Debt Statute of Limitations: The Clock You Didn’t Know Was Ticking

By Article Posted by Staff Contributor

The estimated reading time for this post is 710 seconds

Key Takeaways

- Debt statute limitations usually limit lawsuits—not whether collectors can contact you.

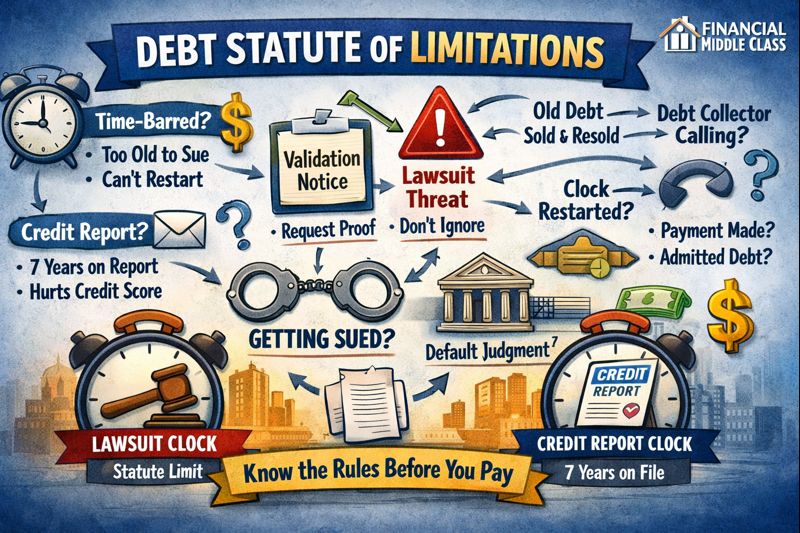

- There are two clocks: the lawsuit clock and the credit-report clock. Mix them up and you make bad moves.

- In some states, a payment or written acknowledgment can restart the lawsuit clock. “Good faith” can become “new timeline.”

- Get validation in writing before you pay, promise, or explain.

- If you’re sued, respond on time. Silence is how default judgments happen.

Last updated: January 9, 2026 — Clarified the “two clocks” problem and the risks of restarting the statute-of-limitations timeline.

Timeline: What to do when an old debt resurfaces

First 10 minutes: Don’t get baited

The goal is not to “be polite.” The goal is not to accidentally give away leverage.

- Don’t admit anything on the phone.

- Don’t pay “just to stop the calls.”

- Ask for details in writing.

Day 1: Build the paper trail

This is where you take the conversation out of emotion and into documentation.

- Save every letter (front and back).

- Log calls, voicemails, dates, and names.

- Write down the collector’s company and mailing address.

Days 2–30: Verify, then decide

You’re confirming facts before you choose a path.

- Confirm the original creditor and amount.

- Confirm the last payment/last activity date.

- Then decide: dispute, negotiate, or seek legal help.

If court papers show up: Act fast

This is deadline territory. The calendar matters more than your intentions.

- Don’t ignore a summons/complaint.

- Respond by the deadline listed on the papers.

- Consider legal aid or an attorney immediately.

Debt Statute of Limitations: The Clock You Didn’t Know Was Ticking

The call comes in from a number you don’t recognize.

You let it ring because you’re in the middle of something normal—work, kids, traffic, a calendar notification that feels like it was designed to bully you. You figure it’s spam. A robocall. Somebody trying to extend your car warranty for the fifth straight year.

Then the voicemail hits with that familiar line: “This is an attempt to collect a debt…” And just like that, your body time-travels.

You’re back in the year you were stretched thin. The year the hours got cut. The year the ER visit happened. The year you were trying to keep the mortgage current and still feed people who act like groceries are optional.

Here’s the thing about the middle class: you’re not out here trying to “get away with something.” You’re out here trying to stay upright. But the debt-collection world doesn’t care about upright. It cares about leverage.

And one of its favorite forms of leverage is time—specifically, the fact that most people don’t know which clock is ticking.

The 60-second triage: what situation are you in?

