Emergency Cash Without New Debt: A Middle-Class Playbook for Finding $500–$2,000 Fast

By Article Posted by Staff Contributor

The estimated reading time for this post is 733 seconds

Emergency Cash Without New Debt: A Middle-Class Playbook for Finding $500–$2,000 Fast

Financial Middle Class • Last updated: December 12, 2025 • Optimized to improve discoverability (not a guarantee)

TL;DR

When you need emergency cash, your mission isn’t “get a loan.” Your mission is create room. Room in the budget. Room in the due dates. Room in the next seven days.

This playbook is built around a simple principle: move the deadline before you borrow the money. Negotiate bills, cut one-time costs, sell/refund smart, and only then consider borrowing.

No calculators. No magic. Just the moves that actually work when you’re living a real middle-class life.

Jump to: The No-Debt Ladder | Choose Your Lane | 48-Hour Triage | Call Scripts | Comparison Table | Red Flags | FAQ | One-Page Checklist

Let’s talk about the moment you’re in: you don’t need a lecture about “planning ahead.” You need $500–$2,000 and you need it fast. This is the part of personal finance that never makes it into the shiny Instagram posts, because it isn’t aesthetic. It’s triage.

And the reason this situation feels so brutal is simple: the system makes “being short” expensive. Late fees. Overdraft fees. Convenience fees. Loan fees. Interest. Then people wonder why the middle class feels like it’s running uphill in sand.

So we’re going to do this the smart way: we’re going to reduce the size of the emergency and buy time—before we buy debt.

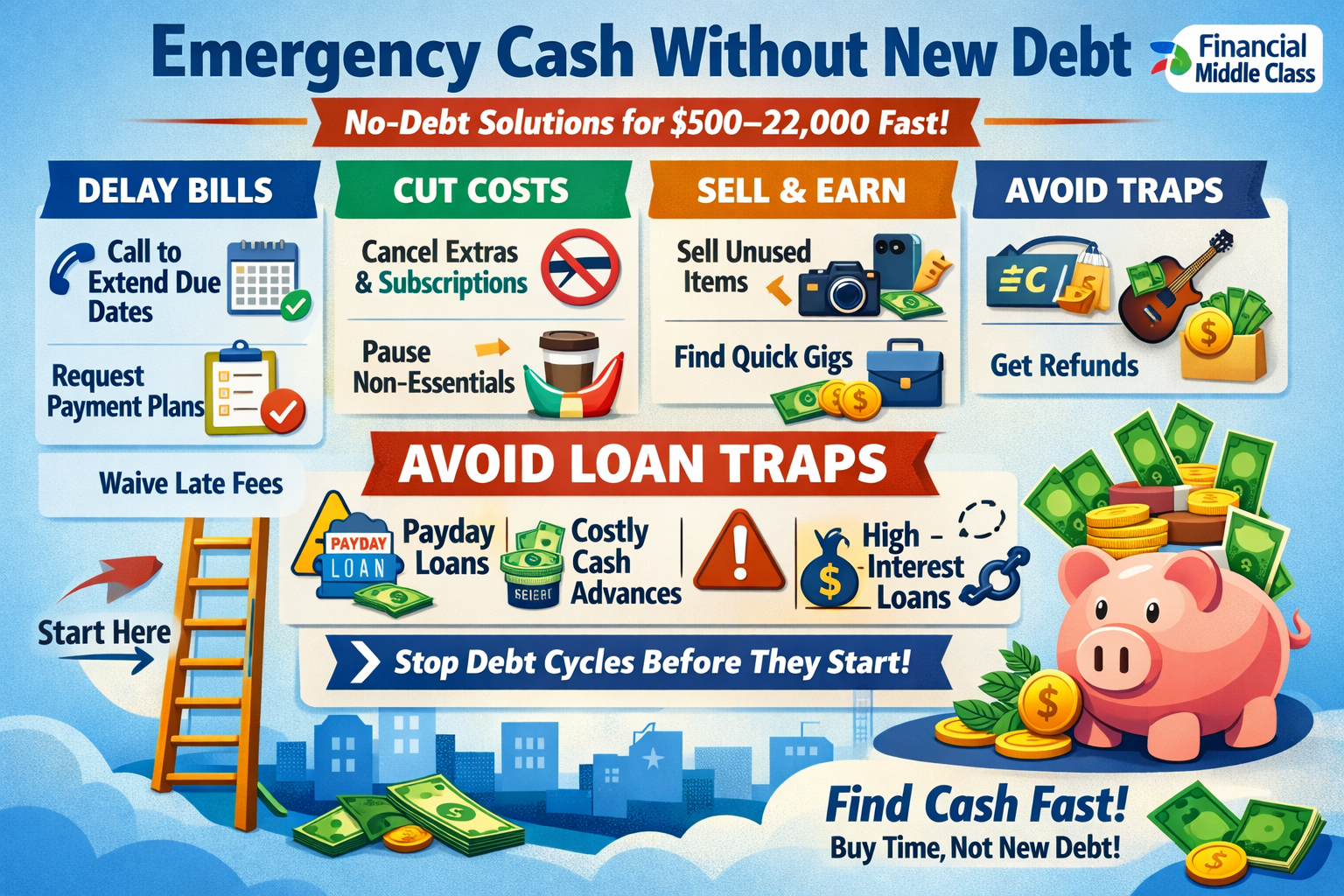

The “No New Debt” Cash Ladder (Cheapest → Most dangerous)

Start at the top. Work down only as needed. The goal is speed without regret.

Cheapest

Payment plans, hardship options, due-date changes, waivers. This is “cash” because it stops money from leaving.

Fast & real

Returns, refunds, selling items safely, picking up short-term shifts, reimbursable expenses.

Last resort

If you must borrow, choose the least expensive lane and avoid traps that require repeat borrowing.

That first step—moving deadlines and reducing bills—doesn’t feel like “finding cash,” but it often does the same job. If you stop $300 from leaving your account this week, that’s $300 you don’t need to “find.” That’s middle-class math.

Choose Your Lane (60 seconds)

Pick the situation that matches your reality right now.

48-hour triageYour best moves are the ones that are fast and reversible: ask for due-date extensions, pause non-essentials, pursue refunds, and sell one or two items safely.

Guardrail: don’t sign up for monthly subscriptions “to save money” today. That becomes tomorrow’s leak.

Stabilize laneYou have enough time to combine: bill negotiations, a temporary cut list, and a short burst of income (extra shift, quick gig, reimbursable expense cleanup).

Guardrail: aim for fewer moves with higher impact. Scattershot “hustle” burns you out.

Stop the bleedingPrioritize the bills that trigger the worst consequences (housing, utilities, transportation to work). Then call everyone else and request hardship options or plans.

Guardrail: late fees are a tax. Make them negotiate with you.

Trap warningBefore you borrow, do the ladder: move deadlines, reduce bills, create cash. If you still must borrow, choose the least expensive option and avoid anything that depends on rolling over.

Guardrail: if the plan is “I’ll just renew it,” it’s a trap.

If your theme strips scripts, read the lane boxes as guidance.

The 48-hour triage (what to do first when you’re stressed)

When you’re in emergency mode, your brain wants the fastest button. That’s why payday loans, cash advances, and “instant approval” products are so successful. They’re not selling money. They’re selling relief.

But the middle-class move is to slow down long enough to pick the least expensive relief. Here’s your order of operations: stop money from leaving, get time, then create cash.

Start by identifying the bills that can’t be played with—housing, utilities, transportation to work, and anything that could trigger a chain reaction. Everything else is negotiable, even if they don’t want you to know that.

Next, do the ugly-but-effective sweep: pause non-essentials, cancel what you can, and hunt refunds. If you’ve got subscriptions you forgot about, this is the week they stop charging you. It’s not glamorous, but it’s real money.

Then create cash with the lowest drama options: return something you bought recently, sell one or two items you can part with, or pick up one extra income move that doesn’t require you to rebuild your life.

Do This / Not That (Emergency Cash Edition)

Do thisMove deadlines before you borrow. Call and ask for a due-date change, hardship option, fee waiver, or payment plan.

You’re buying time with a phone call instead of buying time with interest.

Not thatDon’t panic-borrow for convenience if a payment plan would solve the problem.

Fast money is usually expensive money.

The scripts that save you money (and pride)

Most people don’t negotiate bills because they think it won’t work. The truth is: companies would rather get paid slowly than not get paid at all. You just have to ask the right way—calm, direct, and specific.

Copy/Paste Script: Ask for Time and Lower Payments

Use this with utilities, medical offices, credit cards, and most recurring bills.

“Hi—I’m calling because I can’t pay the full amount by the due date. What hardship options or payment plans do you have?

Can you move my due date, waive late fees, or set up a temporary plan that keeps my account in good standing?”

Now the uncomfortable truth: some people need cash because the emergency is real and the timing is brutal. That’s when selling and earning come in. But do it with your dignity intact and your safety intact. “Fast cash” markets attract scammers the same way open garbage attracts raccoons.

What works fastest (without creating a new monthly bill)

You don’t need a hundred ideas. You need a short list of moves that are actually doable, and a way to choose based on speed and risk.

Emergency Cash Options (No New Debt)

| Move | Why it works | Speed | Risk / downside | Best use-case |

|---|---|---|---|---|

| Due-date change / payment plan | Prevents money from leaving now; stops late-fee snowball | Fast | Takes calls and follow-up | Any recurring bill where timing is the issue |

| Fee waiver request | Removes penalty costs without borrowing | Fast | Not always approved | When fees/penalties are the problem |

| Refunds / returns | Turns recent spending back into cash | Fast to medium | Depends on store policy and timing | When you made purchases you can reverse |

| Sell 1–3 items safely | Creates real cash without a new bill | Medium | Scams, lowball offers, safety risks | When you need cash and have sellable items |

| Extra shift / short burst income | Turns time into cash without long-term debt | Medium | Fatigue; timing may not match emergency | When you have a few days to stabilize |

| Community resources | Emergency help for essentials, sometimes fast | Medium | Eligibility and availability vary | When basics are at risk (food, utilities, housing support) |

Avoid the traps that make next month worse

When you’re desperate, a bad offer can feel like a lifeline. That’s why we’re calling out the traps directly. Not because you’re naive—because stress makes everyone vulnerable.

Red Flags You’re About to Get Played

- Someone promises “guaranteed approval” but needs a fee up front.

- You’re told to pay using gift cards, crypto, or a wire “to verify.”

- A lender rushes you and won’t clearly explain total cost and due dates.

- The solution depends on rolling over, renewing, or refinancing to survive.

- A buyer wants to “send a code,” overpay, or do shipping for an item you’re selling.

Emergency mode is when scammers work overtime. Slow down anyway.

Where borrowing fits (if it has to)

This post is about no new debt, because debt is usually the most expensive “shortcut.” But I’m not going to insult your intelligence: some emergencies require cash and you might have to borrow.

If that’s you, the order still matters. You do the no-debt ladder first. Then if you still need to borrow, you choose the least expensive lane with a clear payoff plan. You avoid anything that depends on repeat borrowing. You avoid anything that punishes you for being human.

FAQ

FAQ: Emergency Cash Without New Debt

Is “moving a due date” really the same as finding cash?

In practice, yes. If you stop money from leaving your account this week, you reduce how much “new cash” you need to find.

What should I say when I ask for a payment plan?

Be direct: you can’t pay the full amount by the due date, you want to stay in good standing, and you’re requesting hardship options, a plan, or a due-date move.

What’s the safest way to sell items quickly?

Meet in public, verify payment, avoid overpayment and shipping scams, and don’t hand over items until payment is confirmed. If the buyer is weird, walk away.

What if I’m already behind and fees are stacking?

Prioritize the bills with the biggest consequences first, then call everyone else for plans/waivers. The goal is to stop the fee snowball.

Do community resources actually help fast?

Sometimes, yes—especially for essentials. Availability varies by area, but it’s worth checking when basics are at risk.

One-page action checklist (print this and do it)

Emergency Cash Checklist (No New Debt)

- I listed the “can’t-fail” bills first (housing, utilities, transportation to work).

- I called for due-date changes, payment plans, hardship options, and fee waivers.

- I paused or canceled non-essentials that are draining cash right now.

- I checked for refunds/returns and made one clean sell plan (safe, simple, fast).

- I chose one short burst income move (not five scattered ones).

- If I still must borrow, I will pick the least expensive option with a clear payoff plan.

Printing strips buttons automatically.

Final word

This is what the middle class rarely gets told: sometimes you don’t need “more money.” You need a better sequence. A better order. A plan that reduces damage instead of multiplying it.

Start at the top of the ladder: move deadlines, reduce bills, stop fees. Then create cash with refunds, safe selling, and one short burst income move. Borrowing is the last step—not the first.

Call to action: If you tell me what the emergency bill is (rent, car, utilities, medical, etc.) and how fast you need relief, I can help you choose the best lane and the exact script to use so you can buy time without buying a trap.

RELATED ARTICLES

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what to do next. Read now.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

Selling Your Home Isn’t a Chore. It’s a Power Test.

Avoid costly seller mistakes—price smart, negotiate, handle appraisals, and protect your equity. Read the full seller playbook.

By Article Posted by Staff Contributor

American Middle Class / Jan 24, 2026

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

By FMC Editorial Team

American Middle Class / Jan 23, 2026

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

By FMC Editorial Team

American Middle Class / Jan 21, 2026

The government was about to take your paycheck. Then it hit pause.

Wage garnishment paused for defaulted student loans—what it means for your paycheck, tax refund, and next steps. Read before it restarts.

By Article Posted by Staff Contributor

American Middle Class / Jan 21, 2026

January Is Financial Wellness Month — and Your Boss Cares More Than You Think

January reset: budget, emergency fund, debt & accountability—plus an employer playbook. Use the tools and start today.

By Article Posted by Staff Contributor

American Middle Class / Jan 19, 2026

Trump’s 401(k) Down Payment Plan: A House Today, a Retirement Tomorrow?

Could Trump let you use 401(k) money for a down payment? Learn how it works, risks to retirement, and price impacts—read first.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

The One-Income Family Is Becoming a Luxury. Here’s the Salary It Takes Now.

How much must one parent earn so the other can stay home? See the real math, examples, and tradeoffs—run your number now.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read...

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what...