Be a Better Investor: Risk-Return Tradeoff

By Article Posted by Staff Contributor

The estimated reading time for this post is 291 seconds

Risk-return tradeoff is the type of investment principle that all investors must understand. Individuals often invest their money in various assets such as stocks, bonds, real estate, or commodities, whether for retirement or building wealth. While making investments, investors often weigh the risks and returns of different investment options before making a decision. This is where the risk-return tradeoff comes into play.

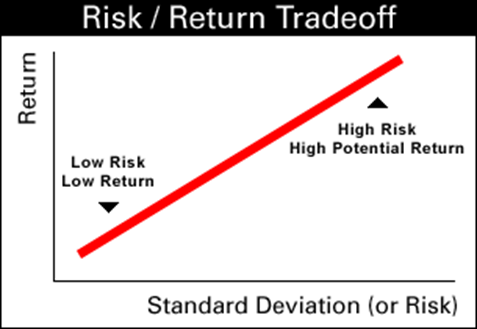

The risk-return tradeoff is a fundamental investment principle that helps investors understand the relationship between risk and return.

The concept states that the potential return an investor expects to earn from an investment should increase as the level of risk increases. In this article, we will explore the concept of risk-return tradeoff, what it tells investors, its meaning, importance, and calculation.

Definition:

The risk-return tradeoff is the principle that investors must be compensated for taking additional risks. The concept states that the higher the risk associated with an investment, the higher the potential return an investor can earn.

The risk-return tradeoff principle assumes that investors are rational and will only take on additional risk if they expect to earn higher returns.

What Risk-Return Tradeoff Tells Investors:

The risk-return tradeoff tells investors they cannot expect to earn high returns without taking on some level of risk. If investors want to earn higher returns, they must be willing to accept a higher level of risk. On the other hand, if investors want to reduce their risk, they must accept lower potential returns.

The principle of risk-return tradeoff also tells investors that there is no such thing as a risk-free investment. Even the safest investments, such as government bonds, carry some level of risk.

While the risk associated with government bonds may be relatively low, the potential return is also low. On the other hand, investments in stocks, which are generally riskier, offer the potential for higher returns.

Meaning:

The risk-return tradeoff means that investors must balance their desire for higher returns with their tolerance for risk. Different investors have different risk tolerances, which affect their investment decisions.

Some investors may be willing to take on more risk to earn higher returns, while others may be more conservative and prefer lower-risk investments with lower potential returns.

The principle of risk-return tradeoff also means that investors must consider the risks associated with different investment options before making a decision.

The risks associated with an investment can include market risk, credit risk, liquidity risk, inflation risk, and interest rate risk. Investors must assess the likelihood and potential impact of each of these risks before making an investment decision.

Importance:

The risk-return tradeoff is important because it helps investors make informed investment decisions. Understanding the relationship between risk and return allows investors to evaluate the potential risks and rewards of different investment options.

This knowledge can help investors make decisions that align with their investment goals and risk tolerance.

The principle of risk-return tradeoff is also important because it helps investors diversify their portfolios. Diversification is spreading investments across multiple asset classes, industries, and geographies to reduce overall risk.

By diversifying their portfolios, investors can earn higher returns while reducing risk exposure.

Calculation:

The calculation of the risk-return tradeoff is relatively simple. It involves comparing an investment’s potential return to the risk associated with that investment.

The potential return of an investment can be estimated based on historical performance, future earnings projections, or other factors. The level of risk associated with an investment can be estimated based on the probability of loss or the volatility of the investment’s returns.

One way to calculate the risk-return tradeoff is to use the Sharpe ratio. The Sharpe ratio is a measure of risk-adjusted return that compares the potential return of an investment to the level of risk associated with that investment.

The Sharpe ratio is calculated by subtracting the risk-free rate of return from the expected return of the investment and dividing the result by the standard deviation of the investment’s returns.

The risk-free rate is typically the rate of return on a government bond or other investment considered low risk.

For example, suppose an investor is considering two investments, Investment A and Investment B. Investment A has an expected return of 10% and a standard deviation of 15%. Investment B has an expected return of 12% and a standard deviation of 20%. The risk-free rate of return is 2%. Using the Sharpe ratio, we can calculate the risk-return tradeoff for each investment as follows:

Sharpe ratio for Investment A = (10% – 2%) / 15% = 0.53

Sharpe ratio for Investment B = (12% – 2%) / 20% = 0.50

Based on the Sharpe ratio, Investment A has a slightly better risk-return tradeoff than Investment B. This means that, on a risk-adjusted basis, Investment A is a better investment option.

Alternative Solutions or Perspectives:

While the risk-return tradeoff is a fundamental investment principle, it is not the only perspective on investing. Some investors may focus more on minimizing risk than maximizing returns, while others may be willing to take on significant risk to earn higher returns potentially.

In addition, some investment strategies may focus on different factors, such as value, momentum, or size. These strategies may have different risk-return profiles than a traditional portfolio that is diversified across asset classes.

Conclusion:

The risk-return tradeoff is a fundamental investment principle that helps investors understand the relationship between risk and return.

It is a concept that states that investors must be compensated for taking on additional risk, and the potential return an investor expects to earn from an investment should increase as the level of risk increases.

The principle of risk-return tradeoff is important because it helps investors make informed investment decisions and diversify their portfolios.

While the Sharpe ratio is a useful tool for calculating the risk-return tradeoff, it is not the only perspective on investing, and investors should consider their individual risk tolerance and investment goals when making investment decisions.

RELATED ARTICLES

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this year. Then Newsmax, the right-wing media outlet, gave it a shot in the arm...

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that when the new gross domestic product (GDP) number is released later this month, it...

Leave Comment

Cancel reply

What’s Going on with the U.S. IPO Market?

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

Gig Economy

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write the epitaph for the U.S. IPO market, at least for this...

By MacKenzy Pierre

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said during an interview with Fox News a few weeks ago that...

By MacKenzy Pierre

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I saw a social media video of a guy who, not even...

By MacKenzy Pierre

American Middle Class / Nov 24, 2024

Saving vs. Investing: What’s the Difference?

The estimated reading time for this post is 173 seconds When managing your finances, two terms often pop up: saving and investing. But what’s the difference,...

By Article Posted by Staff Contributor

American Middle Class / Nov 15, 2024

Exploring the Financial Challenges of the Unbanked: Insights from the FDIC’s 2023 Survey

The estimated reading time for this post is 266 seconds Introduction In 2023, about 4.2% of U.S. households—equivalent to approximately 5.6 million families—remained unbanked. Despite years...

By FMC Editorial Team

American Middle Class / Nov 09, 2024

Should You Rent vs Buy a Home? How to Decide.

The estimated reading time for this post is 327 seconds The question of whether to rent or buy a home has been overanalyzed by just about...

By MacKenzy Pierre

American Middle Class / Nov 05, 2024

Creating an Emergency Fund: Why Everyone Needs One and How to Build It Quickly

The estimated reading time for this post is 331 seconds Introduction: The Safety Net You Can’t Afford to Ignore Life is full of unexpected events—whether it’s...

By Article Posted by Staff Contributor

American Middle Class / Nov 02, 2024

2025 401(k) limit: $23,500; IRA limit unchanged

The estimated reading time for this post is 191 seconds Maximize Your Retirement Savings in 2024: Key IRS Adjustments to Know Saving for retirement just got...

By Article Posted by Staff Contributor

American Middle Class / Oct 30, 2024

US Economy Update

The estimated reading time for this post is 139 seconds The Bureau of Economic Analysis (BEA) report indicates solid economic growth in the third quarter of...

By FMC Editorial Team

American Middle Class / Oct 29, 2024

Zero-Based Budgeting: A Guide on Tracking Every Dollar to Maximize Savings

The estimated reading time for this post is 324 seconds Introduction: Why Zero-Based Budgeting? Have you ever gotten to the end of the month and wondered...

By Article Posted by Staff Contributor

Latest Reviews

Business / Apr 14, 2025

What’s Going on with the U.S. IPO Market?

The estimated reading time for this post is 353 seconds We were ready to write...

American Middle Class / Apr 05, 2025

Commerce Secretary Howard Lutnick Worries about the Wrong GDP

The estimated reading time for this post is 223 seconds Commerce Secretary Howard Lutnick said...

American Middle Class / Mar 17, 2025

Financial Nihilism: How Millennials and Gen Z Are Betting Against Economic Reality

The estimated reading time for this post is 181 seconds A few days ago, I...