Refinance vs. Home Equity Loan: Which Is Better

By Article Posted by Staff Contributor

The estimated reading time for this post is 278 seconds

When homeowners need funds for various purposes, such as home improvements, debt consolidation, or covering unexpected expenses, they often consider tapping into their home’s equity. Cash-out refinancing and home equity loans are popular options for accessing this equity.

This article will delve into these financial tools’ features, benefits, and drawbacks to help you make an informed decision.

By understanding the differences between a cash-out refinance and a home equity loan, you can determine which option best suits your unique circumstances.

What is a Cash-Out Refinance?

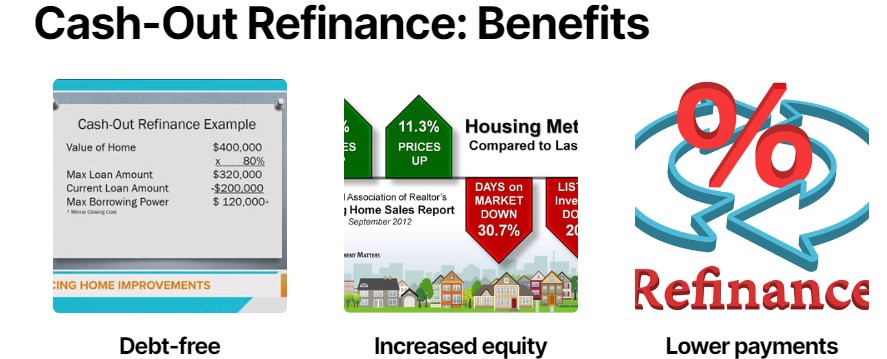

A cash-out refinance involves replacing an existing mortgage with a new one with a higher loan amount, allowing homeowners to borrow against the equity they have built in their homes.

The difference between the new and old mortgage is paid out to the homeowner in cash. For example, let’s consider John, who has a home worth $300,000 and a remaining mortgage balance of $200,000.

If he chooses to do a cash-out refinance for $250,000, he will receive $50,000 in cash (the difference between the new mortgage and the old mortgage).

What is a Home Equity Loan?

On the other hand, a home equity loan is a second mortgage that allows homeowners to borrow against the equity in their property while keeping their existing mortgage intact.

The loan amount is based on the value of the home and the amount of equity available. For instance, if Sarah has a home worth $400,000 and an existing mortgage balance of $250,000, she might qualify for a home equity loan of $100,000, which she can use as she sees fit.

Cash-Out Refinance vs. Home Equity Loan: Which is Right for You?

To determine which option suits your needs, it’s important to consider various factors.

Flexibility

One advantage of a cash-out refinance is its flexibility. Since it replaces your existing mortgage, you can secure a lower interest rate and potentially reduce your monthly payments.

Additionally, you can choose the new mortgage term, allowing for increased control over your finances. On the other hand, a home equity loan allows you to keep your current mortgage intact, which can be beneficial if you have a favorable interest rate or if refinancing is not a viable option due to credit constraints.

Cost

Both cash-out refinancing and home equity loans come with associated costs. When refinancing, you may incur closing costs, appraisal fees, and other charges similar to those of a regular mortgage.

In contrast, home equity loans generally have lower closing costs. However, comparing both options’ interest rates, fees, and terms is crucial to assess the overall cost over the loan term.

Risk and Loan Structure

With a cash-out refinance, you are replacing your existing mortgage with a new loan. This means you will have a single mortgage payment, but the entire property serves as collateral.

On the other hand, a home equity loan adds a second lien to your property, creating two separate payments (the primary mortgage and the home equity loan).

In the event of financial difficulties, failing to make payments on either loan could result in foreclosure. It’s essential to understand the risks associated with each option and evaluate your ability to manage multiple loan payments if you choose a home equity loan.

Alternative Solutions and Perspectives

While cash-out refinancing and home equity loans are popular ways to access home equity, there are alternative solutions to consider:

Home Equity Line of Credit (HELOC)

A HELOC is a revolving line of credit that allows homeowners to borrow against their equity when needed, similar to a credit card. This option provides flexibility, as borrowers can access funds as required and only pay interest on the amount used.

However, it’s crucial to be mindful of potential interest rate fluctuations and the possibility of higher interest rates than other loan options.

Personal Loans:

For smaller funding needs, homeowners may consider a personal loan instead of leveraging their home equity. Personal loans often have shorter terms and higher interest rates, but they do not put the home at risk since they are unsecured loans.

This option may be suitable for those who prefer not to increase their mortgage debt or who have limited equity available.

Pros and Cons

To summarize the pros and cons of each option:

Cash-Out Refinance:

Pros:

- Potential for lower interest rates and improved loan terms.

- Consolidation of debts into a single mortgage payment.

- Ability to access a larger amount of funds.

Cons:

- Potential for higher closing costs.

- Resetting the loan term could result in paying more interest over time.

- Risk of losing the property if unable to meet mortgage payments.

Home Equity Loan:

Pros:

- Ability to keep the existing mortgage intact.

- Lower closing costs compared to a cash-out refinance.

- Flexibility in using funds as needed.

Cons:

- Additional monthly payment and potential for higher interest rates.

- Risk of foreclosure if unable to meet payments on both loans.

- Limited access to funds based on available equity.

Conclusion:

Whether a cash-out refinance or a home equity loan is better depends on your financial situation, goals, and preferences.

A cash-out refinance may be more suitable if you’re looking for flexibility and potential cost savings. However, a home equity loan might be better if you prefer to maintain your existing mortgage or have limited equity available.

It is essential to thoroughly research and compare each option’s costs, terms, and risks before making a decision. Exploring alternative solutions like HELOCs or personal loans can provide additional perspectives.

Ultimately, consulting with a qualified mortgage professional can help you navigate the intricacies of each option and make an informed choice tailored to your needs.

RELATED ARTICLES

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this year. Then Newsmax, the right-wing media outlet, gave it a shot in the arm...

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that when the new gross domestic product (GDP) number is released later this month, it...

1 Comment

Leave Comment

Cancel reply

What’s Going on with the U.S. IPO Market?

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Gig Economy

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this...

By MacKenzy Pierre

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that...

By MacKenzy Pierre

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

Latest Reviews

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write...

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said...

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...

Pingback: How to Finance a Boat - Personal Finance