How Millennials Can Still Buy a Home in 2025 — Even as the American Dream Shrinks

By Article Posted by Staff Contributor

The estimated reading time for this post is 395 seconds

I. The Locked Door of the American Dream

If house-hunting feels harder than it was for your parents, that’s because it is.

Home prices have climbed faster than paychecks, interest rates have doubled in three years, and listings in the “starter-home” range now spark bidding wars before noon. The old idea — save 20 percent, buy the cute three-bedroom, and build equity — feels like a story from another economy.

But this isn’t hopeless. The math has changed, so the playbook must change too.

Today’s buyers win not by chasing prices but by mastering payments, preparation, and patience.

The goal: stop waiting for the market to get easier — and start playing smarter in the one we have.

II. What Changed: A Quick Diagnosis

- Price-to-income drift

That old “three times income” rule? It’s now four to six times in many metros. In Miami and Los Angeles, the gap is even wider. That means a $90 k household can’t comfortably afford what it once could. - Rate volatility

Mortgage rates move faster than wages. A one-point rate jump on a $400 k loan adds roughly $250–$300 a month to payments. That makes locking the right payment more important than chasing the perfect price. - Inventory bottlenecks

Years of under-building, zoning limits, and homeowners clinging to 3 percent loans mean fewer mid-priced homes — exactly the ones middle-class buyers used to start with. - Balance-sheet headwinds

Student loans, higher insurance, and HOA costs raise the bar. Many buyers qualify on paper but fail the real-life cash-flow test.

Why it matters:

Home equity compounds two ways — through price appreciation and through every principal dollar you pay down. The longer you wait, the less time both clocks have to work for you.

III. Five Rules to Actually Reach Closing

Rule 1 — Buy the Payment, Not the Price

A $450 k house at 3 % and the same house at 7 % are two different realities.

Focus on the monthly number you can live with.

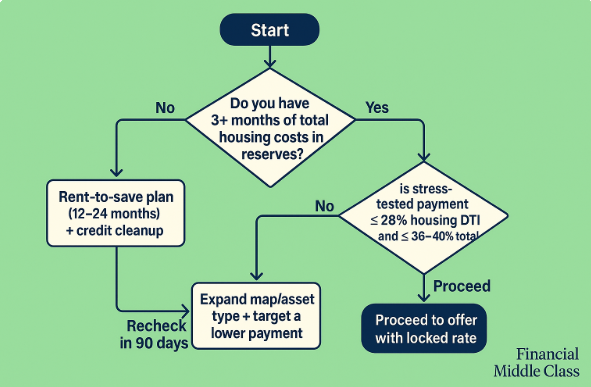

- DTI target: housing ≤ 28 %, total ≤ 36–40 %.

- Stress-test: run the numbers at ± 2 % interest. If you can’t survive the higher one, you can’t afford it.

- All-in math: principal + interest + taxes + insurance + HOA + utilities.

- Trial-month test: move the difference between your rent and the projected mortgage into savings for one month. If your budget breaks, regroup.

💬 “You’re not buying a price tag — you’re buying a lifestyle that fits your paycheck.”

Rule 2 — Engineer the Down Payment

Don’t wait for a miracle. Build tiers.

| Down % | Pros | Watch for |

| 5 % | Low entry cost; redirects cash to reserves | PMI adds $150–$250/mo |

| 10 % | Better pricing; easier approval | Still partial PMI |

| 20 % | No PMI; strongest offer | Requires patience |

Extra fuel:

- Check Down-Payment Assistance (DPA) programs and employer housing grants.

- Verify terms — avoid help that adds long-term monthly costs.

- Gift funds are allowed with documentation.

Action: pick your tier, divide the goal by months, and automate transfers from each paycheck.

Rule 3 — Win on Credit & Debt

Lenders reward consistency, not perfection.

- Keep every credit card under 10 % utilization for at least three months.

- Set autopay minimums on every account — one late hit costs more than small balances.

- For student loans, confirm how they’re counted: actual payment, assumed %, or income-driven plan. Get it in writing.

- After pre-approval, freeze your credit reports to avoid score dips from stray pulls.

30-Day Fix Plan: pull all three reports, pay down balances, dispute errors, and clean old addresses. Small moves here raise approvals — and lower rates.

Rule 4 — Expand the Map

You might not need to give up homeownership — just your favorite zip code.

- Drive-to-qualify radius: one transit stop or school-district line farther can trim hundreds off monthly costs.

- Property trade-offs: condos/townhomes cost less up front, but inspect HOA reserves carefully.

- Condition arbitrage: buy good bones, not granite counters. Cosmetic upgrades can wait.

🧭 Pro tip: Build a simple spreadsheet comparing payment per square foot across nearby areas. Patterns will jump out fast.

Rule 5 — Negotiate the Timeline

Timing and leverage matter as much as location.

- Get two pre-approvals: one from a big bank, one from a credit union or local lender — overlays differ.

- Understand locks, extensions, and float-downs: paying a few hundred for rate certainty can save thousands.

- Ask for precision in concessions: “3 % toward closing” beats vague “seller help.”

Email template to lenders:

Subject: Preapproval & Overlay Questions

Hi [Name],

I’m seeking a fully underwritten preapproval. Priorities:

- Total DTI ≤ 40 %

- Ability to use [gift funds/DPA]

- Clarify overlays for [student loans / condos]

Please confirm:

– Max DTI & score tiers for best pricing

– PMI options at 5 %, 10 %, 15 % down

– Lock / float-down terms & costs

– HOA reserve requirements

Thanks — comparing two offers this week.

— [Your Name]

The 6-Month Playbook

| Month | Focus | Key Actions |

| 0–1 | Baseline & Quick Wins | Pull 3 credit reports, set autopay, drop utilization < 10 %, open a home-fund account, run trial-month savings. |

| 1–3 | Cash-Flow & Docs | Create a zero-based budget, cancel unused subs, gather W-2s/1099s, pay stubs, bank statements, ID, student-loan docs. |

| 3–6 | Lender & Market Work | Secure two pre-approvals, build your payment-per-sq-ft table, tour only homes that fit the stress-tested payment. |

| 6 + | Closing Discipline | Keep three months of reserves, focus inspections on roof/HVAC/electrical/plumbing, verify insurance costs before signing. |

V. Metro Playbooks

South Florida (Miami – Fort Lauderdale – West Palm Beach)

- Insurance drives the deal — model wind & flood precisely. Ask for the seller’s prior declarations page.

- Condos: check reserves, assessments, and lawsuits; thin budgets kill loans.

- Compare Broward vs Palm Beach for taxes and premiums; small shifts save thousands.

Atlanta Metro

- Leapfrog one county or school zone for major payment drops.

- End-of-quarter builder incentives can undercut resale prices.

- Balance taxes vs HOA amenities — don’t pay for perks you’ll never use.

Los Angeles

- Consider small-lot homes or properties with legal ADUs — house-hack potential offsets cost.

- Review tenant-rights laws before inheriting occupants.

- Secondary transit corridors often hide the best value-to-commute ratio.

Smart Alternatives (If Buying Now Doesn’t Fit)

| Strategy | Pros | Cons |

| Shared Equity / CLT | Lower entry price | Limited upside on resale |

| Co-ownership | Split costs, build faster | Needs legal exit plan |

| House-hack lite | Income offsets mortgage | Must meet lender occupancy rules |

| Rent-to-Save Plan (12–24 mo) | Builds discipline | Requires firm deadline |

VII. Mistakes to Avoid

- Shopping by price tag, not by stress-tested payment

- Ignoring insurance, taxes, HOA, and utilities in the monthly math

- Letting student loans default to worst-case DTI assumptions

- Relying on a single lender or skipping pre-approvals

- Closing with no reserves — that’s just expensive renting

VIII. FAQs Millennials Keep Asking

Do I need 20 % down?

No. Buying earlier with PMI often beats waiting as prices rise. Run the five-year math both ways.

Fixed or ARM?

If you can’t survive the highest possible reset, don’t pick an ARM. If you can, and the fixed makes payments unworkable, a conservative ARM can bridge.

Should I wait for lower rates?

Only if waiting improves your cash, credit, or DTI. Otherwise, buy the payment you can handle now and refinance later.

How do lenders treat student loans?

Varies by program. Always ask how they calculate your payment — and get proof in writing.

Is renting throwing money away?

Not if it’s funding a 12-month rent-to-save plan with automated deposits. The waste isn’t rent; it’s drifting without a plan.

IX. Tools & Templates

First-Home Readiness Checklist

- ✅ Housing DTI ≤ 28 %; Total DTI ≤ 40 %

- ✅ Credit reports reviewed; utilization < 10 %

- ✅ Down-payment tier chosen; auto-save active

- ✅ Two pre-approvals obtained; overlays confirmed

- ✅ Payment stress-tested ± 2 % rate

- ✅ Payment-per-sq-ft table built

- ✅ Post-close reserves ≥ 3 months costs

- ✅ Inspection plan focused on major systems

Inspection Notes Template

Roof age • HVAC age • Electrical panel brand • Plumbing type • Moisture signs • Insurance forms (4-point / wind) • HOA reserves / assessments

X. The Mindset Shift

Owning a home in 2025 isn’t about luck — it’s about structure.

You’re not chasing a mythical dream from another generation; you’re engineering a financial plan that fits this one.

🏡 “The American Dream didn’t vanish. It just started requiring a spreadsheet.”

Follow the math, test the payment, and keep building your base.

When the right listing hits, you’ll be ready — not guessing, not hoping, but closing.

RELATED ARTICLES

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

By FMC Editorial Team

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

By MacKenzy Pierre

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs....

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market...

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan...