America’s Repo Crisis: What Soaring Car Repossessions Reveal About the Middle-Class Squeeze

By Article Posted by Staff Contributor

The estimated reading time for this post is 326 seconds

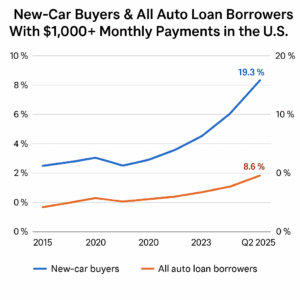

For many Americans, owning a car was long a pillar of middle-class stability. That’s shifting. Monthly car payments have now soared: the average new-vehicle payment is roughly $749 a month in Q2 2025. Meanwhile, among new-car buyers, nearly 1 in 5 committed to monthly payments of $1,000 or more in Q2 2025.

If people can’t keep up with paying for their cars, we’re seeing a clear warning light for the broader consumer economy.

2. The Data Breakdown

Here’s what the numbers tell us about auto-loan stress:

- According to Edmunds, 18.9% of new-car shoppers in Q4 2024 committed to monthly payments of $1,000 or more; that climbed to 19.3% in Q2 2025.

- For the broader pool of all auto-loans (new + used + leases), LendingTree finds about 8.6% of Americans with auto loans had at least one payment of $1,000 or more in Q1 2025.

- Average monthly payment for a new-vehicle loan: $749 (Q2 2025).

- Many loans are underwater: a growing share of financed vehicles are worth less than the loan balance (negative equity risk) — though exact figure varies by lender and region.

- Delinquency and repossession rates are rising (though national up-to-date repo totals remain patchy).

These figures add up to a growing number of American households paying big sums monthly, owning depreciating assets, and in some cases losing the cars they relied on.

America’s Repo Crisis: $1,000 Car Payments Surge

3. Why It’s Happening

Several trends are colliding to produce this pressure:

- High vehicle prices & longer loans: New-vehicle financing average amounts are over $42,000 for many buyers. Buyers are also stretching loan terms (84 months+ for a growing share) to manage payments.

- Stagnant or pressured incomes: While employment is still strong, wage gains haven’t kept pace with the cost increases in vehicles, insurance, fuel, maintenance, etc.

- Subprime exposure and looser underwriting: With fewer “0 % deals” and more consumers stretching terms or taking larger loans, risk is increasing.

- Negative equity risk: Vehicles lose value, and when borrowers finance more than the car’s value, it reduces flexibility. One report noted that many $1,000+ payment loans originated in 2024, meaning those borrowers may be locked in for a while.

All of this means that auto loans — which historically have been relatively stable compared to mortgages — are now showing signs of strain.

4. The Ripple Effect

When car payments and repossessions climb, it’s not just borrowers who feel it. The ripples go wider:

- Credit scores & future borrowing: A repossession or default on an auto loan can damage credit, limit future access to credit (including home loans), and raise borrowing costs.

- Banks, finance companies & lenders: Lenders face higher losses, charge-offs, and risk exposure. Some parts of the lending market—especially sub-prime or extended-term auto loans—could be especially vulnerable.

- Auto manufacturers & dealers: When financing becomes tougher and consumers can’t afford the payments, demand slows. This affects inventory turnover, incentives, and the broader auto-ecosystem.

- Used-car market & asset values: More loans with high payments, longer terms, and negative equity pressure can lead to more repossessions, more supply in auctions, and weaker used-car resale values → making future financing worse.

- Household budgets & mobility: Losing a car or being unable to keep up with payments limits job opportunities, commuting options, and general financial flexibility.

In short: auto-finance stress can become consumer-finance stress, which can become broader economic stress.

5. What This Says About the Economy

Usually when middle-class consumers begin to lose ground on a key expense like auto payments, it’s a signal that something deeper is amiss. A few takeaways:

- Sign of household budget strain: If many consumers are unable to meet auto-loan payments, that implies emergency buffers are depleted, wage growth isn’t enough, or debt loads are too high.

- Early-warning indicator: Historically, rising defaults in less visible layers of credit (auto, student, sub-prime) can precede broader credit tightening or downturns.

- Credit-market caution: Lenders may tighten underwriting, reduce risk appetite, raise rates, shrink loan offerings. That can reduce access for consumers and slow economic activity.

- Consumer sentiment & spending: When consumers are stressed about major bills (car, home, etc.), they pull back on discretionary spending — which feeds into slower economic growth.

- Potential recession arrow: It doesn’t guarantee a downturn, but it adds to the list of red flags (high inflation, rate hikes, stretched households) that forecasters watch.

For the middle class, this isn’t just about making a car payment. It’s about financial breathing room, mobility (literally), and resilience in a tightening environment.

6. Your Playbook — What You Can Do

If you’re a middle-class consumer (or striving to be one), this situation calls for action. Here are realistic moves to consider:

- Re-evaluate your auto budget: Don’t assume new car = good car. Consider if a lower payment or shorter term might make more sense.

- Refinance if possible: If your interest rate is high, explore refinancing into a lower rate or longer term to reduce your monthly payment.

- Avoid being upside-down: Be mindful of how quickly a car may depreciate and the ratio of your loan to the vehicle’s value.

- Sell or trade-down proactively: If your payment is more than 10–15% of your take-home and you feel strain, doing something sooner may be better than waiting for a repossession.

- Use your car as an asset, not a liability: Keep in mind the total cost of owning (loan + insurance + maintenance + fuel + depreciation).

- Budget buffer: Ensure you have emergency savings to cover payments if income dips or a shock hits.

- Contact your lender early: If you begin to struggle, many lenders prefer to work out modifications rather than repossess — delaying the issue doesn’t help.

- Alternative-transport planning: If your car becomes unaffordable, consider public transit, car-sharing, ride-hail etc. to reduce dependence and cost.

In short: this story isn’t just about “people losing cars”; it’s about households balancing on thin margins. Protect your mobility, your credit, and your wallet.

7. Bottom Line

The surge in auto-loan distress and the fact that nearly 1 in 5 new-car buyers now commit to payments of $1,000 or more is more than a niche auto-finance story: it’s a spotlight on stress within the middle-class consumer base. When a key monthly payment like the car starts to break down en masse, it suggests that households are hitting limits — and when the middle class hits limits, the economy feels it.

If you’re part of that middle class — or trying to stay in it — this is your alarm bell. Reassess, protect your financial mobility, and don’t assume auto payments are “just normal.” Because when one big fixed cost becomes unsustainable, the ripple effects can be widespread.

RELATED ARTICLES

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

By FMC Editorial Team

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

By MacKenzy Pierre

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs....

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market...

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan...