Cash Advance vs Personal Loan vs Payday Loan: The Real Cost of “Quick Cash”

By Article Posted by Staff Contributor

The estimated reading time for this post is 728 seconds

Cash Advance vs Personal Loan vs Payday Loan: The Real Cost of “Quick Cash”

Financial Middle Class • Last updated: December 12, 2025 • Optimized to improve discoverability (not a guarantee)

TL;DR

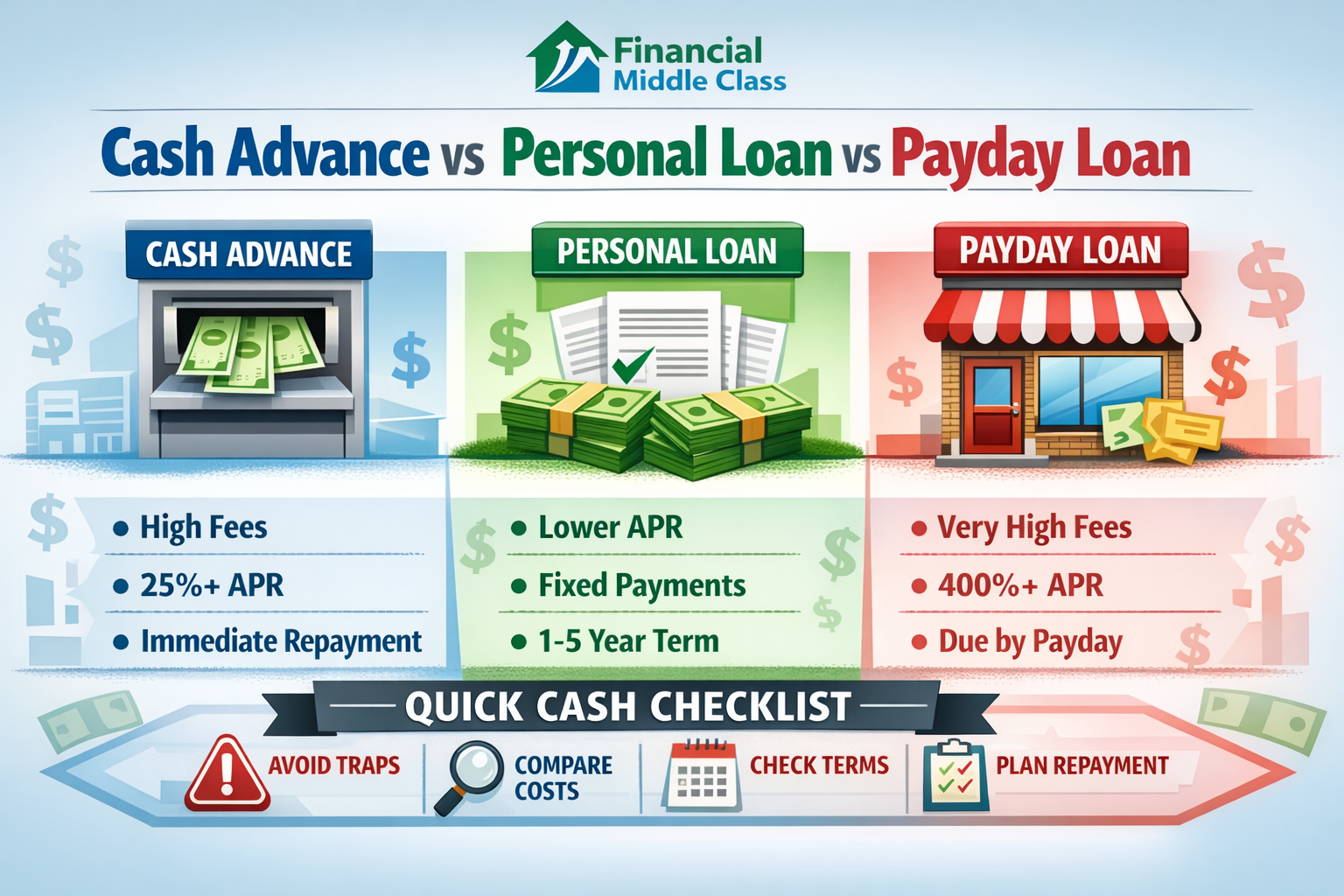

If you’re cornered and need money fast, the question isn’t “what’s available?” It’s “what’s the least expensive way to buy time without entering a debt trap.” In most cases, payday loans are the most dangerous, cash advances are pricey, and a personal loan (or credit-union alternative) is often the least-bad option—if you can qualify and repay on schedule.

Jump to: Cost Ladder | Choose Your Lane | Cash Advances | Personal Loans | Payday Loans | Comparison Table | FAQ | Checklist

Let’s start with the reality most people don’t say out loud: “quick cash” is expensive because it’s sold to you when you’re stressed. When your back is against the wall, you don’t read fine print—you reach for relief.

And that’s exactly where the pricing gets predatory. Too many of us think we’re choosing between three products. You’re not. You’re choosing between three types of pain: upfront fees, high APR, and repayment structures designed to force repeat borrowing.

So let’s put the options on a clean table, rank them by real-world cost, and talk about what to do if you truly have no wiggle room.

The Quick Cash “Cost Ladder” (Least-bad → Most dangerous)

These are general patterns. Your actual terms depend on your credit, lender, and state rules.

Often least-bad

Usually a clearer payoff schedule, potentially lower APR than “emergency” products, and less fee stacking.

Pricey but predictable

Fast access, but common fees plus interest can start immediately—easy to underestimate.

Highest trap risk

Short due dates + high fees can push borrowers into repeat borrowing and debt spirals.

Now let’s make this usable. Because your situation matters. What’s “best” depends on how fast you need funds, whether you can repay quickly, and how close you are to the financial edge.

Choose Your Lane (60 seconds)

Pick what’s true today. Then follow the least-expensive path for that reality.

Lowest-cost laneStart with a personal loan (or a credit-union option) because you’re buying time with structure. Get a fixed payment and an end date.

Guardrail: if the payment doesn’t fit your budget, it’s not “help”—it’s a delayed crisis.

Fast laneIf you truly need funds immediately and can repay quickly, a cash advance can be less catastrophic than payday—but only if you confirm the fee and pay it back aggressively.

Guardrail: treat it like emergency-only and don’t repeat it.

Stability laneIf you’re already behind, taking on high-cost short-term debt can make the hole deeper. Prioritize hardship plans, due-date changes, and payment arrangements before new borrowing.

Guardrail: the goal is lower monthly pressure, not more balances.

Trap warningBefore payday, try a credit-union alternative, negotiate a payment plan, or use a lower-cost borrowing lane. Payday loans often become repeat loans because the due date comes too fast.

Guardrail: if the plan requires “I’ll just roll it over,” it’s not a plan.

If your theme strips scripts, read the lane boxes as guidance.

Option 1: Credit card cash advance (fast, but priced like a penalty)

A cash advance is exactly what it sounds like: you borrow cash against your credit card’s limit. It feels clean because it’s “your card.” But most issuers don’t price it like a normal purchase. They price it like a last-resort loan.

Two things hit you at the door: a cash advance fee (often a percentage of the amount or a minimum flat fee) and then interest that may start immediately, unlike purchases that may have a grace period. In other words, even if you pay it back quickly, the fee already happened.

When is it the least-bad move? When you truly need funds immediately, can repay quickly, and you’re choosing it specifically to avoid the payday-loan cycle. But you still treat it like a one-time emergency—because repeating it is how a short crisis turns into a monthly tax on your paycheck.

Option 2: Personal loan (structure is the point)

A personal loan is usually a fixed amount with a fixed repayment schedule—monthly payments, defined term, and (ideally) a lower APR than emergency products. The core benefit isn’t just rate. It’s structure. It gives you an end date.

Personal loan APRs vary widely based on credit and lender. The middle-class mistake is assuming “loan = help.” Help is a payment you can actually carry without missing rent next month. If the monthly payment squeezes your budget too tight, you’ve just swapped one emergency for a different emergency.

Where people win with personal loans is when the loan replaces chaos with a plan: consolidate expensive debt, cover a necessary expense, then stop the bleeding and repay consistently.

Option 3: Payday loan (the due date is the trap)

Payday loans sell speed. But the real product is the repayment structure: short terms, high fees, and a due date that arrives before most people have recovered financially. That’s why payday loans are notorious for repeat borrowing.

Many storefront payday loans are described as a fee per $100 borrowed, due around the next payday. When you translate that fee into an APR, it can become shockingly high—because the loan term is so short. And once you’re rolling one over, you’re not borrowing for a problem. You’re borrowing to escape the last borrowing.

If you’re reading this and thinking, “I hate this, but I feel like I have no choice,” you’re exactly the person this market targets. So let’s talk alternatives before you sign anything.

Do This / Not That (Quick Cash Edition)

Do thisTry to buy time without high-cost debt first: ask for a payment plan, a due-date change, or a temporary hardship arrangement.

It’s not glamorous. It’s effective. And it avoids compounding fees.

Not thatDon’t borrow with a plan that requires “rolling it over.”

If the repayment relies on future luck, you’re paying for a trap.

Copy/Paste Script: Ask These Before You Accept Any “Quick Cash”

You’re not being difficult. You’re preventing expensive surprises.

“Before I agree, can you confirm: the total cost of this loan in dollars (fees + interest), the APR, the due dates, whether I can repay early without penalty, and whether you report to credit bureaus?”

Red Flags You’re Stepping Into a Debt Trap

- The loan is due in a week or two and the payment requires you to “figure it out later.”

- You’re told the fee is “only” a small amount per $100—without a clear total cost.

- The lender pushes you to refinance/roll over if you can’t repay on time.

- The paperwork is vague about fees, autopay, or what happens if you’re late.

- You feel rushed, embarrassed, or pressured to decide immediately.

Pressure is a feature in the quick-cash world. Slow down anyway.

Side-by-side: speed, cost, and what can go wrong

Here’s the no-drama comparison. Not the marketing. The reality.

Cash Advance vs Personal Loan vs Payday Loan

| Option | Why people choose it | What it really costs | Biggest risk | Best use-case |

|---|---|---|---|---|

| Personal loan | Structure + predictable monthly payments | APR varies; can be far lower than emergency products if you qualify | Payment may strain your budget if borrowed too large | When you can wait a little and need an actual payoff plan |

| Cash advance | Fast access to cash | Common upfront fee + interest may start immediately | High cost if repeated; can worsen utilization and stress | True short-term emergency when repaid quickly |

| Payday loan | Fast approval; minimal underwriting | Short-term fee structure can translate into very high APR | Repeat borrowing / rollover cycle | Last resort only—exhaust alternatives first |

So what’s the “least bad” option?

If you can qualify, a personal loan (especially through a bank or credit union) is often the least-bad quick-cash tool because it gives you a repayment runway and a finish line. A cash advance can be the least-bad emergency tool when you can repay quickly and you’re using it once—not monthly. Payday loans are the “I’m desperate” product that often keeps people desperate.

And here’s the part too many people skip: sometimes the best option isn’t a new loan at all. It’s negotiating time. Utility companies, medical offices, and even landlords sometimes have payment arrangements. You don’t need permission to ask. You need a script and the nerve to use it.

FAQ

FAQ: Quick Cash Without the Regret

Is a cash advance better than a payday loan?

It can be, especially if you repay quickly and avoid repeating it. Both can be expensive; payday loans are often riskier because of short due dates and repeat borrowing patterns.

Why does the payday loan fee look “small” but feel huge?

Because the loan term is short. A fee that doesn’t look crazy over two weeks can translate into an extremely high APR when annualized.

What’s the one question I should ask before any quick-cash loan?

Ask for the total cost in dollars (all fees + all interest) and the exact due dates. If they won’t answer clearly, that’s your answer.

Are there safer alternatives to payday loans?

Often yes: credit-union payday alternative loans (where available), hardship plans, payment arrangements, or a personal loan if you qualify.

Will this hurt my credit?

It depends. Some loans are reported, some aren’t. Cash advances can raise utilization. Always ask whether the lender reports to credit bureaus.

One-Page “Quick Cash” Checklist

- I identified what I actually need: time, not “more money.”

- I asked for a payment plan / hardship option before borrowing.

- I got the total cost in dollars (fees + interest), not just the APR.

- I confirmed due dates, autopay rules, and whether early payoff has penalties.

- I avoided any plan that depends on rollover/refinance as the “solution.”

Printing strips buttons automatically.

Sources & further reading

• CFPB payday loan research highlights (fee per $100 and APR example): CFPB PDF

• CFPB payday/deposit advance trap overview: CFPB Newsroom

• Cash advance fee basics (typical fee range + interest behavior): Experian

• Personal loan rate ranges (typical APR range): NerdWallet

• Credit union payday alternative loan guidance (rate cap reference): NCUA

Disclosure: Educational information only, not individualized financial advice. Loan rules vary by state and lender; always confirm fees, due dates, and repayment terms in writing.

RELATED ARTICLES

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what to do next. Read now.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

Selling Your Home Isn’t a Chore. It’s a Power Test.

Avoid costly seller mistakes—price smart, negotiate, handle appraisals, and protect your equity. Read the full seller playbook.

By Article Posted by Staff Contributor

American Middle Class / Jan 24, 2026

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

By FMC Editorial Team

American Middle Class / Jan 23, 2026

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

By FMC Editorial Team

American Middle Class / Jan 21, 2026

The government was about to take your paycheck. Then it hit pause.

Wage garnishment paused for defaulted student loans—what it means for your paycheck, tax refund, and next steps. Read before it restarts.

By Article Posted by Staff Contributor

American Middle Class / Jan 21, 2026

January Is Financial Wellness Month — and Your Boss Cares More Than You Think

January reset: budget, emergency fund, debt & accountability—plus an employer playbook. Use the tools and start today.

By Article Posted by Staff Contributor

American Middle Class / Jan 19, 2026

Trump’s 401(k) Down Payment Plan: A House Today, a Retirement Tomorrow?

Could Trump let you use 401(k) money for a down payment? Learn how it works, risks to retirement, and price impacts—read first.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

The One-Income Family Is Becoming a Luxury. Here’s the Salary It Takes Now.

How much must one parent earn so the other can stay home? See the real math, examples, and tradeoffs—run your number now.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read...

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what...