It’s Not About How Much You Make — It’s How Much You Keep

By Article Posted by Staff Contributor

The estimated reading time for this post is 504 seconds

Many Americans are earning more than ever, but far too many have almost nothing to show for it beyond bills, debt, and stress.

Even as wages have risen in recent years, the typical household is saving only a sliver of its income and struggling to withstand even small financial shocks, according to a mix of federal statistics and private-sector surveys. The gap between how much people make and how much they actually keep is widening into a quiet crisis for the working and middle class.

On paper, the U.S. personal saving rate — the share of disposable income left after taxes and spending — hovered around 4% to 5% in 2024 and 2025, well below long-term averages and far lower than in previous decades. At the same time, about 67% of Americans report living paycheck to paycheck, and roughly one-third say they can’t comfortably handle a $400 emergency without borrowing, cutting other expenses, or simply not paying.

Those numbers sit uneasily beside stories from people who never earned more than $50,000 a year yet managed to build emergency savings, pay off their homes, and retire without financial panic — while some six-figure earners feel one layoff away from disaster.

At the center of that divide is a simple but often overlooked reality: It’s not about how much money you make. It’s about how much you keep.

What “Keeping Money” Means

A household’s savings rate is the percentage of its income that remains after taxes and everyday expenses and actually stays put — in savings, investments, or debt reduction that permanently shrinks monthly bills.

That can include:

- Cash or high-yield savings for emergencies

- Contributions to retirement accounts like 401(k)s and IRAs

- Extra payments on high-interest debts

- Money put toward paying off a mortgage early

A high income with a low savings rate is financially fragile.

A modest income with a consistent savings rate can quietly build real security over time.

High Incomes Aren’t Translating Into Security

Despite the strong job market in recent years, many households earning well above the national median still report that nearly every dollar is spoken for by the time it arrives.

Rising costs of:

- Housing

- Childcare and education

- Healthcare

- Transportation

have collided with lifestyle expectations to push fixed expenses — mortgages or rent, car payments, subscriptions, tuition, and more — ever closer to 100% of take-home pay.

In surveys, Americans say they are spending more of their paychecks within the first 48 hours of getting them, with essentials like housing, utilities, groceries and credit card payments consuming the bulk of income. Savings typically comes last, if it happens at all.

The result is a growing group of households that look successful on the outside but have little margin for error. A sudden job loss, medical issue, or unexpected expense can quickly push them into high-interest debt or missed payments.

Lifestyle Creep Is a Driving Force

For many workers, every raise or promotion quietly triggers a new round of upgrades:

- Moving to a more expensive apartment or larger home

- Trading in for a newer car on a bigger payment

- Adding streaming services, memberships and subscriptions

- Taking more expensive “once-in-a-lifetime” vacations — every year

This phenomenon, often called lifestyle creep, means that as income climbs, spending rises to match it. Discretionary upgrades often become permanent obligations, leaving little room to save.

A typical pattern looks like this:

- Income rises.

- Fixed bills increase to match.

- Savings and investing remain flat — or don’t happen at all.

Over time, households can find themselves with a much higher income than they had five or ten years ago, but with no more financial cushion — and in some cases, even less.

The Quiet Success Story of the 50K Household

In contrast, some households that never cracked $50,000–$60,000 a year have managed to accumulate meaningful stability.

Common traits among these families include:

- Modest housing choices: buying or renting below what a bank or landlord says they can “afford,” often staying put instead of upgrading every few years.

- Conservative car decisions: buying used cars, paying them off, and driving them for several years after the final payment.

- Early and steady saving: putting a small percentage of income into retirement and emergency savings consistently over time, even when contributions felt small.

- Windfall discipline: using tax refunds, overtime, or bonuses to pay down debt, build savings, or tackle home repairs instead of letting the money disappear into higher spending.

These households rarely go viral on social media, but their finances tell a different story from their six-figure peers: fewer debts, less stress, and more options late in life, even without a dramatic income.

Structural Headwinds Make It Harder to Keep Money

Individual habits matter, but they’re operating inside a tougher environment for today’s working and middle-class households.

Housing and the Cost of “Normal”

Home prices and rents have risen faster than wages in many regions over the last decade, especially in major metro areas. Rising property taxes and insurance costs add to the pressure for homeowners, while renters face frequent increases that can outpace annual raises.

Households that stretch for “dream” homes or luxury rentals often end up devoting 40% or more of their income to housing alone, leaving limited room for savings or unexpected expenses.

Debt-Heavy Paths to Education and Opportunity

For many younger workers, the path to higher income runs through:

- Student loans

- Professional certifications

- Relocations to expensive cities

As federal student loan payments restarted and pandemic-era relief programs ended, borrowers have had to adjust budgets to accommodate loan bills again, squeezing an already tight monthly cash flow.

In practice, this has meant cutting back on saving, relying more on credit, or delaying milestones like homeownership.

A Thin National Savings Buffer

The overall picture is sobering:

- Americans saved an average of about 4–5% of their disposable income in 2024, down from higher levels seen in earlier decades.

- Roughly one-third of adults say they could not cover a $400 emergency with cash, savings, or a card paid off quickly.

- Around two-thirds of workers report living paycheck to paycheck, leaving little margin for error.

Against this backdrop, households that manage to save consistently — even on modest incomes — stand out.

Why Savings Rate Beats Salary

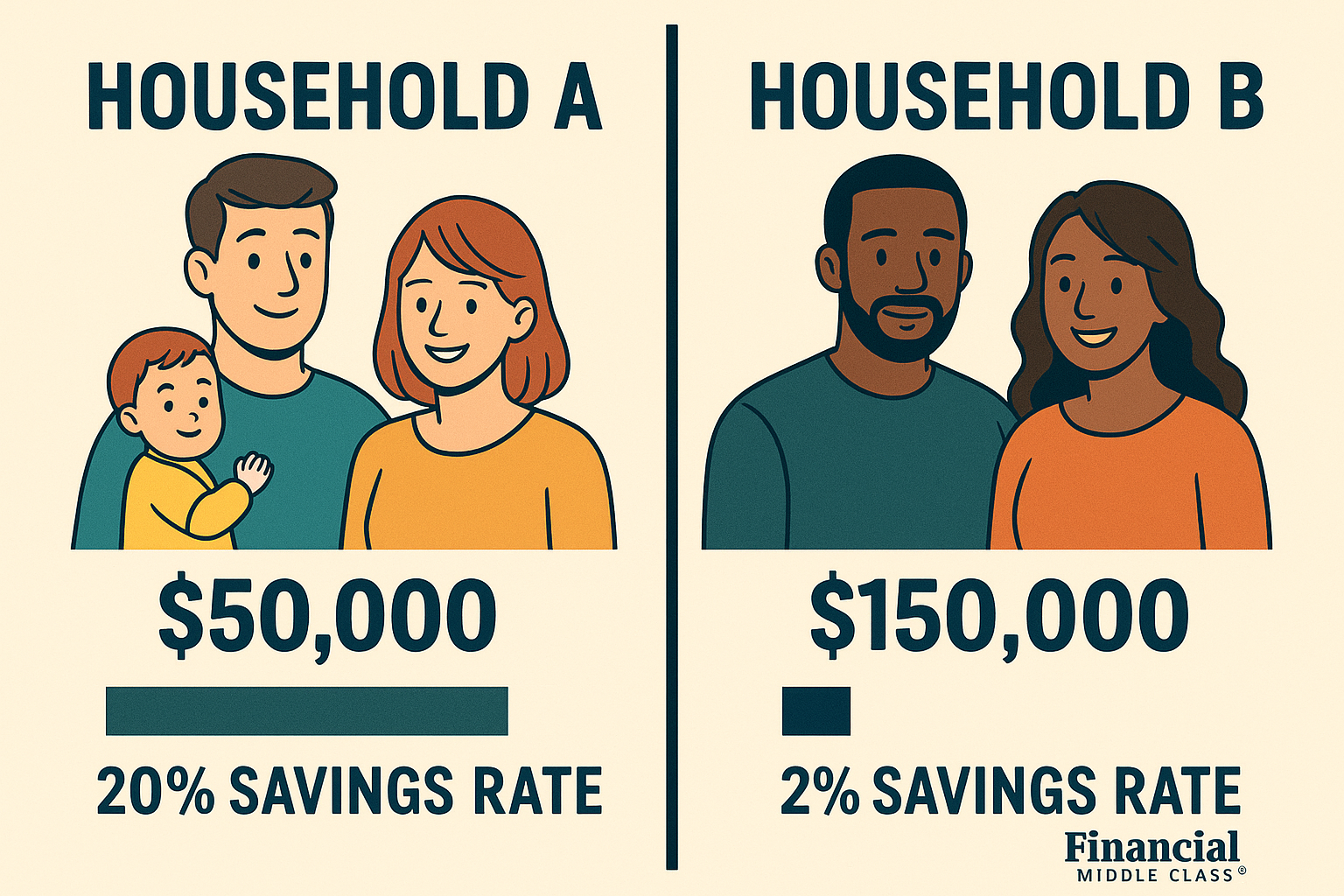

A key distinction between fragile six-figure households and resilient “regular” earners is their savings rate.

Consider two simplified examples:

- Household A earns $50,000 and saves 20% of their income.

- That’s $10,000 a year kept.

- Household B earns $150,000 but saves just 2%.

- That’s $3,000 a year kept.

Over a decade, ignoring investment growth for simplicity:

- Household A would have set aside $100,000.

- Household B would have kept $30,000.

The higher earner has more income flowing through their hands, but the lower earner is actually building more wealth.

A household cannot control every aspect of its income — industries change, layoffs happen, health conditions appear — but it has more influence over how much of each paycheck is allowed to stay.

Ways to Keep More of What You Earn

There is no single fix that works for everyone. But there are practical steps households can take to shift from merely making money to actually keeping it.

Don’t avoid looking at your numbers

Ignoring your budget or account balances doesn’t reduce the stress; it just keeps you flying blind.

- Review the last 1–3 months of your bank and card statements.

- Add up how much came in after taxes and how much you actually saved or put toward debt you won’t run back up.

This simple exercise reveals your real savings rate — the starting point for any plan.

Pay yourself first, not last

Treat saving like a bill you owe your future self, not an optional extra.

- Set a target to save 5%, 10% or more of your take-home pay, depending on your situation.

- Automate a transfer from checking to savings or investment accounts the day your paycheck hits.

When savings happen automatically, they’re less likely to be squeezed out by impulse spending throughout the month.

Keep fixed expenses low and manageable

High fixed expenses — housing, car payments, insurance, childcare, subscriptions — are the main reason many higher earners still feel broke.

Consider:

- Renting or buying below the maximum a lender says you can “afford.”

- Extending the life of a paid-off car instead of upgrading immediately.

- Reviewing recurring charges at least once a year and canceling what you don’t use or truly value.

Every dollar you permanently remove from fixed bills is a dollar you can redirect to savings — not just once, but every month going forward.

Build and protect an emergency fund

An emergency fund is not a luxury; it’s a basic piece of financial infrastructure.

- Start with a goal of $500 to $1,000 to handle small crises.

- Work toward one month of essential expenses, then three to six months if your income allows.

This buffer helps you avoid turning every surprise expense into new credit card debt.

Use windfalls to move forward, not just celebrate

Tax refunds, bonuses, overtime, and side hustle money can either:

- Disappear into lifestyle upgrades, or

- Provide leaps forward for your financial stability.

Decide ahead of time how you’ll allocate windfalls — for example:

- 50% toward savings or debt

- 50% toward something you enjoy

This way, you still feel rewarded, but your long-term self gets a share too.

A Quiet Redefinition of “Doing Well”

For years, “doing well” has been framed in terms of visible markers:

- Square footage

- Car badges

- Vacation photos

- Private schools and extracurriculars

Yet the data and countless real-life stories suggest another definition: being able to handle life without your finances collapsing.

That usually looks less glamorous and more like:

- A payment you don’t have

- An emergency you can handle

- A retirement that feels possible, not mythical

- The ability to walk away from a toxic job sooner because your bills are covered

Many Americans are falling behind on savings and stability even as their paychecks grow, if they are not already falling behind on long-term goals by letting lifestyle costs rise with every raise.

The difference between the household that makes “good money” and feels constantly on edge and the one that never broke $50,000 but retires calm is not just luck. It’s the answer to one question:

Out of every $100 you earn, how much do you actually keep?

RELATED ARTICLES

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what to do next. Read now.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

Selling Your Home Isn’t a Chore. It’s a Power Test.

Avoid costly seller mistakes—price smart, negotiate, handle appraisals, and protect your equity. Read the full seller playbook.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist....

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and...