Before you say a word to anyone, figure out which lane you’re in. Because the lane determines your next move.

Lane 1: You got a call or letter about an old debt. You’re in information mode. Your job is to verify, not confess.

Lane 2: You received details in writing. Now you slow it down and get everything organized.

Lane 3: You got served court papers. Different game. Deadlines matter. Freezing will cost you.

Lane 4: You’re thinking about paying something “just to stop the calls.” That’s the landmine lane. That’s where “good faith” can turn into “new timeline.”

What the statute of limitations is—and what it is not

The statute of limitations on a debt is a legal time limit on how long a creditor or collector can sue you to collect. It’s about lawsuits. Court. Legal enforcement.

It is not automatic forgiveness. It is not a guarantee that the debt disappears. It is not a magic phrase that makes collectors evaporate.

Think of it like this: the statute of limitations can be the difference between someone asking you for money and someone being able to drag you into court for it.

The two clocks problem

Most people think they’re dealing with one timeline. They’re not. They’re dealing with two. And mixing them up is how good people get trapped.

Lawsuit clock vs. credit report clock

| Clock | What it controls | What it doesn’t control |

|---|---|---|

| Statute of limitations (lawsuit clock) | How long someone can sue you | Whether a collector can still contact you and ask you to pay |

| Credit reporting timeline (credit report clock) | How long negative info can appear on your credit report (often around ~7 years for many debts) | Whether someone can sue you |

So yes—something can be too old to sue on and still show up as a collection attempt. And yes—something can fall off your credit report and still get mentioned again later. Different clocks. Different rulebooks. Same stress.

Glossary: the words collectors rely on you not understanding

Time-barred debt: A debt that may be past the legal window for lawsuits, depending on your state and the debt type.

Charge-off: An accounting status. It does not mean you don’t owe the debt.

Debt buyer: A company that purchases old debt for cheap and tries to collect the full amount.

Original creditor: The company you originally owed (bank, hospital, utility, etc.).

Validation/verification: The information a collector provides about the debt (who, how much, and what it’s for).

Dispute: Your written statement that the debt is wrong, not yours, or not provable.

Judgment: A court order saying you owe. This can change the stakes fast.

Default judgment: When you lose because you didn’t respond or show up.

Settlement: Paying less than the full amount to close the account—sometimes helpful, sometimes risky if you don’t understand the timeline.

Revived debt: When an old debt gets new legal life because of a payment or acknowledgment (in some states).

When the statute-of-limitations clock starts

This is where people get cooked: the start date isn’t always the day the debt got “charged off” or the day it got sold. In many situations, it’s tied to last activity—often the last payment you made, or the point you missed a payment and never truly got current again.

And because state laws differ, there isn’t one universal answer. There’s only one universal rule: don’t assume you know the date. Verify it.

How the clock can restart (the landmine section)

This is the part that hurts the responsible people. Middle-class folks are wired to fix things. To “do the right thing.” To throw $50 at a problem so it stops calling.

But with old debt, a “good faith” payment can be the very thing that keeps the problem alive. In some states, certain payments or written acknowledgments can restart the lawsuit clock.

So if you suspect a debt is old, you don’t react from guilt. You don’t react from fear. You don’t react from fatigue. You react from facts.

Zombie debt: why old debts come back

If you’ve ever said, “I thought that was handled years ago,” welcome to zombie debt.

Old accounts get sold. Paperwork gets thin. Details get messy. Amounts change. A debt can bounce from company to company like a bad rumor. That’s why “I’m sure it’s mine” is not a strategy—especially when the debt is old.

Verification is not avoidance. Verification is survival.

Debt validation: the letter that forces the facts to show up

If a collector contacts you, one of the smartest moves you can make is to keep communication in writing. Phone calls are where pressure lives. Writing is where accountability lives.

What you’re trying to confirm is simple: who is the original creditor, what is the true amount, how did the balance grow, and what is the last activity date they’re relying on.

Middle-class move: build a paper trail. The moment you have a paper trail, the conversation changes.

Time-barred debt: what collectors can’t do

Here’s the plain line: if a debt is truly time-barred under your state’s rules, it generally shouldn’t be the basis for a lawsuit threat. But collectors may still attempt to collect voluntarily in many situations.

This is why you don’t let urgency set your strategy. If the message is “pay today,” your response is “send it in writing.”

If you’re sued: don’t freeze

This might be the most important part. If you get court papers—summons, complaint, anything with a court name on it—you do not ignore it.

You respond. You show up. You meet the deadline. Because even if you’re right, you can still lose by default if you don’t participate. That’s how default judgments happen. That’s how people get blindsided.

If you can’t afford an attorney, look for legal aid in your county or your state bar referral options. The point is action. Silence is expensive.

A Florida example (and why details matter)

In Florida, the statute-of-limitations timeline depends on the type of obligation—written contract versus open account versus other categories. That classification can change the timeline, and timelines can hinge on details people don’t think about until they’re under pressure.

The point isn’t memorizing Florida rules. The point is realizing the rules aren’t one-size-fits-all, even inside the same state. So you don’t guess your way through this. You confirm.

Debts that don’t follow the usual rules

Not every debt plays by the same clock. Some obligations can be treated differently, and certain student loan debts—especially federal—are often discussed as not following the same statute-of-limitations framework as ordinary consumer credit.

That doesn’t mean panic. It means precision. Label the debt before you react to it.

Your options, side-by-side

There isn’t one “right” move. There’s the right move for your facts, your timeline, and your goal—relief, closure, or protection.

| Option | When it makes sense | Risk to watch |

|---|---|---|

| Pause + gather facts | You need dates, proof, and ownership details | Missing a court deadline if you’re sued |

| Request validation in writing | Old debt, unclear amount, unclear creditor | Getting baited into admissions on the phone |

| Dispute | Not yours / wrong amount / not provable | Weak documentation or inconsistent statements |

| Negotiate / settle | Debt is valid and you want closure | Restarting the clock in some states if it’s old |

| Legal help | You’re sued, confused, or high-stakes | Waiting too long to act |

If you take nothing else from this article, take this: you don’t make the biggest decision first. You make the smallest safe decision first—get it in writing, get the facts, then choose your lane.

Scripts + documentation checklist

Phone script (short and safe): “I’m not discussing this by phone. Please send me the details in writing.” Then stop talking.

If they push urgency: “I’ll review what you send. If you can’t send it in writing, I’m not moving forward.”

Documentation checklist (your paper trail)

- Every letter you receive (front and back)

- Dates/times of calls and voicemails (even if you don’t answer)

- Collector’s name, company name, and mailing address

- Any reference/account numbers listed

- Copies of anything you send

- Brief notes on what was said (factual, not emotional)

Not legal advice

This is educational information, not legal advice. Statutes of limitations vary by state and debt type, and details matter. If you’re facing a lawsuit or you’re unsure, consider speaking with a qualified attorney or legal aid organization in your area.

The truth that hits home

Debt collectors aren’t just collecting money. They’re collecting moments—moments when you’re tired, embarrassed, rushed, and you just want the problem to stop.

That’s why debt statute limitations matter. It’s not trivia. It’s not “extra.” It’s a boundary.

Because the minute you understand which clock is ticking, you stop negotiating with panic—and you start negotiating with facts.

And for the middle class, facts are sometimes the only luxury left.

FAQ

Does the statute of limitations mean the debt disappears?

No. It typically limits lawsuits after a certain period. A collector may still attempt to collect in many situations. Verify the debt and timeline before you act.

What’s the difference between “time-barred” and “charged off”?

“Charge-off” is an accounting status. “Time-barred” relates to whether a lawsuit may be blocked by the statute of limitations in your state. One does not automatically mean the other.

Can I restart the statute-of-limitations clock by accident?

In some states, yes—certain payments or written acknowledgments can revive an old timeline. That’s why you verify first and keep everything in writing.

If I’m served court papers, can I ignore it because the debt is old?

Don’t. Deadlines matter. If you believe the debt is time-barred, you generally still need to respond on time and raise the issue appropriately.

Is the credit-report timeline the same as the statute of limitations?

No. They’re different clocks. Credit reporting often follows its own timeline (commonly around seven years for many debts), while lawsuits depend on state law and debt type.

What should I do first when a collector contacts me?

Get details in writing, keep a paper trail, and don’t rush into payment or admissions. Your first job is to verify what’s real and what’s provable.

RELATED ARTICLES

Save & Borrow: The Financial Needle the Middle Class Tries to Thread

Trying to save while paying debt? Learn a realistic middle-class plan to build slack, stop interest leaks, and breathe again.

The Danger of Setting Up Unrealistic Financial Goals

Unrealistic money goals can wreck your budget. Learn a realistic plan that actually sticks. Read this before you set 2026 goals.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Jan 09, 2026

Debt Statute of Limitations: The Clock You Didn’t Know Was Ticking

Learn how debt statutes work, avoid resetting the clock, and protect yourself from lawsuits. Read before you pay.

By Article Posted by Staff Contributor

American Middle Class / Jan 08, 2026

Save & Borrow: The Financial Needle the Middle Class Tries to Thread

Trying to save while paying debt? Learn a realistic middle-class plan to build slack, stop interest leaks, and breathe again.

By Article Posted by Staff Contributor

American Middle Class / Jan 08, 2026

The Danger of Setting Up Unrealistic Financial Goals

Unrealistic money goals can wreck your budget. Learn a realistic plan that actually sticks. Read this before you set 2026 goals.

By Article Posted by Staff Contributor

American Middle Class / Jan 07, 2026

Tax Season Scams: The Refund Promise, the Debt Relief Pitch, and the ‘New Credit’ Trap”

Spot refund, debt-relief, and “new credit” tax scams fast. Learn the red flags and protect your refund—read before you file.

By Article Posted by Staff Contributor

American Middle Class / Jan 07, 2026

What Will Another Year of Geopolitical Uncertainties Mean for the Middle Class?

How global conflict and trade shocks hit middle-class budgets in 2026—prices, jobs, rates. Get the evidence and outlook. Read now.

By FMC Editorial Team

American Middle Class / Jan 07, 2026

Humanoid Is Coming for Your Middle-Class Job

Humanoid robots are moving into workplaces. Here’s what it means for middle-class jobs—and how to adapt. Read the analysis.

By FMC Editorial Team

American Middle Class / Jan 06, 2026

A 401(k) → IRA rollover Can Be A Non-taxable event

Avoid rollover tax mistakes. Learn 401(k)→IRA rules and Roth IRA eligibility in plain English. Read before you click.

By MacKenzy Pierre

American Middle Class / Jan 06, 2026

Assumable Mortgages: Inheriting Yesterday’s Low Rate (Legally)

Learn how FHA/VA assumable mortgages work, qualify, and cover the equity gap—so you can snag yesterday’s low rate. Read now.

By Article Posted by Staff Contributor

American Middle Class / Jan 06, 2026

Short-Term Rental Reality: Occupancy, Regulation, and Insurance

Before you Airbnb your place, run the real math—occupancy, rules, insurance. Read this STR reality check first.

By Article Posted by Staff Contributor

American Middle Class / Jan 05, 2026

Holiday Debt Detox: What to Do in January

The estimated reading time for this post is 701 seconds Skip to main content Holiday Debt Detox: What to Do in January A 30-day plan to...

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jan 09, 2026

Debt Statute of Limitations: The Clock You Didn’t Know Was Ticking

Learn how debt statutes work, avoid resetting the clock, and protect yourself from lawsuits. Read...

American Middle Class / Jan 08, 2026

Save & Borrow: The Financial Needle the Middle Class Tries to Thread

Trying to save while paying debt? Learn a realistic middle-class plan to build slack, stop...

American Middle Class / Jan 08, 2026

The Danger of Setting Up Unrealistic Financial Goals

Unrealistic money goals can wreck your budget. Learn a realistic plan that actually sticks. Read...