Smart Approaches to Money Management

By Article Posted by Staff Contributor

The estimated reading time for this post is 198 seconds

Guiding Your Financial Journey: Smart Strategies for Effective Wealth Management

Mastering the complexities of your personal finances is an indispensable life skill in today’s fast-paced, unpredictable economic landscape.

Navigating this journey successfully requires understanding and skillfully managing your financial resources, thus highlighting the crucial role of money management in achieving financial security and freedom.

The Foundations of Effective Money Management

Smart money management transcends the confines of timely bill payments and earning a high salary. It’s about making well-informed, strategic decisions about your earnings and savings. This involves mastering budgeting, investing, retirement planning, insurance, taxes, and maintaining a thorough understanding of the broader financial market.

The road to successful money management begins with setting practical financial goals.

Remember, personal finance doesn’t adopt a one-size-fits-all approach – everyone’s financial circumstances and aspirations vary. For some, the ultimate goal could be an early retirement, while others may strive to purchase a dream home or fund a child’s higher education.

Budgeting: Your Financial Blueprint

Budgeting is the cornerstone of financial management. It’s the process of mapping out your income and expenses to gain insights into your spending patterns and how to optimize your resource allocation.

Creating a budget may seem intimidating, but with a plethora of tools and applications available today, the task has become considerably simpler. As you draft your budget, be sure to account for both fixed and variable expenses and anticipate potential future costs.

Once you have a budget, adherence is critical – discipline is indeed the backbone of budgeting. However, keep in mind that flexibility is equally important. Changes in income, expenses, or personal circumstances might necessitate revisions to your budget.

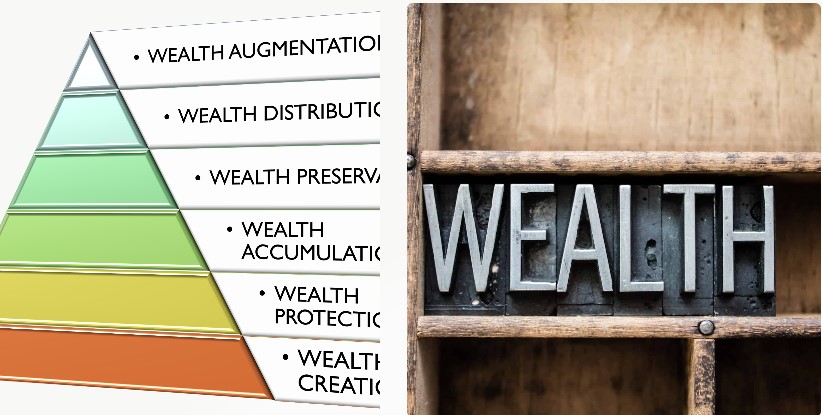

Investing: The Route to Wealth Accumulation

Investing is an essential tool for wealth generation. Prudent investments can augment your wealth, providing a safety net for unexpected expenses and ensuring a comfortable post-retirement life.

Investing necessitates an understanding of various investment vehicles like stocks, bonds, mutual funds, real estate, among others. It also requires a grasp of the potential risks and rewards associated with each.

Diversification – spreading your investments across different asset classes – is a smart approach to minimize risk while maximizing returns. However, it’s crucial that your investment strategies align with your financial goals and risk tolerance.

Remember, patience is a virtue in investing. Wealth accumulation is often a gradual process that rewards long-term investing.

Retirement Planning: Safeguarding Your Future

Regardless of your age, it’s never too early to begin planning for retirement. The sooner you start, the more time your money has to grow through the magic of compound interest.

Consider leveraging tax-advantaged retirement plans like 401(k)s or individual retirement accounts (IRAs) to bolster your wealth accumulation.

Understanding Insurance and Taxes

Insurance is a crucial component of a comprehensive financial plan, serving as a safety net for unexpected life events. Meanwhile, understanding taxes can help you optimize your income and investments. Familiarity with tax laws and potential deductions can save you a significant sum annually.

Utilizing Technology in Finance

Finally, embrace the power of the multitude of financial tools and apps available today. These platforms can simplify tasks like budgeting and investing, provide real-time insights into your financial status, and offer personalized advice to enhance your financial acumen.

Closing Remarks

Navigating the journey of smart money management is a lifelong endeavor with the potential to lead to financial freedom.

Understanding the fundamentals of financial planning, budgeting, investing, retirement planning, insurance, taxes, and the effective use of technology can empower you to take control of your financial destiny.

Financial literacy isn’t acquired overnight – it’s a constant process of learning, adjustment, and evolution. As your life circumstances change, so should your financial strategies.

With patience, discipline, and the right knowledge, you’ll be well-equipped to traverse the complex terrain of personal finance.

Though the journey of smart money management can seem daunting at first, the rewards are truly worth the effort. So why hesitate? Kickstart your journey to financial freedom today!

RELATED ARTICLES

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing to Chinese Real Estate, there have been about nine notable global asset bubbles since the Great Depression. The most recent was the Special Purpose Acquisition...

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing market continues to navigate a complex landscape shaped by fluctuating interest rates, varying home prices, and evolving buyer behavior. Understanding the potential mortgage costs is...

Leave Comment

Cancel reply

In Search of the Next Asset Bubble

Biggest Financial Crimes: Washington Mutual Financial Scandal

How Much is a Mortgage on a $700,000 House

Gig Economy

American Middle Class / Jul 20, 2024

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing to Chinese Real Estate, there have been about nine notable global...

By MacKenzy Pierre

Fraud & Financial Crimes / Jul 16, 2024

Biggest Financial Crimes: Washington Mutual Financial Scandal

The estimated reading time for this post is 249 seconds Biggest Financial Crimes: Washington Mutual Financial Scandal Washington Mutual, once the largest savings and loan association...

By Article Posted by Staff Contributor

American Middle Class / Jul 16, 2024

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing market continues to navigate a complex landscape shaped by fluctuating interest...

By MacKenzy Pierre

American Middle Class / Jul 14, 2024

Financial Literacy: Building a Foundation for Financial Well-being

The estimated reading time for this post is 206 seconds Financial literacy is a critical skill that empowers individuals to make informed decisions about their financial...

By Article Posted by Staff Contributor

Stock News / Jan 02, 2024

Re-Drafting the 2023 IPO Class

The estimated reading time for this post is 147 seconds The Initial Public Offering (IPO) market is a significant barometer for economic health and investor sentiment. ...

By MacKenzy Pierre

Stock News / Dec 29, 2023

2024 IPO Draft Class

The estimated reading time for this post is 151 seconds 2024 IPO Draft Class: Ranking the Top Prospects Following the pattern of last year’s tumultuous market...

By MacKenzy Pierre

Stock News / Dec 22, 2023

Build Wealth with Boring Investments

The estimated reading time for this post is 314 seconds Due to their boredom, long-term, low-cost, and passive investing strategies have lost ground to more speculative...

By MacKenzy Pierre

Finance / Dec 10, 2023

Yes,Bitcoin Is a Financial Asset

The estimated reading time for this post is 239 seconds Yes, Bitcoin is a financial asset, but it’s not ready yet to be inside your 401(k),...

By MacKenzy Pierre

Business / Nov 24, 2023

Cash Management for Growing Businesses

The estimated reading time for this post is 147 seconds Cash Management for Growing Businesses: Navigating the Waters of Growth and Liquidity In the early stages,...

By MacKenzy Pierre

Fraud & Financial Crimes / Nov 21, 2023

Biggest Financial Crimes: Adelphia

The estimated reading time for this post is 255 seconds Biggest Financial Crimes: Adelphia Adelphia Communications Corporation, once a titan in the cable industry, became synonymous...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jul 20, 2024

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing...

Fraud & Financial Crimes / Jul 16, 2024

Biggest Financial Crimes: Washington Mutual Financial Scandal

The estimated reading time for this post is 249 seconds Biggest Financial Crimes: Washington Mutual...

American Middle Class / Jul 16, 2024

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing...