The Real Cost of Your Car: Why That “Affordable” Payment Is Wrecking Middle-Class Budgets

By Article Posted by Staff Contributor

The estimated reading time for this post is 316 seconds

The Real Cost of Your Car: Why That “Affordable” Payment Is Wrecking Middle-Class Budgets

If you’re middle class in America, odds are your car is your second-biggest bill after housing. But here’s the catch: almost nobody actually knows what their car really costs.

We know the monthly payment by heart. We vaguely know what gas “feels like.” Insurance is just that annoying bill that goes up every renewal. The rest? It blurs into the background. Oil changes, tags, random repairs, tires, parking, tolls—death by a thousand swipes.

What Is the Total Car Cost?

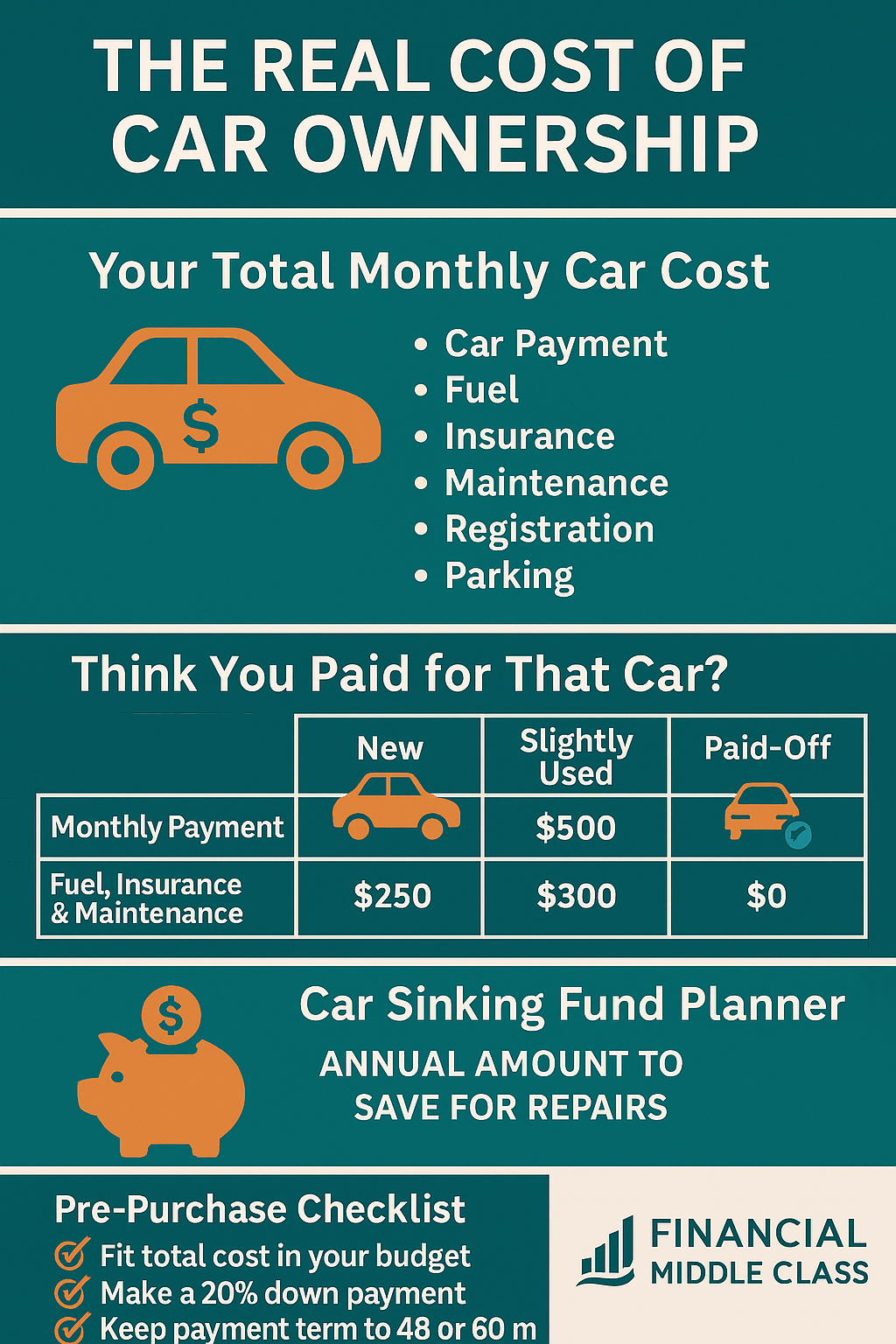

The total car cost (the total cost of car ownership) is everything you spend to own and use a car each month—the payment, fuel, insurance, maintenance, repairs, registration, taxes, parking and tolls, not just the loan. When you add it all up, many “affordable” cars quietly eat a double-digit share of your take-home pay.

When you put it all together, the average American who buys a new car is spending about $11,577 per year—roughly $965 a month—just to own and operate that vehicle, assuming 15,000 miles a year. That’s AAA’s 2025 estimate, and it actually reflects a drop from 2024.

Now zoom out: transportation overall eats roughly 17% of the average U.S. household budget, making it the second-largest expense after housing. For lower-income households, the share is far higher. So when we get car decisions wrong, we don’t just “overspend a bit.” We blow a hole in the part of the budget that was supposed to go to savings, debt payoff, or retirement.

Let’s break down what’s really happening with the total cost of car ownership, and what it means for a middle-class household that’s trying to build wealth instead of just feed the driveway.

1. The Payment Is a Distraction

Dealers talk in monthly payments on purpose.

“Can you do $599 a month?”

“Don’t worry about the price, let’s get that payment where you need it.”

It sounds helpful. It’s not. It’s a way to hide the total cost of ownership—what this car will actually drain from your wallet over the next five years.

AAA’s 2025 “Your Driving Costs” breakdown takes all of this into account: depreciation, interest, fuel, insurance, maintenance and repairs, license and registration, and taxes. That’s how they land on that $11,577 per year for the “average” new vehicle.

That number is not just a payment. It’s the whole ecosystem of money that disappears around your car. Which means:

- A “comfortable” payment can still sit on top of a very expensive car life.

- A cheaper car with a boring payment can actually be the wealth-builder in disguise.

If you only ever look at the payment, you’re negotiating on the dealer’s terms, not yours.

Stop guessing. See what your car really costs you every month.

Rule of thumb: Under 10% of take-home is lean, 10–15% is caution, above 15% is car-heavy.

2. The Big, Quiet Killer: Depreciation

Every time you start the car, it loses value. That’s depreciation—and it’s the single biggest cost of new-car ownership.

AAA’s 2025 fact sheet pegs average depreciation at around $4,334 per year across the vehicles it studied.

You never write a check labeled “depreciation,” but you absolutely pay it:

- When you go to sell or trade in and realize you’re upside down.

- When your car loses $15,000 of value in five years and that wealth just… evaporates.

- When you roll negative equity into your next car because you “had to” trade early.

New cars hit you hardest in the first few years. That’s why for many middle-class families, buying slightly used and holding for a long time is where the math starts to flip in your favor. That’s also why 72- and 84-month loans are dangerous: the car is falling faster than the loan balance for a big chunk of that time.

3. The Rest of the Drain: Interest, Insurance, Fuel, and “Little” Bills

After depreciation, you still have all the stuff you do see—just not all at once.

Interest: Paying rent to use money

AAA assumes a five-year loan with 15% down at an average interest rate and estimates about $1,131 per year in finance charges for the average new car.

Stretch that to 72 or 84 months, and your payment drops—but your total interest climbs. You also trap yourself in the car longer before you can cleanly exit.

Insurance: Different car, different story

Insurance is not a flat tax on driving. It changes wildly by:

- Car type (a cheap sedan vs. a luxury SUV vs. a performance car)

- Where you live

- Your driving history

AAA estimates an average $1,694 per year for a full-coverage policy on a typical new car driven by a clean driver, living in a city/suburb.

For the middle class, this is where the “fun” choice—sporty, bigger, flashier—quietly becomes a multi-hundred-dollar-a-year penalty for as long as you own it.

Fuel: The price of every mile

Fuel is the one category everyone feels, but still underestimates.

AAA’s 2025 numbers show fuel at about 13 cents per mile on average, assuming gas around $3.15/gal and typical fuel economy. At 15,000 miles per year, that’s about $1,950 a year just in fuel. Drive more, drive a thirsty SUV, or commute in stop-and-go traffic, and that number spikes fast.

Maintenance, repairs, and tires: The sneaky budget wreckers

AAA’s 2025 analysis puts maintenance/repairs/tires at about 11 cents per mile, again at 15,000 miles per year. That’s roughly $1,650 a year baked into the average.

But real life isn’t “average.” You know how it really looks:

- $65 oil change here

- $900 brake job there

- $700 for new tires

- $1,500 surprise when a sensor or air conditioning dies after warranty

Most households don’t have a line item for that. So those costs turn into credit card balances or “We’ll just skip an extra payment on the student loans this month.”

Turn “random car bills” into a predictable monthly line item.

Estimate your yearly car costs below. We’ll tell you how much to set aside each month.

Move this amount into a separate “car fund” each month so repairs and tags stop feeling like emergencies.

Taxes, tags, and fees: The annual punch in the face

AAA estimates about $813 per year on average in license, registration, and taxes for a new car.

If your state charges property tax on vehicles, you already know how painful that renewal notice can be. For the budget, these costs are predictable but often unplanned—which is why they still feel like an emergency.

4. Cars vs. the Middle-Class Budget

The latest Consumer Expenditure Survey from the Bureau of Labor Statistics shows transportation at about 17% of household spending in 2023, with total transportation costs averaging over $13,000 per household—up more than 7% from the year before.

For the lowest-income households, transportation is brutal: they spend a smaller dollar amount but a much higher share of income—around a third of their before-tax income.

Too many of us are doing something like this:

- Two cars in the driveway

- One or both on 72-month loans

- Full-coverage insurance on both

- Daily commuting miles that belong in a trucking logbook

- No sinking fund for maintenance, just vibes and a Visa

On paper, it looks like you “can afford” the payments. In real life, those cars are crowding out:

- Extra principal payments on the mortgage

- Roth IRA and 401(k) contributions

- Building a real emergency fund

- Starting a side business

Car decisions show up everywhere else in your financial life. You feel it when the transmission fails at the same time the dentist says your kid needs braces. You feel it when you should be investing but your checking account is always in “recovery mode” from last month’s car drama.

5. New vs. Used, Gas vs. Hybrid vs. EV: Where the Math Actually Lives

Then there’s the flavor of the car itself.

New vs. used

New cars:

- Hit you hardest on depreciation

- Often come with better warranty coverage and fewer repairs early on

- Look great on Instagram and terrible on a net-worth statement for the first few years

Gently used cars (2–4 years old):

- Let someone else pay the steepest part of depreciation

- Still have usable life and often some factory warranty left

- Can be financed over a shorter term with a lower total hit

For most middle-class households, the sweet spot for building wealth is: reliable, boring, slightly used, and kept for a long time.

Why “slightly used and kept” usually wins.

| Profile | What it looks like | Typical cost profile | Impact on wealth |

|---|---|---|---|

| Brand-new, every 4–5 years | Always under warranty, latest features, frequent trades. | High depreciation, higher insurance, higher payment; repairs low early on. | Wealth leaks through depreciation and constant payments. |

| Slightly used (2–4 years), kept 8–10 years | Let someone else eat the steepest depreciation; you keep it long term. | Moderate payment for a few years, then many years with no payment; balanced maintenance. | Often the lowest total cost per year of useful life. Frees up cash for investing. |

| Paid-off older car, driven into the ground | No payment, higher miles, more repairs. | Very low fixed cost, rising maintenance and risk of big repairs. | Can be a wealth accelerator if you bank the “no payment” savings and prepare for repairs. |

Gas vs. hybrid vs. EV

AAA’s 2025 analysis shows that hybrids and EVs shift the cost mix: lower fuel costs but often higher purchase prices, insurance, and sometimes depreciation.

- Gas cars: cheaper to buy, more expensive to fuel, straightforward to insure and register.

- Hybrids: often a cost sweet spot—higher upfront cost but noticeably lower fuel spend; total cost of ownership can be lower if you drive a lot.

- EVs: very cheap “fuel” per mile, fewer moving parts, but higher sticker prices and, in some places, extra registration fees. Insurance can be more expensive, and resale values are still volatile.

For you, the right answer depends on your actual use:

- Long commute plus home charging? An EV or hybrid may win on total cost.

- Short, light city driving? You may never recoup the extra upfront cost.

- No garage, street parking only? Living your EV life on public chargers changes the math again.

The point is not “EVs are good” or “gas is bad.” It’s “Run the numbers for your life, not the commercial.”

6. The Industry Traps That Keep You Overpaying

Car sellers know most people are payment-driven and time-starved. They design the process around that.

Here’s what that looks like in real life:

1. Payment shopping instead of price shopping

If all you give a dealer is a monthly payment target, you’re playing blindfolded. They can hit your number by extending the loan term, raising the rate, loading in add-ons, and staying firm on a high price. You drive off with your “win,” and they keep the real victory in the finance office.

2. Add-ons and “protection packages”

Everything from paint sealant to nitrogen in your tires can be rolled into your loan at a fat markup. Some add-ons are useful; many aren’t. But in the moment, when you’re exhausted, you just want to sign and get your keys.

3. Rolling negative equity into the next loan

If you owe more than your car is worth and trade it in anyway, the leftover balance gets quietly stapled to the new loan. Now your new car starts life underwater too. The total cost of ownership explodes, but your payment might only inch up.

4. Ignoring insurance until after the deal

People choose the car first, then get blindsided when the insurance quote comes back hundreds more per year than expected. Some body styles and trims are insurance magnets.

5. Misunderstanding “cheap fuel” as “cheap car”

With hybrids and EVs, it’s easy to get hypnotized by fuel savings and ignore higher insurance, fees, or purchase price. A low gas bill doesn’t automatically mean low total cost.

See how much extra interest 72- and 84-month loans really cost you.

| Term | Monthly payment | Total interest paid |

|---|---|---|

| 48 months | – | – |

| 60 months | – | – |

| 72 months | – | – |

| 84 months | – | – |

Longer terms lower the monthly payment but increase total interest and keep you upside down longer.

7. A Saner Framework: How Much Car Can You Really Afford?

For middle-class households, it helps to think in total annual cost, not just “what can I finance.”

A few practical guardrails:

- Keep all car costs under 15% of take-home pay if you can. That includes payments, insurance, fuel, maintenance, and registration. Under 10% is even better if you’re trying to catch up on saving and investing.

- Prefer shorter loans (48–60 months) over long ones. If you need 72 or 84 months to “afford” the car, that’s your signal the car is too expensive for your current income.

- Buy less car than the bank says you can. Banks approve based on risk of non-payment, not on whether you can still max your Roth IRA and hit your savings goals.

- Own the car longer than the finance term. Real savings show up years 6–10, when you have no payment but still have a reliable car. That’s where wealth quietly builds.

- Budget for the hidden stuff. Set aside a monthly amount for maintenance and repairs, even if the car is still new. That’s how you turn a surprise $900 repair into an inconvenience, not a crisis.

8. Action Steps: Turning “Car as Cash Drain” into “Car as Tool”

If you already own a car (or two), here’s how to get practical without judgment.

Step 1: Calculate your real monthly car cost

For each vehicle, add up:

- Monthly payment (or what you’d set aside for replacement if it’s paid off)

- Average monthly fuel

- Insurance premium divided by 12

- Maintenance/repair/tire spending over the last 12 months, divided by 12

- Registration and taxes divided by 12

- Average parking and tolls

That number—not just your payment—is what your car really costs you every month.

Compare that to your take-home pay:

- If your total across all vehicles is under 10% of take-home, you’re in strong territory.

- Around 10–15%? Manageable but worth watching.

- Over 15%? Your cars are likely choking off your ability to save and invest.

Step 2: Decide what problem you’re solving

You might be facing one of these:

- Cash flow problem (monthly cost is too high)

- Risk problem (car is unreliable, likely to blow up your budget later)

- Wealth problem (too much tied up in fast-depreciating metal)

Your solution depends on which problem is biggest.

Step 3: Explore your levers

- Refinance to a lower rate while not extending the term (or not by much).

- Accelerate payoff if the car is reliable and you’re close to the finish line.

- Downsize the car—trade to something less expensive, with lower insurance and fuel, even if it bruises your ego.

- Go from two cars to one if your household can realistically rearrange work, school, and errands. That’s not possible for everyone—but when it is, the savings are enormous.

Step 4: For your next car, set rules now

Before the next salesman hands you a pen:

- Decide your total monthly budget for car costs (all-in), not just the payment.

- Pre-approve your financing with a credit union or bank.

- Check insurance quotes for models you’re considering.

- Use tools like AAA’s Your Driving Costs and Edmunds True Cost to Own to compare models on five-year costs, not horsepower.

A quick checklist so your next car doesn’t wreck your budget.

- Write down your all-in monthly car budget (payment + fuel + insurance + maintenance + tags), not just a payment.

- Check your credit score and pre-approve with a bank or credit union so the dealer doesn’t control the rate.

- Get insurance quotes for 2–3 models you’re considering before you fall in love with one.

- Use a total cost of ownership tool (AAA or Edmunds) to compare models on 5-year cost, not horsepower.

- Decide your maximum loan term (e.g., 60 months) in advance and refuse anything longer.

- List 2–3 “good enough” models you’d be happy with so you don’t get tunnel vision on one car.

- Bring this checklist with you and leave if the deal doesn’t fit your numbers. You can always walk.

FAQ: Total Cost of Car Ownership

What is the total cost of car ownership?

The total cost of car ownership is everything you spend to own and use a car, not just the loan or lease payment. It includes your payment, fuel, insurance, maintenance, repairs, registration, taxes, parking and tolls. When you add it all up, the “cheap” car payment often isn’t cheap at all.

How much of my income should go to my car?

A good rule of thumb is to keep all car costs under 15% of your take-home pay. That means your payment, fuel, insurance, maintenance and tags together. Under 10% is lean and gives you room to save and invest. Once you creep above 15%, the car starts crowding out bigger financial goals.

Is it cheaper to buy new or used?

In most cases, slightly used wins. Buying a reliable car that’s 2–4 years old lets someone else eat the steepest depreciation. If you then keep that car for 8–10 years, your total cost per year of useful life is usually lower than constantly rolling into a brand-new car every few years.

Are EVs really cheaper to own than gas cars?

EVs and hybrids can be cheaper on fuel and maintenance, but that doesn’t automatically make them cheaper overall. You have to factor in the higher purchase price, insurance, registration fees in your state and how many miles you actually drive. For long commuters with home charging, EVs can win. For low-mileage drivers, a simple, fuel-efficient gas car may still be cheaper.

How often should I replace my car?

From a wealth-building standpoint, the goal is to keep a safe, reliable car for as long as it makes financial sense—often well past the last payment. If the annual cost of repairs stays lower than what a new payment would be, it can pay to drive the car longer and send the “no payment” money to savings, investing and debt payoff instead.

9. The Bigger Picture: Cars and Class Mobility

For a lot of working- and middle-class families, the car is a lifeline to work, school, and childcare. Opting out isn’t realistic when public transit is unreliable or nonexistent.

But that’s exactly why total cost of ownership matters so much.

If a household is spending thousands more than necessary every year on transportation, that money isn’t going to:

- Kill credit card balances

- Build a six-month emergency fund

- Max out retirement contributions

- Pay off student loans or medical debt

- Seed a side business

Over ten years, an extra $400–$800 a month into investments instead of car overhead is the difference between “I hope Social Security is there” and “We actually have options.”

Your car doesn’t have to be the villain in your financial story. It can just be what it was supposed to be all along: a tool that gets you where you need to go—without eating your future in the process.

If Your Car Is Over 15% of Your Take-Home Pay, It’s a Problem

Use the calculators on this page to total up your real monthly car cost. If it’s swallowing more than 15% of your take-home pay, your car is slowing down your wealth. Your next move isn’t perfection—it’s one concrete change: refinance, downsize, or start a real sinking fund.

Want more middle-class money fixes like this? Join the Financial Middle Class newsletter for practical breakdowns on cars, credit, housing and everything in between.

RELATED ARTICLES

Trump’s 401(k) Down Payment Plan: A House Today, a Retirement Tomorrow?

Could Trump let you use 401(k) money for a down payment? Learn how it works, risks to retirement, and price impacts—read first.

The One-Income Family Is Becoming a Luxury. Here’s the Salary It Takes Now.

How much must one parent earn so the other can stay home? See the real math, examples, and tradeoffs—run your number now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Jan 19, 2026

Trump’s 401(k) Down Payment Plan: A House Today, a Retirement Tomorrow?

Could Trump let you use 401(k) money for a down payment? Learn how it works, risks to retirement, and price impacts—read first.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

The One-Income Family Is Becoming a Luxury. Here’s the Salary It Takes Now.

How much must one parent earn so the other can stay home? See the real math, examples, and tradeoffs—run your number now.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

Credit Cards vs. BNPL: Which One Actually Works for the American Middle Class?

Credit cards vs BNPL: costs, risks, and the best choice for middle-class cash flow. Use this 60-second framework—read now.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

The Affordability Pivot: Can Trump’s New Promises Actually Lower the Middle-Class Bill?

Will Trump’s affordability proposals lower your bills—or backfire? Housing, rates, tariffs, gas, credit cards—explained. Read now.

By Article Posted by Staff Contributor

Business / Jan 13, 2026

Starting a Nonprofit Is Easy. Starting the Right Nonprofit Is the Hard Part.

The estimated reading time for this post is 880 seconds Last updatedJanuary 13, 2026 — Updated for IRS e-filing pathways (Pay.gov), the 501(c)(4) notice requirement, and...

By Article Posted by Staff Contributor

American Middle Class / Jan 12, 2026

America’s 25 Fastest-Growing Jobs—and the part nobody tells you

BLS lists 25 fast-growing jobs for 2024–2034. Learn what it means, avoid traps, and pick a lane that fits your life—read now.

By Article Posted by Staff Contributor

American Middle Class / Jan 12, 2026

Is It All Glitter? The Middle Class and the Gold Craze

Should the middle class buy gold? Learn who’s buying, hidden costs, and smarter hedges—plus a simple test. Read now.

By Article Posted by Staff Contributor

American Middle Class / Jan 11, 2026

Hey, California: Tax Loans Backed by Capital Assets, Not

California’s billionaire tax misses the point—tax asset-backed borrowing, not paper wealth. Read the argument and decide.

By MacKenzy Pierre

American Middle Class / Jan 11, 2026

“People live in homes, not corporations.” Now what?

Do big investors drive housing costs? A neutral, data-backed look at the evidence, tradeoffs, and what a ban could change. Read now.

By FMC Editorial Team

American Middle Class / Jan 09, 2026

Debt Statute of Limitations: The Clock You Didn’t Know Was Ticking

Learn how debt statutes work, avoid resetting the clock, and protect yourself from lawsuits. Read before you pay.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jan 19, 2026

Trump’s 401(k) Down Payment Plan: A House Today, a Retirement Tomorrow?

Could Trump let you use 401(k) money for a down payment? Learn how it works,...

American Middle Class / Jan 18, 2026

The One-Income Family Is Becoming a Luxury. Here’s the Salary It Takes Now.

How much must one parent earn so the other can stay home? See the real...

American Middle Class / Jan 18, 2026

Credit Cards vs. BNPL: Which One Actually Works for the American Middle Class?

Credit cards vs BNPL: costs, risks, and the best choice for middle-class cash flow. Use...