Should You Get a Debt Consolidation Loan in 2026?

By Article Posted by Staff Contributor

The estimated reading time for this post is 633 seconds

Last updated: December 26, 2025

Rates and lender rules change—confirm APR, fees, and terms before you sign.

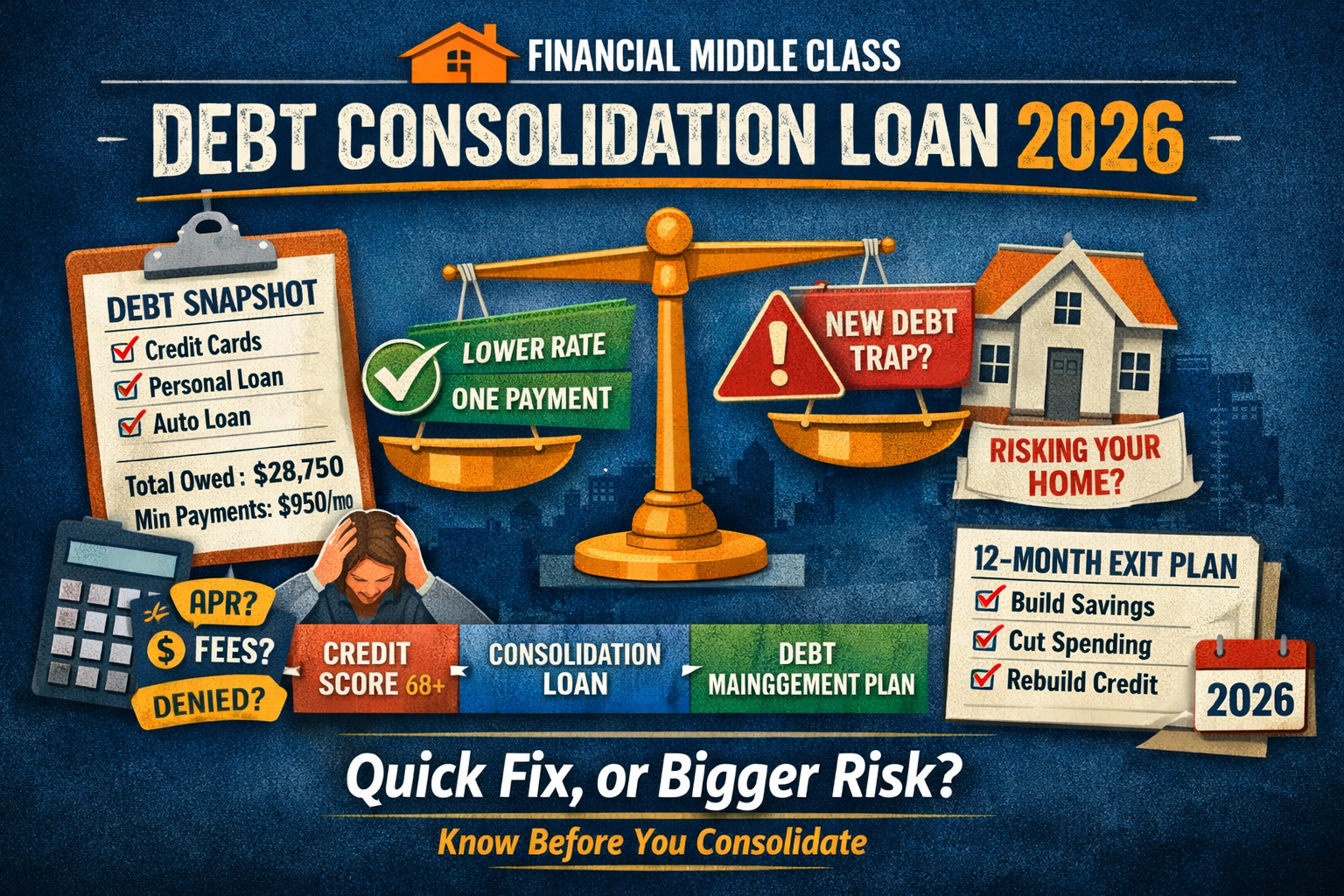

Key Takeaways (Read This Before You Apply)

- Consolidation isn’t settlement. Consolidation combines debts; settlement tries to reduce balances and often damages credit.

- The only win is a real math win. Lower APR + reasonable fees + a term that doesn’t trap you for years.

- Watch the two-debt trap. If you re-run the cards after payoff, you’ll stack debt, not solve it.

- Home equity raises the stakes. Turning unsecured debt into secured debt can put your home at risk.

- If you’re behind, stabilize first. Housing and essentials come before optimizing interest rates.

Table of Contents

Should You Get a Debt Consolidation Loan in 2026?

You want one payment. One due date. One number you can stare down.

I get it. When you’re living the middle-class reality—mortgage or rent, car insurance that keeps creeping,

groceries that feel personal, and a credit card that quietly became “Plan B”—a debt consolidation loan sounds like oxygen.

But let’s say the quiet part out loud:

a consolidation loan is not a reset button. It’s a new container for the same debt.

Sometimes that’s smart. Sometimes it’s how people end up with two debts instead of one.

Let’s walk through it like grown folks.

Debt Consolidation vs Debt Settlement: Don’t Confuse These

People use the word “settle” when they really mean “combine.” That mix-up costs money.

Debt consolidation loan (what most people actually want)

You take one new loan and use it to pay off multiple debts. You still owe the full amount—just to one lender now.

Debt settlement (what a lot of ads are selling)

Settlement tries to negotiate balances down, often by having you stop paying and build up money for settlements.

That can mean collections pressure and credit damage while you wait.

Helpful resources (primary sources)

If you want official, plain-English explanations, start here:

Why This Question Hits So Hard in 2026

Because interest is still doing what interest does: multiplying your stress.

Credit card APRs have stayed painfully high in recent years, and that’s why consolidation even feels like a lifeline.

By comparison, personal loan rates can be meaningfully lower depending on your credit profile.

(If you like hard numbers, the Federal Reserve publishes credit card interest rates and personal loan rates in its consumer credit series. The New York Fed tracks household debt and credit trends.)

The 30-Minute Debt Snapshot (Do This First)

Don’t choose a tool before you know the job.

Set a timer for 30 minutes. No shame. No spiraling. Just facts.

Write down every debt

- Balance

- APR (interest rate)

- Minimum payment

- Due date

- Type (credit card, medical, personal loan, auto, etc.)

- Secured or unsecured (this matters)

Answer two questions

- What’s your total minimum payment every month? That’s your debt rent.

- Do you have margin? Money left after housing, utilities, food, transportation, insurance, and kid costs.

No margin means no miracle. If there’s no breathing room, consolidation can become a tighter noose.

When a Debt Consolidation Loan Makes Sense

A consolidation loan is worth considering when it does three things at once:

1) It lowers your interest rate—for real

Not “by a little.” Meaningfully. If your cards are in the 20s and your consolidation offer lands closer to the low teens,

you’re not just simplifying—you’re slowing the bleeding.

2) It gives you a fixed payoff date

Credit cards don’t have finish lines. Personal loans do. That psychological shift matters.

3) The payment fits your worst month, not your best month

If one sick week, one car repair, or one slow month at work knocks you off track, the payment isn’t manageable. It’s fragile.

The Consolidation Math That Actually Matters

This is where people get fooled: they chase the monthly payment and ignore the total cost.

APR matters more than the advertised rate

APR is the all-in price. That’s the number that tells the truth.

Fees can quietly erase your savings

Origination fees are common in personal loans. If the fee is big enough, it can eat the benefit of a lower rate.

Ask exactly how fees are charged and whether they reduce what you receive.

Term length is where debt becomes a lifestyle

Lower payments often mean longer payoff. Longer payoff often means more interest. More interest means more time stuck.

Rule of thumb

If the payment drops but the total paid goes up, you didn’t win. You just spread the pain thinner.

Credit Score Reality: What If You Don’t Qualify?

Most people start looking for consolidation after the debt shows up on their face: utilization up, score down, options worse.

If you can’t beat your current APR by a meaningful margin—or the fees are ugly—don’t force it.

You still have paths.

If the offers are bad, try this order

- Credit unions (often more human underwriting)

- Nonprofit credit counseling / Debt Management Plan (DMP)

- A 90-day payoff push while you reduce utilization

- 0% balance transfer (only if you have the score and discipline)

- Settlement (only if you truly understand the risks and can vet the provider)

Best Option in 2026: Side-by-Side Comparison

You don’t need “a” solution. You need the right one for your situation.

| Option | Best for | Biggest risk | What it feels like |

|---|---|---|---|

| Consolidation loan | Lower rate + fixed payoff | Re-running cards (two-debt trap) | “One payment, finally.” |

| 0% balance transfer | Good credit + fast payoff | Promo ends, fees, new spending | “I bought time—now I must use it.” |

| Debt Management Plan (DMP) | High APR + need structure | Requires consistency | “A plan that keeps me from free-falling.” |

| Debt settlement | Deep hardship + limited options | Credit damage, collections, scams | “High-risk surgery.” |

The Two-Debt Trap: How Consolidation Backfires

Most consolidation failures aren’t math problems. They’re behavior problems.

You consolidate, feel caught up… then start swiping again.

Now you have a personal loan payment and new credit card balances.

That’s not progress. That’s debt stacking.

Guardrails that actually work

- Remove cards from saved checkouts (Amazon, Apple Pay, subscriptions)

- Freeze cards (yes, literally)

- Keep one “true emergency” card, but make it inconvenient

- Build a starter buffer (even $500 changes choices)

Home Equity Consolidation: Read This Twice

A HELOC can offer a lower rate. True.

But it changes the stakes: you’re turning unsecured debt into secured debt—tied to your home.

If your problem is cashflow and overspending, putting your house behind it is a dangerous upgrade in risk.

Home equity consolidation is only worth discussing if income is stable, spending is controlled, and the plan is strict—not emotional.

Lender Fine Print: Questions to Ask Before You Sign

Copy/paste these into your notes before you accept an offer:

- What is the APR including all fees?

- Is there an origination fee? How much—and is it deducted from what I receive?

- Is the rate fixed or variable?

- Any prepayment penalty?

- Any add-ons I didn’t request (credit insurance, “protection plans”)?

- What happens if I’m late once?

If they rush you, dodge, or talk down to you, walk. That’s not guidance. That’s a sales pitch.

If You’re Already Behind, Stabilize First

If you’re missing payments—or you’re one bad week away—your job is triage.

Your goal is stability, not optimization.

Middle-class triage order

- Housing (mortgage/rent)

- Utilities

- Transportation

- Food and essentials

- Then unsecured debt

If you’re behind, consider hardship options with creditors and look at nonprofit counseling/DMPs.

The point is to stop the bleeding without stepping into a scam.

Scam-Proofing: Spot Predatory “Debt Help”

When people are desperate, the predators get loud.

Watch for any company that promises guaranteed results, pushes secrecy, or tries to charge upfront fees before delivering results.

A good starting point for scam warnings and basics is the FTC’s consumer guidance on debt relief and credit repair scams.

(See the resource box above.)

Real-Life Scenarios: Who Should Consolidate?

Scenario 1: High APR, steady income, decent credit

You’re current, but interest is killing you. Consolidation can work if the APR drop is real and the payment fits your worst month.

Scenario 2: Offers aren’t meaningfully better

If your consolidation APR is close to your card APR (or fees are heavy), don’t force it.

Stabilize, reduce utilization, and improve options first.

Scenario 3: You haven’t stopped the swiping

Consolidation won’t fix that. It’ll just give you a second bill.

Put guardrails in place before you “clean up” the balances.

Scenario 4: Homeowner tempted by a HELOC

If your problem is cashflow, turning card debt into house-backed debt can escalate risk fast.

Be careful trading a card problem for a house problem.

Scenario 5: Already behind or income unstable

You need stability first—hardship options, counseling, triage—before you sign up for a new fixed payment you might not keep.

Timeline: What Smart Consolidation Looks Like (0–12 Months)

Week 0–2: Get the facts (no vibes)

Do the debt snapshot. Pull 2–3 quotes. Compare APR with fees. Decide if it’s a true math win—not just a lower payment.

Month 1–2: Stabilize and block the two-debt trap

Autopay the loan. Remove cards from wallets and saved checkouts. Build a small buffer ($500 is enough to change behavior).

Month 3–6: Build margin

Cut one recurring cost you don’t even enjoy. Add one predictable extra payment monthly. Track spending to protect progress.

Month 6–12: Rebuild and future-proof

Grow emergency savings, keep utilization low, and lock in systems so the next surprise expense doesn’t go on plastic.

Your 12-Month Exit Plan After Consolidation

Consolidation is the start, not the finish.

The goal isn’t a new loan. The goal is a life where the next surprise doesn’t turn into a new balance.

Months 1–2: Stabilize

- Autopay the new loan

- Cards frozen/removed from wallets

- Starter buffer (even $500)

Months 3–6: Build margin

- Cut one recurring cost you don’t enjoy

- Add one predictable extra payment monthly

- Track spending to protect progress

Months 6–12: Rebuild

- Grow emergency savings

- Keep utilization low

- Decide what you’ll do differently next time life gets expensive

FAQ

Will a debt consolidation loan hurt my credit?

You may see a small dip from the inquiry/new account. Over time, it can help if it lowers utilization and you pay on time.

Should I close my credit cards after consolidation?

Not automatically. Closing can reduce available credit and raise utilization. Make cards safe (inconvenient), not necessarily gone.

What if I get denied for consolidation?

Try a credit union, consider a nonprofit DMP, and run a 90-day plan to lower utilization and stabilize cashflow before reapplying.

Is a 0% balance transfer better than a consolidation loan?

It can be—if you can pay it down before the promo ends and you won’t re-run the balance. Don’t ignore transfer fees.

Should I use home equity (HELOC) to pay off cards?

Be careful. You may lower the rate, but you’re turning unsecured debt into secured debt. If cashflow is tight, you can raise the risk level fast.

The Truth That Hits Home

A debt consolidation loan can be a smart tool. It can lower interest, simplify payments, and give you a finish line.

But it can’t give you stability.

Stability comes from margin. From breathing room. From not needing a credit card to act like a second paycheck.

Consolidation changes the shape of your debt. It doesn’t change the reason you needed debt in the first place.

And that’s the middle-class truth nobody can “budget hack” their way out of:

life is priced like you’re rich—while your paycheck is priced like you’re not.

Quick question for you:

If you could wave a wand and fix one money pressure this year—credit cards, car note, mortgage/rent, or groceries—what would it be, and why?

RELATED ARTICLES

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what to do next. Read now.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

Selling Your Home Isn’t a Chore. It’s a Power Test.

Avoid costly seller mistakes—price smart, negotiate, handle appraisals, and protect your equity. Read the full seller playbook.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist....

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and...