Are You a Deadbeat If You Have Bad Credit

By MacKenzy Pierre

The estimated reading time for this post is 398 seconds

Your credit report is your virtual first impression. Lenders start painting a picture of you the moment they see that credit score. Insufficient credit, high credit utilization, and other factors might be the cause of your bad credit report. However, it’s tough to make a second “first” impression on lenders and underwriters.

Credit Agencies

There are hundreds of credit bureaus or agencies that track the credit history of American borrowers. Each credit bureau generates its own credit report.

However, Experian, Equifax, Transunion are the 3 major credit tracking companies, and their reporting methods differ. As a result, you can have different credit scores across all three credit bureaus.

For most typical revolving and installment credit, the lender might pull just one of your credit reports. Revolving credit allows you to use the credit limit, pay it and use it, and you in. You can do this continually.

However, installment credit has finite terms and a maturity date, and you make your installment payments until the maturity date.

Your credit cards, home equity line of credit (HELOC), and personal lines of credit are all examples of revolving credit while your car, mortgage, and personal loans are all examples of installment credit.

However, mortgage lenders often pull all 3 of your credit reports and use your middle score to price your loan.

Credit Scores

Your credit scores and creditworthiness are everything if you want to participate in the credit markets.

Financial institutions and non-bank lenders use the score to decide how much to approve you for both revolving and installment credit, your credit limit, and interest rates.

Accessing financial products and services can be prohibitively expensive if you have bad credit.

VantageScore and FICO are the two major credit scores. They both tell lenders how likely you are to repay your debts.

The VantageScore is a collaboration amongst the 3 national credit bureaus while the FICO is a scoring model by the Fair Isaac Corporation.

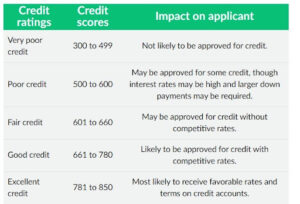

VantageScore Range

The Data analytics company was founded in 1956. Its headquarter is in San Jose, California, and has more than 4,000 employees.

The FICO score is widely more popular than the VantageScore. More than 90% of top lenders use FICO Scores according to the company

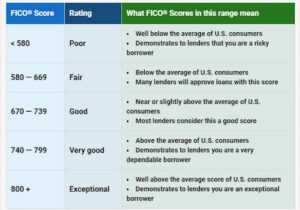

FICO Range

Credit Agencies Scoring Models

Each credit agency uses its FICO scoring model, which gives consumers 3 different FICO scores. Again, all lenders except mortgage pull just one credit report.

Mortgage lenders often pull all 3 credit reports and use the middle score to figure how what interest rate to charge and how much they should approve the loan for.

A car buyer can ask the lender ahead of time which credit report that they will to assess her creditworthiness.

- Experian developed FICO 2

- Equifax developed FICO 5

- TransUnion developed FICO 4

All 3 credit bureaus use FICO 8

Are You A Deadbeat if You Have Bad Credit?

Not quite, but potential lenders might disagree with me if all they have in front of them is your credit report.

You might have experienced or are still experiencing financial distress, making it hard for you to meet your financial obligations.

Serious delinquency, unpaid collections, and high credit utilization might result from unusual or unexpected financial shocks.

The good news is if you have bad credit, you can start taking steps today to improve it. However, there are a few things you need to know first:

Personal Financial Budget

There is a reason why you have bad credit. You need to figure out that reason (s) before you start taking steps to improve your credit scores.

Not mastering your cash flows is often one of the main reasons. You must know how much money is coming in and out of the house. Where and what are you spending your cash inflow on? A personal financial budget will help you master your cash flow.

Credit Repair Companies

There are no such things as “top credit repair companies” or “ legitimate credit repair companies.”

Popular credit repair companies such as Lexington Law, CreditRepair.com, and The Credit Pros will charge an exorbitant fee to do what you can do yourself.

Repairing your credit is a slow and simple process. You dispute erroneous accounts, pay off and settle the chargeoff and collections accounts, pay down revolving credit down to 30% of credit limit and start making all your payments on time.

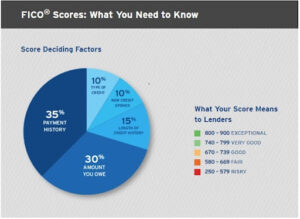

As you can see on the infographic below, 65% of the FICO deciding factors is making payment on time and don’t overuse your credit limit.

FICO Deciding Factors

No fast credit repair company can do this for you, and you have to do it yourself.

Time Heals All Wounds

Give yourself enough time to pull and review your credit and come up with an action plan. You don’t want to wait three months before you start house-hunting to pull and review your credit report.

Depending on how bad your credit report is, you might need up to 24 months to increase your FICO score to 700-plus.

You can get an FHA mortgage loan with a credit score as low as 580 as long as you are okay with paying higher interest rates and fees.

Accessing Your Credit Reports & Credit Scores

Most credit card and fintech companies now give consumers free access to credit reports and scores.

You can also access all 3 of your credit reports on annualcreditreport.com, a website jointly operated by the major credit bureaus.

The website has been giving consumers weekly free access to their credit reports since the pandemic.

Collections/Debt Revival/Statutes of Limitations

A deadbeat is someone who makes a habit of avoiding or evading his responsibilities and financial obligations. Having bad credit does not necessarily make you a deadbeat, and you have to stop postponing or ignoring your responsibilities.

Before you start reaching out to your lenders and try to settle and pay off old debts, you must be aware of debt revival and the statute of limitations.

Every state has its specific statute of limitations language on debt. In Florida, it is five years meaning that your creditor has five years to collect or start a lawsuit against you for the money you owe them.

You have to make sure that you are ready to settle and pay off your collection and charge-off accounts before reaching out to your lenders.

Making a small payment towards the debt can revive it, meaning that its statute of limitations resets. Only reach out to lenders when you have the money to settle. Depending on the age of the debt, you might be able to settle for as low as 50 cents on a dollar.

You Have Rights

Because you are past due on a few bills does not give any organization the right to abuse and harass you.

The consumer laws and regulations below protect against abuse and harassment. Take the time and get yourself familiarized with their provisions.

- Fair Credit Reporting Act (FCRA)

- Fair Debt Collection Practices Act

- Truth in Lending Act

- The Credit Repair Organization Act

In 2010, Congress passed, and President Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act which established the Consumer Financial Protection Bureau (CFPB). If you feel like any of the above law has been violated, you can file a complaint with the CFPB.

In conclusion

Having bad credit history does not necessarily mean that you are a deadbeat. However, potential lenders who just have your bad credit report before them might think that you intentionally avoid your financial responsibilities.

You can start taking steps today to improve your credit. www.annualcreditreport.com lets you pull and review all 3 of your credit reports every week. Once you are done reviewing your credit report, draft an action plan.

A personal financial budget will help you master cash flow. It takes you time to damage your credit, so it will take an equal amount of time to increase your fico score to 700-plus.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing to Chinese Real Estate, there have been about nine notable global asset bubbles since the Great Depression. The most recent was the Special Purpose Acquisition...

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing market continues to navigate a complex landscape shaped by fluctuating interest rates, varying home prices, and evolving buyer behavior. Understanding the potential mortgage costs is...

1 Comment

Leave Comment

Cancel reply

In Search of the Next Asset Bubble

Biggest Financial Crimes: Washington Mutual Financial Scandal

How Much is a Mortgage on a $700,000 House

Gig Economy

American Middle Class / Jul 20, 2024

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing to Chinese Real Estate, there have been about nine notable global...

By MacKenzy Pierre

Fraud & Financial Crimes / Jul 16, 2024

Biggest Financial Crimes: Washington Mutual Financial Scandal

The estimated reading time for this post is 249 seconds Biggest Financial Crimes: Washington Mutual Financial Scandal Washington Mutual, once the largest savings and loan association...

By Article Posted by Staff Contributor

American Middle Class / Jul 16, 2024

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing market continues to navigate a complex landscape shaped by fluctuating interest...

By MacKenzy Pierre

American Middle Class / Jul 14, 2024

Financial Literacy: Building a Foundation for Financial Well-being

The estimated reading time for this post is 206 seconds Financial literacy is a critical skill that empowers individuals to make informed decisions about their financial...

By Article Posted by Staff Contributor

Stock News / Jan 02, 2024

Re-Drafting the 2023 IPO Class

The estimated reading time for this post is 147 seconds The Initial Public Offering (IPO) market is a significant barometer for economic health and investor sentiment. ...

By MacKenzy Pierre

Stock News / Dec 29, 2023

2024 IPO Draft Class

The estimated reading time for this post is 151 seconds 2024 IPO Draft Class: Ranking the Top Prospects Following the pattern of last year’s tumultuous market...

By MacKenzy Pierre

Stock News / Dec 22, 2023

Build Wealth with Boring Investments

The estimated reading time for this post is 314 seconds Due to their boredom, long-term, low-cost, and passive investing strategies have lost ground to more speculative...

By MacKenzy Pierre

Finance / Dec 10, 2023

Yes,Bitcoin Is a Financial Asset

The estimated reading time for this post is 239 seconds Yes, Bitcoin is a financial asset, but it’s not ready yet to be inside your 401(k),...

By MacKenzy Pierre

Business / Nov 24, 2023

Cash Management for Growing Businesses

The estimated reading time for this post is 147 seconds Cash Management for Growing Businesses: Navigating the Waters of Growth and Liquidity In the early stages,...

By MacKenzy Pierre

Fraud & Financial Crimes / Nov 21, 2023

Biggest Financial Crimes: Adelphia

The estimated reading time for this post is 255 seconds Biggest Financial Crimes: Adelphia Adelphia Communications Corporation, once a titan in the cable industry, became synonymous...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jul 20, 2024

In Search of the Next Asset Bubble

The estimated reading time for this post is 308 seconds From Dot-com to U.S. Housing...

Fraud & Financial Crimes / Jul 16, 2024

Biggest Financial Crimes: Washington Mutual Financial Scandal

The estimated reading time for this post is 249 seconds Biggest Financial Crimes: Washington Mutual...

American Middle Class / Jul 16, 2024

How Much is a Mortgage on a $700,000 House

The estimated reading time for this post is 193 seconds As of mid-2024, the housing...

Pingback: Credit Inquiry: Mortgage, Auto Loans & More - Credit Cards