Perceptions of the “Trump Economy”: Data, Sentiment, and the Debate Over Prosperity

By FMC Editorial Team

The estimated reading time for this post is 775 seconds

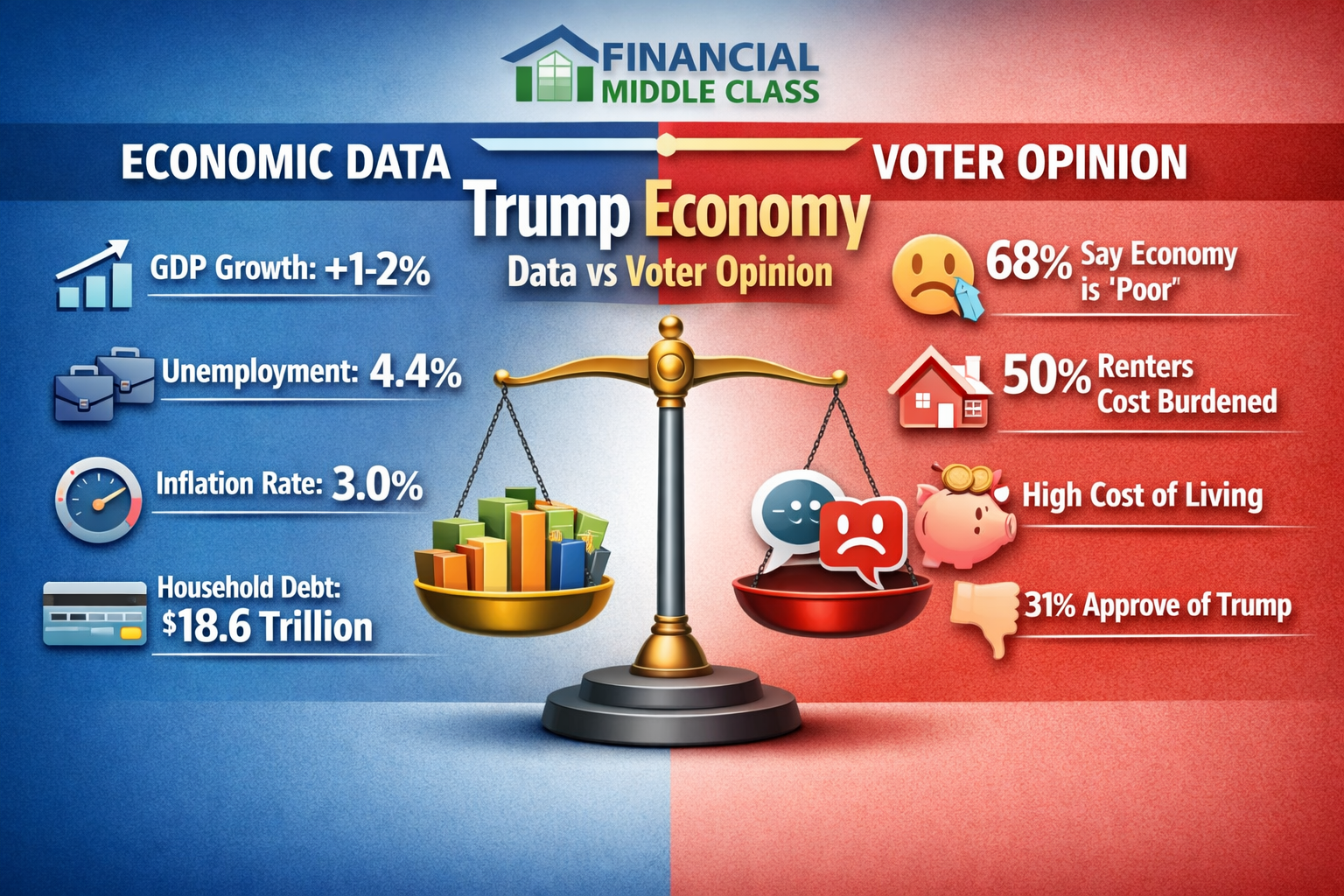

In late 2025, the United States offers a striking economic paradox. Key national indicators—growth, unemployment, and inflation—suggest a cooling but still expanding economy. At the same time, public opinion surveys show persistent pessimism and declining confidence in President Donald Trump’s handling of economic policy.

This divergence has fueled a contentious debate. Supporters of the administration argue that the economy is fundamentally strong and that negative public sentiment is driven by partisan media narratives and lingering memories of the inflationary spike earlier in the decade. Critics contend that headline statistics mask a serious affordability crisis, particularly for middle- and lower-income households facing high housing costs, record debt, and limited financial buffers.

This essay outlines the main empirical facts and presents the arguments advanced on both sides, highlighting where the evidence is relatively clear and where significant uncertainties remain.

Economic Conditions in Late 2025: What the Data Show

Growth, inflation, and unemployment

Official data point to an economy that has slowed from the rapid post-pandemic rebound but has not tipped into recession. Forecasts from private-sector and policy institutions in late 2025 generally place real GDP growth in the 1–2% range for the year, a pace consistent with a “soft landing” rather than a contraction.

Inflation, which reached a four-decade high of over 9% in 2022, has moderated. According to the U.S. Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) for all urban consumers was 3.0% higher in September 2025 than a year earlier, with core inflation (excluding food and energy) also at 3.0%. This is above the Federal Reserve’s 2% target but far below the peaks of 2022.

The headline unemployment rate stood at 4.4% in September 2025, up from 4.1% a year earlier but still low by historical standards. Weekly jobless claims have shown occasional spikes related to seasonal factors but remain at levels economists describe as consistent with a relatively steady labor market.

These aggregate figures underpin administration claims that the U.S. economy is fundamentally healthy, even if no longer booming.

Household finances: affordability, housing, and debt

Other data underscore why many households report feeling financially strained.

Housing affordability. The 2025 State of the Nation’s Housing report from Harvard’s Joint Center for Housing Studies concludes that “record-high levels of unaffordability” show little sign of easing. High home prices and elevated mortgage rates have pushed homebuying to its lowest level since the mid-1990s, while rising insurance premiums and property taxes have added stress for owners.

Renters face even more acute challenges. Analyses of federal survey data show that in 2023 about half of all renter households—22.6 million—were “cost burdened,” meaning they spent 30% or more of income on housing; roughly 27% were severely cost-burdened, spending over half their income on housing. More recent American Community Survey data indicate that median gross rent continued to rise into 2024, with renters typically devoting about 31% of income to rent.

Mortgage costs have improved somewhat compared with earlier peaks. As of mid-December 2025, the average 30-year mortgage rate was about 6.2%, down from over 7% earlier in the year and slightly below the 2024 average of 6.6%, but still roughly double the sub-3% rates common in the late 2010s.

Household debt. The Federal Reserve Bank of New York’s Household Debt and Credit report shows total U.S. household debt reaching $18.59 trillion in the third quarter of 2025, a record high. Credit card balances alone rose to $1.23 trillion, up about 6% from a year earlier and nearly 50% higher than five years ago. Overall delinquency rates remain below crisis levels, but the share of debt in some stage of delinquency has climbed to around 4.5%, with particular stress in credit card and student loan accounts.

These figures suggest that while many households remain able to service their debts, a significant segment is using high-interest borrowing to cope with living costs, leaving them vulnerable to shocks.

Public opinion: persistent pessimism

Despite moderate growth and lower inflation, public sentiment about the economy remains strongly negative. An AP-NORC poll conducted December 4–8, 2025, finds that 68% of Americans describe the national economy as “poor,” and only 31% approve of President Trump’s handling of the economy, the lowest figure recorded for his presidency. A separate Pew Research Center survey in September 2025 similarly reports that 74% of adults say economic conditions are “only fair” or “poor,” with just 26% calling them “excellent” or “good.”

Consumer confidence indices from Gallup, the Conference Board, and the University of Michigan show weakened confidence compared with pre-pandemic norms, even as spending has not yet fallen dramatically. Analysts often refer to this pattern—relatively solid macroeconomic readings paired with gloomy sentiment—as a “vibecession.”

Against this backdrop, the debate over the “Trump economy” centers on how to interpret these mixed signals and whether the president’s optimistic framing is justified.

The Proponents’ Case: A Strong Economy Undermined by Perceptions

Supporters of President Trump’s economic narrative make several core arguments, grounded partly in the macro data and partly in political interpretation.

1. Headline indicators remain comparatively favorable

Proponents emphasize that the United States has avoided a deep recession despite aggressive interest rate hikes earlier in the decade and ongoing global uncertainty. Growth, while modest, is positive; unemployment remains well below the levels seen during the 2008–09 crisis or the early pandemic; and inflation has fallen sharply from its peak.

From this perspective, a 3.0% annual inflation rate and 4.4% unemployment in late 2025 represent a reasonably good outcome given the severity of recent shocks. Supporters argue that many advanced economies have struggled more, and they credit Trump-era policies—such as deregulation, certain tax provisions, or support for domestic energy production—for keeping U.S. growth comparatively resilient, though isolating the effect of any single policy is empirically difficult.

2. Progress relative to the inflation peak

Proponents also stress the direction of change. Inflation above 9% in 2022 represented a severe erosion of purchasing power. By late 2025, price growth has slowed to around 3% year-over-year. Supporters argue that this disinflation, combined with nominal wage growth, has started to stabilize real incomes, even if not restoring all lost ground.

In speeches, President Trump has claimed to be “crushing” inflation and to have engineered an economic environment where prices are “coming down,” pointing to the decline in the inflation rate versus the earlier peak and to specific examples like gasoline in some regions. Factually, the rate of increase in prices has slowed, though average price levels remain substantially higher than before the inflation surge—a point critics emphasize.

3. Easing financial conditions relative to earlier spikes

Supporters further highlight recent declines in interest rates, particularly mortgage rates. After surging above 7% earlier in 2025, the average 30-year mortgage rate has fallen to roughly 6.2%, bolstering home sales and refinancing activity. The Federal Reserve has also cut its policy rate several times in 2025, which proponents argue reflects confidence that inflation is under control and that looser monetary conditions are appropriate.

From this vantage point, the economic narrative is one of gradual normalization after extraordinary shocks: inflation is down, rates are off their highs, the labor market is still generating jobs, and GDP continues to grow.

4. Explanations for negative public sentiment

To account for the gap between these indicators and public pessimism, supporters often point to three factors:

- Media and political framing. Supporters argue that negative economic coverage by major news outlets, and messaging by Democratic leaders, has reinforced a sense of crisis even as conditions improve. They note that partisan divides in economic perceptions are large, with Republicans generally more positive than Democrats about the same set of data.

- Lagged perceptions. Some analysts sympathetic to the administration suggest that public attitudes are slow to adjust after a period of very high inflation. Even as current inflation falls, households continue to anchor their feelings to earlier price shocks and may not yet perceive the moderation as meaningful.

- Broader political discontent. A separate argument holds that survey responses about “the economy” often double as proxies for overall political mood, including views on immigration, crime, or cultural issues. On this view, low economic ratings may partly reflect broader dissatisfaction with politics rather than purely financial assessments.

While these explanations are plausible, their relative importance is difficult to measure precisely. Survey and experimental research do show strong partisanship in economic perceptions, but they also suggest that concrete experiences—rent increases, grocery bills—play an independent role.

The Opponents’ Case: A Persistent Affordability Crisis

Critics of the administration’s economic narrative accept many of the same headline statistics but draw different conclusions about their significance. Their case centers on the distinction between aggregate averages and household-level affordability.

1. High price levels despite lower inflation

Critics emphasize that while inflation has slowed, price levels remain permanently higher for essentials such as housing, food, and services. The BLS reports that food prices were about 3.1% higher in September 2025 than a year earlier, with similar increases for medical care and household operations. These annual increases are layered on top of substantial cumulative rises in prior years.

From this perspective, the key burden is not only the rate of current inflation, but the multi-year jump in living costs that has not been fully offset by wage growth, especially for middle- and lower-income workers. Critics argue that describing such an environment as “thriving” overlooks the lived reality of households whose budgets remain tight.

2. Housing as a central pressure point

For many analysts, housing is the clearest focal point of the affordability problem. The 2025 Harvard housing report notes that high home prices and elevated mortgage rates have pushed homebuying to its lowest level in roughly 30 years and that both renters and owners face rising cost burdens.

Separate analyses based on Census and other federal data find that around half of all renters—over 22 million households—are cost-burdened, and more than one quarter are severely cost-burdened, paying more than 50% of income for housing. Advocates and housing scholars describe this as a “historic” level of strain.

Critics argue that the administration’s policies—such as maintaining or expanding tariffs that can raise construction costs, or focusing messaging on other topics—have not directly addressed these structural housing constraints, even as President Trump increasingly acknowledges that “prices are too high.”

3. Rising household debt and financial fragility

Opponents also highlight record levels of consumer debt as evidence of an economy that is less healthy than topline growth figures suggest. The New York Fed’s data show total household debt at $18.59 trillion in Q3 2025 and credit card balances at $1.23 trillion, with card debt up nearly 6% in a year and significantly more over a five-year horizon.

While not all debt is problematic—mortgages and student loans can finance long-term investments—critics point to rising balances on high-interest credit cards and upticks in delinquency as signs that many households are borrowing to cover day-to-day expenses. For these households, even a modest slowdown in inflation does not translate into a sense of security.

4. Concerns about rhetoric and policy priorities

Critics also focus on the administration’s messaging. In several widely reported appearances, President Trump has minimized or mocked concerns about “affordability,” at one point calling the focus on affordability a “Democratic hoax” before later acknowledging that prices are in fact too high.

Opponents argue that such rhetoric signals a lack of urgency about cost-of-living issues and risks alienating voters who experience financial stress.

On the policy side, critics question whether certain actions—such as broad tariffs on imported goods—may themselves contribute to higher consumer prices, even as administration officials cite tariff revenues as a policy success. Economists are divided on the magnitude of these effects, but many agree that tariffs can raise prices for imported goods and inputs, at least in the short to medium term.

5. Interpretation of public opinion

Opponents see public pessimism less as a misperception and more as a rational reaction to lived conditions. They note that economic dissatisfaction was also widespread under President Biden, despite strong job growth and falling inflation, and argue that this continuity suggests deeper structural issues—especially in housing and household balance sheets—rather than simply partisan messaging.

On this reading, the “vibecession” reflects not confusion but a consistent judgment that the combination of high costs, uncertain job quality, and thin financial cushions is inconsistent with a truly strong economy.

Why Data and Sentiment Diverge: Areas of Uncertainty

Both proponents and opponents agree on many factual points: inflation is lower than at its peak but higher than before; unemployment is higher than a year ago but not high by historical standards; housing and debt burdens are elevated; public sentiment is negative. The disagreements arise largely over causation and interpretation.

Several questions remain contested or empirically uncertain:

- How much of current economic performance is attributable to Trump-era policies?

Macroeconomic outcomes reflect monetary policy, global conditions, technological change, and policy lag effects. Economists differ on how much credit or blame should be assigned to specific tax, trade, or regulatory decisions. Isolating those effects reliably is methodologically complex and often produces wide ranges of estimates. - To what extent is public pessimism driven by partisanship versus material conditions?

Research clearly shows that partisans tend to rate the economy more positively when their preferred party holds the presidency. At the same time, cross-party agreement that affordability is a major concern suggests that material conditions also play a substantial role. Quantifying the relative weight of these factors is an active area of study.

- Are current levels of debt and housing stress sustainable?

Some analysts argue that as long as unemployment stays relatively low and rates continue to ease, households will gradually adjust and delinquencies will remain manageable. Others warn that persistent cost burdens—especially among renters and highly indebted consumers—make the system fragile and vulnerable to shocks. Recent increases in foreclosure rates and the continued rise in cost-burdened households are seen by some as early warning signs.

- How will sentiment evolve if inflation remains around 3%?

It is unclear whether public attitudes will improve if inflation stabilizes modestly above the 2% target but below earlier peaks, or whether households will continue to compare current prices to pre-pandemic levels and feel aggrieved. Early evidence from the Biden years suggests that negative views can persist even as objective indicators improve, but data from the Trump period are still emerging.

Acknowledging these uncertainties is crucial for any balanced assessment.

Conclusion: Competing Narratives Around a Mixed Economic Picture

By late 2025, the U.S. economy presents a mixed picture. Growth continues, inflation is far below its peak but not fully subdued, the labor market is weaker than a year ago but not in crisis, housing remains historically expensive, and household debt is at record highs. Public opinion is decidedly negative, with large majorities describing the economy as poor and only about one-third approving of President Trump’s economic stewardship.

Supporters of the president emphasize the avoidance of recession, the moderation of inflation from earlier extremes, and relatively low unemployment, framing the situation as a broadly successful normalization after extraordinary shocks. Critics highlight the elevated cost of living, especially for housing, the rise in high-interest consumer debt, and the persistence of economic anxiety across income and partisan lines, arguing that the administration’s optimistic narrative does not match daily experience.

The available evidence supports elements of both perspectives: the macroeconomy has not collapsed, but many households remain under financial strain. Whether history ultimately judges the “Trump economy” as thriving or troubled will depend not only on how indicators evolve in the coming years, but also on how scholars and the public weigh aggregate performance against distributional outcomes and lived affordability.

For now, the gap between official data and popular sentiment remains a central feature of American economic life—and a key point of contention in the nation’s political debate.

RELATED ARTICLES

Can you buy and move in 180 days? Get a realistic timeline, budget, and Plan B so your deadline doesn’t break you. Read now.

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what to do next. Read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what to do next. Read now.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

Selling Your Home Isn’t a Chore. It’s a Power Test.

Avoid costly seller mistakes—price smart, negotiate, handle appraisals, and protect your equity. Read the full seller playbook.

By Article Posted by Staff Contributor

American Middle Class / Jan 24, 2026

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

By FMC Editorial Team

American Middle Class / Jan 23, 2026

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

By FMC Editorial Team

American Middle Class / Jan 21, 2026

The government was about to take your paycheck. Then it hit pause.

Wage garnishment paused for defaulted student loans—what it means for your paycheck, tax refund, and next steps. Read before it restarts.

By Article Posted by Staff Contributor

American Middle Class / Jan 21, 2026

January Is Financial Wellness Month — and Your Boss Cares More Than You Think

January reset: budget, emergency fund, debt & accountability—plus an employer playbook. Use the tools and start today.

By Article Posted by Staff Contributor

American Middle Class / Jan 19, 2026

Trump’s 401(k) Down Payment Plan: A House Today, a Retirement Tomorrow?

Could Trump let you use 401(k) money for a down payment? Learn how it works, risks to retirement, and price impacts—read first.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

The One-Income Family Is Becoming a Luxury. Here’s the Salary It Takes Now.

How much must one parent earn so the other can stay home? See the real math, examples, and tradeoffs—run your number now.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

Credit Cards vs. BNPL: Which One Actually Works for the American Middle Class?

Credit cards vs BNPL: costs, risks, and the best choice for middle-class cash flow. Use this 60-second framework—read now.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what...

American Middle Class / Jan 25, 2026

Selling Your Home Isn’t a Chore. It’s a Power Test.

Avoid costly seller mistakes—price smart, negotiate, handle appraisals, and protect your equity. Read the full...