The government was about to take your paycheck. Then it hit pause.

By Article Posted by Staff Contributor

The estimated reading time for this post is 645 seconds

Payday is supposed to feel like relief. For a lot of people, it’s more like a relay race where your money sprints from your employer to your landlord, your car lender, your insurer, and your grocery store, and then collapses at the finish line with a cramp.

Now imagine a letter that basically says: We can take part of your pay before you even touch it.

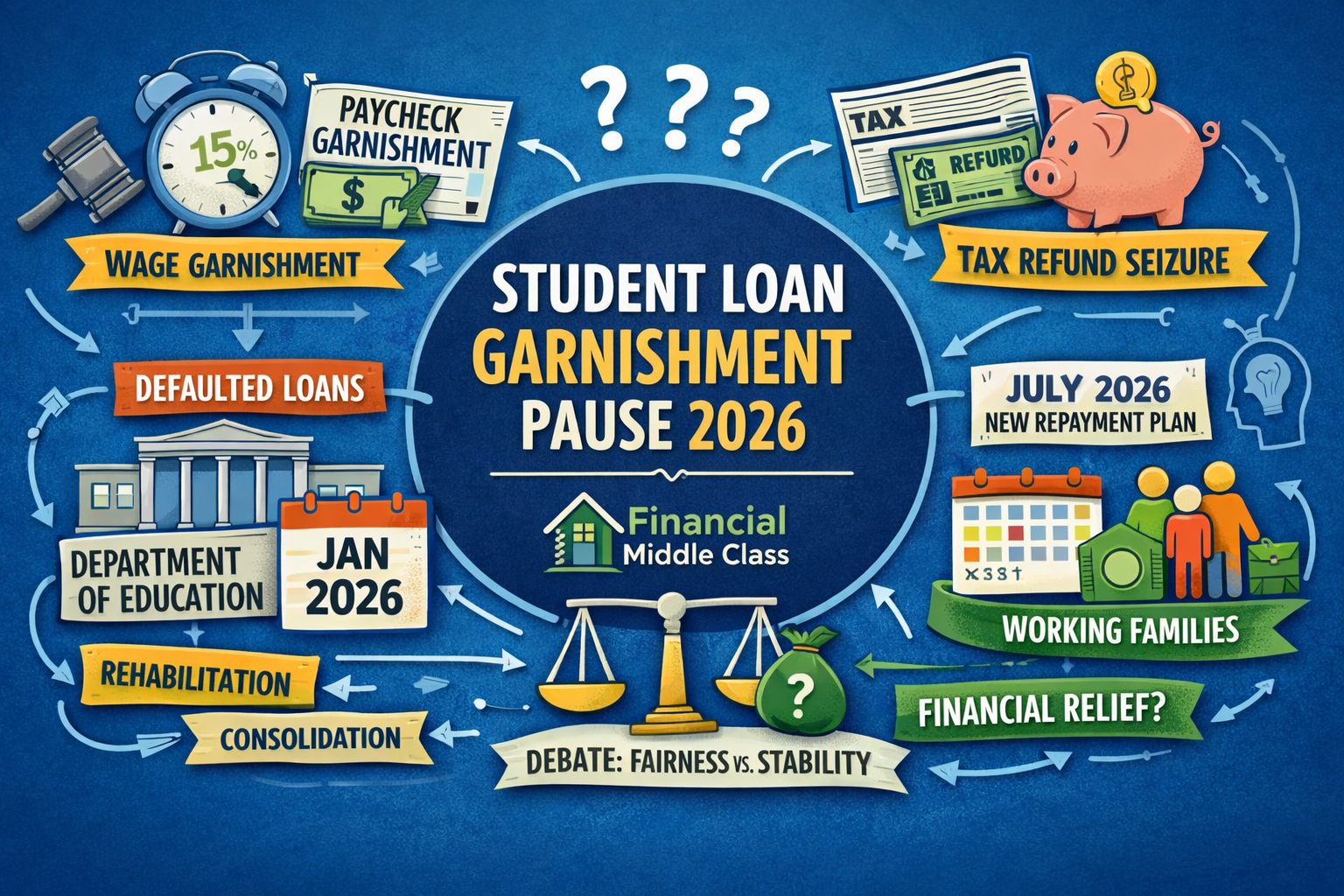

That’s wage garnishment. And in mid-January 2026, the Trump administration—through the U.S. Department of Education—announced it’s delaying involuntary collections on federal student loans, including Administrative Wage Garnishment (AWG) and the Treasury Offset Program (TOP).

If you read that and thought, “Wait…am I about to get garnished because I’m behind?” take a breath. This story has one big misunderstanding baked into it.

Most headlines say “past due.” The real line is default.

And that difference is the entire ballgame.

What happened on January 16, 2026 (and what didn’t)

On January 16, 2026, the Department of Education said it will delay involuntary collections on federal student loans—specifically naming AWG (wage garnishment) and TOP (offsetting federal payments, like tax refunds).

The Department framed the delay as a bridge while it implements repayment reforms under what it calls the Working Families Tax Cuts Act, including a streamlined set of repayment choices and a new income-driven repayment (IDR) plan available July 1, 2026.

ED also highlighted a change that matters if you’ve been in default before: the law now allows a second chance to rehabilitate a defaulted loan (where previously borrowers generally had only one rehab shot).

What this didn’t do is erase debt. It didn’t declare student loans optional. It didn’t turn repayment into a vibe.

It’s a pause on the government’s sharpest collection tools while the repayment system gets remodeled—again.

“Past due” vs “default”: the difference between embarrassment and emergency

If you don’t learn anything else from this article, learn this: being behind is not the same thing as being in default. People use those words like they’re interchangeable, and that’s how you end up terrified on the wrong day.

Here’s the clean comparison.

| Delinquent (“past due”) | Default |

|---|---|

| You missed one or more payments. You’re behind. It can hurt your credit and snowball fast. | You’re far enough behind that your loan is officially in default, which triggers the government’s strongest collection tools. AP notes default can mean being at least 270 days behind on payments. |

| Your servicer is still in the world of late fees, calls, notices, and repayment options. | The system moves into collection mode: wage garnishment and tax refund offsets are on the table. |

| Your goal is to stop the slide: get current, get into an affordable plan, or get temporary relief if you qualify. | Your goal is to get out of default—because default is what puts your paycheck and refund in the blast radius. |

AWG vs TOP: how the government takes money when you don’t pay

When people hear “collections,” they picture a rude phone call. Federal student loan collections can be much more direct.

Administrative Wage Garnishment (AWG) is exactly what it sounds like: your employer is told to withhold part of your pay. Federal Student Aid says your loan holder can order your employer to withhold up to 15% of your disposable pay to collect defaulted debt, and it can happen without taking you to court.

Treasury Offset Program (TOP) is less personal but just as painful. Treasury describes TOP as a program that matches people who owe delinquent debts with federal payments and withholds money—such as from a tax refund—when the law allows it. Treasury also reports TOP recovered more than $3.8 billion in fiscal year 2024.

Federal Student Aid explains TOP as a tool that allows the government to collect income tax refunds and certain government benefits.

Here’s the side-by-side that matters.

| AWG (Wage Garnishment) | TOP (Tax Refund / Federal Payment Offset) |

|---|---|

| Hits your paycheck: money disappears before it becomes “your money.” | Hits federal payments: commonly your tax refund, sometimes other payments depending on the debt and rules. |

| Can be up to 15% of disposable pay. | Can reduce or wipe out a refund when an offset occurs. |

| Feels like a pay cut you never agreed to. | Feels like the government took your emergency fund—because for many people, that’s what the refund is. |

| ED paused/delayed it as part of “involuntary collections.” | ED paused/delayed it too, explicitly naming TOP. |

These tools are why default is not just a credit score issue. It’s a cash flow issue.

The policy whiplash: restart in 2025, delay in 2026

This didn’t come out of nowhere. It’s the sequel.

On April 21, 2025, the Department of Education announced it would resume collections on defaulted federal student loans starting May 5, 2025, including restarting TOP.

That same 2025 announcement said required notices for administrative wage garnishment would go out later.

Fast forward to January 2026, and the Department reversed course. AP reported the agency is delaying plans to restart wage garnishment and tax refund withholdings for borrowers in default, and that the Department did not set a new date for involuntary collections.

The Department’s own press release says the delay is meant to give time to implement new repayment reforms, including a new IDR plan available July 1, 2026.

If you’re feeling dizzy, that’s normal. The student loan system has been a long-running experiment in mixed messaging, shifting deadlines, and policy resets. That confusion is part of the story, not a footnote.

Why the Department says it’s delaying collections

ED’s official argument is straightforward: it wants the enforcement tools to operate “more efficiently and fairly” after new repayment options roll out.

Under the Department’s description, the new law reduces repayment plans down to something simpler—basically a standard plan or an IDR plan—because the old maze of choices confused borrowers and trapped people in bad fits.

It also points to specific features of the new IDR plan: it would waive unpaid interest for borrowers who make on-time payments when those payments don’t cover all accrued interest, and it would include small matching payments in some cases so principal actually goes down. ED says that plan will be available starting July 1, 2026.

Then there’s the rehab change: a second chance to rehabilitate a defaulted loan, which the Department says the law now allows.

That’s the official pitch: pause the punishment, fix the repayment system, then restart collections in a cleaner world.

The skeptical read (because adults read footnotes)

The skeptical argument isn’t hard to understand.

One side says: if you keep delaying consequences, you teach people consequences aren’t real. You reduce collections, debts grow, and taxpayers ultimately eat the loss. The Committee for a Responsible Federal Budget criticized the decision in those terms, arguing the pause could reduce collections and increase costs.

The other side says: wage garnishment and refund seizures aren’t “accountability,” they’re a financial chokehold. AP quoted advocates warning that restarting wage garnishment could push millions deeper into debt, especially households already behind.

Both can be true depending on who you are.

If you’re a budget hawk, you see leakage. If you’re a borrower living paycheck to paycheck, you see an eviction notice waiting behind a garnishment.

Financial Middle Class translation: the system is trying to get people to repay without blowing up their ability to survive long enough to repay.

Who this affects (and why the numbers don’t match)

This policy is mainly about borrowers in default because AWG and TOP are default-era tools in the way the public experiences them.

How many borrowers are we talking about? “Millions” is true but lazy. The Department’s April 2025 release said more than 5 million borrowers were in default, with millions more delinquent and at risk of default.

AP reported that more than 5 million Americans were in default as of September (citing department data).

Other outlets cite different estimates; Investopedia recently referenced more than 5.5 million borrowers in default.

So if you want the honest version: it’s at least five million people directly in the blast radius, and millions more close enough to feel the heat.

And this is why tax refunds matter in this conversation. For a lot of households, the refund isn’t “extra.” It’s the only moment all year they can catch up, replace tires, fix a tooth, or build a baby emergency fund. When TOP takes it, it doesn’t just “collect a debt.” It deletes a recovery plan.

What you should do while the clock is stopped (use the pause like a bridge)

A pause is not a pardon. It’s time. And time is a resource you can either waste or convert into leverage.

The Education Department is telling defaulted borrowers to use this delay to explore options to resolve default, and it notes that defaults are reported to credit agencies, which can harm your credit.

In plain terms, the move is: get out of default before the system turns the lights back on.

For most borrowers, the common routes to exit default are rehabilitation or consolidation. Investopedia recently laid out these two paths and why the choice matters.

Here’s the side-by-side that helps you decide.

| Loan Rehabilitation | Loan Consolidation |

|---|---|

| Typically requires a set of on-time payments (often described as nine payments over ten months) to remove default status and return the loan to good standing. | Combines loans into one new loan; you can restore good standing faster in some cases, often by enrolling in an IDR plan or making a few qualifying payments, depending on program rules. |

| Can improve your record by removing the default status from your credit report in many situations (a key reason people choose it). | Can keep the history of default showing even after you consolidate, depending on how it’s reported, and it may not “clean” the story the same way rehab can. |

| Usually doesn’t add a big new layer of interest to principal the way consolidation can, though interest still matters and terms vary. | Can capitalize accrued interest into the new balance, which can make the loan feel bigger overnight. |

| Often best if you care about cleaning up the default mark and can commit to the payment sequence. | Often best if you need speed and simplification, and you’re ready to choose a sustainable repayment plan immediately. |

This is not legal advice and it’s not a one-size-fits-all decision, but the principle is consistent: if you’re in default, your goal is to get back into a status where the government can’t treat your paycheck like a vending machine.

And if you’re not in default yet—if you’re just behind—your job is to not let “behind” become “default,” because default is where the sharp tools live. AP’s reporting and ED’s own language make that line clear even when public conversation doesn’t.

The next big date, and the risk nobody wants to say out loud

ED says the new IDR plan it describes will be available starting July 1, 2026.

AP also notes the department said new repayment plans are expected to be available starting July 1, and the Department did not provide a new restart date for involuntary collections.

So yes, there’s a clear “watch this” date. But there’s also the part that always bites borrowers: implementation.

A repayment plan can be gorgeous on paper and miserable in real life if customer service is overwhelmed, processing is delayed, or borrowers can’t get clear answers. The system doesn’t just punish people for refusing to pay. It punishes people for not being able to navigate the maze fast enough.

That’s why this pause matters. Not because it’s mercy. Because it’s a rare window where the government is saying, out loud: We’re not ready to flip the switch yet—use this time to fix your status.

The Financial Middle Class truth

Here’s the cold truth that doesn’t care about your intentions: the student loan system doesn’t grade you on effort. It grades you on status.

You can be a decent person who had a rough year and is “trying.” If your loan is in default, the tools exist to take your wages and your refund.

And if you’re not in default, you can still be one missed paycheck away from sliding into it.

The Trump administration’s delay of AWG and TOP is a real policy change with real relief attached to it.

But the smartest way to read it is simple: the system paused the punch—not because it forgot how to swing, but because it’s rewriting the rules of the ring.

Use the pause like a bridge. Cross over into “good standing.” Because when the lights come back on, the math is going to be the math.

RELATED ARTICLES

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

By FMC Editorial Team

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

By MacKenzy Pierre

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs....

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market...

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan...