Worrying about your credit score or FICO score might seem like a mixed priority right now because the world is amidst of a pandemic. However, an excellent credit score will facilitate your financial recovery after COVID-19 is contained.

Americans, especially the middle class, are getting walloped by this pandemic. More than 3.3 Americans filed for unemployment claims last week according to the Labor Department reporting. Job loss, layoffs, and furloughs will continue.

To curtail the economic impact of the pandemic, President Donald Trump signed a massive $2.2 trillion coronavirus stimulus bill. The stimulus package will send up to $1,200 for individuals, $2,400 for married couples, and $500 per child, reduced if an individual makes more than $75,000 or a couple makes more than $150,000.

Getting a one-time check from the government is nice, but taking advantage of this great low-interest-rate environment is the only way you can expedite your financial recovery. You need an excellent credit score to access low mortgage and personal loan rates and other financial products. Here are three quickest ways to raise your credit score:

Lower Your Credit Utilization Ratio

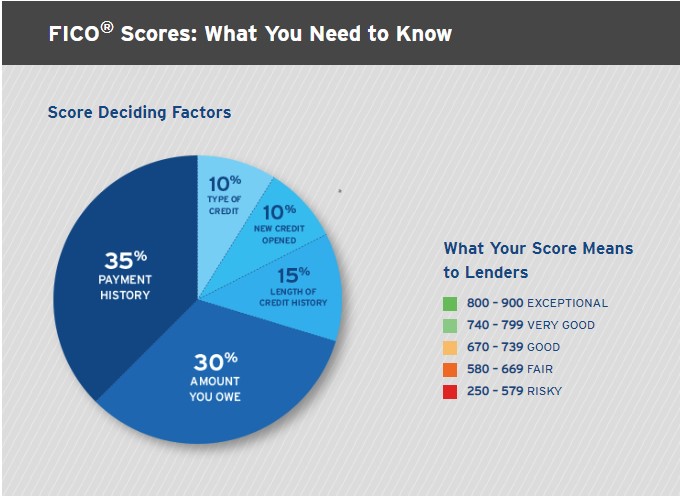

Credit card issuers love sending you credit offers, but they don’t like it when you max them out. 65% of the factors that go into your credit/FICO are related to payments, with 30 percent being how much of your available credit you spend. You will see a big jump on your FICO if you reduce all revolving debt to 30% of the limit.

If you have three credits with a total available credit limit of $3,700, your outstanding credit debt cannot be more than $1,110 ($3,700 x.3). if you get a new credit card with a $500 credit limit, you need to spend $150, which brings your available credit limit to $4,200 ($3,700 +$500) and your outstanding credit debt to $1,250 ($1,110 + $150)

Going over the 30% threshold on any of your four credit cards is not a big problem, but your total outstanding credit card debt cannot more than 30%. So, if your utilization ratio is 45% on a card, one card has to be at 15 percent.

Satisfying Judgments and Settling Collections

If you have tax liens and other judgments and collection accounts on your credit report, you need to get on the phone with the creditors and explore ways to settle them. For most parts, those creditors already lost confidence in collecting on judgments and collection accounts.

They might settle with you for as low as 50 percent of the amount owed. Moreover, if you are persuasive enough, your creditors might even agree to remove the past due account from your credit report. The majority of people don’t pick up the phone and play nice with these types of creditors. You can gain a lot if you muscle the courage to deal with them.

Get Higher Credit Limit

Making on-time payments and reducing all revolving debt to 30% of the limit account for 65 % of your credit score or FICO score. The quickest way to lower your outstanding debt to 30% of the available limit is to call your credit company and ask them to increase your credit limit. If you have a good payment history with the company, they will increase your limit.

The Bottom

The bottom line is that raising your credit score is quite easy to do if you want to put in the work. Controlling your spending and making payments on time get you 65 percent there.

Pingback: How to Overcome Intergenerational Poverty - Personal Finance

Pingback: If Your Credit Card Debt Is Ballooning and You Are Having Problems Making Payments, There Are Steps You Can Take - FMC