FICO Says Scores Are Slipping to 715 — Here’s What’s Actually Driving It (and How to Stay Out of the Downward Group)

By Article Posted by Staff Contributor

The estimated reading time for this post is 499 seconds

Introduction:

The latest FICO® Score Credit Insights report shows something easy to miss if you only look at the headline number: yes, the national average score dipped to 715, but the story behind that drop is what matters — rising credit card utilization, student loan delinquencies being reported again, and households reordering which bills they pay first. In other words, the score didn’t fall because people suddenly became irresponsible; it fell because the cost of staying current went up.

FICO’s data also makes clear that not everyone is experiencing this the same way. Younger borrowers and consumers in already lower-scoring states took the biggest hits, which tells us stress is concentrated — it’s clustering where savings are thinner and payment shocks (like student loans restarting) hit harder. That’s a prevention signal: these are the people who can benefit fastest from a plan to get payments back under control.

Layer on top of that a quiet rise in delinquencies — especially on credit cards and, earlier, on personal loans — and you can see why lenders will start tightening around the edges. When that happens, the households that were already juggling bills are the ones who lose access or pay more to borrow. So this article is going to do what the report doesn’t spell out loudly enough: translate those trends into steps you can take right now to protect your score, keep borrowing affordable, and avoid being grouped with the riskiest borrowers.

What Actually Changed?

Student loans came back to the party — and not in a fun way.

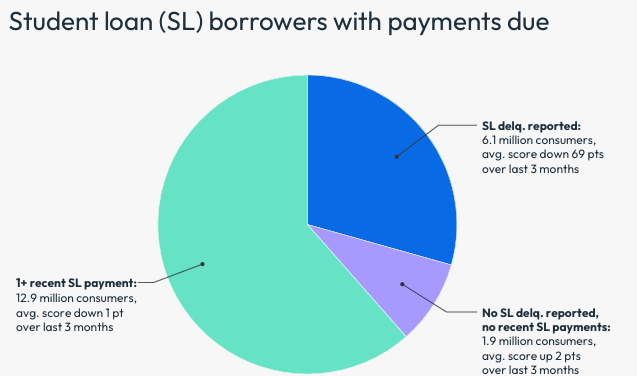

For almost five years, federal student loan payments were paused or softened. Then in early 2025, true delinquencies started hitting credit files again. And when they hit, some people saw huge drops — FICO’s own data shows about a 69-point average decrease for the people who got reported late between February and April 2025. Why so harsh? Because payment history is the heaviest chunk of your score — roughly a third. A 90-day late is like shouting to the entire credit system, “I’m struggling.”

Script: Call Your Servicer and Say This

Use this if your student loan just resumed or you’re about to be reported late.

Can you review my account and move me into the lowest available payment — including an income-driven option — so I don’t get reported late?

Also, can you tell me what to do about anything that’s already past due?”

Financial Middle Class — Protective guidance for working & middle-income households.

People are using more credit to live.

Credit card balances and utilization have been marching upward since 2021 — not because people love shoes, but because inflation stuck around longer than pay raises. Utilization is now in the mid-30s, up from under 30%. To the score, that looks like a risk.

The middle of the score distribution is shrinking.

More people are way up high, and more people are sliding down low. Fewer are in that safe 650–739-ish “I can do most things” zone. That tells you the current economy is rewarding people who could keep paying through inflation — and punishing people who had to float bills.

How Households Are Really Paying Bills Now

FICO laid it out plain: the payment hierarchy is now

- Auto

- Mortgage

- Personal loan

- Credit card

- Student loan

That’s survival logic. If you lose the car, you might lose the job. If you miss the mortgage, you’ve got more time before the worst happens. Cards? You can still survive with one late card. Student loans? People got used to not paying them and not being punished.

But here’s the tension: what’s “survival smart” isn’t always “score smart.” A 90-day late on a federal student loan now hurts more than a small bump in credit card utilization. So your financial planning has to combine both: what keeps the lights on and what keeps the score from crashing.

Early-Warning Signs Your Credit Is About to Slip

If two or more of these are true, take action this month — don’t wait for a 30- or 90-day late to hit your report.

- Credit card balances are creeping up and total utilization is over 30%.

- You received a student loan bill but haven’t picked a repayment plan yet.

- You’re choosing which bill to pay every month.

- You opened a new card or personal loan just to create “a cushion.”

- You live in a state/area where average FICO® Scores just fell.

Financial Middle Class — Protective guidance for working & middle-income households.

Spot Trouble Early (Prevention Mode)

Here are early-warning signs you should not ignore:

- Your total card utilization is over 30% and creeping up each month.

- You got a student loan bill and thought, “I’ll deal with it later.”

- You’re choosing which bill to pay — and student loans are always last.

- You’ve opened a card or personal loan “just to have a cushion.”

- You live in a state that already had lower average scores — those states saw bigger drops this time.

If two or more of those are true, don’t wait for the 90-day late. Call, consolidate, or re-set the payment now.

Do-This-Now Plan (Next 30 Days)

- Pull your credit reports and your score.

You can’t protect what you don’t measure. List: mortgage, auto, student loans, cards, personal loans. Circle the ones that report monthly and the ones that are past due. - Fix student loans first if you’re behind.

Because reporting just turned back on, you may have missed a bill without realizing the consequences. Call your loan servicer and say:

“I’m resuming payments and need the lowest available payment right now. Can you place me in an income-driven plan and tell me what to do about the amount I missed?”

That line tells them you intend to pay — that matters.

- Knock down utilization.

Even $200–$500 toward the card that’s closest to maxed can move your utilization percentage and soften any other negative that hits this year. - Turn on auto-pay at least for minimums.

A 30-day late on a credit card is avoidable. Automation is prevention. - If you’re choosing between auto and mortgage, call the one you can’t pay.

Repossession is faster and less forgiving than a mortgage process. Get in front of it.

30-Day Credit Stabilization Plan

- Pull reports + score: list every account that reports monthly.

- Call student loan servicer: ask for the lowest payment (IDR/SAVE-style) before you get marked 90 days late.

- Pay down 1 high-utilization card: even $200–$500 can drop your percentage.

- Turn on auto-pay: at least the minimum on cards to avoid accidental 30-day lates.

- Contact auto/mortgage early: if cash is tight, ask about hardship before missing a payment.

Tip: screenshot this plan and save it to your phone so you actually do it.

Financial Middle Class — Protect the score, then build wealth.

Medium-Term Stabilizers (3–12 Months)

This is where financial planning shows up.

- Build a “credit buffer fund.” Not just an emergency fund — a small stash that keeps you from throwing groceries on a credit card when rates are 20%+. Even $1,000–$1,500 makes a difference.

- Shrink the number of active debts. FICO’s data shows lenders started tightening on personal loans because delinquencies ticked up. If you can roll smaller debts into a lower-rate product without resetting the clock forever, do it.

- Protect your oldest, cleanest tradeline. Younger consumers have more score volatility because their files are thin. Don’t close the card you’ve had since college.

- Check monthly, adjust quarterly. Younger people check their scores more than anyone — but some don’t know what to do with the info. Your rule: if utilization is up, pay it down; if a late appeared, dispute or cure; if a student loan is back, get it into a plan.

Long-Term Resilience (1–5 Years)

- Keep utilization under 30% as a lifestyle. Under 10% before major borrowing.

- Don’t open accounts just to feel secure. The report shows people opened cards and personal loans “for cushion.” That’s fine once — not a habit.

- Plan your big credit events. If you know you’ll need a car in 18 months, don’t also let a student loan go 90 days late this year.

- Over-prepare if you’re in a lower-score state. Those states saw bigger swings; give yourself a bigger emergency fund and more conservative credit usage.

The Cost of Doing Nothing

If you let a student loan go 90 days late now, it can wipe out years of on-time car and card payments. That can push you into a rate tier that makes cars, personal loans, and even insurance more expensive. And remember: card delinquencies are already up almost 50% from 2021 — lenders are watching for exactly that pattern. Don’t make yourself look like the average struggler when you can look like the careful outlier.

Documents to Gather Before You Ask for Help

Having these ready makes servicers, lenders, and counselors take you seriously — and it speeds up approvals.

- Most recent pay stubs (or income letter if hours were cut)

- Last 2–3 months of bank statements

- Most recent student loan, auto, mortgage, and credit card statements

- Driver’s license or ID (to verify the account)

- Hardship explanation (1–2 sentences: job loss, medical, higher expenses)

- Budget showing income vs. expenses (even a simple one)

Financial Middle Class — bring receipts and they work with you.

You Still Have Agency

The encouraging part of the report is this: even with higher prices, millions of people are still maintaining excellent scores because they do three boring things — pay on time, keep balances low, and watch their reports. The system still rewards that. The difference in 2025 is that student loans are back in the scoring picture and everyday expenses are fatter, so the “margin for sloppiness” got smaller.

If you tighten up now — call lenders, pick the right payment plan, lower utilization — you can stay out of the group whose scores are trending down and stay closer to the group that’s still in the high 700s.

RELATED ARTICLES

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what to do next. Read now.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

Selling Your Home Isn’t a Chore. It’s a Power Test.

Avoid costly seller mistakes—price smart, negotiate, handle appraisals, and protect your equity. Read the full seller playbook.

By Article Posted by Staff Contributor

American Middle Class / Jan 24, 2026

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

By FMC Editorial Team

American Middle Class / Jan 23, 2026

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and...

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy....

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect...