Financing a Pool: Exploring Options for Your Backyard Oasis

By Article Posted by Staff Contributor

The estimated reading time for this post is 329 seconds

A swimming pool can be a fantastic addition to any home, offering a refreshing escape from the summer heat and a gathering place for family and friends. However, the cost of building a pool can be a significant investment.

This article aims to provide an in-depth guide on financing a pool, covering various financing options and weighing their pros and cons.

We will discuss the cost of pools, maintenance considerations, affordability, pool loans, cash-out refinancing, home equity lines of credit (HELOCs), home equity loans, personal loans, top lenders for pool loans, and whether pool financing is a good idea.

Different Types of Swimming Pools

Above Ground Pools

Above-ground pools are a cost-effective and versatile option for homeowners. They are typically constructed using steel, aluminum, or resin materials and come in various sizes and shapes.

Above-ground pools are easy to install and require minimal excavation, making them a popular choice for those on a budget or with limited space.

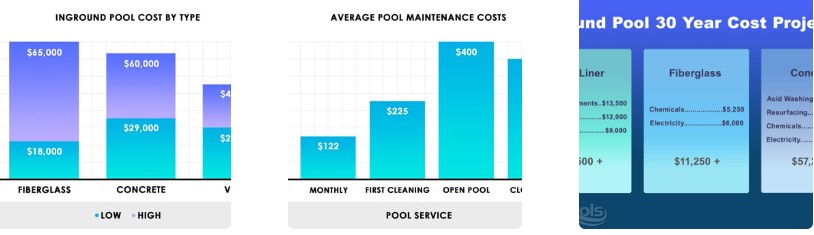

The average cost to build an above-ground pool can range from $1,500 to $15,000, depending on size, materials, and additional features.

In-Ground Vinyl Pools

In-ground vinyl pools feature a flexible liner that stretches across a dug-out hole and is supported by steel, aluminum, or polymer walls. These pools offer more design flexibility than above-ground pools and can be customized to fit various shapes and sizes.

In-ground vinyl pools are typically more affordable than concrete or fiberglass options, with construction costs ranging from $20,000 to $50,000. However, the vinyl liner may require periodic replacement, increasing long-term maintenance costs.

Concrete Pools

Concrete pools are a popular choice for those seeking durability and customization options. These pools are constructed by excavating the desired shape, installing steel reinforcements, and spraying or pouring concrete to create the pool structure.

Concrete pools can be tailored to suit specific design preferences and include features like attached spas, waterfalls, and intricate tile work.

Due to their versatility and longevity, concrete pools are often the most expensive to build, ranging from $30,000 to $100,000 or more.

Fiberglass Pools

Fiberglass pools consist of a pre-formed shell made of fiberglass-reinforced plastic. These pools are manufactured off-site and then transported to the installation location, where they are placed in a prepared excavation.

Fiberglass pools are known for their smooth, non-porous finish, which resists algae growth and requires less maintenance.

They are available in various shapes and sizes but offer less customization than concrete pools. The average cost of a fiberglass pool installation can range from $30,000 to $60,000, depending on size, features, and site preparation.

Maintenance Costs to Consider:

Owning a pool entails ongoing maintenance expenses that should be factored into your budget. These costs include water, electricity, chemicals, cleaning equipment, regular servicing, and repairs.

On average, you can spend around $1,200 to $2,500 annually for maintenance.

How Much Pool Can You Afford?

Determining how much pool you can afford involves evaluating your financial situation and considering your income, expenses, and existing debt.

Experts suggest that your monthly pool payment, including maintenance costs, should be at most 10% of your monthly income. It is essential to establish a realistic budget to avoid potential financial strain.

What is a Pool Loan?

A pool loan is financing specifically designed for swimming pool construction or renovation. It is often an unsecured personal loan that can cover the entire cost of the pool project, including materials, labor, and additional features.

Pool Financing Options

Cash-out Refinance:

Cash-out refinancing involves replacing your existing mortgage with a new loan for a higher amount, allowing you to borrow against the equity in your home.

This option provides a lump sum of cash that can be used to finance a pool. However, it extends your mortgage term and may incur closing costs. Pros include lower interest rates and tax-deductible interest payments.

Home Equity Line of Credit (HELOC):

A HELOC is a revolving line of credit that uses your home equity as collateral. It provides flexibility in borrowing and repaying funds and can be used to finance a pool.

Pros include low-interest rates, tax-deductible interest payments, and the ability to reuse the credit line. However, it carries the risk of variable interest rates and may require a longer repayment period.

Home Equity Loan:

Similar to a HELOC, a home equity loan utilizes the equity in your home as collateral. It provides a lump sum for pool financing with a fixed interest rate and predictable monthly payments.

Pros include fixed interest rates, potentially lower rates than other loans, and tax-deductible interest payments. However, it may extend your mortgage term and involve closing costs.

Personal Loans or “Pool Loans”

Personal loans are unsecured loans that can be used for various purposes, including financing a pool. These loans offer flexibility and quick access to funds.

Pros include no collateral required, a simplified application process, and shorter loan terms. However, interest rates may be higher than secured loans, and loan amounts may be limited.

Pros and Cons of Different Financing Options

To summarize the advantages and disadvantages:

Cash-out Refinance:

- Pros: Lower interest rates and tax-deductible interest payments.

- Cons: Extended mortgage term, closing costs.

Home Equity Line of Credit (HELOC):

- Pros: Low-interest rates, tax-deductible interest payments, flexibility in borrowing.

- Cons: Variable interest rates, the potential for a long repayment period.

Home Equity Loan:

- Pros: Fixed interest rates, potentially lower rates, tax-deductible interest payments.

- Cons: Extended mortgage term, closing costs.

Personal Loans or “Pool Loans”

- Pros: No collateral required, simplified application process, shorter loan terms.

- Cons: Higher interest rates and limited loan amounts.

Top Lenders for Best Pool Loans

There are numerous lenders offering pool financing options. The best lenders vary based on individual circumstances, credit history, and loan requirements.

Research and compare offers from reputable financial institutions such as LightStream, SoFi, Wells Fargo, and TD Bank.

Is Pool Financing a Good Idea?

The decision to finance a pool depends on your financial situation, goals, and priorities. Consider the following points:

- Assess your long-term financial stability and ability to repay the loan.

- Determine if the enjoyment and benefits of having a pool outweigh the costs.

- Explore alternative options, such as saving or scaling down your pool project.

- Take into account potential home value appreciation and increased property appeal.

Conclusion:

Financing a pool requires careful consideration of costs, maintenance expenses, and available financing options.

Evaluate your financial situation and preferences before committing to a loan. While pool financing can provide access to your dream backyard oasis, weighing the pros and cons, exploring alternative solutions, and choosing the best option with your financial goals and circumstances is crucial.

Remember, a well-planned and financially responsible approach can help turn your pool dreams into a reality without causing undue financial strain.

RELATED ARTICLES

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

By FMC Editorial Team

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

By MacKenzy Pierre

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs....

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market...

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan...