Mortgage Rates Slip Toward 2025 Lows: Should You Wait for a Fed Cut or Lock In Now?

By Article Posted by Staff Contributor

The estimated reading time for this post is 396 seconds

If you’ve been watching mortgage rates the past couple of years, you probably feel like you’re riding in the back of a car with a driver who can’t decide which lane to be in.

First they were near 3%. Then they shot toward 7–8%. Now the headlines say “rates near year-to-date lows,” and the Fed is talking about more rate cuts.

So what do you actually do with that as a middle-class homebuyer or homeowner? Wait for lower. Lock what you can. Or give up and stay put?

Let’s walk through the moving parts in plain English.

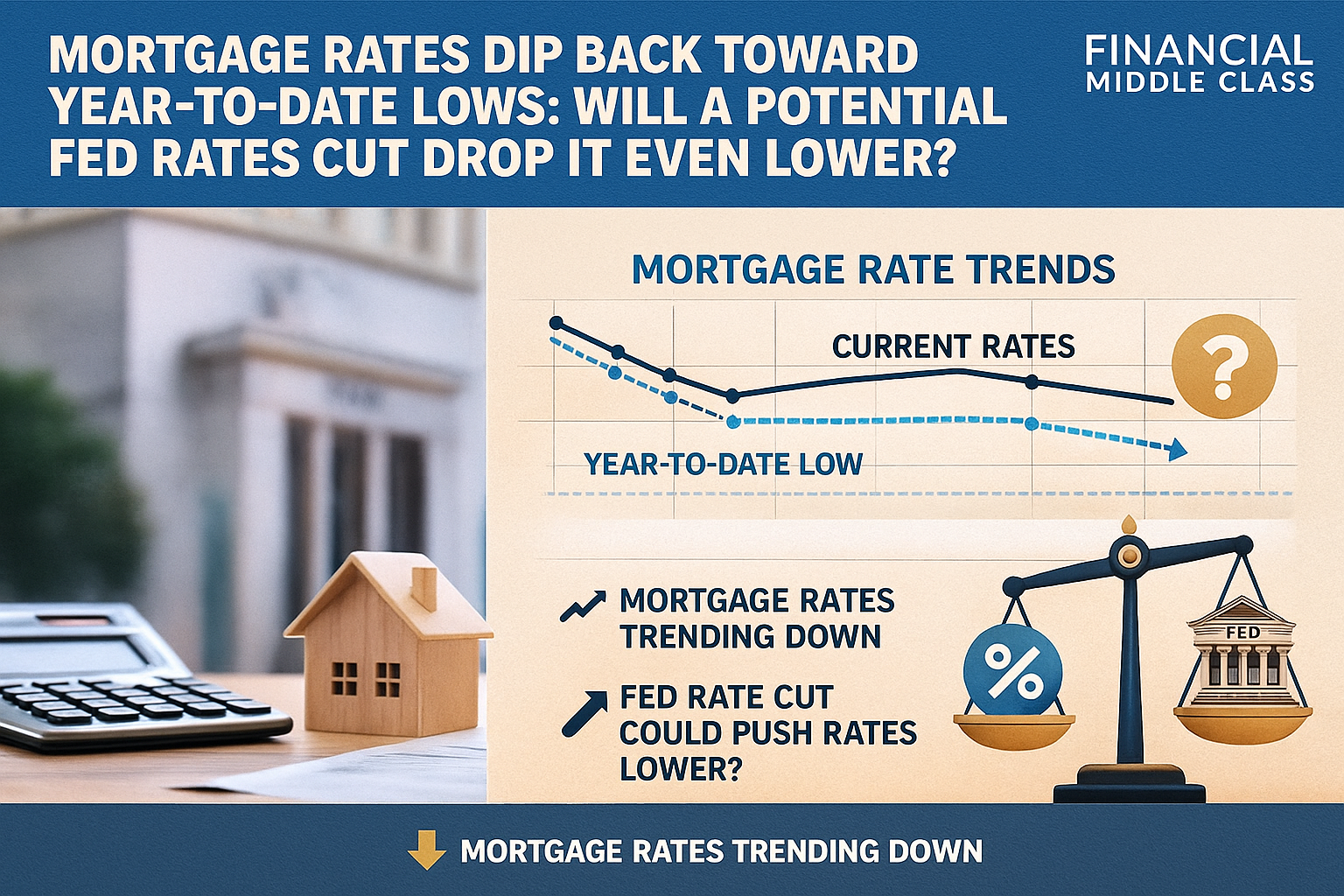

Where mortgage rates are right now

As of early December 2025:

- The average 30-year fixed mortgage rate is around 6.19%, down from 6.23% the week before and lower than about 6.7% a year ago

- Rates have been hovering in a narrow band around 6.2–6.3% since the fall, near their lows for the year.

So no, this is not the 3% era. But it’s also not the 7.5% punch in the gut we saw not long ago.

Meanwhile, the Federal Reserve has:

- Cut its benchmark rate twice already (September and October), and

- Is widely expected to cut again in December, which would bring the federal funds rate down into the 3.5–3.75% range — the lowest in nearly three years.

The natural instinct is to think: If the Fed cuts again, mortgage rates must fall, right?

Not so fast.

The uncomfortable truth: The Fed does not control your mortgage rate

The Fed sets short-term interest rates — what banks charge each other overnight. That strongly affects:

- Credit cards

- Personal loans

- HELOCs

- Savings account rates

But fixed mortgage rates move mostly with the 10-year Treasury yield and broader bond markets, not directly with the Fed’s overnight rate.

Lenders price mortgages off what investors demand for mortgage-backed securities. Historically, 30-year mortgage rates sit roughly 1.5–2 percentage points above the 10-year Treasury yield.

So what actually drives your rate?

- Expectations about inflation

- Expectations about future Fed moves

- Investor appetite for safe assets like Treasuries

- Overall economic fear or optimism

That’s why we’ve seen this weird pattern lately:

- In September 2025, mortgage rates dropped to a three-year low right before the Fed cut rates — and then ticked up afterward.

- Investors “priced in” the Fed’s move ahead of time by buying bonds and pushing yields (and mortgage rates) down.

So yes, Fed cuts matter. But often the market moves in anticipation of the cut, not after the press conference.

Will a Fed cut push rates much lower from here?

Let’s look at what forecasters are actually saying instead of what social media threads hope:

- Fannie Mae’s economic outlook projects mortgage rates around 6.4% at the end of 2025 and 5.9% by the end of 2026.

- Other forecasts see average mortgage rates around 6.3% in 2026, not some magical return to 3%.

Translation:

We may drift down into the high-5% range over time if the economy cooperates. But the odds of going back to 2–3% anytime soon are slim.

That matters for your decision. Waiting might shave off half a point. Waiting for 3% is probably waiting forever.

What a small rate drop actually means in dollars

Let’s put real numbers behind this. Say you’re eyeing a $400,000 mortgage on a 30-year fixed loan.

Monthly principal + interest (rounded):

- At 6.2% → about $2,450

- At 5.7% → about $2,320

- At 5.0% → about $2,150

So dropping from 6.2% to 5.7% saves you roughly $130 a month.

Dropping from 6.2% to 5.0% saves about $300 a month.

Those are meaningful numbers for a middle-class budget. But notice the scale:

- A 0.5% drop is “nice but not life-changing.”

- A 1–1.5% drop is “this actually changes whether we can breathe.”

That’s why your starting point matters. A homeowner stuck at 7.5% has more to gain from waiting than a buyer already choosing between 6.1% and 6.3%.

For buyers: Should you wait or lock?

Ask yourself three practical questions:

1. Are you ready to move, or just Zillow-browsing?

If you’re seriously house-hunting — you’ve saved the down payment, know your price range, and your lease ends in a few months — then trying to time 0.25% changes in rates is usually a distraction.

Home prices and inventory matter just as much as rates. Forecasts for 2026 show:

- Only modest national price increases (around 1–2%),

- Slightly better affordability as wages catch up, but

- Big regional differences: some Sunbelt markets softening, some Northeast / Midwest metros still climbing.

A slightly lower rate six months from now doesn’t help if:

- You’re forced to sign another 12-month lease, or

- Prices in your target neighborhood climb faster than rates fall.

2. How tight is your monthly budget at today’s rates?

Run the numbers with your lender:

- If today’s rate gives you a payment that’s tight but survivable, and you’re buying a home you genuinely want to stay in, locking can make sense.

- If today’s rate gives you a payment that already feels like a stretch, hoping for a small rate drop is not a fix. That’s a signal you may need to lower your price point or wait.

3. Do you have a plan if rates don’t fall?

There’s a real risk in “we’ll just wait for 5%.”

If inflation flares back up or the economy surprises on the upside, rates can climb again. Investors have already baked a lot of optimism into current yields.

For most middle-class buyers, a healthier mindset is:

“Can I buy a home I like and comfortably afford at today’s rate — and then refinance later if we get lucky?”

If yes, you have options. If no, the problem isn’t just the Fed. It’s the gap between local home prices and your income.

For current homeowners: When does a refi make sense?

There are three broad groups right now:

- You locked in around 3% in 2020–2021.

Do not touch that loan unless you absolutely have to. You’re holding a winning lottery ticket. - You bought or refinanced at 6–7%+ in the last couple of years.

You’re the most likely winner if rates keep drifting down. A rough rule of thumb:- A refi starts to make sense when you can cut your rate by about 1 percentage point and plan to stay in the home long enough to recoup closing costs.

- You’re somewhere in the middle (4–5% from an older mortgage).

Today’s rates don’t help you. You might refinance if we ever see low-5s or high-4s again, but that’s not the base case in most forecasts.

And remember: your credit score, debts, and income still drive the actual rate you get, not just what the headlines say.

What you can do right now, regardless of what the Fed does

You can’t control the 10-year Treasury. But you can tighten up your own side of the equation:

- Clean up your credit.

Paying your credit cards down below 30% of their limit can improve your score and cut your rate more than another Fed move would. - Shop more than one lender.

Different lenders price risk differently. The spread between lenders can easily be 0.25–0.5 percentage points for the same borrower. - Ask about points and lender credits.

Sometimes paying extra at closing to “buy down” the rate makes sense. Sometimes it doesn’t. Run the math over how long you realistically plan to stay. - Tighten your budget before you buy.

Less monthly debt (cars, cards, personal loans) means more room in your debt-to-income ratio, which can qualify you for better rates or more options.

This is the unglamorous part, but it’s the part you actually own.

The bottom line: Stop chasing perfect timing

It’s tempting to treat the housing market like a meme stock: “I’ll buy at the bottom.”

That mindset is how people end up frozen for years.

Here’s the reality for a middle-class family:

Mortgage rates will go up and down, but your real question is simpler: Can you lock a rate that lets you live, save, and sleep at night in a home that fits your life?

The Fed doesn’t answer that.

Only your numbers do.

RELATED ARTICLES

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

By FMC Editorial Team

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

By MacKenzy Pierre

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs....

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market...

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan...