How Much Car Can I Afford? The Middle-Class Answer (Not the Dealer Answer)

By Article Posted by Staff Contributor

The estimated reading time for this post is 706 seconds

Last updated: — refreshed with late-2025 pricing, payment trends, and the most common dealership tactics.

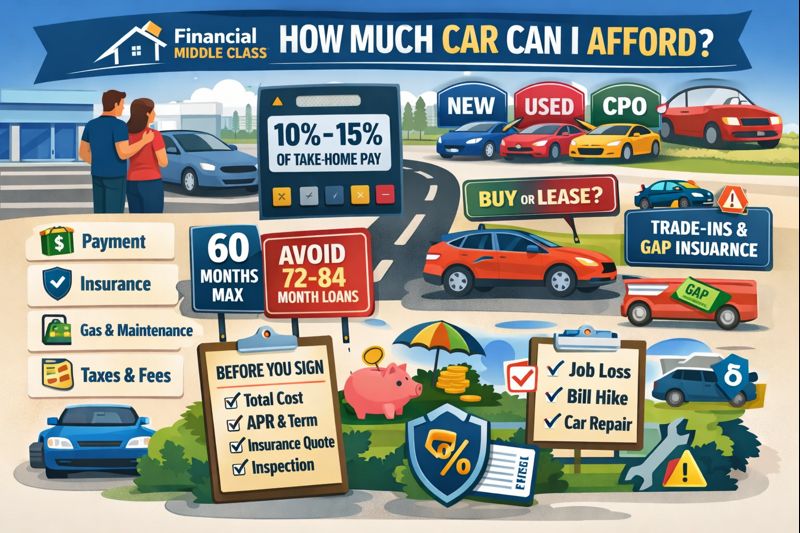

Key takeaways (read this before you test drive anything)

- Budget the whole car—payment + insurance + fuel + maintenance + fees—not just the note.

- Keep all-in car costs at 10%–15% of take-home pay. If it needs 72–84 months to “work,” it’s too much car.

- Shop your APR before you shop the vehicle. A bad rate makes a “cheap” car expensive.

- Don’t empty your emergency fund for a down payment. Liquidity is what keeps repairs from becoming debt.

- Never roll negative equity forward unless you’re choosing to pay for two cars at once.

How Much Car Can I Afford? The Middle-Class Answer (Not the Dealer Answer)

The first question at a dealership is almost always the slickest one:

“What monthly payment are you trying to be at?”

That’s not a budgeting question. That’s a steering wheel grab.

Because once you say “$600,” they can make $600 happen on almost anything—by stretching the term, shuffling the numbers, and quietly turning your “reasonable” payment into a long relationship with debt you can’t breathe inside.

And the timing is nasty. Kelley Blue Book reported the average new car buyer paid $49,814 in November 2025. That’s basically $50K with better PR.

Experian’s Q3 2025 numbers show how that pain shows up at home: average payments of $748/month for new and $532/month for used. You can “afford” a lot when the loan is long enough. Your life is the part that can’t afford it.

FMC translation: A car payment can become a second rent check. And unlike rent, it doesn’t come with repairs included.

The real cost of a car (what your budget actually pays)

Middle-class people don’t usually get wrecked by the sticker price. We get wrecked by the monthly—because the monthly feels manageable right up until life does what life always does: a deductible, a daycare increase, a job wobble, a surprise dental bill, a “we need tires” moment that shows up like an uninvited cousin who also needs money.

And the monthly isn’t just the loan. It’s the whole car:

- Payment

- Insurance

- Gas (or charging)

- Maintenance + repairs

- Registration/taxes

- Tires

- Parking/tolls (if that’s your world)

AAA’s annual driving-cost analysis puts total ownership and operating costs for a new vehicle at $11,577 per year—about $964.78 per month when you add up the full picture. That’s not “a note.” That’s a bill.

And insurance alone can be its own rent. Bankrate’s national average for full coverage is about $225/month. (And yes—depending on where you live, it can be worse.)

The Financial Middle Class rule: budget the whole car, not the note

If you want a rule that protects your stability, use this one:

Keep your all-in car cost at 10%–15% of take-home pay

Not gross pay. Not “before benefits.” Take-home. The money that actually hits your account.

- 10% if your budget is already tight, you’re carrying credit card debt, your income swings, or housing is heavy.

- 15% if you’re stable, have savings, and your other debts aren’t already chewing your ankles.

Two real-life scenarios (because “it depends” is not a plan)

Scenario A: $5,200/month take-home. That’s a very normal “we’re okay but still feel tight” number.

All-in car budget: $520 (10%) to $780 (15%).

Now subtract reality: insurance ($225), fuel ($150), maintenance/repair savings ($100). That leaves roughly $45 to $305 for the payment.

That’s where people get mad. Good. That’s the math telling the truth about today’s market.

Scenario B: $7,500/month take-home. More room, still not “rich.”

All-in car budget: $750 (10%) to $1,125 (15%).

Subtract insurance ($225), fuel ($200), maintenance ($125). That leaves about $200 to $575 for the payment.

Even here, the point stands: affordability isn’t “what clears.” It’s what doesn’t steal your margin.

Work backward: all-in budget → payment → car price

This is the order adults use:

- Decide your all-in monthly car budget (10%–15% of take-home).

- Subtract insurance + fuel + maintenance savings.

- What’s left is your max payment.

- Shop cars that fit that payment at a sane term.

The sentence that saves people: “I’m negotiating the out-the-door price and the APR. I’m not shopping a monthly payment.”

Why long auto loans fake affordability

Experian’s numbers show how normalized long loans have become. Average payments are high ($748 new, $532 used), and loans get stretched to make those payments feel “doable.”

Long terms do one thing really well: hide the damage. They lower the payment while increasing total interest, keeping you upside down longer, and locking you into a car longer than your life is likely to stay stable.

The middle-class guardrail

Aim for 48–60 months when possible. If the deal only “works” at 72–84 months, it’s not a deal. It’s a lifestyle squeeze wearing a bowtie.

Total cost of ownership + depreciation: the car’s real price

Two cars can have the same sticker price and totally different outcomes.

One holds value, sips fuel, and doesn’t punish you at the shop. The other eats tires, sensors, and insurance premiums like it’s getting paid to do it.

AAA’s driving-cost breakdown routinely shows that depreciation is one of the biggest cost drivers. Translation: “I got a good deal” doesn’t mean much if the car bleeds value and cash every month.

Think of it like this: buying the car is the down payment. Owning the car is the mortgage.

Down payment vs emergency fund: when “put more down” is bad advice

Yes, a down payment can lower what you finance and reduce how long you’re upside down. But the middle class also needs something rich people don’t talk about:

liquidity.

A bigger down payment feels responsible until it leaves you with $200 in savings and a prayer. Then the first repair goes on a credit card, and now your “responsible” choice is charging 24% interest because your alternator had other plans.

A practical middle-class rule

Put down what you can without emptying your emergency fund. Keep cash for year-one surprises. They are not hypothetical. They are scheduled.

Credit score + rate shopping: win before you walk in

APR is not a detail. It’s the game.

Experian’s Q3 2025 data shows average APRs around 6.56% for new and 11.40% for used. That spread is the difference between “this fits my life” and “this owns my calendar.”

What to do (simple, not fancy)

- Get pre-approved from a bank or credit union.

- Walk in knowing your rate range.

- Let the dealer try to beat it—but don’t let them blindfold you first.

New vs Used vs CPO: what fits your life?

There isn’t one “best.” There’s best for your situation.

| Option | Best for | Trade-offs |

|---|---|---|

| New | Keeping the car long-term, warranty comfort, stable income | Highest depreciation early, highest price, often higher insurance |

| Used | Lower purchase price, budget-focused buyers, flexible choices | Higher rate risk, more unknowns, repairs sooner if you buy wrong |

| CPO | “Used” with more inspection and warranty-style protection | Costs more than typical used; warranty details vary—read them |

Lease vs Buy: who leasing is for (and who it punishes)

Leasing gets sold like a cheat code: lower payment, always in something new, fewer repair worries.

Leasing can make sense if your miles are predictable and you truly value “new” enough to pay for it. Leasing is usually a bad fit if your car is a family workhorse, your life changes fast, or you’re trying to build long-term stability.

| Question | Buying | Leasing |

|---|---|---|

| Want to own long-term? | Yes | No (you’re renting) |

| Drive a lot? | Better fit | Risky (mileage fees) |

| Need flexibility to keep the car? | Yes | Limited |

| Lowest long-term cost? | Usually yes | Usually no |

Insurance reality check: the expense that blindsides people

Insurance is the sneaky expense that turns a “manageable” car into a budget bully.

Bankrate pegs average full coverage around $225/month nationally. That’s an average, not a promise. Your number could be lower—or it could be the reason the car doesn’t work.

Do this before you fall in love

Get quotes for the exact year/make/model/trim you’re considering—before you sign. Not “something like it.” That exact one.

Trade-ins + negative equity: the silent debt rollover

This is the cycle that keeps people permanently paying for cars:

You trade in a car you still owe on. The dealer offers less than what you owe. The gap gets rolled into your new loan. Now you’re paying for two cars at once—you just can’t see it.

If you’re upside down, the best move is often boring: keep the car longer, pay it down, and get above water before you switch.

Boring isn’t sexy. Boring is how you get free.

GAP insurance, warranties, and add-ons: what’s worth it?

The finance office is where “extras” show up—because that’s where profit lives.

GAP insurance

Worth considering if you put little down, finance long, or know you’ll be upside down early. If the car gets totaled and insurance doesn’t cover what you owe, GAP can keep a bad day from becoming a long-term financial injury.

Extended warranties

Sometimes useful. Often overpriced—especially when bundled into the loan. Don’t buy fear. Buy math. Read what’s covered and what’s excluded.

The junk drawer add-ons

Etching, paint protection, fabric treatments, “security packages”—most of it is markup dressed up as confidence.

EV/hybrid reality: no hype, no hate

EVs and hybrids can be great. They can also be a headache if your life doesn’t match the commercial.

If you can charge at home, your daily costs may drop. If you rent, rely on public charging, or live where charging is a hassle, the convenience tax is real. Either way, the middle-class question is the same:

Does this fit your actual life—not the life an ad is selling?

Before you sign: the checklist that saves people

- You know the out-the-door price (price + taxes + fees + add-ons).

- You know your APR, term, and total paid over the life of the loan.

- You priced insurance on the exact car you’re buying.

- You’re setting aside money monthly for maintenance + repairs.

- If used/CPO, you got an inspection and checked history.

- You removed junk fees and add-ons you didn’t ask for.

- You stress-tested the payment: if income dips or a bill hits, the car is still manageable.

Quiet truth: If the deal can’t survive these questions, it’s not a deal. It’s a liability with a touchscreen.

The truth that hits home

A car is not a promotion. It’s not proof you made it. It’s not a personality.

It’s transportation.

And the middle class doesn’t drown because we’re “bad with money.” We drown because we keep signing up for fixed payments in a life full of surprises—then acting shocked when the surprises show up.

The right car isn’t the one that turns heads in the parking lot. It’s the one that lets you exhale when you check your bank account.

Because the real flex isn’t what you drive. It’s having enough margin that one bad month doesn’t break you.

Timeline: how to buy a car without getting played

Step 148–72 hours before: set your all-in number

Step 248 hours before: shop APR (get pre-approved)

Step 324 hours before: run insurance quotes

Step 4At the lot: negotiate out-the-door price

Step 5Finance office: delete the junk

FAQ

How much car can I afford per month?

Is a 72- or 84-month car loan ever a good idea?

Should I buy new or used if I’m trying to stabilize my finances?

When do I need GAP insurance?

What’s the smartest way to negotiate at the dealership?

Talk to me in the comments:

What’s the one number you wish you’d focused on before your last car purchase—APR, loan term, insurance, or the out-the-door price?

RELATED ARTICLES

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

By FMC Editorial Team

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

By MacKenzy Pierre

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs....

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market...

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan...