Student Debt Relief

By Article Posted by Staff Contributor

The estimated reading time for this post is 341 seconds

The Biden-Harris Administration has proposed a comprehensive student debt relief plan that aims to alleviate the burden of student loan debt on millions of Americans.

The plan includes measures such as expanding Public Service Loan Forgiveness (PSLF), cancelling up to $10,000 in student debt per borrower, and providing debt relief for borrowers who attended predatory for-profit institutions.

However, the plan has faced opposition from various quarters, including the Supreme Court of the United States (SCOTUS), which could potentially strike down student debt relief, and the Grand Old Party (GOP), whose debt ceiling plan puts student debt relief in jeopardy.

In this article, we will examine the Biden-Harris Administration student debt relief plan and the PSLF program, their potential impact on borrowers, and the challenges that lie ahead in their implementation.

The Biden-Harris Administration Student Debt Relief Plan

The Biden-Harris Administration’s student debt relief plan seeks to address the growing crisis of student loan debt in the United States, which currently stands at a staggering $1.7 trillion. The plan aims to provide relief to borrowers by cancelling some of their debt and expanding existing loan forgiveness programs.

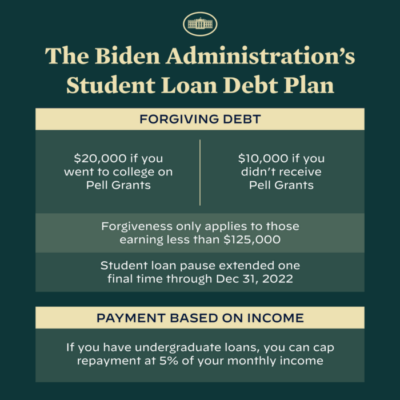

Under the plan, the administration has proposed to cancel up to $10,000 in student debt per borrower. This would provide immediate relief to millions of borrowers who are struggling to make their monthly payments.

The administration has also proposed to provide debt relief for borrowers who attended predatory for-profit institutions that engaged in fraudulent or deceptive practices.

In addition to these measures, the administration has proposed to expand the PSLF program, which currently allows borrowers who work in public service jobs to have their loans forgiven after making 120 qualifying payments. The proposed expansion would make the program available to more borrowers and simplify the application process.

PSLF Program

The PSLF program was created in 2007 to incentivize borrowers to enter and remain in public service jobs.

Under the program, borrowers who work in public service jobs, such as teachers, nurses, and government employees, can have their loans forgiven after making 120 qualifying payments while working full-time for a qualifying employer.

The PSLF program has been a lifeline for many borrowers who have taken on significant amounts of student loan debt to pursue careers in public service. However, the program has faced numerous challenges, including high denial rates and a complex application process.

One of the main issues with the PSLF program is that it is difficult to navigate. Borrowers must meet a number of requirements to qualify for loan forgiveness, including making qualifying payments while working full-time for a qualifying employer.

This can be challenging for borrowers who are not familiar with the program’s requirements or who work in jobs that do not qualify.

Another issue with the program is that many borrowers have been denied loan forgiveness.

According to a report from the Government Accountability Office, only 1% of borrowers who applied for loan forgiveness under the PSLF program were approved as of December 2020.

The high denial rate has been attributed to a variety of factors, including unclear program requirements and insufficient guidance from loan servicers.

Despite these challenges, the PSLF program remains an important tool for borrowers who are pursuing careers in public service. The proposed expansion of the program under the Biden-Harris Administration’s student debt relief plan could make it more accessible to more borrowers and simplify the application process.

Potential Impact on Borrowers

The Biden-Harris Administration’s student debt relief plan and the proposed expansion of the PSLF program could have a significant impact on borrowers who are struggling with student loan debt.

The cancellation of up to $10,000 in student debt per borrower would provide immediate relief to millions of borrowers and make it easier for them to make their monthly payments.

The debt relief for borrowers who attended predatory for-profit institutions could also be a game-changer for these borrowers, who often face high levels of debt and limited job prospects.

The expansion of the PSLF program could also provide much-needed relief to borrowers who are pursuing careers in public service and struggling to make their loan payments.

However, the impact of these measures is likely to be limited in the face of the broader student loan debt crisis. While cancelling up to $10,000 in student debt per borrower would provide relief to some, it would not address the underlying issue of the rising cost of higher education and the increasing burden of student loan debt on borrowers.

Furthermore, the proposed expansion of the PSLF program may not be sufficient to address the challenges that borrowers currently face in accessing loan forgiveness.

While simplifying the application process and making the program more accessible is a step in the right direction, more needs to be done to ensure that borrowers are aware of the program and understand its requirements.

Challenges in Implementation

The implementation of the Biden-Harris Administration’s student debt relief plan and the proposed expansion of the PSLF program is likely to face significant challenges. One of the biggest challenges is the potential for legal challenges to the plan, including from the SCOTUS.

The SCOTUS recently heard arguments in a case involving a group of borrowers who are seeking loan forgiveness under the PSLF program.

The case centers on the question of whether borrowers who have made payments under income-driven repayment plans are eligible for loan forgiveness under the PSLF program.

If the SCOTUS rules against the borrowers, it could have significant implications for the PSLF program and the Biden-Harris Administration’s student debt relief plan.

It could also create uncertainty for borrowers who are currently making payments under income-driven repayment plans and relying on the PSLF program for loan forgiveness.

Another challenge in implementing the student debt relief plan is the potential for political opposition, particularly from the GOP.

The GOP has opposed the plan and has proposed a debt ceiling plan that would limit the amount of money the government can borrow and potentially jeopardize the student debt relief measures.

The GOP’s opposition to the plan could make it more difficult for the Biden-Harris Administration to pass the necessary legislation to implement the plan. It could also lead to a protracted political battle that could further delay relief for borrowers.

Conclusion

The Biden-Harris Administration’s student debt relief plan and the proposed expansion of the PSLF program have the potential to provide much-needed relief to millions of borrowers who are struggling with student loan debt. However, the plan faces significant challenges, including legal challenges and political opposition.

While the proposed measures would provide immediate relief to some borrowers, they do not address the broader issue of the rising cost of higher education and the increasing burden of student loan debt on borrowers.

More needs to be done to address these issues and ensure that borrowers have access to affordable higher education and a path to financial stability.

RELATED ARTICLES

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

1 Comment

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what to do next. Read now.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

Selling Your Home Isn’t a Chore. It’s a Power Test.

Avoid costly seller mistakes—price smart, negotiate, handle appraisals, and protect your equity. Read the full seller playbook.

By Article Posted by Staff Contributor

American Middle Class / Jan 24, 2026

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

By FMC Editorial Team

American Middle Class / Jan 23, 2026

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

By FMC Editorial Team

American Middle Class / Jan 21, 2026

The government was about to take your paycheck. Then it hit pause.

Wage garnishment paused for defaulted student loans—what it means for your paycheck, tax refund, and next steps. Read before it restarts.

By Article Posted by Staff Contributor

American Middle Class / Jan 21, 2026

January Is Financial Wellness Month — and Your Boss Cares More Than You Think

January reset: budget, emergency fund, debt & accountability—plus an employer playbook. Use the tools and start today.

By Article Posted by Staff Contributor

American Middle Class / Jan 19, 2026

Trump’s 401(k) Down Payment Plan: A House Today, a Retirement Tomorrow?

Could Trump let you use 401(k) money for a down payment? Learn how it works, risks to retirement, and price impacts—read first.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

The One-Income Family Is Becoming a Luxury. Here’s the Salary It Takes Now.

How much must one parent earn so the other can stay home? See the real math, examples, and tradeoffs—run your number now.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read...

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what...

Pingback: Americans of all Generations Living Paycheck to Paycheck - FMC