NO, TESLA IS NOT WORTH MORE THAN TOYOTA, VOLKSWAGEN, HYUNDAI, GM, AND FORD PUT TOGETHER

By MacKenzy Pierre

The estimated reading time for this post is 390 seconds

Tesla, the American electric vehicle and clean energy company, market capitalization hit $500 billion this week. Market capitalization or market cap is the market value of a publicly-traded company’s outstanding shares.

On February 19, 2020, Tesla completed a public offering of its common stock and issued a total of 15.2 million shares; on August 10, 2020, it declared a five-for-one split, and on September 1, 2020, it raised $5 billion by selling additional 11,141,562 shares of common stock.

The above financial and accounting transactions created a lot of additional outstanding shares. Also, it shows that Tesla is far from being able to finance its growth through its operations.

The new market cap makes Tesla more valuable than Ford, Hyundai, General Motors (GM), Toyota, and Volkswagen combined.

Omitting irrational exuberance, Tesla should not even be more valuable than Toyota, which Lexus luxury vehicle division is marketed in more than 70 countries and territories worldwide. As of this writing, Toyota’s market capitalization is around $186 billion.

The common rebuttals that I often get from Tesla’s fanatics are it is the leader in the alternative fuel vehicle market and the self-driving technology and other vehicle applications and software platforms. They mean that Tesla is a technology company like Google and Microsoft.

Jim Cramer, the animated host of the American finance television program Mad Money, said that ” Tesla’s not really a car company, it’s a tech company one wheels. That’s what keeps confusing people.”

Daimler AG and Volkswagen AG have been pioneered intuitive mobility technology for years, but investors have never mistaken the parent companies of Mercedes-Benz and Lamborghini for technology firms.

I remember that it was not too long ago that people like Jim Cramer were telling their viewers that WeWork was a technology company, not just another commercial real estate firm. We all know how that situation ended.

Before digging into the fundamental analysis for all the six companies ( Tesla, Ford, Hyundai, General Motors (GM), Toyota, and Volkswagen), I want to remind you of the additional brands that legacy automakers such as Toyota and Volkswagen have in their portfolios.

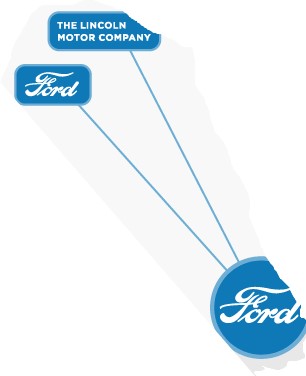

Ford Brands

The Ford Motor Company controls the Ford and Lincoln brands. In 2019, the company sold 5.4 million vehicles. According to cardsanddrive.com, its Ford F-Series was the best-selling vehicle in the united state of America in 2019, with 896,526 vehicles sold.

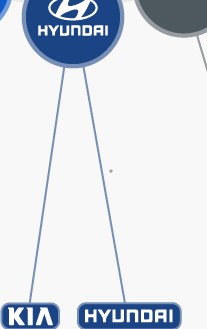

Hyundai Brands

The Hyundai Motor Company or Hyundai Motors control both Hyundai and Kia brands. The South Korean multinational automotive manufacturer sold 688,771 vehicles in the U.S., with nearly 4.6 million cars sold globally.

According to cardsanddrive.com, Hyundai Elantra was one of the best selling cars in America in 2019.

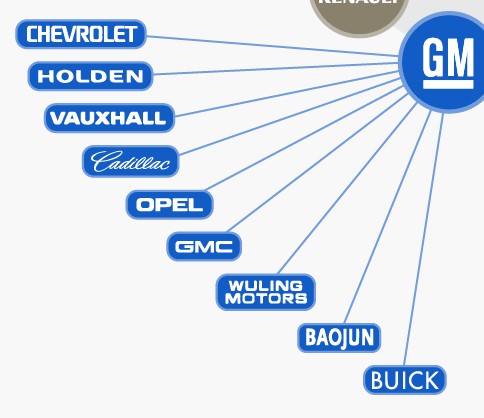

General Motors Brands

According to carsandrives.com, GM will soon have 12 electric vehicles, including Hummer EV, Chevy Bolt, and Cadillac LYRIQ.

In 2019, GM sold nearly 2.9 million vehicles in the United States, with about 7.7million vehicles sold globally.

Chevrolet Silverado, Chevrolet Equinox, GMC Sierra were amongst the best selling cars in the united states in 2019.

Toyota Brands

Toyota Motor Corporation is the world’s largest automaker by volume. Lexus and Scion are its two wholly-owned brands, but it owns controlling and minority stakes in truck and bus manufacturers Hino and Daihatsu and Subaru, respectively.

In 2019, Toyota Motor Corporation sold nearly 9 million vehicles globally. Toyota Highlander, Toyota Tacoma, Toyota Corolla, Toyota Camry, Toyota RAV4 were amongst the top-selling cars in America.

Subaru Forester and Subaru Outback were also amongst the top-selling cars in America. Toyota Motor Corporation owns a minority stake in Subaru’s parent company.

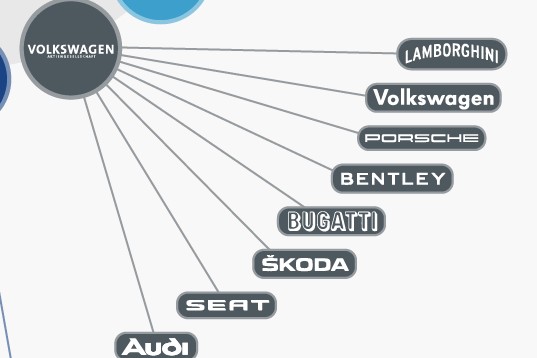

Volkswagen Brands

Lamborghini, Bentley, and Bugatti are amongst Volkswagen AG’s twelve brands with an individual identity and common goal.

The German multinational automotive manufacturing sold nearly 6.3 million vehicles globally in 2019.

Volkswagen AG does not have any vehicles listed on the carsanddrives.com 25 best-selling cars, trucks, and SUVs of 2019. However, Lamborghini, Bentley, and Bugatti, Audi are loved brands in America.

Tesla Brands

In 2019, Tesla sold 367,500 cars. Toyota Camry, Toyota RAV4, and Ford F-Series sold 336,978, 448,071, and 896,526 units sold.

However, the Tesla Model 3 was the world’s most popular plug-in electric vehicle with worldwide unit sales of more than 300,000 in 2019

Tesla Fundamental Analysis

On Oct. 21, Tesla reported third-quarter results net income of $331 million on revenue of $8.77 billion.

The company’s adjusted earnings of $0.76 per share, above estimates of $0.56.

Tesla sees third-quarter revenue of $8.77 billion vs. consensus for $8.36 billion.

The company reported deliveries of 139,300 vehicles for the third-quarter ending September 30, 2020

Operating expenses increased by 33%; its income from operations was $809 million.

This year, Tesla has a couple of profitable quarters. However, it remains to be seen whether or not the company can grow global product sales, install and service vehicle charging networks, and continue to remove vehicle delivery bottlenecks for consumers are yet to be seen.

Most importantly, all the aforementioned established automotive manufacturers’ Capital expenditures (CapEx) are allocating towards their alternative fuel vehicle divisions, with Volvo promised to have all-electric vehicles by 2030.

Ford Fundamental Analysis

On Oct. 28, Ford Motor Company reported third-quarter results net income of $2.4 billion on revenue of $38 billion.

The company’s adjusted earnings of $0.65 per share, well above estimates of $0.19.

Ford sees third-quarter revenue of $38 billion vs. consensus for $37 billion.

The company sold 551 796 vehicles for the third-quarter ending September 30, 2020

Ford Motor Company’s Ford F-Series was the best-selling vehicle in the united state of America in 2019, with 896,526 vehicles sold. The 117-year old company has executed and delivered stronger than expected financial results during the 3rd quarter.

Hyundai Fundamental Analysis

On Oct. 26, Hyundai Motor Company reported third-quarter results loss of $97.72 million on revenue of $24.4 billion below analyst expectations.

The company sold 173,028 vehicles in the United States for the third-quarter ending September 30, 2020. They sold 997,842 vehicles worldwide in the July-September period.

Hyundai Motor Company would have had a $1.6 billion net income if it were not because of its engines’ ongoing issues. During the third quarter, the company spent nearly $5 billion to address the quality problem with the engines.

GM Fundamental Analysis

On Nov. 5, General Motors Company reported third-quarter results net income of $4.05 billion on revenue of $35.48 billion. The net income increased by a whopping 74% in the July-September period.

The company’s adjusted earnings of $2.83 per share, above estimates of $1.38.

GM had third-quarter revenue of $35.48 billion vs. consensus for $35.51 billion.

The company sold 665,192 vehicles for the third-quarter ending September 30, 2020

Unlike Tesla, which depends on outside funds to fund its ambitious growth. The largest US automaker generated $9.1 billion in cash flow from its auto operations during the third quarter. At the end of the third quarter, GM had $30.2 billion in cash.

Toyota Fundamental Analysis

On May 12, the Japanese giant automotive reported its financial results for the fiscal year ended March 31, 2020. Toyota reported third-quarter results with a net income of $17.27 billion on revenue of $274.6 billion.

The company sold 8,958,423vehicles for the fiscal year ended March 31, 2020

Toyota Motor Corporation Global Presence

During the fiscal year ended March 31, 2020, Toyota Motor Corporation sold 2,239,549 in Japan, 2,713,165 in North America, 1,028,537 in Europe, 1,604,870 in Asia, 1,372,302 in South America, Africa, and the Middle East.

Volkswagen Fundamental Analysis

On Oct. 29, Tesla reported third-quarter results net income of $3.2 billion on revenue of $66.9 billion.

The company sold 2.6 million vehicles for the third-quarter ending September 30, 2020

The German auto giant seems like it put the CO2 emission scandal behind as it returned to profitability in the midst of a pandemic.

Conclusion

Tesla is not worth more than the Ford Motor Company, Hyundai Motors, General Motors Company, Toyota Motor Company, and Volkswagen AG combined.

At the end of the third quarter, GM had $30.2 billion in cash. Toyota reported a net income of $17.27 billion for that same quarter, and they sold nearly 2.8 million vehicles in Nort America alone.

A valid argument can be made that Tesla is more valuable than Ford because of its excess debt and rigid bureaucracy or Hyundai Motors with its continuous operational deficiency.

However, that argument starts losing weight when factoring well-established and profitable giants such as Toyota Motor Company or Volkswagen AG.

Senior Accounting & Finance Professional|Lifehacker|Amateur Oenophile

RELATED ARTICLES

The Affordability Pivot: Can Trump’s New Promises Actually Lower the Middle-Class Bill?

Will Trump’s affordability proposals lower your bills—or backfire? Housing, rates, tariffs, gas, credit cards—explained. Read now.

Starting a Nonprofit Is Easy. Starting the Right Nonprofit Is the Hard Part.

The estimated reading time for this post is 880 seconds Last updatedJanuary 13, 2026 — Updated for IRS e-filing pathways (Pay.gov), the 501(c)(4) notice requirement, and a clearer “choose your lane” decision framework. Skip to Jump to the section you...

1 Comment

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what to do next. Read now.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

Selling Your Home Isn’t a Chore. It’s a Power Test.

Avoid costly seller mistakes—price smart, negotiate, handle appraisals, and protect your equity. Read the full seller playbook.

By Article Posted by Staff Contributor

American Middle Class / Jan 24, 2026

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

By FMC Editorial Team

American Middle Class / Jan 23, 2026

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and...

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy....

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect...

Pingback: 2021 IPO DRAFT CLASS: Ranking the Top 10 Prospects - FMC