Be a Better Investor: Tax-Advantaged Accounts

By Article Posted by Staff Contributor

The estimated reading time for this post is 284 seconds

Tax-advantaged accounts allow individuals to save money while enjoying additional tax benefits. These accounts, including retirement, education, and health plans, can significantly impact an individual’s financial future.

By understanding these accounts’ key features and benefits, individuals can make informed decisions to optimize their tax savings and achieve their financial goals.

Retirement Plans

Retirement plans are one of the most well-known types of tax-advantaged accounts. They provide individuals with various options to save for their golden years while enjoying tax benefits.

Employer-sponsored 401(k) plans are a popular choice, as they often come with employer contributions and the ability to defer taxes on the contributed amount and any investment gains until withdrawal.

Individuals who are self-employed or have maximized their contributions to employer-sponsored plans can turn to Individual Retirement Accounts (IRAs).

IRAs allow for tax-deferred growth, with traditional IRAs offering tax-deductible contributions and Roth IRAs providing tax-free withdrawals in retirement.

Education Plans

Education plans, such as 529 Plans and Coverdell Education Savings Accounts, are designed to help individuals save for educational expenses while enjoying tax advantages.

529 Plans are state-sponsored investment accounts that allow tax-free growth and withdrawals when funds are used for qualified education expenses, including tuition, books, and room and board. They offer flexibility in terms of beneficiary and state residency requirements.

Coverdell Education Savings Accounts are another option for educational savings.

They offer tax-free growth and withdrawals for qualified educational expenses, including primary, secondary, and higher education costs. However, contributions to Coverdell ESAs are limited to $2,000 per year per beneficiary.

Health Plans

Health Savings Accounts (HSAs) are tax-advantaged accounts designed to help individuals save for medical expenses while reducing their tax burden.

To be eligible for an HSA, individuals must be covered by a high-deductible health plan (HDHP). Contributions to an HSA are tax-deductible, and the funds can be invested and grown tax-free. Withdrawals used for qualified medical expenses are also tax-free.

Benefits of Tax-Advantaged Accounts

Reduced Current Tax Burdens: Tax-advantaged accounts allow individuals to lower their current tax liabilities. Contributions to these accounts are often tax-deductible or made with pre-tax dollars, reducing taxable income.

Predictability in Tax Payments: With tax-deferred accounts, such as traditional 401(k)s and traditional IRAs, individuals can postpone paying taxes until retirement when they may be in a lower tax bracket. This provides predictability in tax payments and allows for greater savings growth.

Financial Incentives for Savings: Tax-advantaged accounts provide individuals with financial incentives to save for specific purposes. These accounts are structured to encourage long-term savings by offering tax benefits that can amplify growth over time.

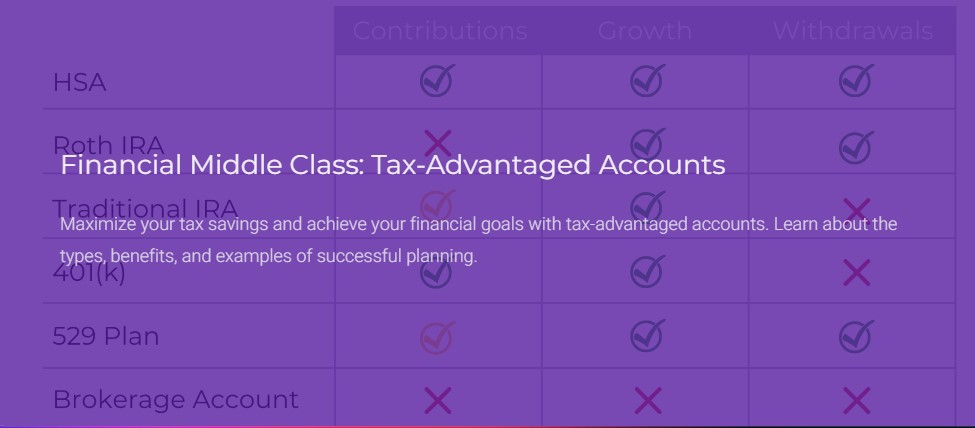

Types of Tax-Advantaged Accounts

Health Savings Accounts (HSAs): Ideal for saving for medical expenses, HSAs offer tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Flexible Spending Accounts (FSAs): FSAs are typically employer-sponsored accounts that allow employees to set aside pre-tax dollars to cover eligible medical, dental, and vision expenses. However, FSAs have a “use it or lose it” provision, meaning unused funds are forfeited at the end of the year.

529 Plans: These state-sponsored plans allow tax-free growth and tax-free withdrawals when funds are used for qualified educational expenses, making them an attractive option for saving for college or other educational costs.

Coverdell Education Savings Accounts: Coverdell ESAs provide tax-free growth and withdrawals for qualified educational expenses. However, contributions are limited to $2,000 per year per beneficiary.

Traditional and Roth 401(k)s Employer-sponsored retirement plans that offer tax advantages. Traditional 401(k)s allow tax-deferred contributions, while Roth 401(k)s offer tax-free withdrawals in retirement.

Traditional and Roth IRAs: Individual retirement arrangements with distinct tax advantages. Traditional IRAs allow for tax-deductible contributions, while Roth IRAs provide tax-free withdrawals in retirement.

Simplified Employee Pension IRAs (SEP-IRAs): Designed for self-employed individuals and small business owners, SEP-IRAs allow tax-deductible contributions and tax-deferred growth.

Considering Other Options

While tax-advantaged accounts provide significant benefits, individuals should also consider their financial goals and need for flexibility.

If accessibility and easy withdrawal options are essential, exploring high-yield savings accounts or certificates of deposit (CDs) with favorable interest rates may be worthwhile.

These options can complement tax-advantaged accounts and provide additional financial stability.

Successful Tax Planning with Tax-Advantaged Accounts

Strategies for Retirement Planning:

- Start early to maximize compound growth

- Contribute regularly: Consistent contributions maximize the benefits of tax-deferred growth and potential employer matching.

- Consider a Roth IRA: While contributions to a Roth IRA are not tax-deductible, qualified withdrawals during retirement are tax-free. Roth IRAs can be an excellent option if you anticipate being in a higher tax bracket in retirement.

- Choose low-cost index funds to minimize fees

Strategies for Healthcare Planning:

- Contribute the maximum allowed: Take full advantage of the contribution limits for HSAs and FSAs to maximize tax savings.

- Plan for future medical expenses: Utilize HSAs as a long-term investment vehicle, allowing funds to grow to cover future healthcare costs in retirement.

- Save your receipts for qualified medical expenses to withdraw tax-free in the future.

Strategies for Education Planning:

- Start early and save regularly: Compounding can significantly impact education savings, so it’s essential to begin saving early and contribute regularly.

- Explore state benefits: Research the available state tax benefits for 529 plans, as some states provide additional incentives for residents.

Conclusion

Tax planning with tax-advantaged accounts is a smart and efficient way to optimize your financial strategy while minimizing tax liabilities.

By utilizing retirement, healthcare, and education accounts, you can save for the future, manage medical expenses, and fund educational aspirations effectively.

Remember to consult with a financial advisor or tax professional to understand the specific rules and regulations governing each account and to tailor your tax planning strategy to your unique circumstances.

Carefully planning and using tax-advantaged accounts can enhance your financial well-being and achieve your long-term goals.

RELATED ARTICLES

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing to Chinese Real Estate, there have been about nine notable global asset bubbles since the Great Depression. The most recent was the Special Purpose Acquisition...

Yes,Bitcoin Is a Financial Asset

The estimated reading time for this post is 239 seconds Yes, Bitcoin is a financial asset, but it’s not ready yet to be inside your 401(k), 403(b), and Traditional IRAs. If you know me, then you know that’s breaking news. ...

1 Comment

Leave Comment

Cancel reply

In Search of the Next Asset Bubble

Biggest Financial Crimes: Washington Mutual Financial Scandal

How Much is a Mortgage on a $700,000 House

Gig Economy

American Middle Class / Jul 20, 2024

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing to Chinese Real Estate, there have been about nine notable global...

By MacKenzy Pierre

Fraud & Financial Crimes / Jul 16, 2024

Biggest Financial Crimes: Washington Mutual Financial Scandal

The estimated reading time for this post is 249 seconds Biggest Financial Crimes: Washington Mutual Financial Scandal Washington Mutual, once the largest savings and loan association...

By Article Posted by Staff Contributor

American Middle Class / Jul 16, 2024

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing market continues to navigate a complex landscape shaped by fluctuating interest...

By MacKenzy Pierre

American Middle Class / Jul 14, 2024

Financial Literacy: Building a Foundation for Financial Well-being

The estimated reading time for this post is 206 seconds Financial literacy is a critical skill that empowers individuals to make informed decisions about their financial...

By Article Posted by Staff Contributor

Stock News / Jan 02, 2024

Re-Drafting the 2023 IPO Class

The estimated reading time for this post is 147 seconds The Initial Public Offering (IPO) market is a significant barometer for economic health and investor sentiment. ...

By MacKenzy Pierre

Stock News / Dec 29, 2023

2024 IPO Draft Class

The estimated reading time for this post is 151 seconds 2024 IPO Draft Class: Ranking the Top Prospects Following the pattern of last year’s tumultuous market...

By MacKenzy Pierre

Stock News / Dec 22, 2023

Build Wealth with Boring Investments

The estimated reading time for this post is 314 seconds Due to their boredom, long-term, low-cost, and passive investing strategies have lost ground to more speculative...

By MacKenzy Pierre

Finance / Dec 10, 2023

Yes,Bitcoin Is a Financial Asset

The estimated reading time for this post is 239 seconds Yes, Bitcoin is a financial asset, but it’s not ready yet to be inside your 401(k),...

By MacKenzy Pierre

Business / Nov 24, 2023

Cash Management for Growing Businesses

The estimated reading time for this post is 147 seconds Cash Management for Growing Businesses: Navigating the Waters of Growth and Liquidity In the early stages,...

By MacKenzy Pierre

Fraud & Financial Crimes / Nov 21, 2023

Biggest Financial Crimes: Adelphia

The estimated reading time for this post is 255 seconds Biggest Financial Crimes: Adelphia Adelphia Communications Corporation, once a titan in the cable industry, became synonymous...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jul 20, 2024

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing...

Fraud & Financial Crimes / Jul 16, 2024

Biggest Financial Crimes: Washington Mutual Financial Scandal

The estimated reading time for this post is 249 seconds Biggest Financial Crimes: Washington Mutual...

American Middle Class / Jul 16, 2024

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing...

Pingback: Traditional 401(k) vs. Roth 401(k): Which Is Better for You? - FMC