The Danger of Setting Up Unrealistic Financial Goals

By Article Posted by Staff Contributor

The estimated reading time for this post is 631 seconds

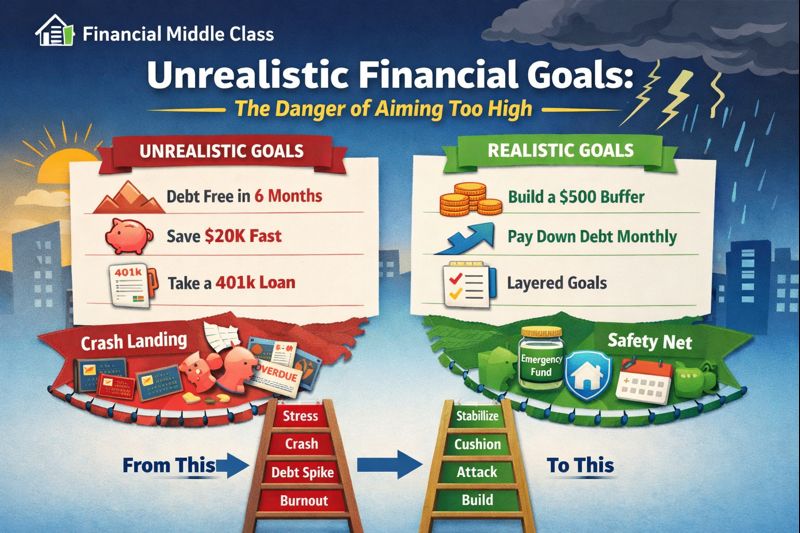

Unrealistic Financial Goals: Why They Fail (and Hurt)

Key Takeaways

- If your goal requires a perfect year, it’s not a plan. It’s a bet, and life loves ruining bets.

- Thin margin changes everything. Goals must survive surprise expenses without forcing high-interest debt.

- Trade deadlines for systems. Track inputs you can repeat: automation, fixed costs, and debt trend lines.

- Layer your goals. Keep a “floor” version for rough months so progress doesn’t collapse.

- Stability first. Cushion before you attack; attack before you build.

Timeline: A realistic path that survives real life

Week 1–2: Stabilize (stop the chaos)

Get current on essentials, kill late fees, fix overdrafts, and make bills predictable. Stability is step one, not a “nice to have.”

Week 3–6: Build a small cushion

Start with a mini-buffer so one surprise doesn’t turn into a credit card swipe and a shame spiral.

Months 2–6: Attack the highest-interest debt (consistently)

Pick the highest APR balance and make extra payments monthly. The win is the trend line going down, not a dramatic deadline.

Months 6–12: Build (automate the next level)

Increase savings, raise investing, and expand the emergency fund. Systems beat motivation.

The goal that sounds good until Tuesday happens

Every January has the same soundtrack. You’re at the kitchen table, coffee getting cold, laptop open, banking app doing what it does best: humbling you. The mortgage or rent is sitting there like a bouncer. Car insurance is next. Then utilities. Then the credit card minimums—plural, because life is expensive and pride doesn’t accept cash.

And you tell yourself, This is the year I get it together. That sentence isn’t the problem. The problem is what usually comes after it: unrealistic financial goals with timelines that require a perfect life. No emergencies. No surprises. No price hikes. No “life happened.”

Middle-class life isn’t a motivational poster. It’s a calendar full of due dates. It’s a plan that needs to survive contact with reality—because reality shows up every Tuesday.

Why unrealistic goals are dangerous

Unrealistic goals don’t just fail politely. They fail loudly. They take your confidence with them. They turn one rough month into a character judgment. Suddenly you’re not someone who hit a setback—you’re “bad with money.” That’s the lie that keeps people stuck.

Shame is expensive. Shame makes people do risky things fast: lean harder on credit, rob the emergency fund, skip the dentist, tap retirement, “just this once” their way into a hole that takes a year to climb out of.

The danger isn’t ambition. The danger is designing a goal that corners you into desperation.

The middle-class margin problem

A lot of financial advice is written like you’ve got slack—like your paycheck has a wide open lane between income and bills. For many households, that lane is a shoulder. Sometimes it’s not even that. You can be “doing everything right” and still have a budget that’s one surprise away from borrowing.

This is why unrealistic goals hit middle-class readers differently. When margin is thin, your plan needs shock absorbers. It needs room for a car repair, a medical copay, a school expense, an escrow surprise, a family emergency. If your goal collapses the first time life gets loud, it wasn’t a plan. It was a fantasy with a spreadsheet.

Why we set goals that don’t fit

Because we’re tired of the loop. Tired of debt hanging around like an uninvited cousin. Tired of “we make decent money” but still sweating the calendar. Tired of being responsible and not feeling rewarded for it.

So we reach for dramatic change: big numbers, clean outcomes, bold deadlines. Culture rewards extremes. Social media loves a transformation story. Nobody goes viral saying, “I steadily improved my cash flow over 18 months and built resilience.” That’s not a reel. That’s real life.

And real life is what your goals need to survive.

The 60-second Reality-Check Test

Before you commit to a goal, run it through four questions. Be honest. This isn’t about optimism. It’s about durability.

1) Does this goal require a perfect year?

If one surprise expense breaks the plan, you’re not planning—you’re betting.

2) Can I still do it in a bad month?

A strong goal has a minimum version you can keep even when life hits.

3) Am I trying to solve three problems with one goal?

If you’re paying debt, building savings, investing, and buying a home on the same deadline, something will snap. Usually peace.

4) What am I willing to stop paying to hit this?

If the answer is maintenance, health, insurance, or retirement, that “discipline” is really damage.

Pass the test and your goal becomes sturdier. Fail it and you adjust—before the adjustment comes in the form of a crisis.

All-or-nothing goals and burnout

All-or-nothing goals sound responsible. They feel clean. They look good in a planner. And they quietly set you up for financial whiplash.

You restrict hard. You cancel everything. You become the Budget Police. Then life punches you—car repair, medical bill, school fees, family obligation, job surprise. You miss the target. You feel like you failed. Then you swing the other way because you’re exhausted. The result is the same: the budget gets wrecked, and you end up more discouraged than when you started.

That isn’t weakness. That’s a plan with no shock absorbers.

Outcomes vs inputs: stop promising results, start building levers

Outcomes feel satisfying to announce. Inputs are what actually change your life. If you’re stuck in the middle-class reality, inputs are your best friend because they don’t require a perfect year—just repetition.

| Outcome goal (fragile) | Why it breaks | Input goal (durable) |

|---|---|---|

| “Save $20,000 this year.” | One emergency turns it into guilt, then borrowing. | Automate $X each payday + add a percentage of any extra income. |

| “Debt-free by December.” | Requires perfect months; encourages risky shortcuts. | Pay extra on the highest APR monthly; balance must trend down. |

| “Buy a home next year.” | Markets and life don’t respect your deadline. | Improve DTI, build closing-cost fund, stabilize income 6–12 months. |

Inputs don’t make great speeches. Inputs build stability.

The Goal Ladder: Stabilize → Cushion → Attack → Build

If you’re living the middle-class reality—housing costs, debt, family obligations—the order matters. The biggest mistake is trying to start at “build wealth” while your life is still stuck in “stop the chaos.”

| Step | What it looks like | Why it matters |

|---|---|---|

| Stabilize | Get current, stop late fees, stop overdrafts, predictable bills. | Chaos is a tax. Stability stops the bleed. |

| Cushion | Build a small buffer (mini emergency fund). | Prevents “one surprise = new debt.” |

| Attack | Consistent extra payments on high-interest debt. | Progress without punishment. |

| Build | Scale savings, investing, larger emergency fund. | Now you’re building from a stable base. |

This isn’t about lowering your ambition. It’s about putting your ambition on a foundation that won’t crack.

The Setback Plan (because setbacks are the plan)

You don’t need a plan that works only when life behaves. You need a plan that works when it doesn’t. That means you need a protocol for the month that goes wrong.

When you get hit, pause the stretch goal and keep the floor goal. Protect the essentials—housing, utilities, food, transportation. Stop making it personal and make it procedural. Then restart next payday without trying to “make up for it” by doing something reckless.

The goal isn’t to never get hit. The goal is to stop one hit from becoming a spiral.

Floor / Target / Stretch goals

Layered goals are the difference between a plan that survives real life and a plan that collapses the first time your car makes a new noise. You pick three versions of the same goal: a minimum you can do in a bad month, a normal target for most months, and a stretch for good months.

Your floor goal is not “small.” Your floor goal is what keeps you from starting over.

| Layer | When to use it | Example |

|---|---|---|

| Floor | Bad month | Save a small amount + pay all minimums on time. |

| Target | Normal month | Automate savings + add extra to highest APR debt. |

| Stretch | Good month | Use surplus (bonus/refund/extra paycheck) to accelerate goals while keeping some buffer. |

This is how you stay consistent without pretending your life is smooth.

Mini case studies: same goal, different life

The renter at renewal time

They set “save big this year,” then rent jumps at renewal. Their plan wasn’t irresponsible—it just didn’t account for how fast housing can shift. The adjustment isn’t shame. The adjustment is redesign.

The homeowner with a “fixed” payment that isn’t fixed

Escrow shortages. Insurance increases. Repairs that don’t care about your timeline. A strict plan collapses. A layered plan absorbs the hit and keeps going.

The parent or caregiver whose budget gets interrupted

Childcare, school costs, family emergencies. They don’t need advice that assumes predictability. They need a plan that expects disruption and still makes progress.

The “good income” household with high fixed costs

On paper, they look fine. In reality, necessities eat the paycheck. The solution isn’t a speech. The solution is lowering the load where possible, increasing income where realistic, and building cushion so one surprise doesn’t become a debt event.

Scripts for real conversations

Money goals don’t live in a vacuum. They live in a household, in family expectations, in pressure, and in the quiet voice in your head that turns setbacks into insults.

To your partner

“Let’s set goals that make us steadier, not goals that make us fight. I want progress we can repeat.”

To family pressure

“I can help, but I need to protect my household first. I can do $X, not $Y.”

To yourself after a setback

“This wasn’t failure. This was feedback. I’m adjusting the plan, not quitting.”

A 30-day Stability Sprint (realistic momentum)

Thirty days won’t fix your whole financial life. But it can prove something important: you can create traction without fantasy timelines.

Week one: find one leak. A fee, a forgotten subscription, a rate you can shop, a bill you can renegotiate. Week two: build a mini-buffer, even if it’s small. Week three: make one debt move—pick the highest APR and send an extra payment. Week four: automate one win so payday does the work without needing your willpower.

Not dramatic. Not viral. But sturdy. And sturdy is what gets people out of the loop.

FAQ

What if my income is irregular?

Use percentage-based goals (e.g., 1–2% of every deposit) and keep a floor goal so you never “start over.”

What if I’m behind on bills right now?

Prioritize stabilization: housing, utilities, food, transportation. Aggressive savings goals come after the chaos stops.

How do I set goals with a partner who isn’t on board?

Start with a shared outcome: peace. Agree on one system (buffer, autopay, or one debt target) before expanding.

What if my goal is urgent (moving, layoffs, rent hike)?

Keep the floor goal, protect essentials, and build a short-term cushion. Urgency without structure often leads to expensive debt.

The truth that hits home

Unrealistic financial goals don’t fail because you’re lazy. They fail because they were built for a life you’re not living.

Middle-class stability isn’t a dramatic declaration. It’s a set of small moves that don’t break you—moves you can repeat when the car acts up, when the grocery bill jumps again, when housing costs keep pressing, when life refuses to be convenient.

A plan that keeps you going beats a plan that impresses people.

Every single time.

RELATED ARTICLES

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

By FMC Editorial Team

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

By MacKenzy Pierre

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs....

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market...

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan...