Spend Your FSA Before It Disappears: FSA vs HSA for Real Middle-Class Life

By Article Posted by Staff Contributor

The estimated reading time for this post is 618 seconds

Spend Your FSA Before It Disappears: FSA vs HSA for Real Middle-Class Life

You know the email.

Subject line: “Reminder: Use your FSA funds before they expire.”

You click it half-distracted, standing at the kitchen counter, trying to remember what you thawed for dinner.

Then you see it: you’ve got a few hundred dollars sitting in your Flexible Spending Account — money you already earned — and a couple of weeks, maybe days, to spend it before it vanishes.

For a typical middle-class household, that’s not “extra.” That’s:

- A car payment.

- A week of groceries.

- Part of the light bill that just went up.

And yet, every year, people in your exact situation quietly lose this money.

Recent analysis of millions of FSAs found that roughly half of account holders forfeited money to their employers, with average losses in the $400 range per person. That’s billions — with a “B” — of middle-class dollars evaporating because the rules are confusing and life is busy.

You’re not “bad with money” if this has happened to you. You’re living in a system designed to be easy to ignore until it’s almost too late.

Let’s fix that.

FSA 101: What It Is, How It Works, and Why It Expires

An FSA (Flexible Spending Account) is an account your employer offers so you can set aside money before taxes for eligible healthcare costs — copays, deductibles, prescriptions, glasses, and a long list of over-the-counter items.

Key points, in plain English:

- For 2025, most health FSAs let you contribute up to $3,300 per year.

- That money comes out of your paycheck pre-tax, which lowers your taxable income.

- Throughout the year, you spend from that pot on eligible medical expenses.

So far, so good.

The catch is the part everyone forgets until December: “use it or lose it.”

By default, FSA money is tied to the plan year. If you don’t use it by your deadline, the leftover balance usually reverts to your employer.

Some employers soften the blow with one of two options the IRS allows — but they only get to pick one:

- A grace period: up to 2½ extra months after year-end to spend the leftover balance, or

- A carryover: the ability to roll a portion of unused funds (up to $660 for 2025) into the next year’s FSA.

Your employer might offer one, or neither. And the emails they send about it usually read like they were written for lawyers, not people juggling kids, car notes, and blood-pressure meds.

Here’s the bottom line:

- Every dollar you don’t use (above any allowed carryover) is gone.

- That loss is very real in a middle-class household.

If the average forfeiture is around $400 per person, that’s like voluntarily skipping a student loan payment or a chunk of daycare.

HSA 101: The Account That Follows You

Now, let’s talk about the cousin that doesn’t get nearly enough attention: the HSA (Health Savings Account).

To even qualify for an HSA, you have to be on a high-deductible health plan (HDHP) — one with at least $1,650 deductible for self-only coverage or $3,300 for family in 2025. If your plan’s deductible is lower than that, no HSA for you.

If you do qualify, HSAs come with a powerful trio of benefits:

- Pre-tax contributions go in (through your paycheck or on your own).

- Tax-free growth while the money sits there or is invested.

- Tax-free withdrawals when used for qualified medical expenses.

That’s the famous “triple tax advantage.”

For 2025, total HSA contributions (employer + you) are capped at:

- $4,300 if you have self-only HDHP coverage

- $8,550 if you have family HDHP coverage

- If you’re 55 or older, you can put in an extra $1,000 as a “catch-up” contribution.

And unlike FSAs, your HSA is yours:

- The money rolls over forever — there’s no use-it-or-lose-it deadline.

- You can take it with you if you change jobs or retire.

- Many HSA providers let you invest the balance in mutual funds, so it can grow like a mini retirement account for future medical costs.

Here’s the trade-off in one sentence:

FSAs are great for predictable, near-term healthcare spending. HSAs reward you for long-term planning — if you can handle the high deductible and cash-flow bumps along the way.

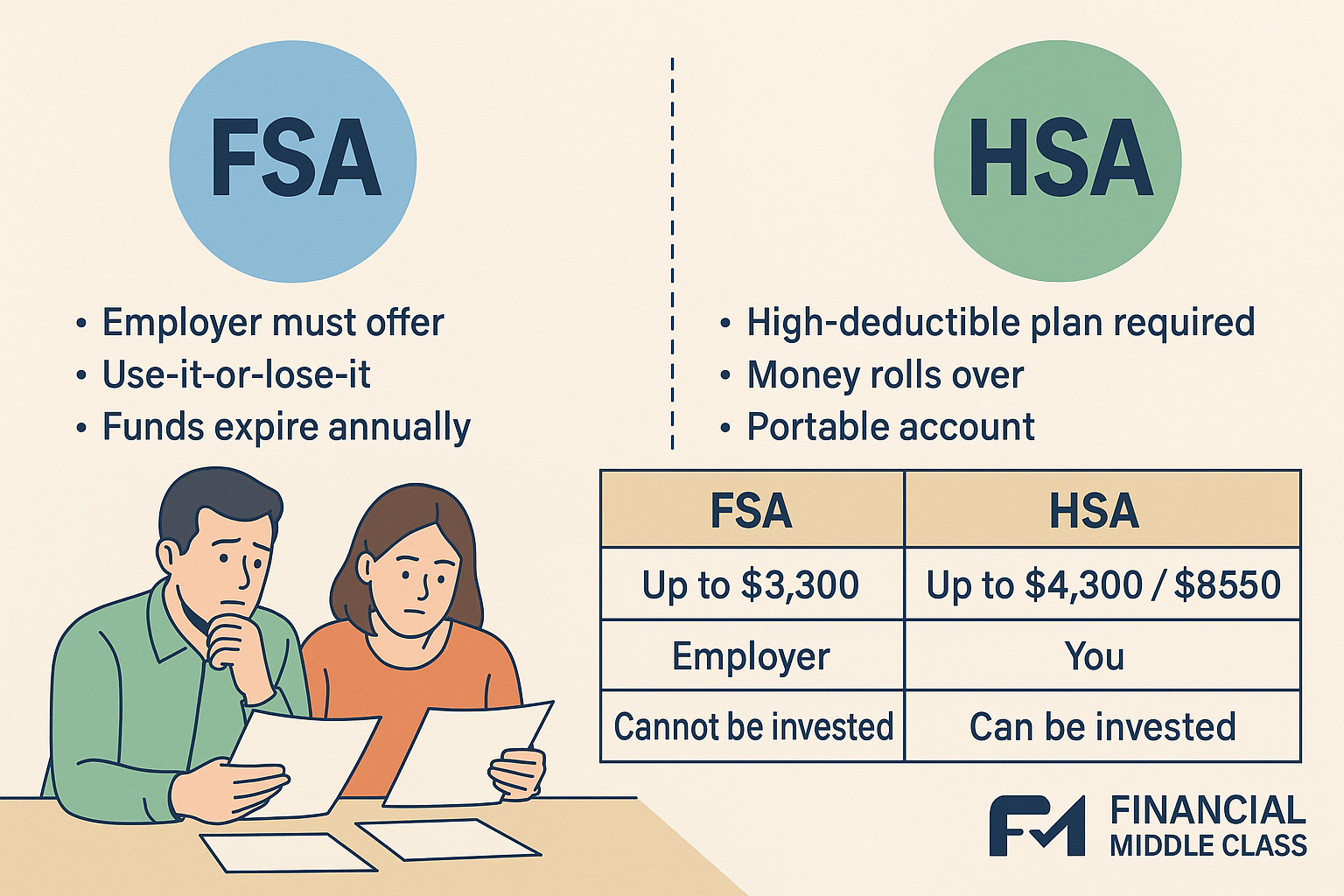

FSA vs HSA: What’s Really Different (Without Jargon)

Let’s strip it down to what matters when you’re trying to keep the lights on and still afford glasses for the kids.

| Feature | FSA | HSA |

|---|---|---|

| Who can get it? | Only if your employer offers it | Only if you’re on a high-deductible health plan |

| Contribution limit 2025 | Up to $3,300 (health FSA) | Up to $4,300 self-only / $8,550 family(IRS) |

| Use-it-or-lose-it? | Yes, except limited grace period or carryover | No. Money stays until you use it |

| Who owns the money? | Effectively your employer if you don’t use it | You — it follows you even if you change jobs |

| Can the money be invested? | No | Often yes, once you hit a minimum balance |

| Tax treatment | Pre-tax in, tax-free for qualified expenses | Pre-tax (or deductible), tax-free growth & use |

So if you:

- Have predictable costs (therapy copays, ongoing prescriptions, braces coming up), an FSA can work well — if you’re organized enough not to leave money behind.

- Have some cushion in your budget, can survive a high deductible, and want to build a long-term health fund, an HSA is incredibly powerful.

The reality for a lot of middle-class families? You’re stuck in the middle. You can’t easily absorb a $3,000 surprise bill, but you also hate the idea of money evaporating in an FSA.

That tension is exactly why people freeze at open enrollment.

Real Middle-Class Profiles: Which One Sounds Like You?

Let’s walk through a few situations — no perfection, just reality.

1. The Family With Kids and Constant Appointments

- Two kids, regular pediatrician visits, one in braces soon.

- One parent on ADHD meds, the other dealing with recurring back issues.

- Cash flow is tight but somewhat predictable.

Here, a health FSA can make sense because:

- You know you’ll have ongoing out-of-pocket costs each year.

- You’ll likely use the money on copays, prescriptions, orthodontics, and vision without much struggle.

The risk: overshooting the FSA election. If you guess too high, you’re scrambling in December to burn through the leftovers on things you wouldn’t have bought otherwise.

A practical move:

- Estimate only what you’re confident you’ll spend (prescriptions + known copays + planned dental/vision), not your entire worst-case scenario.

2. The Single Worker With Few Medical Needs

- No kids, no major conditions, maybe an occasional urgent care visit.

- Decent income, some room to save if you’re intentional.

If your employer offers a high-deductible health plan with HSA, this is a prime candidate:

- You can take the premium savings (if any) plus some extra each month and funnel it straight into the HSA.

- You might rarely touch it now, letting it grow for future you — when knees, backs, and blood pressure start acting up.

Think of the HSA as a future “medical emergency + retirement” hybrid bucket.

3. The Household With Chronic Conditions and Tight Cash Flow

- Someone in the family has diabetes, asthma, or another condition that guarantees regular care.

- Budget feels like a game of musical chairs every month.

Here, the high deductible required for an HSA may feel dangerous. If you can’t stomach a $3,000 or $4,000 bill hitting early in the year, a more traditional health plan + carefully chosen FSA amount might be safer.

You might still want an HSA in theory, but theory doesn’t pay the bill when the hospital wants cash.

If Your FSA Balance Is About to Expire: What to Do This Week

Let’s say you’re already in the “oh no” moment — you’ve got money in your FSA, and the deadline is coming fast.

First step: Find out your actual rules.

- Log into your benefits portal or call HR.

- Confirm three things:

- Your plan year end date

- Whether you have a grace period (and until when)

- Whether you have carryover, and the max carryover amount (often up to $660 for 2025)

Anything above that carryover limit is on the chopping block.

Then, get strategic. Your goal is not to panic-shop. Your goal is to pull forward spending you know is coming in the next few months.

Smart ways to use up FSA funds:

- Book the eye exams you’ve been putting off (for you and the kids) and buy the glasses or contacts you actually need.

- Refill prescriptions — if your plan and pharmacy allow 90-day refills, this can soak up funds quickly on stuff you already use.

- Schedule dental work you’ve been delaying: cleanings, fillings, getting that crown you’ve been ignoring until it hurts.

- Buy eligible over-the-counter items you’ll genuinely use over the next year:

- Pain relievers, allergy meds, bandages

- Menstrual products

- First-aid supplies, thermometers, etc.

What you don’t want:

- A cart full of random junk just to say you didn’t “waste” the money. If you wouldn’t buy 10 of something without an FSA, don’t buy 10 now.

Think about it this way:

If you let $300–$400 disappear, that’s like handing back part of your paycheck and pretending it never existed. For a middle-class household, that’s real harm.

How to Make a Better Choice at Next Open Enrollment

FSA vs HSA isn’t a morality test. It’s a math and lifestyle question:

- What health plan options do you actually have?

- How steady is your income?

- How much pain can your cash flow handle in a single bad month?

Here’s a simple framework.

Step 1: Check if You’re Even HSA-Eligible

You must:

- Be covered by a high-deductible health plan (meeting IRS minimums), and

- Not be covered by other disqualifying coverage (like a general-purpose health FSA in someone else’s name).

If you’re not eligible, the decision shifts to: FSA or nothing.

Step 2: Reality-Check the Deductible

Look at the HDHP’s deductible and out-of-pocket max and ask:

- “If we got hit with this deductible in February, could we cover it without going into high-interest debt?”

If the honest answer is “No way,” then chasing HSA tax benefits isn’t worth the stress. A more traditional plan + modest FSA may be safer, even if it looks less “optimized” on paper.

Step 3: Decide Your Strategy

If you choose an FSA next year:

- Add up what you know you’ll spend:

- Recurring prescriptions

- Regular specialist copays

- Braces already scheduled

- Annual eye exams and basic dental

- Set your FSA contribution close to that number — not your fantasy worst-case.

If you choose an HSA next year:

- Treat it as part emergency fund, part future-you fund.

- Even $25–$50 per paycheck adds up over time, especially if you leave it invested.

- Keep a separate cash cushion so one big deductible doesn’t wipe you out.

Step 4: Ask HR Better Questions

Most people just accept whatever HR slides across the table. Don’t.

Ask:

- “What are the exact FSA deadlines, grace period, and carryover rules for our plan?”

- “If I switch to the high-deductible plan, what’s the total cost — premiums plus worst-case out-of-pocket?”

- “Does the company put any money into the HSA?” (Employer contributions can tilt the whole equation.)

You’re not being difficult. You’re trying not to leave hundreds or thousands of your own dollars on the floor.

A Few Hard Truths — And One That Should Comfort You

Here’s what nobody tells you during benefits meetings:

- The system counts on you being too tired and busy to read the fine print.

- Employers don’t mind too much when people forfeit FSA balances — those dollars revert back and may reduce their costs.

- The people who can least afford to waste $400 are often the ones losing it — not because they’re careless, but because their lives are overloaded.

You don’t fix that overnight. But you can do this:

- This year: Check your FSA balance, know your deadline, and aim every remaining dollar at real needs you already have.

- Next enrollment: Choose between FSA and HSA with your actual life in mind, not someone else’s perfect spreadsheet.

At the end of the day, middle-class families don’t have the luxury of forgetting about money they already earned.

An FSA punishes you for not paying attention.

An HSA rewards you for planning ahead.

The game is rigged enough already. Your job is simple, but not easy:

Stop letting your own money quietly slip out the back door.

RELATED ARTICLES

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

By FMC Editorial Team

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

By MacKenzy Pierre

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs....

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market...

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan...