2022 IPO DRAFT CLASS: Ranking the Top 10 Prospects

By MacKenzy Pierre

The estimated reading time for this post is 359 seconds

2021 was a banner year for the stock, with all three indexes registering numerous closing highs. The S&P 500 alone closed high 70 times last year.

Despite a banner year for existing publicly-traded companies, new arrivals to the public market did not fare so well.

According to Barrons, 1,006 companies went public and raised about $315.6 billion in 2021. However, a whopping 64% of this year’s new listings are trading below their offer price.

2022 IPO DRAFT CLASS: Ranking the Top 10 Prospects

Last year was Financialmiddleclass.com’s inaugural IPO Draft Class. 6 out of our ten companies went public last year.

Moreover, we are glad to report that one of our companies, Rivian Automotive, was the biggest IPO for the U.S. company since Facebook or Meta. You can read how the six new listings fare here.

10 Most Anticipated IPOs for 2022

What we learned from our 2021 List are the companies that went public either via-SPAC mergers or direct listings were the ones that were getting pressured by their private stakeholders who wanted to cash in or exit.

Cheap money makes private investors more, extending the time startups exit. However, stakeholders are going to wait forever:

Reddit, Inc

Last month, the social media filed a confidential S-1 with the Securities and Exchange Commission (SEC) announcing its plan to go public.

Reddit was founded in 2005 and had its seed round that same year. The company’s latest funding round was on August 12, 2012, raising $700 at $10 billion valuations.

According to Crunchbase, it has raised a total of $1.3B in funding over eight rounds. The social media platform that has been the birthplace of “meme” stocks has been rumored to be considering an IPO for some time; 2022 might be the year it finally goes public.

Key Operational Metrics

- Founded in 2005

- Has 52 million daily users as of last funding round

- 100,00 active sub-reddits

- ~700 employees as of February 2021

- $170 million revenue in 2020

- Twitter Inc & Facebook are amongst its major competitors

Stripe

The payments processor was on our 2021 List. the company co-founder, John Collinson, told CNBC back in November that “they are very happy staying private.”

The online payments behemoth is 13-years old, raised $2.2 billion at a mega-unicorn valuation of $95 billion. Its “staying private” days are numbered.

After the series H funding round that valued Stripe as the most highly valued venture-backed private company in the U.S., its last funding round was in the secondary market

Key Operational Metrics

- Founded in 2009

- Processes billions of dollars in transactions

- Charges 2.9% of total transaction value

- ~4k employees

- 14 global offices

- $7.4 Billion in revenue in 2020

- PayPal & Square are amongst its major competitors

Instacart

The grocery delivery company was on our 2021 List. According to a report published by The Information, the company decided to push off its IPO to grow.

The company’s latest round of funding was on November 1, 2021. It is not clear whether it was private equity or debt financing, but It raised $232 million. The funding type was unknown.

In March 2021, it raised $265 million at more than $39 billion valuations. So far, Instacart has raised a total of $2.9 billion in funding over 19 rounds.

Key Operational Metrics

- Founded in 2012

- 600+ retail partners in North America

- Provides delivery and pickup services from 45,000+ stores

- 5,500+ cities in U.S. & Canada

- $1.65 billion in revenue in 2020

Chime

The digital bank provides checking accounts with no monthly and overdraft fees to lower and middle-income Americans.

Last year, the successful IPO of the “ buy now pay later” company Affirm showed that investors see values in companies that cater to that group of clients.

On August 13, 2021, the financial technology startup raised $750 million in its Series G funding round at $25 billion valuations.

Key Operational Metrics

- Founded in 2013

- Fee-free checking and savings accounts

- 60,000 ATMs for free

- 13+ million active customers

- $600 million in revenue in 2020

Houzz

The home-remodeling platform provides homeowners with a whole host of products and services that alleviate the stress of home remodeling, including designed ideas, vetted contractors, and more.

Pandemic home remodeling is still booming, and Houzz wants to capitalize on it.

Houzz’s last private equity funding was on June 9, 2017. The company raised $400 million at about $4 billion valuations. It raised a total of $613.6 million in funding over eight rounds.

Key Operational Metrics

- Founded in 2009

- ~1,700 employees

- ~500 million in revenue in 2020

TPG Partners LLC

The private equity firm that mainly manages funds for institutional investors wants to access the secondary market or the world of index funds and exchange-traded funds (ETFs).

The firm filed a confidential S-1 with the SEC last month. The Wall Street Journal reported that the company could be valued at $10 billion.

Key Operational Metrics

- Founded in 1992

- $109 billion of assets under management (AUM)

- 912 employees

- Blackstone Group, Carlyle Group, and Apollo Global Management are competitors.

- $2.11 billion in revenue in 2020

- $1.44 billion net income in 2020

- Major deals: $5 billion purchase of luxury retailer Neiman Marcus, $44 billion buyouts of Texas Power/TXU

Impossible Foods, Inc

The meatless-burger company is another company that was on our 2021 List. The appetite for faux meat products is still there, but the Agrifoodtech company had already raised $2 billion in the private equity market.

On November 23, 2021, Impossible Foods raised $500 million at a $7 billion valuations. So far, the company raised a total of $2.1 billion in funding over two rounds.

Key Operational Metrics

- Founded in 2011

- Has products in 22,000 grocery stores and 40,000 restaurants

- Beyond Meat (publicly listed) and MeaTech are amongst its major competitors.

- ~800 employees

Discord

The chat app company was founded five years ago, but its growth has been skyrocketed. It has about 150 million active monthly users, and it turned down a $10 billion offer from Microsoft last year.

Jason Citron founded Discord to help remote tech workers remove slacks and have a reliable way to communicate. Gamers discovered and loved the social aspect of the app. They ditched TeamSpeak and Skype in favor of it.

On September 16, 2021, Discord raised $500 million at about $15 billion valuations. It has raised a total of $982.6 million in funding over 14 rounds so far.

Key Operational Metrics

- Founded in 2015

- 1,200+ employees

- 150M+ monthly active users (MAUs)

- 300+ million registered accounts

- $130 million revenue in 2020

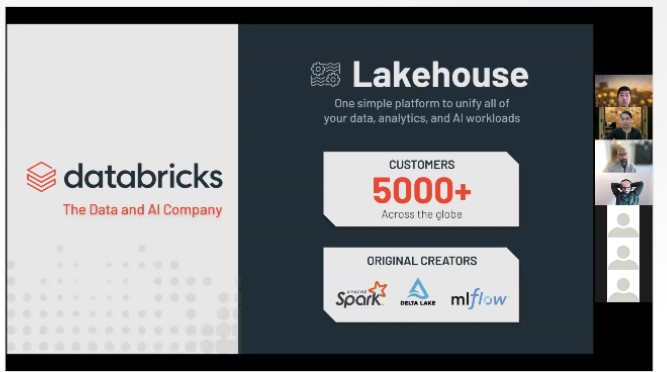

Databricks

The enterprise software company offers big firms an open and unified platform for data and artificial intelligence (AI).

The AI-powered data company has raised money from venture capital and non-venture capital investors. Fidelity and Franklin Templeton have poured money into the startup.

Databricks raised $1.6 billion at a valuation of $38 billion in a Series H round. It has raised a total of $3.5 billion in funding over nine rounds.

Key Operational Metrics

- Founded in 2013

- 2,000+ employees

- 5,000+ organizations use its data lakehouse software

- $600 million revenue in 2020

- Google, Microsoft & Snowflake are amongst its competitors

Klarna

Affirm, the “ buy now pay later” company had a very successful IPO last year; its stock skyrocketed to nearly 100% after IPO.

Other key players from the BNPL market will likely follow suit this year. Klarna is one of the most significant players in that space, and its growth has been rapid.

According to a report from Worldpay, Klarna processed $97 billion of global e-commerce transactions in 2020.

On June 10, 2021, Klarna raised $639 million at a valuation of $46 billion. It has raised a total of $3.7 billion in funding over 31 rounds.

Key Operational Metrics

- Founded 2005

- 90+ Million total active customers

- 250K total number of merchants

- 2M number of transactions per day

- Live in 17 countries

- ~3,800 employees

- $1.2 billion revenue in 2020

- $109.2 million net loss in 2020

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this year. Then Newsmax, the right-wing media outlet, gave it a shot in the arm...

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that when the new gross domestic product (GDP) number is released later this month, it...

1 Comment

Leave Comment

Cancel reply

What’s Going on with the U.S. IPO Market?

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Gig Economy

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this...

By MacKenzy Pierre

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that...

By MacKenzy Pierre

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

Latest Reviews

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write...

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said...

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...

Pingback: Re-Drafting the 2022 IPO Draft - Stock News