Rent Burden: 11 Cities Where a Six-Figure Salary is a Must for Affordable Housing

By Article Posted by Staff Contributor

The estimated reading time for this post is 252 seconds

The rental market in the United States has experienced unprecedented highs in the aftermath of the Covid-19 pandemic. With rental rates soaring nationwide, many individuals and families need help to secure affordable housing.

This article will explore the challenges renters face in various cities and the reasons behind the rising rent burden. We will focus on the Waller, Weeks, and Johnson Rental Index, which ranks the most overvalued rental markets in the country based on past leasing data.

This index estimates that the average U.S. rent should be around $1,915, but the current reality sees it at a staggering $2,018. Furthermore, we will analyze the financial implications of the rent burden and highlight 11 cities where a six-figure salary is necessary for comfortable and affordable housing.

The Rent Burden Dilemma

Financial experts often recommend that individuals spend no more than 30% of their gross income on rent to avoid being rent-burdened.

Unfortunately, many United States renters exceed this threshold due to exorbitant rental costs. According to the Waller, Weeks, and Johnson Rental Index, renters in the top six cities spend over 50% of their household income on rent, categorizing them as severely rent-burdened.

On average, a U.S. renter must earn almost $81,000 yearly to avoid being considered rent-burdened. However, in 11 cities, residents must earn over $100,000 a year to comfortably afford their rent. It is important to note that these estimates provided by the index are conservative and do not account for utilities, increasing the actual income required to sustain a reasonable standard of living.

California’s Dominance in the Rent Burden Crisis

The list of cities where a six-figure salary is necessary for affordable housing is dominated by California, with six out of the 11 cities located in the state.

California’s high cost of living and limited housing supply contributes significantly to the rental affordability crisis. Cities such as San Francisco, Los Angeles, and San Diego consistently rank among the most expensive rental markets in the country.

A booming technology industry, an attractive climate, and limited housing availability have created a perfect storm, resulting in astronomical rental prices.

Beyond California: Other Cities Struggling with Rent Burden

While California leads the rent burden crisis, other cities across the United States also grapple with similar challenges. New York City, with its vibrant culture and job opportunities, is notorious for its sky-high rents.

The competitive rental market and a lack of affordable housing options have made it incredibly difficult for New Yorkers to secure affordable accommodations.

Seattle, Washington, is another city where the rent burden is a pressing issue. The rapid growth of tech giants such as Amazon has led to an influx of highly paid employees, driving up the demand for housing and subsequently escalating rental costs.

This surge in rental prices has made it increasingly challenging for lower-income individuals and families to find affordable housing options.

The Impact of the Pandemic and Stagnant Wages

The housing market in the United States has been significantly influenced by the Covid-19 pandemic and stagnant wages, further exacerbating the issue of affordability.

While some areas have experienced a cooling of housing costs, high mortgage rates have made homeownership less attainable for many individuals. This, in turn, has increased the demand for rental properties, driving up rents in many cities nationwide.

Additionally, stagnant wages have failed to keep up with the rising cost of living, particularly in cities with booming industries and high demand for skilled workers.

This disconnect between wage growth and housing costs has created a situation where even those with well-paying jobs find it challenging to afford suitable rental accommodations.

The Ongoing Housing Affordability Crisis

The rent burden faced by many Americans highlights an ongoing housing affordability crisis. The lack of affordable housing options and skyrocketing rental prices disproportionately affect low-income individuals and families, pushing them into precarious financial situations.

The Economist, renowned for its analysis of global economic trends, recently addressed the severity of the housing affordability crisis in the United States. The article emphasizes the need for increased incomes to address this pressing problem, as high rents continue to burden individuals and households across the country.

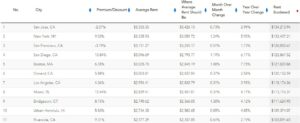

11 Cities Where a Six-Figure Salary is a Must for Affordable Housing

Rent Burden

Conclusion

The rental market in the United States has reached record highs, with rental rates surpassing the 30% threshold for the average American.

