Scam Red Flags, “Limited Time” Pressure, and Fake Charity Drives A red-flag checklist and two-step verification script before you click. A Financial Middle Class infographic reminding...

If you’ve ever paid a $35 overdraft fee or borrowed $500 from a payday lender, you’ve felt the reach of America’s quietest predator — the financial...

A bank account should keep your money safe — not nickel-and-dime you every month. If you’ve ever been hit with a $35 overdraft fee or had...

The fight for fairness in finance isn’t fought in marble halls — it’s fought every time a family gets hit with a $35 overdraft fee. If...

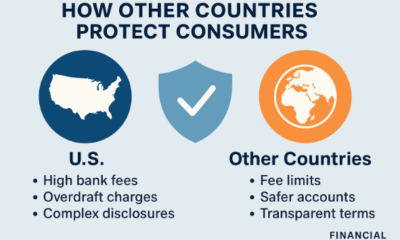

If you think American banks charge too many fees, you’re right — and you’re not imagining it. Compared to much of the developed world, the United...

Introduction: Why the Same Names Keep Coming Up When headlines break about banks mistreating customers, the names are often familiar: Wells Fargo. Bank of America. Citibank....

The $500 that vanished in seconds You sell a couch. The buyer says they’ll Zelle you $500. A notification pops up—money received! You help load the...

Introduction: The Bank’s $35 Coffee You buy a $3 coffee on your debit card, but your account is a little short. Instead of declining the transaction,...

Introduction: When Rationality Meets Reality Traditional economics tells us that consumers make rational decisions: weigh the costs and benefits, and choose the best outcome. If that...

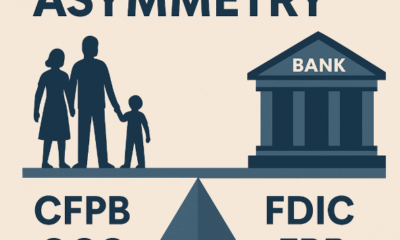

Abstract Middle-class Americans maintain a structurally unequal relationship with the country’s largest banks. This asymmetry stems from persistent financial literacy gaps, the complexity of modern banking...