What to Expect at Tax Time Under the One Big Beautiful Bill

By Article Posted by Staff Contributor

The estimated reading time for this post is 1052 seconds

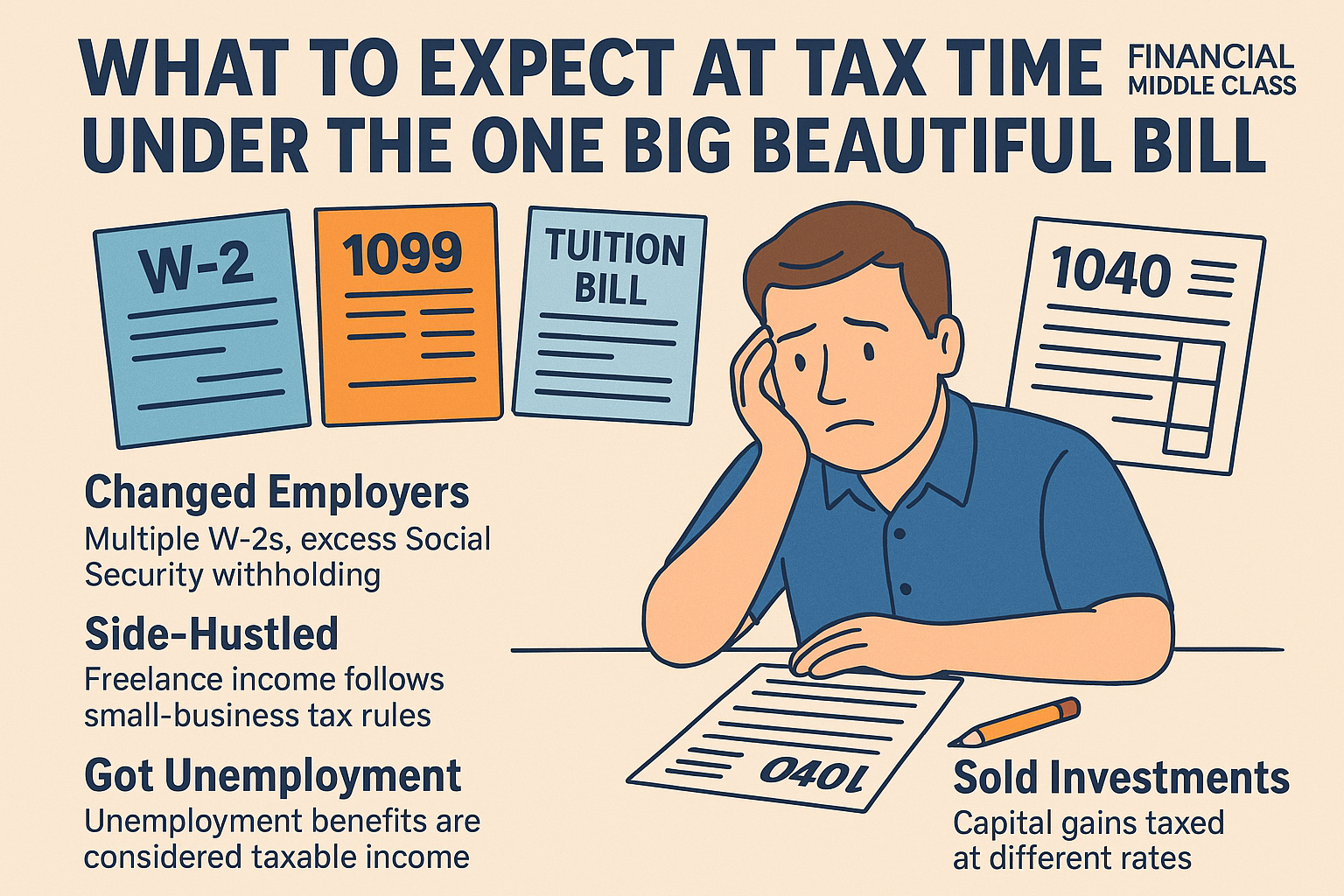

If you changed jobs, side-hustled, went back to school, got a raise, collected unemployment, or sold investments this year

With a few weeks left in the working year, your inbox is probably already humming with H&R Block, TurboTax, and TaxSlayer ads. Same headline every year: “Big tax changes. Don’t leave money on the table.” Most of the time that’s just marketing noise. This year, annoyingly, it’s real.

On July 4, 2025, Congress passed and President Trump signed the One Big Beautiful Bill Act. It locked in many of the 2017 Tax Cuts and Jobs Act rules and layered on new deductions for workers, seniors, and parents, plus long-term goodies like “Trump Accounts” for kids. The problem is simple: your paycheck and your W-2 still look basically the same, but the rules behind your 2025 tax return do not.

If you sit in the middle class and any of this happened to you this year — you switched employers, picked up contract or freelance work, paid college tuition, got a raise or bonus, spent time on unemployment, or sold stocks or other investments — you’re filing under a different landscape than you were even twelve months ago. This isn’t a scare tactic. It’s a straight warning: the tax code just got friendlier on paper and trickier in practice.

Let’s walk through what changed, then talk about what it means for you, move by move.

The Bill Changed the Rules. Your Paycheck Didn’t.

The One Big Beautiful Bill did a few big things regular people will feel, even if they never read a line of IRS guidance.

First, it made the TCJA structure permanent. That means seven tax brackets from 10% up to 37%, and a bigger standard deduction instead of the old personal exemption system. For 2025, the standard deduction is indexed up again — roughly around $15,750 for single filers and $31,500 for married couples filing jointly, with head-of-household in between. The details will inch around with inflation, but the point stands: most middle-class filers will keep using the standard deduction instead of itemizing.

Second, it added headline-friendly deductions that sound like “no tax” but really live on your 1040 as write-offs:

- A “No Tax on Tips” deduction, letting eligible workers deduct up to $25,000 in qualified reported tips for a few years, subject to income limits.

- A “No Tax on Overtime” deduction, up to $12,500 per worker ($25,000 for some joint filers).

- A “No Tax on Car Loan Interest” deduction, up to $10,000 of interest on qualifying U.S.-assembled passenger vehicles, again with rules and limits.

- A new $6,000 per-person deduction for taxpayers 65 and older, stacked on top of the usual senior standard deduction.

You will not see these on your pay stub. Your employer did not stop withholding tax from your tips, overtime, or car-loan interest. The deductions live in the return itself, which means you either know to claim them or you don’t.

Third, the law raises the SALT (state and local tax) deduction cap from $10,000 to $40,000 for several years for many filers before it drops back down in 2030. If you own a home in a higher-tax state, that matters because it quietly makes itemizing worth another look.

Layer on new savings vehicles like Trump Accounts — tax-deferred stock-only accounts seeded with $1,000 for eligible kids born between 2025 and 2028, plus $250 from private donors like Michael Dell for millions of younger children — and you have a tax system that is trying very hard to look generous while still rewarding people who already have the time and knowledge to use it.

So if you’re in the financial middle and your year looked anything like most people’s — messy, with multiple income sources and life events — the right question isn’t “Am I getting a refund?” It’s “Did I actually match my real life to the new rules?”

If You Changed Employers: Same W-2 Shape, Different Risk

Job hopping is normal now. Maybe you left a toxic workplace, chased better pay, or got forced out and landed somewhere else. On paper you still “just” have W-2 wages. Under the hood, your tax picture got more complicated.

Every employer you worked for this year will send you a separate W-2. The IRS sees your total income only when all of those forms land on the same 1040. No single payroll department saw the whole picture. Each one withheld taxes as if they were your only job.

That’s how you end up with the classic middle-class surprise: you thought you were “fine” because taxes came out of every check, and then April says you under-withheld. The reverse happens too; you get a big refund because every employer withheld at a conservative rate, and you lent the government thousands of dollars for free.

On top of that, Social Security contributions have an annual wage cap. When multiple employers don’t see each other, they can collectively withhold more Social Security tax than you actually owe. The good news is that the excess is refundable on your return, but only if you file correctly and report every W-2.

Here’s how two very ordinary workers can land in very different places under the exact same tax code.

| Worker A: One Employer, All Year | Worker B: Two Employers, Mid-Year Switch | |

|---|---|---|

| Pay history | $75,000 from one job, steady all year | $40,000 from Job 1, $45,000 from Job 2 |

| Withholding logic | Single set of tables sees full-year income | Each employer withholds as if $40k–45k is the whole story |

| Risk at filing | Withholding closer to “just right” | Higher risk of under- or over-withholding |

| OBBB deductions impact | Tips/overtime apply if job has them | Tips/overtime may be split across W-2s but still one deduction |

| Social Security cap | Easy to track with one employer | Possible excess Social Security, refundable only if return is correct |

Worker B isn’t richer or poorer in any moral sense. They just live the modern job-change reality. The One Big Beautiful Bill doesn’t change the multiple-W-2 problem; it just adds new moving parts like the worker deductions and SALT cap on top of it. If that’s you, “I got all my W-2s” is the bare minimum, not a full tax plan.

If You Picked Up Contract or Freelance Work: Welcome to Small-Business Tax Rules

A lot of Americans quietly became small businesses this year without meaning to. You might have driven rideshare to cover higher groceries, delivered for apps on weekends, shot a few paid photos, or picked up contract work your employer couldn’t put on payroll.

The moment money hit your account for work where no one treated you as an employee, the tax code stopped seeing you only as a W-2 worker and started seeing you as self-employed.

Instead of a W-2, you may see Forms 1099-NEC or 1099-K from the platforms and clients that paid you. If the amounts are small or spread out, you might not see any forms at all. The income is still taxable; the paperwork simply gets thinner.

Thanks to the One Big Beautiful Bill, the 1099-K threshold drama calmed down. The law effectively reset the reporting trigger so most third-party platforms only have to send a 1099-K if your payments exceed $20,000 and 200 transactions, instead of the $600 cliff that almost went into effect. That is a paperwork relief, but it’s also a temptation. A lot of casual sellers may think “no form, no tax.” The IRS disagrees.

Here is where the side-by-side reality gets stark.

| W-2-Only Worker | W-2 + Freelance Worker | |

|---|---|---|

| Income paperwork | One or more W-2s | W-2s plus 1099-NEC/1099-K or informal payment records |

| Payroll tax | Shared by you and employer | You pay both halves via self-employment tax |

| Deductions | Standard or itemized, plus new OBBB worker deductions | Same as W-2, plus business expenses on Schedule C |

| Risk if ignored | Possible mismatch if a W-2 is missing | Underreported income, penalties, unpaid SE tax |

The law did not erase self-employment tax or the extra record-keeping that comes with running even a tiny side business. What it did do is keep the TCJA structure in place — including the pass-through deduction for some small-business income — and overlay the new “no tax”-style worker deductions if your side work includes tips or overtime-like pay.

So if you were grinding nights and weekends to close the gap created by inflation, don’t let the platforms’ softer reporting rules trick you into thinking the IRS stopped caring. It didn’t. You’re just more responsible for the story your tax return tells.

If You Paid College Tuition or Education Costs: Credits Still Work, Debt Rules Are Moving

Middle-class families live with education costs like a second rent. Tuition, mandatory fees, and course materials now routinely run into five figures per year. The one bright spot in the current system is that education credits still exist and still matter — and the One Big Beautiful Bill didn’t blow them up for this filing season.

For 2025, you can still potentially claim the American Opportunity Tax Credit (AOTC) for an eligible student in their first four years of higher education. The maximum annual AOTC is $2,500 per student; up to 40% of whatever’s left after wiping out your tax bill (up to $1,000) can actually come back to you as a refund.

If you or a family member is in grad school, a trade program, or taking classes to upgrade skills, the Lifetime Learning Credit (LLC) may be the better fit. It is worth up to $2,000 per return, not per student, and it can be used for any post-secondary education and job-skills training, with no four-year cap.

You cannot use both credits for the same student in the same year, but you can mix and match across family members on the same return if the numbers justify it. Your school will send Form 1098-T; your job is to pick the credit that actually stretches your dollars the furthest.

The One Big Beautiful Bill’s bigger impact on education is long-term. It reshapes federal student loan programs, cuts some borrowing limits, and phases out some of the Biden-era income-driven repayment plans in favor of a new structure. It also launches those Trump Accounts for kids — tax-advantaged investment accounts seeded by the government and private donors that can eventually be used for education, a first home, or starting a business.

In other words, for this year’s taxes the credits still work, but the way future education is financed and repaid is shifting under your feet. If you’re paying tuition now and borrowing at the same time, you’re living in both systems at once.

If You Got a Raise or Bonus: More Money, More Moving Parts

Raises and bonuses are supposed to feel clean. You did more, you got more, end of story. The tax code has always had other ideas. The One Big Beautiful Bill adds another layer: you might be taxed less harshly at the bracket level, but you’re now juggling new deductions and phase-outs.

The law makes permanent the TCJA’s lower tax brackets and higher standard deduction, which generally means that compared with the old pre-2017 code, more of your income sits in lower brackets. That’s good. At the same time, your bonus might have had tax withheld at a flat “supplemental” rate that doesn’t match your real marginal bracket, so your return is where the true answer lands.

Where the One Big Beautiful Bill really changes the conversation is for people whose raises are actually overtime and tipped hours. If you’re working in a restaurant, driving a bus route that routinely demands extra shifts, or picking up overtime as a nurse, the new tips and overtime deductions can shield part of that extra income — up to $25,000 in qualified tips and $12,500 in qualified overtime ($25,000 for some joint filers) for several years, with phase-outs for higher incomes.

Consider two workers with similar paychecks:

| Worker C: Salary Only | Worker D: Lower Base, Heavy Tips/Overtime | |

|---|---|---|

| Base pay | $80,000 | $55,000 |

| Extra income | Occasional small bonus | $20,000 in overtime and $10,000 in reported tips |

| OBBB worker deductions | None | Can potentially deduct large chunks of tips/OT |

| Emotional story | “I’m the higher earner; I must be paying more tax” | “I’m barely keeping up; at least OT helps” |

Under the new rules, Worker C may still have the higher overall income and tax bill, but Worker D — the person grinding nights and weekends — has more tools to push their taxable income down if they actually track their numbers and claim the deductions. If you are Worker D and you don’t pay attention, you’re doing two jobs: your main job, and unpaid outreach for the Treasury.

If you’re 65 or older, that extra $6,000 senior deduction per person is another quiet lever. It can knock your taxable income lower even if you take the standard deduction, which matters if you went back to work part-time or kept working full-time because retirement got more expensive than you expected.

The dangerous myth in all of this is “I’m in the 22% bracket, so 22% is my tax rate.” Under OBBB, your effective rate — what you actually pay after deductions and credits — can swing a lot depending on how much of your raise was straight salary versus overtime, how many kids you have, whether you paid tuition, whether you sold investments, and whether you’re old enough to claim senior breaks.

If You Received Unemployment: The Check Helped, the Tax Bill Still Comes

Too many of us learned the hard way that unemployment benefits are not free money. They’re a lifeline with strings.

Federal law still treats unemployment compensation as taxable income unless Congress passes a one-off exclusion, like the temporary break in 2020. If you received unemployment this year, you should get Form 1099-G from your state showing how much was paid and how much, if anything, was withheld for federal tax.

Most people either don’t know they can withhold, or they turn it off to keep more cash coming in during a crisis. Emotionally, that makes sense. Mathematically, it means a tax bill is waiting for you at filing time. If you worked part of the year and were unemployed part of the year, your W-2 withholding might have been set as if you worked the whole year at that rate. The combination of too-low withholding on unemployment and “normal” withholding on wages is exactly what produces the “How do I owe taxes when I was out of work?” moment.

The One Big Beautiful Bill does not change that fundamental rule. It rewrites plenty of other things — safety-net programs like SNAP and Medicaid took cuts and tighter rules — but unemployment remains taxable. The risk for middle-class households is obvious: more precarious coverage during a jobless stretch, plus the same old surprise bill in April if you don’t plan for it.

If You Sold Stocks or Other Investments: Old Rules, New Context

For many middle-class families, investments are no longer limited to a 401(k). You might have a small taxable brokerage account, some mutual funds in a college fund, or a leftover chunk of stock you bought back when “everyone was trading.” The tax rules here haven’t changed much under the One Big Beautiful Bill, but the context around them has.

If you sold stocks, stock funds, or other capital assets in a regular taxable account, you’re dealing with capital gains and losses. The IRS still makes a big distinction between:

- Short-term gains, where you owned the asset for one year or less; those are taxed at your ordinary income rates.

- Long-term gains, where you held for more than one year; those get special rates of 0%, 15%, or 20%, with most middle-income filers paying 15%.

Losses still offset gains first. If your net capital loss exceeds your gains, you can use up to $3,000 per year to reduce other income and carry the rest forward. That fundamental structure has not changed.

The One Big Beautiful Bill left these rates intact. There were political conversations about slashing top capital-gains rates or indexing gains to inflation; those did not make it into law.

What has changed is everything else on your return. If you had a year where you switched jobs, side-hustled, paid tuition, and sold investments, your capital gains aren’t happening in a vacuum. The bigger standard deduction, the worker deductions, the senior deduction, the SALT cap, and education credits all decide how much of your gain is effectively shielded.

A simple comparison makes the point.

| Household E: Smooth Year | Household F: Chaotic Year | |

|---|---|---|

| Job situation | One W-2, no side income | Two W-2s plus freelance |

| Life events | No tuition, no unemployment | Tuition paid, brief unemployment, car purchase |

| Investments | Sold $10,000 long-term gain | Sold $10,000 long-term gain |

| Tax context for the sale | Few moving parts; gain sits on top of wages | Gain layered on top of deductions, credits, SE tax |

| Resulting “feel” of the sale | Easier to predict, often cleaner | Harder to predict; sale may push or pull credits |

Same $10,000 profit. Very different experience once it collides with everything else you did during the year.

Putting It All Together: How a Middle-Class Year Shows Up on Your 1040

If you feel like your money life has turned into a patchwork quilt, you’re not imagining it. The One Big Beautiful Bill didn’t create that feeling; it just codified it.

Picture two households that look similar on the surface.

| Household G | Household H | |

|---|---|---|

| Total household income | Around $90,000 | Around $90,000 |

| Primary earner | Single W-2, no side work | Two W-2s plus gig income |

| Other income | None | A few months of unemployment |

| Major expenses | Regular bills only | Community-college tuition for one child |

| Investment activity | No sales | Sold some stock to cover tuition |

| OBBB-specific deductions | None available | Tips, overtime, maybe car-loan interest |

| Filing experience | Straightforward standard deduction return | Multi-form return with credits, SE tax, deductions |

Both households had a six-figure-ish gross–to–net story once benefits and taxes are considered. But Household H has more levers and more landmines: education credits to claim correctly, self-employment tax to plan for, unemployment to report, capital gains to classify, and worker deductions to actually use.

Household H is the one that looks and feels like the modern middle class. The danger is that they keep using a mental model built for Household G.

What You Should Do Before You File

None of this matters if you shrug and hit the “file” button blind. You don’t have to turn into a tax pro, but you absolutely cannot afford to coast through this season the way you may have in the past.

Start by treating January and February as your document season, not just your “where’s my W-2?” season. You need every W-2 from every employer. You need 1099-NECs and 1099-Ks from side gigs and platforms, and your own records if no form shows up. You need 1098-Ts from schools and proof of education expenses. If you received unemployment, go pull your 1099-G from the state website even if it never hits your mailbox. If you sold investments, gather your trade confirmations, cost basis information, and year-end statements — don’t just trust that the brokerage’s summary did the thinking for you.

Next, look at your year through the One Big Beautiful Bill lens. If you worked in a job with substantial tips or overtime, ask yourself whether you can actually document them well enough to claim the new deductions. If you bought a new vehicle with a qualifying loan, dig up the paperwork so you can see whether the car-loan interest deduction applies. If you or your partner is over 65, make sure the preparer or software is actually applying the extra senior deduction.

Then, after you file, pay attention to what the return is telling you. If you owed a painful amount or got an oversized refund, use the IRS withholding estimator or a similar tool and adjust your W-4 so 2026 isn’t another surprise. The middle class does not have the luxury of giving or owing the government thousands by accident every spring.

Finally, treat the Trump Accounts and other long-term provisions as part of your broader planning, not a magic ticket. A $1,000 seed in a kid’s investment account is helpful. It is not a replacement for retirement saving, a real college plan, or an emergency fund. It’s another tool. The law is full of tools. Tools only work when someone picks them up.

The bottom line is simple. The One Big Beautiful Bill made the tax code look more generous for working families, but it also raised the bar on how organized and informed you have to be to actually benefit. If you changed jobs, cobbled together side income, sent money to a school, rode out a layoff, or tapped your investments this year, your tax return is no longer a boring annual chore. It’s a mirror.

You can ignore what it shows you. Or you can finally decide that if everyone else — Congress, corporations, and high-net-worth households — is using the rules to their advantage, the financial middle class is done playing the game on hard mode with the tutorial turned off.

RELATED ARTICLES

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Jan 24, 2026

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

By FMC Editorial Team

American Middle Class / Jan 23, 2026

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

By FMC Editorial Team

American Middle Class / Jan 21, 2026

The government was about to take your paycheck. Then it hit pause.

Wage garnishment paused for defaulted student loans—what it means for your paycheck, tax refund, and next steps. Read before it restarts.

By Article Posted by Staff Contributor

American Middle Class / Jan 21, 2026

January Is Financial Wellness Month — and Your Boss Cares More Than You Think

January reset: budget, emergency fund, debt & accountability—plus an employer playbook. Use the tools and start today.

By Article Posted by Staff Contributor

American Middle Class / Jan 19, 2026

Trump’s 401(k) Down Payment Plan: A House Today, a Retirement Tomorrow?

Could Trump let you use 401(k) money for a down payment? Learn how it works, risks to retirement, and price impacts—read first.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

The One-Income Family Is Becoming a Luxury. Here’s the Salary It Takes Now.

How much must one parent earn so the other can stay home? See the real math, examples, and tradeoffs—run your number now.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

Credit Cards vs. BNPL: Which One Actually Works for the American Middle Class?

Credit cards vs BNPL: costs, risks, and the best choice for middle-class cash flow. Use this 60-second framework—read now.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

The Affordability Pivot: Can Trump’s New Promises Actually Lower the Middle-Class Bill?

Will Trump’s affordability proposals lower your bills—or backfire? Housing, rates, tariffs, gas, credit cards—explained. Read now.

By Article Posted by Staff Contributor

Business / Jan 13, 2026

Starting a Nonprofit Is Easy. Starting the Right Nonprofit Is the Hard Part.

The estimated reading time for this post is 880 seconds Last updatedJanuary 13, 2026 — Updated for IRS e-filing pathways (Pay.gov), the 501(c)(4) notice requirement, and...

By Article Posted by Staff Contributor

American Middle Class / Jan 12, 2026

America’s 25 Fastest-Growing Jobs—and the part nobody tells you

BLS lists 25 fast-growing jobs for 2024–2034. Learn what it means, avoid traps, and pick a lane that fits your life—read now.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jan 24, 2026

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and...

American Middle Class / Jan 23, 2026

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what...

American Middle Class / Jan 21, 2026

The government was about to take your paycheck. Then it hit pause.

Wage garnishment paused for defaulted student loans—what it means for your paycheck, tax refund, and...