The Waller, Weeks and Johnson Index sheds light on the severity of the rent burden crisis, estimating that renters in 11 cities must earn over $100,000 a year to afford rent comfortably.

While California dominates the list, other cities, such as New York City and Seattle, face significant challenges regarding affordable housing.

The pandemic and stagnant wages have further complicated the issue, making it increasingly difficult for individuals to secure suitable rental accommodations.

Addressing the housing affordability crisis requires a multi-faceted approach that includes increasing the availability of affordable housing, implementing rent control measures, and addressing income disparities.

Without concerted efforts from policymakers, the rent burden crisis will persist, leaving millions of Americans struggling to secure safe and affordable housing.

RELATED ARTICLES

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing to Chinese Real Estate, there have been about nine notable global asset bubbles since the Great Depression. The most recent was the Special Purpose Acquisition...

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing market continues to navigate a complex landscape shaped by fluctuating interest rates, varying home prices, and evolving buyer behavior. Understanding the potential mortgage costs is...

Leave Comment

Cancel reply

In Search of the Next Asset Bubble

Biggest Financial Crimes: Washington Mutual Financial Scandal

How Much is a Mortgage on a $700,000 House

Gig Economy

American Middle Class / Jul 20, 2024

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing to Chinese Real Estate, there have been about nine notable global...

By MacKenzy Pierre

Fraud & Financial Crimes / Jul 16, 2024

Biggest Financial Crimes: Washington Mutual Financial Scandal

The estimated reading time for this post is 249 seconds Biggest Financial Crimes: Washington Mutual Financial Scandal Washington Mutual, once the largest savings and loan association...

By Article Posted by Staff Contributor

American Middle Class / Jul 16, 2024

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing market continues to navigate a complex landscape shaped by fluctuating interest...

By MacKenzy Pierre

American Middle Class / Jul 14, 2024

Financial Literacy: Building a Foundation for Financial Well-being

The estimated reading time for this post is 206 seconds Financial literacy is a critical skill that empowers individuals to make informed decisions about their financial...

By Article Posted by Staff Contributor

Stock News / Jan 02, 2024

Re-Drafting the 2023 IPO Class

The estimated reading time for this post is 147 seconds The Initial Public Offering (IPO) market is a significant barometer for economic health and investor sentiment. ...

By MacKenzy Pierre

Stock News / Dec 29, 2023

2024 IPO Draft Class

The estimated reading time for this post is 151 seconds 2024 IPO Draft Class: Ranking the Top Prospects Following the pattern of last year’s tumultuous market...

By MacKenzy Pierre

Stock News / Dec 22, 2023

Build Wealth with Boring Investments

The estimated reading time for this post is 314 seconds Due to their boredom, long-term, low-cost, and passive investing strategies have lost ground to more speculative...

By MacKenzy Pierre

Finance / Dec 10, 2023

Yes,Bitcoin Is a Financial Asset

The estimated reading time for this post is 239 seconds Yes, Bitcoin is a financial asset, but it’s not ready yet to be inside your 401(k),...

By MacKenzy Pierre

Business / Nov 24, 2023

Cash Management for Growing Businesses

The estimated reading time for this post is 147 seconds Cash Management for Growing Businesses: Navigating the Waters of Growth and Liquidity In the early stages,...

By MacKenzy Pierre

Fraud & Financial Crimes / Nov 21, 2023

Biggest Financial Crimes: Adelphia

The estimated reading time for this post is 255 seconds Biggest Financial Crimes: Adelphia Adelphia Communications Corporation, once a titan in the cable industry, became synonymous...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jul 20, 2024

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing...

Fraud & Financial Crimes / Jul 16, 2024

Biggest Financial Crimes: Washington Mutual Financial Scandal

The estimated reading time for this post is 249 seconds Biggest Financial Crimes: Washington Mutual...

American Middle Class / Jul 16, 2024

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing...