Be a Better Investor: Diversification

By Article Posted by Staff Contributor

The estimated reading time for this post is 247 seconds

Diversification is a fundamental concept in investment management that aims to minimize risk and maximize returns by spreading investments across different asset classes, industries/sectors, and geographical regions.

This strategy helps investors reduce their exposure to individual risks and achieve a more balanced and resilient portfolio. This article will explore the concept of diversification, its strategy, and its implications for retail investors.

We will also examine the pros and cons of diversification and differentiate between diversifiable and non-diversifiable risks.

What Is Diversification?

Diversification is an investment strategy that involves allocating funds across various assets to reduce exposure to any single investment. The underlying principle is based on the notion that different assets tend to have varying correlations.

By investing in a mix of assets with low correlations, investors aim to mitigate the impact of adverse events affecting any particular investment.

Understanding Diversification

Diversification spreads investments across different asset classes, such as stocks, bonds, real estate, commodities, and alternative investments.

It also involves investing in various industries or sectors within those asset classes. The rationale behind this approach is that different assets and sectors tend to perform differently under various market conditions.

When one asset class or sector underperforms, others may compensate and provide positive returns, minimizing the overall portfolio risk.

Diversification Strategies

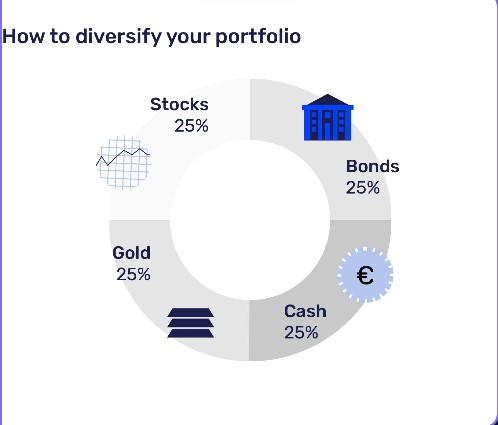

Asset Class Diversification

Investors can diversify across asset classes, such as equities, fixed income, and commodities. Each asset class has unique risk and return characteristics.

By allocating investments across these classes, investors can benefit from the uncorrelated performance of different portfolio assets. For instance, during an economic downturn, bonds may provide stability while equities face a decline.

Industry/Sector Diversification

Investors can diversify within each asset class by allocating investments across different industries or sectors.

For example, investors can spread their investments within the equity market across sectors like technology, healthcare, finance, and energy. By doing so, they can reduce the risk associated with being overly concentrated in a single industry, such as suffering significant losses if that sector experiences a downturn.

Diversification and the Retail Investor

Diversification is equally relevant for retail investors as it is for institutional investors.

Retail investors often have limited resources and may need access to sophisticated investment options. However, they can still achieve diversification through mutual funds, exchange-traded funds (ETFs), or target-date retirement funds.

These investment vehicles pool together funds from multiple investors and diversify across various asset classes and sectors, making diversification accessible to retail investors.

Pros of Diversification

Risk Reduction

Diversification helps reduce the impact of individual investment losses by spreading risk across different assets or sectors. When one investment performs poorly, others may counterbalance those losses, mitigating overall portfolio risk.

Potential for Higher Returns

By diversifying, investors can capture positive returns from different assets or sectors that outperform during specific market conditions. This can enhance portfolio performance and generate higher returns over the long term.

Protection against Uncertainty

Diversification can shield investors from unforeseen events or market shocks affecting specific investments or sectors. It provides a safety net by avoiding overexposure to a single asset, reducing the portfolio’s vulnerability.

Cons of Diversification

Potential for Lower Returns

Diversification inherently means spreading investments across multiple assets, which could limit the potential for outsized gains.

A diversified portfolio may not fully capture those high returns if a particular investment performs exceptionally well.

Complexity and Increased Costs

Building and maintaining a diversified portfolio can be complex and time-consuming, especially for individual investors.

It requires research, analysis, and ongoing monitoring of various investments. Moreover, diversification can increase transaction costs and management fees, impacting overall returns.

Diversifiable vs. Non-Diversifiable Risk

Diversifiable, unsystematic, or idiosyncratic risks are the portion of an investment’s risk that can be eliminated through diversification.

This risk is specific to individual securities or companies and includes factors such as management decisions, product performance, or regulatory changes. By holding a diversified portfolio, investors can reduce diversifiable risk.

Non-diversifiable or systematic risk is inherent to the overall market or economy and cannot be eliminated through diversification.

Factors such as interest rate fluctuations, geopolitical events, or broad economic trends impact all investments to some extent. Examples of non-diversifiable risks include recessions, inflation, or sudden market downturns.

Asset allocation and risk management strategies are the only way to manage non-diversifiable risk.

Conclusion

Diversification is a crucial strategy for managing risk and maximizing returns in investment portfolios.

By spreading investments across different asset classes, industries/sectors, and regions, investors can reduce the impact of individual risks and increase the potential for long-term gains.

Retail investors can achieve diversification through investment vehicles like mutual funds or ETFs.

While diversification offers numerous benefits, investors should consider the potential trade-offs, such as limited returns and increased complexity.

Moreover, it is essential to distinguish between diversifiable and non-diversifiable risks to implement effective risk management strategies.

Finding the right balance between diversification and concentration based on individual investment goals and risk tolerance is critical to successful portfolio management.

RELATED ARTICLES

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this year. Then Newsmax, the right-wing media outlet, gave it a shot in the arm...

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that when the new gross domestic product (GDP) number is released later this month, it...

Leave Comment

Cancel reply

What’s Going on with the U.S. IPO Market?

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Gig Economy

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this...

By MacKenzy Pierre

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that...

By MacKenzy Pierre

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

Latest Reviews

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write...

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said...

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...