Middle Class Finance

By Article Posted by Staff Contributor

The estimated reading time for this post is 347 seconds

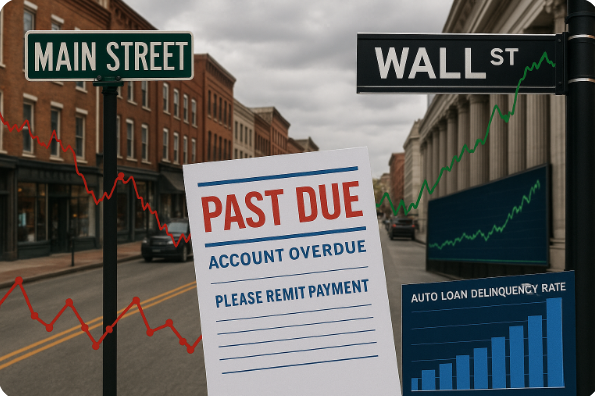

The Growing Divide Between Main Street and Wall Street

Walk down any neighborhood street today, and the story is clear: Americans are financially stretched thin. Auto loan delinquencies are spiking, credit card balances are ballooning, and personal loan defaults are rising. Foreclosures and repossessions are creeping higher, a reminder that many households are just one missed paycheck away from crisis. The job market — once a pillar of strength — is showing cracks, with unemployment creeping upward.

Now shift your gaze to Wall Street. The stock market is at record highs, corporate profits remain robust, and investors are buzzing with optimism. To the casual observer, it feels like the nation is living in two separate realities: Main Street under strain, Wall Street in celebration.

This paradox is not only confusing — it’s dangerous, because it obscures the financial vulnerability of America’s middle class.

Main Street: The Reality of Strain

For everyday households, the economic picture is far less rosy than Wall Street headlines suggest.

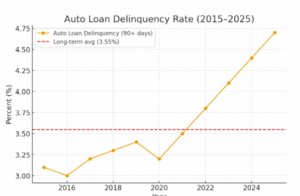

- Rising Delinquencies: According to recent Federal Reserve data, auto loan delinquencies have reached levels not seen since before the Great Recession. Credit card debt is at a record high, and with interest rates north of 20% in many cases, balances grow faster than families can pay them down.

- Housing Instability: Mortgage delinquencies and foreclosures, while not at crisis levels, are trending upward. Renters aren’t spared either — evictions are climbing in several major cities.

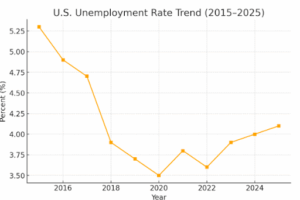

- Job Market Softness: Unemployment is still “low” by historical standards, but it’s moving in the wrong direction. Behind the headline numbers are countless stories of reduced hours, fewer job openings, and industries — from tech to retail — shedding staff.

Put simply: Main Street is struggling to keep up with the cost of living, even as the broader economy is technically expanding.

Wall Street: The Celebration Continues

On Wall Street, the narrative couldn’t be more different. Stock indexes are breaking records, venture capital is flowing back into tech, and corporate earnings are beating expectations.

- Forward-Looking Optimism: Investors are betting on what’s next. The prospect of Federal Reserve rate cuts fuels belief that markets will soar higher, regardless of today’s pain.

- Corporate Resilience: Big companies have weathered inflation by passing costs on to consumers. Households may be strained, but corporate balance sheets look healthy.

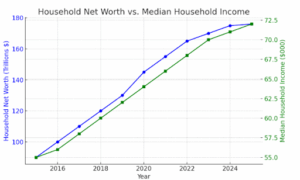

- Wealth Effects: For those who own stocks or real estate, asset values are rising. But ownership is heavily concentrated: the top 10% of households own nearly 90% of all stock wealth.

The result? A market narrative that celebrates growth and opportunity, while millions of families feel like they’re slipping backward.

Historical Parallels

This disconnect is not new. America has a long history of Main Street pain coexisting with Wall Street celebration:

- The Great Recession (2008): Housing markets collapsed, foreclosures spiked, and unemployment surged. Yet by 2009, Wall Street was already recovering thanks to bailouts and monetary stimulus, while households slogged through years of lost wealth.

- Pandemic Recovery (2020–2021): Millions lost jobs, small businesses shuttered, and families faced eviction. Meanwhile, the S&P 500 posted one of its fastest recoveries ever, driven by tech stocks and Federal Reserve liquidity.

- The “Roaring ’20s” (1920s): The stock market boomed while rural America faced an agricultural depression. The divide between Main Street and Wall Street helped set the stage for the eventual crash in 1929.

Each era shows the same story: markets can soar while households suffer — until the gap becomes too wide to ignore.

Why the Disconnect Exists

The divergence between Main Street and Wall Street can be explained in four key ways:

- Time Horizons

Wall Street prices in the future. Main Street pays bills today. While investors anticipate rate cuts and earnings growth, families grapple with rent due on the first of the month. - Unequal Ownership

Only about half of Americans own stocks, and most ownership is concentrated among the wealthy. Rising markets disproportionately benefit those who already have wealth. - Policy Filters

Federal Reserve policy affects Main Street and Wall Street differently. Rate hikes raise borrowing costs immediately for households, but investors often interpret them as temporary pain before future gains. - Global vs. Local Economics

Corporations operate globally. A multinational firm can post record profits thanks to overseas sales, even as U.S. households struggle with stagnant wages and rising costs.

The Middle Class Squeeze

The middle class sits at the heart of this contradiction. They’re told the economy is strong, yet their daily reality suggests otherwise. Consider the following:

- Wage Growth vs. Inflation: Wages have risen, but much of those gains are eaten away by higher costs for housing, healthcare, childcare, and groceries.

- Debt Dependency: More families are using credit cards to cover essentials, a sign not of financial confidence but of desperation.

- Retirement Paradox: Retirement accounts may be growing thanks to the market rally, but many households are simultaneously dipping into savings to make ends meet.

This is the essence of middle class finance: living in the gap between optimistic economic narratives and the harsh reality of personal budgets.

What It Means for Policy

The divide between Main Street and Wall Street poses risks beyond individual households:

- Political Frustration: When people are told the economy is strong but they feel financially weak, it fuels distrust in institutions and leaders.

- Market Vulnerability: If Main Street defaults rise high enough, they can eventually drag down Wall Street — as seen in 2008.

- Systemic Inequality: Asset booms that bypass the middle class widen wealth gaps, threatening long-term social stability.

Bridging this divide requires policies that focus not only on GDP growth or stock indexes, but on household-level financial resilience.

Navigating Middle Class Finance

So how can middle-class households survive — and even thrive — in this environment? A few guiding principles:

- Protect Liquidity

Build an emergency fund, even small. Liquidity buys time and peace of mind in uncertain job markets. - Attack High-Interest Debt

Credit card debt compounds quickly. Prioritizing its reduction is the single most impactful financial move most households can make. - Stay Invested for the Long Term

If you have a retirement account, don’t panic-sell when Main Street feels rough. Historically, Wall Street’s long-term trajectory benefits disciplined savers.

Prioritize Stability Over Flash

A reliable income, stable housing, and low debt can be more powerful wealth-building tools than chasing speculative trends.

Conclusion

The American economy is sending mixed messages — because it is two economies. Main Street is struggling with rising debt, housing instability, and job insecurity. Wall Street is booming with record profits, soaring stocks, and investor optimism.

For the middle class, the challenge is to navigate the gap. That means acknowledging the daily struggles without losing sight of long-term opportunities. It means managing debt today while building wealth for tomorrow.

In the end, “Middle Class Finance” isn’t about picking sides between Main Street and Wall Street. It’s about equipping yourself with the tools to survive in one economy while investing in the other. Because until the gap closes, middle-class households will continue to live at the crossroads of contradiction — balancing resilience with hope.

RELATED ARTICLES

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what to do next. Read now.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

Selling Your Home Isn’t a Chore. It’s a Power Test.

Avoid costly seller mistakes—price smart, negotiate, handle appraisals, and protect your equity. Read the full seller playbook.

By Article Posted by Staff Contributor

American Middle Class / Jan 24, 2026

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

By FMC Editorial Team

American Middle Class / Jan 23, 2026

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

By FMC Editorial Team

American Middle Class / Jan 21, 2026

The government was about to take your paycheck. Then it hit pause.

Wage garnishment paused for defaulted student loans—what it means for your paycheck, tax refund, and next steps. Read before it restarts.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy....

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect...

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises....