Does Retiring the U.S. Penny Nudge America Further into a Cashless Future?

By Article Posted by Staff Contributor

The estimated reading time for this post is 414 seconds

Introduction: A Tiny Coin, a Loud Message

In February 2025, President Trump told Treasury to stop making new pennies, calling the coin wasteful because it cost almost four cents to make one cent. Treasury followed through in May and placed its final order for penny blanks. By August 2025, the Fed pushed out its last big batches to banks. Now we’re watching stores and banks actually run low. This is real, not theoretical.

So the question isn’t, “Should the U.S. get rid of the penny?” That ship sailed. The question now is: does killing the penny shove America a little farther into the cashless lane — especially for middle-class households that were already 80–90% digital? Because money systems aren’t just about denominations and seigniorage. They’re about habits, dignity at the register, and which method feels smoother.

Short version: the end of the penny didn’t make America cashless overnight. But it did something more powerful — it made cash a little messier while digital stayed clean. And in a country already tilted toward tap-to-pay, even a small annoyance can move the needle.

Where We Are Now: Cash Is Already the Minority

By the time the administration said “no more pennies,” most middle- and upper-middle-income Americans were already swiping and tapping their way through life — groceries, gas, Target runs, Amazon, app-based food. Cash was already the minority payment, especially above about $50K–$75K income.

Cash is still important — but it’s concentrated: lower-income households, older shoppers, people budgeting in envelopes, cash-only businesses. That’s the group a coin change actually touches. The people who were Apple Pay from day one? They only noticed because the little copper coin pile stopped growing. The policy hit the people in the cash lane, not the people in the tap lane.

What “Eliminating the Penny” Means Now

Let’s make it concrete, because the headlines made it sound bigger than it is.

- Trump ordered the stop in February 2025.

- Treasury placed the final order for penny blanks in May 2025.

- The Fed’s final distributions to banks were going out by late summer — August 2025 is when many banks said, “That’s it, no more refills.”

- Existing pennies are still legal tender. Nobody is canceling the ones in your jar.

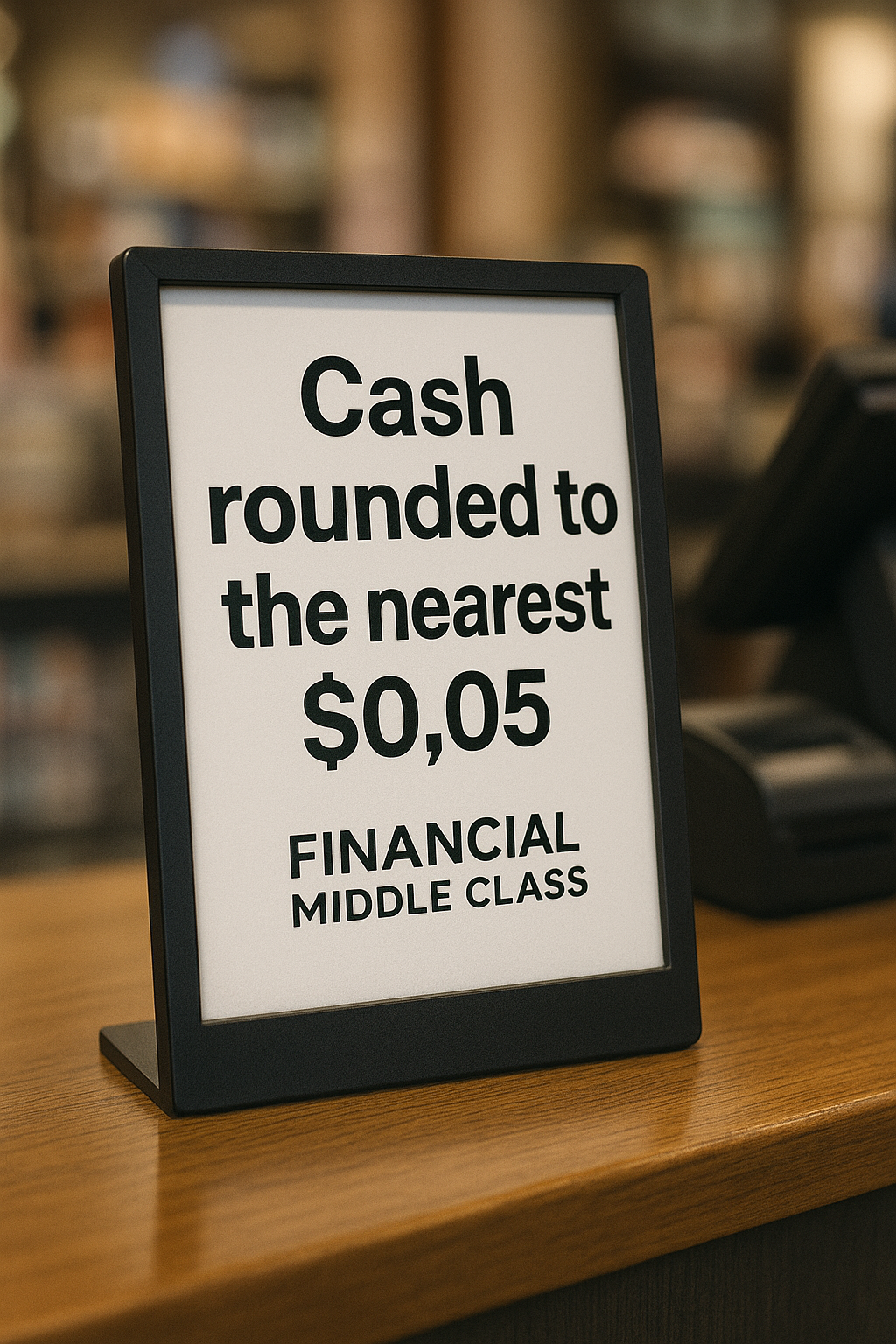

But here’s the key: the rounding only applies to cash. If your total is $12.37 and you pay with cash, the register now rounds to the nearest $0.05 — $12.35 or $12.40 — according to the store’s posted policy. If you pay with card or phone, you still pay $12.37. That’s the split.

Other countries did this — Canada, Australia, New Zealand — and life kept going. Americans will adjust too. But we’re already seeing the part that matters: some merchants are running short and can’t make exact change, so they’re putting up signs and explaining things at checkout. That’s where the friction lives now.

The New Asymmetry: Digital Stays Exact, Cash Becomes Approximate

This is the quiet shift the policy created.

- Digital: exact, automatic, no conversation.

- Cash: “We round to the nearest nickel,” “We’re out of pennies,” “Today it’s $12.40.”

People like payments that feel fair and precise. Once you tell them, “If you pay this way, it’s exact; if you pay that way, we estimate,” most people pick the exact one — especially middle-class shoppers who already have debit, credit, or mobile wallets. So the end of penny minting created a two-lane world: clean lane (digital) and explained lane (cash).

And once you have to explain money, money loses.

Friction Economics: Small Annoyances Change Behavior

Since August, frontline reports all sound the same: banks rationing pennies, small retailers posting signs, cashiers explaining rounding, some customers feeling like it “rounded up on me.” None of that happens with a card. That’s friction — and people avoid friction.

The new micro-frictions are:

- Checkout explanations.

- “We can’t give exact change.”

- Signage about rounding.

- A handful of 2–3 cent round-ups that feel one-sided.

What do regular consumers do when a payment method gets mildly annoying?

“I’ll just tap.”

Not because of policy. Because of convenience.

Who Feels the Nudge the Most

Now that the penny stoppage is real, the impact is clearer.

- Already cashless (upper-middle, urban, younger):

They barely felt it. They read the headline, maybe posted “finally,” and kept tapping. - Middle-class households:

This is the group that still keeps some cash around — for kids, for offerings, for small shops, for “I don’t want this on my statement.” The new setup doesn’t hurt them, but it settles the argument in more places: digital is now the default because it stays exact. - Cash-reliant, unbanked, older Americans:

This is the group taking the brunt, because they’re the ones who now hear “we round” the most often, and they don’t have an easy way to jump to exact digital. That’s the equity tension baked into this decision: it made life smoother for the majority that already had access, and a bit clunkier for the people still using the oldest form of access.

Retailers and POS Behavior After the Stop

Retailers are doing exactly what you’d expect now that the Mint has actually stopped: they’re standardizing language — “cash rounded to the nearest $0.05” — and leaning on their POS systems to handle it. Most modern systems can do that. But stores also hate customer complaints, and the early coverage says some are getting them. So what happens? They start nudging digital harder.

Not a conspiracy. Just vibes plus operations:

- “Card is exact.”

- “Tap is faster.”

- “We’re out of pennies — card will be the exact amount.”

That’s how a coin decision becomes a payment-behavior decision.

Symbolism: The Retreat of Low-Denomination Cash

The 2025 decision said the quiet part out loud: a one-cent coin that costs nearly four cents to make doesn’t make sense. Treasury said stopping it would save tens of millions a year. That’s rational. But the message people hear is: “We’re moving away from tiny physical money.”

Add that to the rest of 2025 America — subscriptions, online shopping, tap-to-ride transit, P2P apps — and the penny’s death looks less like a one-off and more like one more brick in the digital wall.

Will This Make the U.S. Fully Cashless?

No. Not by itself.

The real engines are still the same:

- Card rewards and protections.

- E-commerce.

- App-based ordering.

- Zelle/Cash App/Venmo.

- Merchant preference for faster, safer payments.

The penny decision is an accelerator, not the main driver. Think of it as removing one more reason to stay in cash, at the exact moment banks and stores are literally telling people, “We don’t have pennies anymore.”

Equity and Access: The Part Policymakers Didn’t Finish

Several outlets are already pointing out the awkward part: the administration ended penny production to save money, but didn’t give smaller retailers a super-clear national rounding framework at the same time, so now you’ve got scattered store policies and some consumer confusion. That’s where people who pay in cash over and over can feel nickeled-and-dimed — literally.

To make this fair, we’d need:

- Standard, posted rounding rules.

- Outreach to cash-reliant and older Americans.

- Stronger promotion of low-fee, low-barrier digital accounts so people can choose the “exact” method too.

Otherwise we’ve created a two-tier payment reality: exact for the banked, approximate for the cash-only.

International Lessons Still Hold — We Just Joined Them

Canada, New Zealand, Australia — they all did this. Consumers adapted fast. Inflation didn’t jump because of rounding. Cash use kept trending down because it was already trending down. The U.S. is now in that same lane — just louder, messier, and with more retailers complaining on TV.

Conclusion: The Penny Is Gone — The Nudge Isn’t

So yes — the Trump administration actually did it. The Mint stopped making pennies. Banks got their last big shipments in August 2025. Stores are now living in the “we round” era. That part is done.

And now we see the real effect: not a dramatic leap to cashless, but a steady push — because digital stayed simple while cash got a conversation attached to it.

Money habits don’t always change because people wake up financially enlightened. Sometimes they change because the old way got slightly annoying — and the new way didn’t. This was one of those times.

RELATED ARTICLES

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what to do next. Read now.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

Selling Your Home Isn’t a Chore. It’s a Power Test.

Avoid costly seller mistakes—price smart, negotiate, handle appraisals, and protect your equity. Read the full seller playbook.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist....

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and...