Home » Debt » Double-Debt Trap After Cash-Out The Double-Debt Trap After Cash-Out: Why Card Balances Creep Back Rolling card debt into your mortgage sounds smart,...

Charitable Giving That Actually Helps (and Helps Your Taxes) You’ve probably had this moment: you’re juggling rising rent, a grocery bill that somehow got bigger again,...

Home › Family & Money › Kid Magic on a Budget Kid Magic on a Budget: Memory-First Traditions Low-cost rituals that outlast the plastic toys forgotten...

Scam Red Flags, “Limited Time” Pressure, and Fake Charity Drives A red-flag checklist and two-step verification script before you click. A Financial Middle Class infographic reminding...

Americans can put more into 401(k)s, IRAs, and SIMPLE plans in 2026—and higher earners will see new Roth rules. Here’s what changed, who’s affected, and how...

In October, lenders started the foreclosure process on more than 25,000 homes across the country — a jump of about 20% compared with a year earlier....

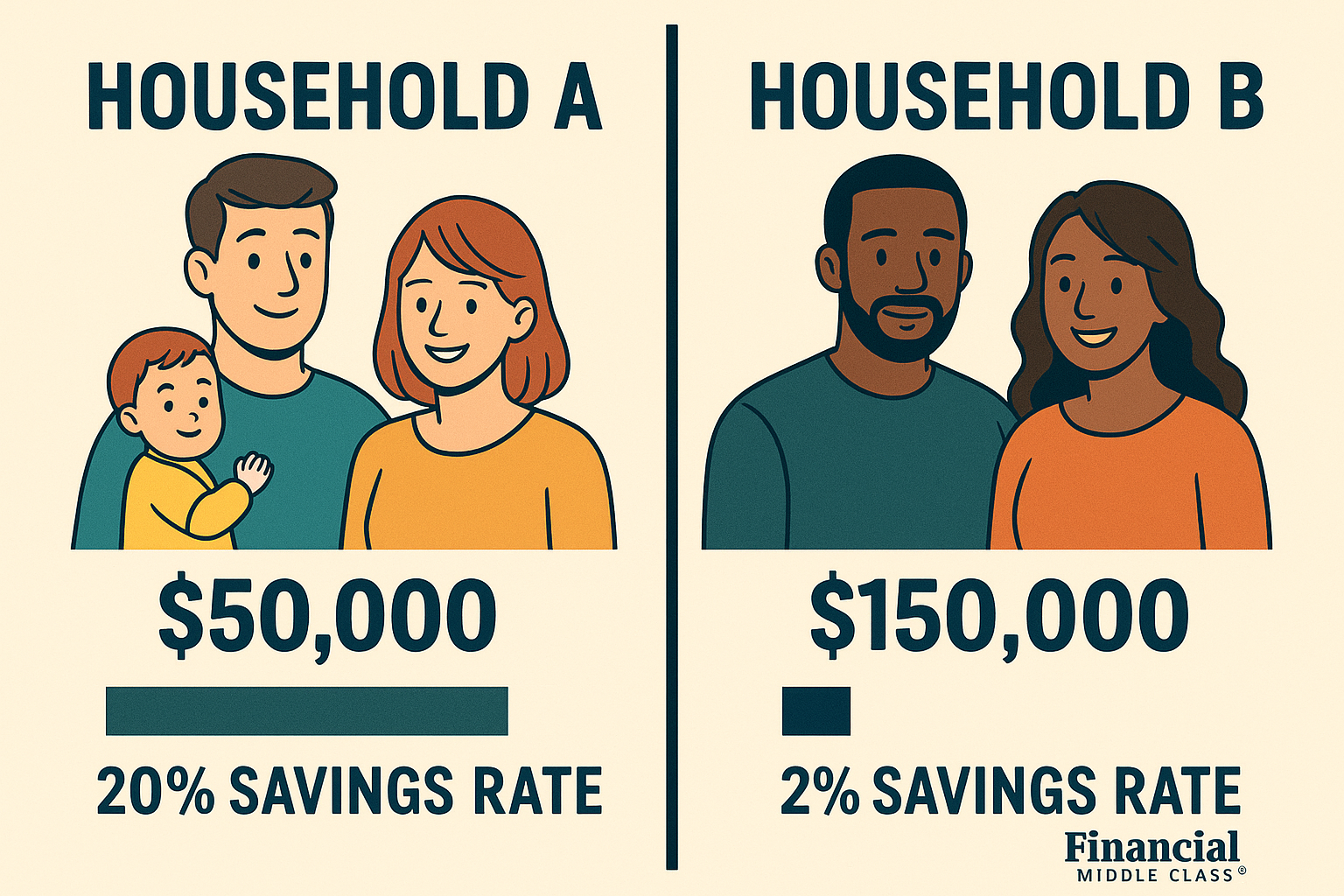

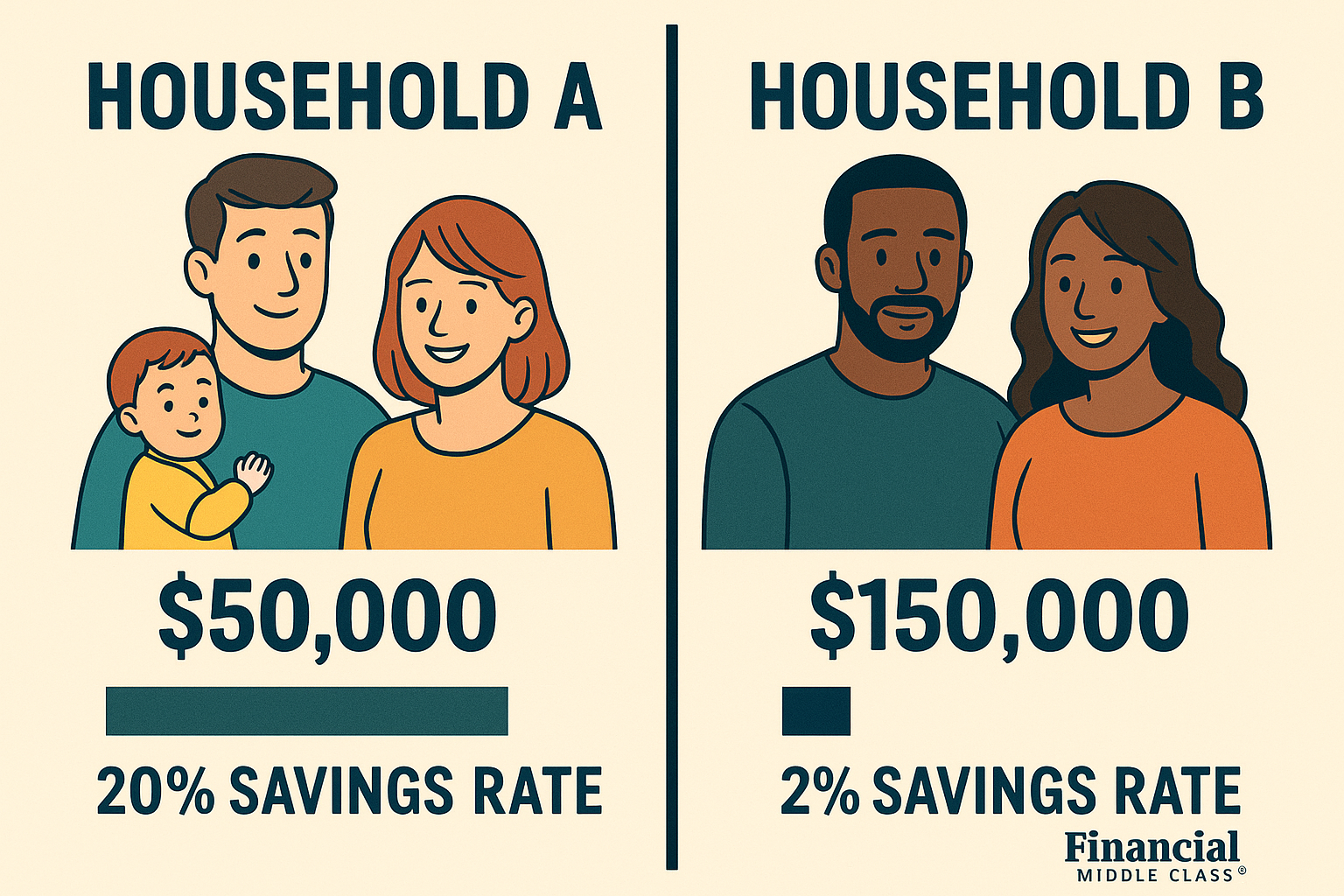

Many Americans are earning more than ever, but far too many have almost nothing to show for it beyond bills, debt, and stress. Even as wages...

If you’re sitting on a 3% mortgage right now, congratulations — and I’m sorry. Congratulations, because you locked in one of the best deals the American...

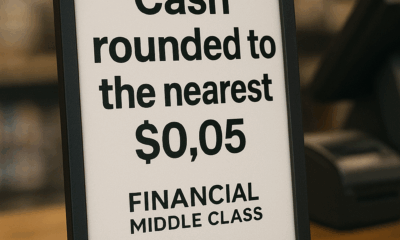

Introduction: A Tiny Coin, a Loud Message In February 2025, President Trump told Treasury to stop making new pennies, calling the coin wasteful because it cost...

In the 1930s, Franklin D. Roosevelt’s team looked at a housing market full of short, risky mortgages and said: we’re going to redesign this so regular...