Trump’s New $40,000 SALT Deduction Cap: Should Middle-Class Americans Care?

By Article Posted by Staff Contributor

The estimated reading time for this post is 414 seconds

If you own a home, pay state income tax, and watch the news with one eye while making dinner, you’ve probably heard some version of this headline:

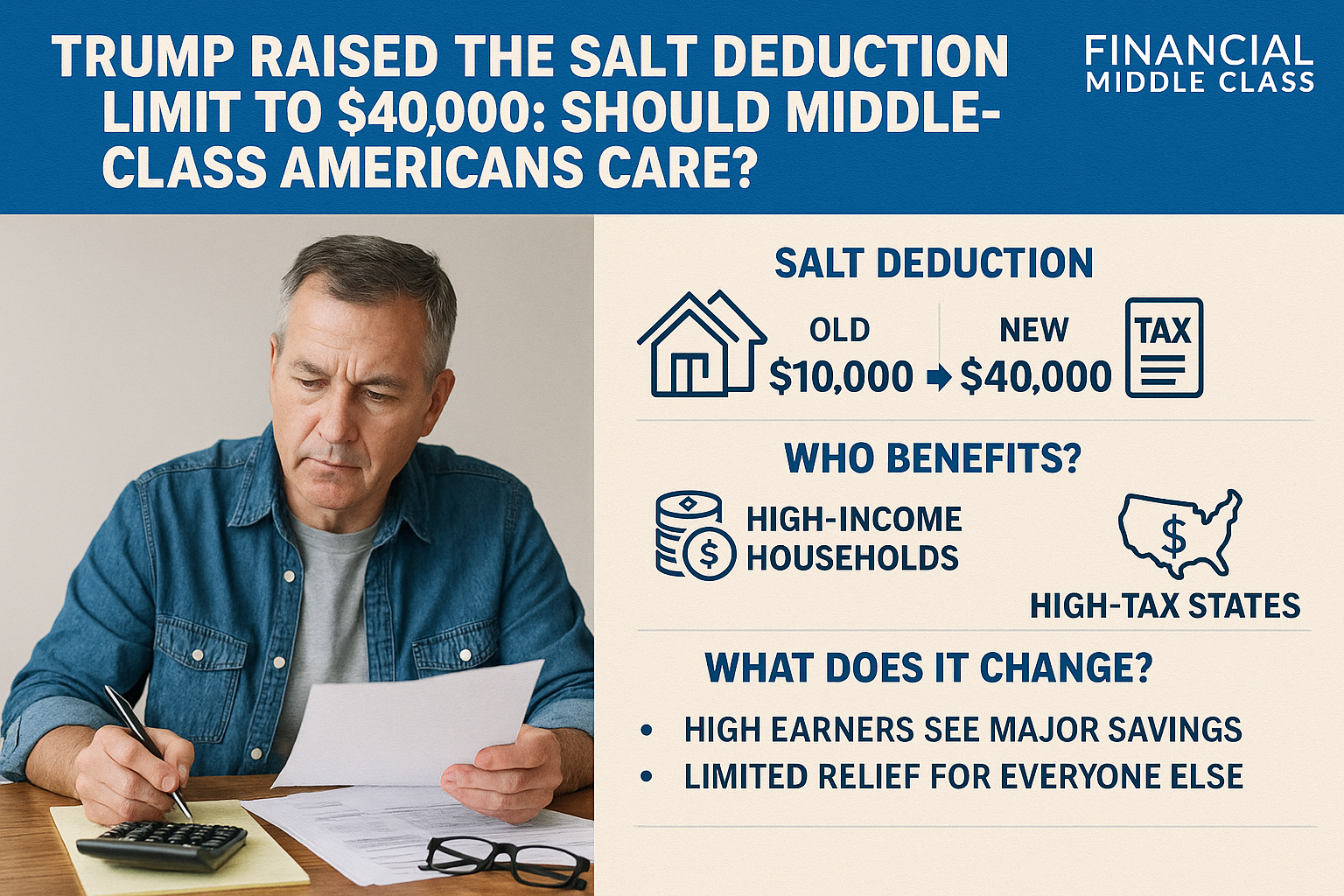

“Trump raises SALT cap to $40,000 in 2025.”

It sounds huge. Ten thousand to forty thousand. Feels like free money.

But here’s the uncomfortable truth for a lot of middle-class families:

Most of you will never get close to $40,000 in state and local taxes. And even if you do, the bigger question is whether you even itemize your deductions in the first place.

Let’s slow this down and walk through what actually changed — and whether it moves the needle for a household trying to stay afloat, not buy a third vacation home.

Quick refresher: What is the SALT deduction?

SALT = State And Local Taxes. On your federal tax return, you can deduct:

- State and local income taxes or sales taxes

- Property taxes

- Some smaller local taxes

Before 2018, if you itemized, there was no hard dollar cap. High-income households in high-tax states could deduct big chunks of their state income and property taxes. Then the 2017 Tax Cuts and Jobs Act slammed a lid on it:

- From 2018 onward, SALT deductions were capped at $10,000 per return, no matter how high your state and local tax bill was.

Fast-forward to 2025 and the One Big Beautiful Bill Act (OBBB). That law:

- Raises the SALT cap from $10,000 to $40,000 starting in 2025.

- Applies the full $40,000 cap only if your income is at or below $500,000 (modified AGI). Above that, the cap phases back down toward $10,000.

- Builds in small inflation adjustments each year through 2029, then reverts the cap back to $10,000 in 2030 unless Congress changes it again.

So yes: on paper, the cap really did jump to $40,000. But the people who can realistically use that are a specific slice of the population.

The first filter: Do you even itemize?

The SALT deduction only matters if you itemize instead of taking the standard deduction.

Under the new law, the 2025 standard deduction is:

- $31,500 – Married filing jointly

- $15,750 – Single or married filing separately

- $23,625 – Head of household

And that’s before any extra senior deduction if you’re 65+.

Most households now take the standard deduction. In 2020, only about 9–10% of taxpayers itemized at all, and the SALT deduction skewed heavily toward higher-income filers.

Middle-income filers generally don’t itemize because:

- Their mortgage interest + SALT + charity usually doesn’t beat the standard deduction.

- The higher standard deduction created under the 2017 law and then boosted again under OBBB is already pretty generous for middle incomes.

So before you get excited about the $40,000 number, you have to answer a more basic question:

“Last year, did I even itemize?”

If the answer is no — and you don’t expect a big jump in mortgage interest, property tax, or charitable giving — the new SALT cap may be background noise for you.

The second filter: Is your SALT bill actually that high?

Let’s be blunt: most middle-class households don’t have $40,000 in combined state and local taxes.

Data from the Tax Policy Center show that in 2020, only 3% of filers with income between $20,000 and $50,000 claimed the SALT deduction at all. Even in the $100,000–$200,000 income band, only about 21% claimed it.

And historically, the majority of SALT benefits have gone to people making well over $100,000, clustered in a handful of high-tax states.

Where the new $40,000 cap does matter:

- High-tax states like California, New York, New Jersey, Massachusetts, Maryland, Virginia, and D.C., where a big share of filers already bump into (or approach) the old $10,000 cap.

- Households with high property values and state income taxes — usually upper-middle to high earners.

If your combined property tax and state income (or sales) tax bill is, say, $8,000 or $9,000, the old $10,000 cap never bothered you. Raising it to $40,000 changes nothing about your deduction.

Quick reality check: Example families

Family A: Solidly middle class in a mid-tax state

- Married couple, income: $110,000

- Property tax: $4,500

- State income tax: $3,500

- Charitable giving + mortgage interest: $5,000

Total potential itemized deductions:

- SALT: $4,500 + $3,500 = $8,000

- Other deductions: $5,000

- Total: $13,000

The standard deduction is $31,500 for married filing jointly. They are nowhere near that. They take the standard deduction, period. The SALT cap could be $10,000 or $40,000 — their taxes don’t change.

Family B: Upper-middle-class in a high-tax suburb

- Married couple, income: $220,000

- Property tax: $13,000

- State income tax: $15,000

- Mortgage interest + charity: $9,000

Total SALT: $28,000

Old cap: deduction limited to $10,000

New cap: deduction up to $28,000 (well below the $40,000 cap)

Itemized total under old law: $10,000 + $9,000 = $19,000

Itemized total under new law: $28,000 + $9,000 = $37,000

Now itemizing beats the $31,500 standard deduction by about $5,500. That translates into real tax savings, especially if they’re in the 24% or 32% bracket.

This is the kind of household the new SALT cap is really written for.

So… does the middle class actually benefit?

Even policy analysts who don’t love the law admit something simple:

Most low- and middle-income households won’t see much from the SALT cap increase because they don’t have big enough tax bills and they usually take the standard deduction.

The change does help some upper-middle-income households who:

- Live in high-tax states

- Own homes with high property taxes

- Already itemize or are now pushed into itemizing

- Have incomes under the $500,000 phase-out threshold

In other words, the “middle class” that benefits here is the version with very expensive houses and very high local tax bills — not the family whose biggest worry is daycare + car note + groceries.

How to tell if you should care

Here’s a simple checklist:

- Did you itemize last year?

- No? The SALT change probably won’t move your tax bill unless your situation changed a lot (big new mortgage, big jump in property tax, etc.).

- Yes? Keep going.

- Did you hit the old $10,000 SALT cap?

Look at Schedule A from a recent return, or your tax software summary. If your SALT line showed $10,000, you were capped. - What’s your total SALT bill now?

Add up:- 2025 property tax bill

- 2025 state income tax (withholding + April payment/credit) or state sales tax if you use that route

- 2025 property tax bill

- If that number is still under $10,000, the new cap doesn’t help. If it’s in the $15,000–$30,000 range, the change might be real money.

- Compare itemizing vs standard deduction.

Take:- SALT (up to $40,000 if you qualify)

- Mortgage interest

- Charitable giving

- Other itemized deductions

- If that total beats the standard deduction for your filing status, itemizing could now make sense when it didn’t before.

- Check your income vs the $500,000 threshold.

The full $40,000 cap applies only up to $500,000 of modified AGI. Above that, the benefit phases back down until you’re effectively stuck at $10,000 again.

If you’re nowhere near those numbers, you’re probably watching a political tax fight that’s not about you.

Planning moves if you are in the group that benefits

If you run the math and find out you are in the “this helps me” category, a few tactical moves could matter:

- Bunch property taxes and charity into 2025–2029.

Some taxpayers can prepay part of next year’s property tax bill in December to maximize deductions — but local rules vary, and there are IRS limits on prepaying income tax. Don’t do this blindly. - Coordinate SALT with your mortgage interest.

In these years when the cap is higher, stacking mortgage interest + SALT + charity may push you over the standard deduction. After 2030, you may go back to the standard deduction.

Watch for AMT and phase-outs.

High-income filers still have to pay attention to the alternative minimum tax and various phase-outs that can blunt the benefit of extra deductions.

But again, this is advanced tax planning territory — not where most paycheck-to-paycheck middle-class households live.

The bottom line for real middle-class households

If you’re a teacher and a nurse in Ohio with a $1,800 property tax bill, this law does not suddenly drop thousands into your lap.

If you’re a software engineer and project manager in the New Jersey suburbs with a $15,000 property tax bill, it might.

For most genuinely middle-class Americans, here’s the honest takeaway:

The $40,000 SALT cap is loud politics for people with big tax bills. Your life still comes down to wages you can live on, housing you can afford, and a tax system that doesn’t punish you for trying to get ahead.

The number on the headline changed from $10,000 to $40,000.

For a lot of families in the real middle, nothing else changed at all.

RELATED ARTICLES

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

By FMC Editorial Team

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

By MacKenzy Pierre

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs....

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market...

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan...