If you think American banks charge too many fees, you’re right — and you’re not imagining it.

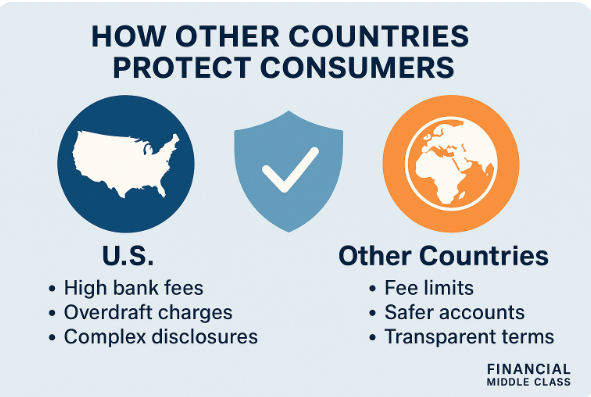

Compared to much of the developed world, the United States is the outlier when it comes to high bank fees, aggressive overdraft practices, and complex fine print.

While other nations have reined in financial excesses, American consumers are still fighting battles most of the world solved a decade ago.

But here’s the good news: other countries offer a blueprint for what fair banking looks like — and what’s possible when regulators prioritize people over profits.

Why Consumer Protection Looks Different Abroad

In the U.S., the system leans on disclosure — as long as a company tells you about a fee, it can usually charge it.

In much of Europe and Asia, the focus is prevention — stopping unfair or exploitative practices before they happen.

That’s a fundamental difference in philosophy:

America says, “Read the fine print.”

Europe says, “There shouldn’t be fine print.”

1. Europe’s Approach: Transparency with Teeth

European nations learned hard lessons from their own financial crises, and many built stronger consumer protections as a result.

Banking Regulations

The European Union’s Payment Accounts Directive (PAD) requires every bank to offer a basic payment account — a low-cost account with no overdraft and no hidden fees.

If a consumer wants to switch banks, the new bank handles the entire process, including transferring automatic payments and closing the old account.

In other words, they made “Switching Banks Made Simple” a legal right.

Credit and Loan Oversight

EU rules limit how much interest can be charged on consumer credit and require lenders to evaluate affordability — meaning they can’t issue loans people can’t realistically repay.

That’s a concept still debated in the U.S., where “responsible lending” remains largely voluntary.

2. The United Kingdom: Simplicity and Accountability

Britain’s Financial Conduct Authority (FCA) enforces clear, no-nonsense standards for financial products.

Banks must prove their fees are “reasonable” and that they deliver fair value for consumers.

Overdraft Reform

In 2020, the UK banned daily overdraft charges and introduced a single interest rate cap across all banks.

This reform cut overdraft costs for millions and forced banks to compete on service, not penalty revenue.

Payday Lending Crackdown

Britain also capped payday loan interest rates at 0.8% per day, limited total repayment to no more than twice the loan, and required clear repayment disclosures.

Defaults and financial stress fell sharply afterward.

Compare that to the U.S., where payday loan APRs often exceed 400% — and where each state sets its own loose rules.

3. Canada: Banking with a Human Touch

Canada’s banking system, though dominated by a few large banks, maintains some of the lowest complaint and fee levels in the developed world.

Why? Because regulators require:

- Plain-language disclosure of all fees

- No “surprise” account closures

- Standardized reporting to federal consumer agencies

Canadian banks are also required to offer no-fee accounts to students, seniors, and low-income consumers — something the U.S. has left to voluntary programs.

4. Asia: Innovation Meets Consumer Fairness

Countries like Singapore, Japan, and South Korea blend digital innovation with strict consumer oversight.

Singapore

Every bank is required to refund unauthorized transactions within 14 days, unless the customer was grossly negligent.

That’s a far cry from the U.S., where consumers can wait weeks for resolution — or be told it’s their fault.

Japan

Japanese regulators limit most consumer loan interest rates to 15–20%, and lenders are banned from offering multiple overlapping loans that trap borrowers in cycles of debt.

South Korea

The government built a national financial consumer protection agency, combining the powers of banking, insurance, and securities oversight.

The agency runs 24/7 hotlines and online dispute portals where consumers can report issues — and banks must respond.

5. What the U.S. Can Learn

The U.S. doesn’t need to reinvent the wheel — it just needs to use the parts that work elsewhere.

1. Mandate No-Fee Accounts

Like Europe, every bank should offer a basic, low-cost account that can’t overdraft or accumulate junk fees.

2. Cap Payday Loan Rates

A federal cap on interest — even at 36% APR — would save millions from endless debt cycles.

3. Require Simpler Fee Disclosures

Financial products should be judged by whether the average person can understand the terms — not just lawyers.

4. Make Switching Banks Automatic

It shouldn’t take hours of paperwork to move your money.

Automation would create competition and lower costs across the board.

5. Empower the CFPB

While other nations’ regulators have unified authority, the U.S. system remains fragmented across agencies (CFPB, FDIC, OCC, Federal Reserve).

Streamlining oversight would mean faster action and fewer loopholes.

Global Perspective: Fair Finance Isn’t Utopian — It’s Policy

The difference between predatory and protective finance isn’t morality — it’s law.

Other countries didn’t wait for banks to do the right thing; they forced them to.

And in doing so, they built systems that empower the middle class to grow wealth instead of dodge fees.

Related Reads

The CFPB vs. the Banks: What America’s Consumer Watchdog Really Does

Switching Banks Made Simple: A Middle-Class Guide to Beating Junk Fees

Safe Bank Accounts: What They Are and How to Get One

From Payday Loans to Junk Fees: Why Predatory Finance Targets the Middle Class

Final Call-to-Action

👉 Be part of the pressure.

Consumer protection doesn’t move without demand. File complaints, write your representatives, and share stories of unfair fees.