 2024

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing...