The December Energy Bill: Heat, lights, and inflated utility bills—practical cuts that don’t kill the vibe.

By Article Posted by Staff Contributor

The estimated reading time for this post is 581 seconds

The December Energy Bill

Heat, lights, and inflated utility bills—practical cuts that don’t kill the vibe.

The answer isn’t to sit in the dark and eat cold food. You don’t need a miserable, candlelit austerity Christmas to be responsible. You need to know where the money is actually going, what cuts move the needle, and what’s just guilt masquerading as savings.

Let’s pull the holiday vibes and the hard numbers into the same room.

Where Your December Energy Money Actually Goes

Most people underestimate some parts of their usage and wildly overestimate others.

The big energy hogs in December are almost always:

- Heating (or cooling, depending on your climate)

- Hot water

- Major appliances (oven, dryer, dishwasher)

The stuff we obsess over—like whether the tree lights are on for an extra hour—matters, but not nearly as much as you think compared to running the heat a few degrees higher all day.

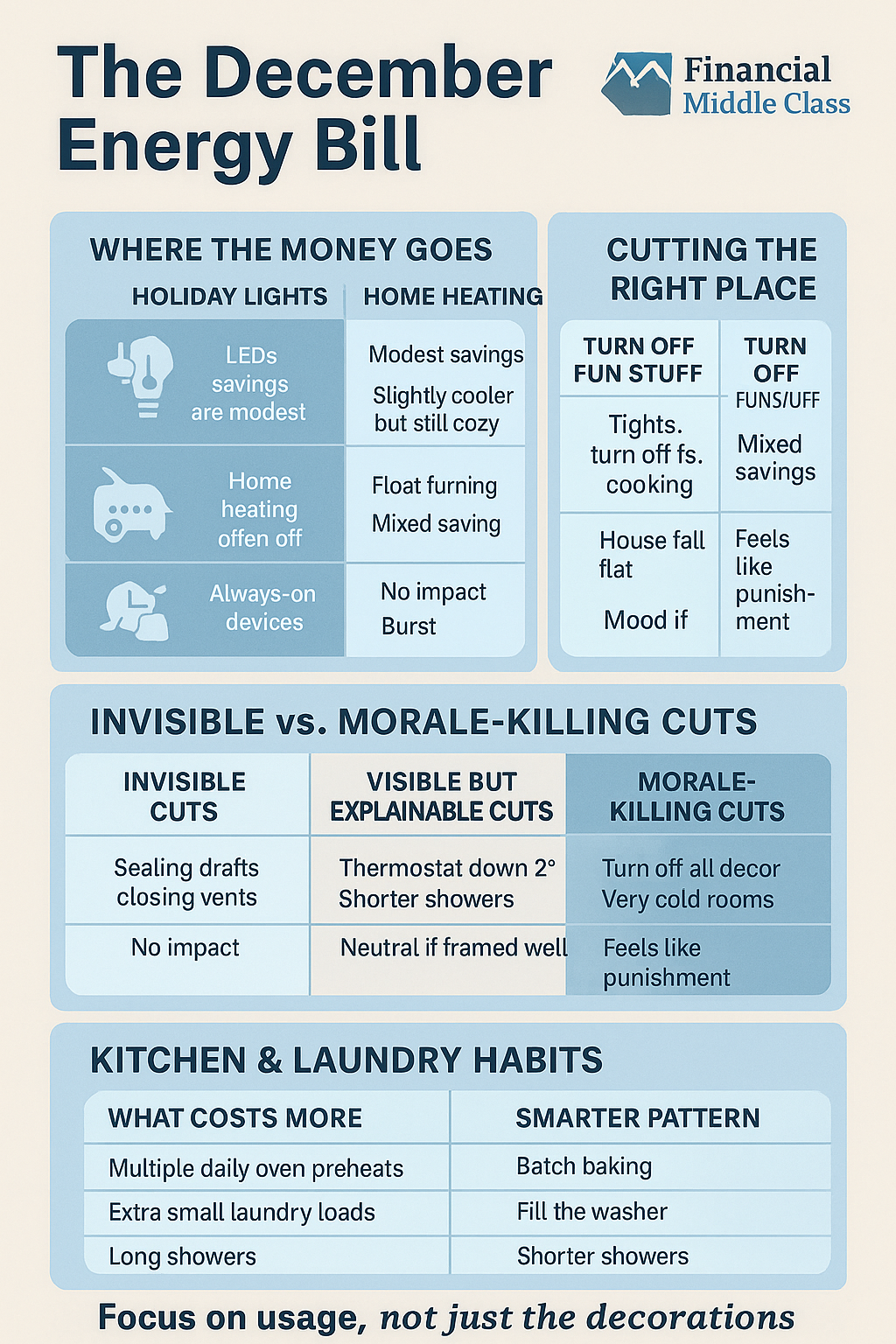

Here’s a simple side-by-side way to think about it:

| Category | What Feels Big Emotionally | What Usually Costs More in Reality |

|---|---|---|

| Holiday lights | “The whole house is lit up, that must be expensive.” | LED strings and timers are relatively cheap per hour of use |

| Home temperature | “Two degrees can’t make that much difference.” | Heating is often 40–50%+ of winter energy usage |

| Oven / cooking | “I’m just baking a little more, that can’t be it.” | Frequent baking and roasting adds up, especially with older ovens |

| Laundry & dishes | “The machine is running in the background; I barely notice it.” | Hot water and dryer cycles quietly chew through kWh or gas |

| Always-on devices | “TVs and chargers don’t seem like a big deal.” | Individually small, but constant draw adds up month after month |

Once you see that clearly, you stop obsessing over the wrong things. You focus on the handful of levers that give you a real drop in the bill without turning your house into a cave.

Heat vs Holiday Glow: Cutting in the Right Places

If you want to cut your December bill, you’re usually better off nudging the thermostat than unplugging the tree.

But you also don’t want to freeze your family for the sake of a $20 savings. The sweet spot is comfort with intention: you target waste, not warmth.

Here’s how that tradeoff really looks:

| Turn Down the Heat a Bit | Turn Off All the Fun Stuff | |

|---|---|---|

| What changes | Thermostat down 2–3°F during waking hours; more at night with blankets | No tree lights, no outdoor lights, minimal cooking, few hot showers |

| Impact on bill | Often meaningful in cold climates; heating is a big slice | Mixed; some savings, but often smaller than you think |

| Impact on mood | Slightly cooler, but still cozy with layers | House feels flat, kids notice, “holiday” feels like any other week |

| Realistic to sustain? | Yes, if the whole family is on board | Usually not; people rebel and stop doing it |

The point isn’t to pretend small things never matter. It’s to admit that some cuts get you 80% of the benefit with 20% of the sacrifice. That’s where a middle-class household should start.

The December Utility Check-In: Two Columns, Honest Answers

Before you start unplugging everything and snapping at people to close the fridge, do a quick check-in. Fill out two mental columns:

| Question | Practical Column (Hard Numbers) | Emotional Column (What You’re Afraid Of) |

|---|---|---|

| “What was my bill this time last year?” | Pull last December’s statement or app history | “I don’t want to see how bad it was.” |

| “What’s different this year?” | More people home? Colder? Higher rates? New appliances? | “Everything feels more expensive; I feel out of control.” |

| “What can’t I realistically change?” | Size of your home, your climate, your basic work schedule | “I wish I could just move or install solar tomorrow.” |

| “What can I tweak without making us miserable?” | Thermostat, water temperature, timers, usage patterns | “I’m worried the kids will feel punished or I’ll look ‘cheap.’” |

This is the real tension: you’re trying to manage a bill without broadcasting scarcity to your family. That’s where framing and small, smart moves come in.

Smart Cuts That Don’t Kill the Vibe

You can think of December energy decisions in three buckets: invisible cuts, visible but explainable cuts, and cuts that damage morale. You want to maximize the first two and avoid the third.

| Bucket | Examples | How It Feels at Home |

|---|---|---|

| Invisible cuts | Sealing drafts, using door snakes, closing vents in unused rooms, smart power strips | Nobody really notices; house simply feels more comfortable |

| Visible but explainable cuts | Thermostat down a couple degrees, shorter showers, running full loads only | Kids might ask why; easy to frame as “team effort” or “eco-smart” |

| Morale-killing cuts | No lights at all, very cold rooms, shaming people for normal use | Feels like punishment; holiday mood tanks |

Start with the invisible cuts. They improve comfort and cost at the same time. Then decide as a family how far you’re willing to go on the visible ones.

Instead of “We’re broke, turn everything off,” try, “Energy is expensive this month. Let’s make a few smart moves so we can keep the stuff that really matters.”

A Simple “December Energy” Decision Tree

You don’t need to become an energy auditor. You just need a basic decision path for any change you’re considering.

Think of it like this:

| Step / Question | If YES | If NO |

|---|---|---|

| 1. Does this change target a big usage category (heat, hot water, major appliances)? | Go to Q2. | It’s a small win; do it only if it doesn’t cause drama. |

| 2. Will this noticeably hurt comfort or mood? | Go to Q3. | Do it. This is prime territory (e.g., sealing drafts, better use of thermostat). |

| 3. Can I frame this as a family “smart move,” not punishment? | Explain the “why” and set a clear limit (e.g., “2 degrees down, blankets out”). | If you can’t explain it without shame, reconsider; look for smaller or different cuts. |

| 4. Does this change save enough to be worth the friction? | Keep it for now and review next month’s bill. | Drop it; focus on a different lever that offers more savings for less resentment. |

That tree keeps you from going hard on things that save pennies while burning goodwill.

Holiday Lights and Decorations: Where to Draw the Line

Let’s talk honestly about lights.

Are they the biggest problem on your bill? Usually not. Can they matter? Sure, especially with older incandescent strands running all night. But modern LEDs on timers are closer to “symbolic” expenses than budget wreckers.

Here’s how to think about it:

| Setup | Cost / Tradeoff Reality | Middle-Class Move |

|---|---|---|

| Old incandescent strands, on all night | Higher draw; leaving them on 8+ hours nightly will show up more | Replace a few each year with LEDs; use timers to shut off overnight |

| LED strands on timers | Much lower draw per hour | Keep them; focus cuts elsewhere |

| Giant inflatable displays | Bigger bump, especially if multiple are running constantly | Keep one statement piece or time-limit when it’s on |

| Whole-house dark to “save” | Some savings but heavy mood cost | Overkill unless you’re in a real emergency |

You’re allowed to keep some glow. The key is intentionality: timers, LEDs, and a choice about how many hours per night feel worth paying for.

Kitchens, Laundry, and Showers: Where Habits Quietly Drive the Bill

If you want to get serious about that December bill without turning into a dictator, the low-drama place to focus is how and when you use energy-heavy stuff.

Side by side:

| Area | Typical Holiday Use Pattern | Smarter Pattern That Still Feels Normal |

|---|---|---|

| Oven | Multiple preheats per day, small batches, door opened often | Batch baking, fewer preheats, use smaller appliances when possible |

| Laundry | Many small loads, extra “just in case” washing | Full loads only, cold water when possible, hang-dry some items |

| Dishwasher | Half-full cycles after every gathering | Full loads, air-dry option, run at off-peak times if rates vary |

| Showers | Longer “it’s cold out” showers for everyone | Agree on a reasonable time; kids first, set a family norm |

You’re not banning comfort. You’re cutting mindless waste.

The conversation at home matters more than the exact settings. “We’re all going to be a bit more mindful this month so we can afford X without stressing about the bill,” lands a lot better than, “Turn that off; you’re costing me money.”

The Emotional Side of the December Bill (And How to Talk About It)

Part of why the December bill hits so hard is that it doesn’t show up in isolation. It lands on top of holiday spending, travel costs, and the mental load of “Did I give my family enough?”

So when you see a bigger number than you like, your brain doesn’t just think, “Hmm, usage up.” It goes to, “I’m failing. I can’t keep up. I’m bad with money.” That shame makes it harder to make rational changes.

Here’s a healthier way to frame it for yourself and your household:

| Old Story | Better Story |

|---|---|

| “We’re terrible with money; look at this bill.” | “Energy is more expensive and we’re home more. Let’s make a few smart changes.” |

| “Nobody respects how hard I work to pay this.” | “I need to share the real numbers so we can be a team about it.” |

| “We can’t have nice holidays without going broke.” | “We can have warmth and lights; we just can’t waste energy where it doesn’t add joy.” |

You’re not lying about reality. You’re choosing a frame that leads to action instead of paralysis.

Putting It All Together: A December Energy Plan That Respects Your Life

You don’t need a spreadsheet and a decade-long retrofit plan to get control of December. You need a one-page plan that fits your actual life.

Think of it like this:

| Piece of the Plan | Example You Might Use |

|---|---|

| Target bill change | “I want this December’s bill within $X of last year, not $100 higher.” |

| Thermostat rule | “Daytime: 68°F. Night: 65°F with blankets. No random cranking to 75.” |

| Lights rule | “Tree and front lights on from 5–10 p.m., LEDs only, timers set.” |

| Hot water rule | “Shorter showers, full loads for laundry and dishes only.” |

| Communication script | “Energy is expensive. We’re making a few smart moves so we can still enjoy the fun stuff without worrying about the bill.” |

If you want to go one step further, you can screenshot or print your utility usage graph and make it a little scoreboard: “Team [Your Family Name] vs. the Energy Bill.” Kids will often get weirdly into beating last year’s number if you present it as a challenge instead of a scolding.

The goal isn’t a perfect, minimalist December. The goal is a month where your utility bill feels like something you chose, not something that ambushed you.

You deserve warmth and light without dread. That’s what a few honest decisions and small, smart cuts can buy you.

RELATED ARTICLES

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

By FMC Editorial Team

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

By MacKenzy Pierre

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs....

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market...

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan...