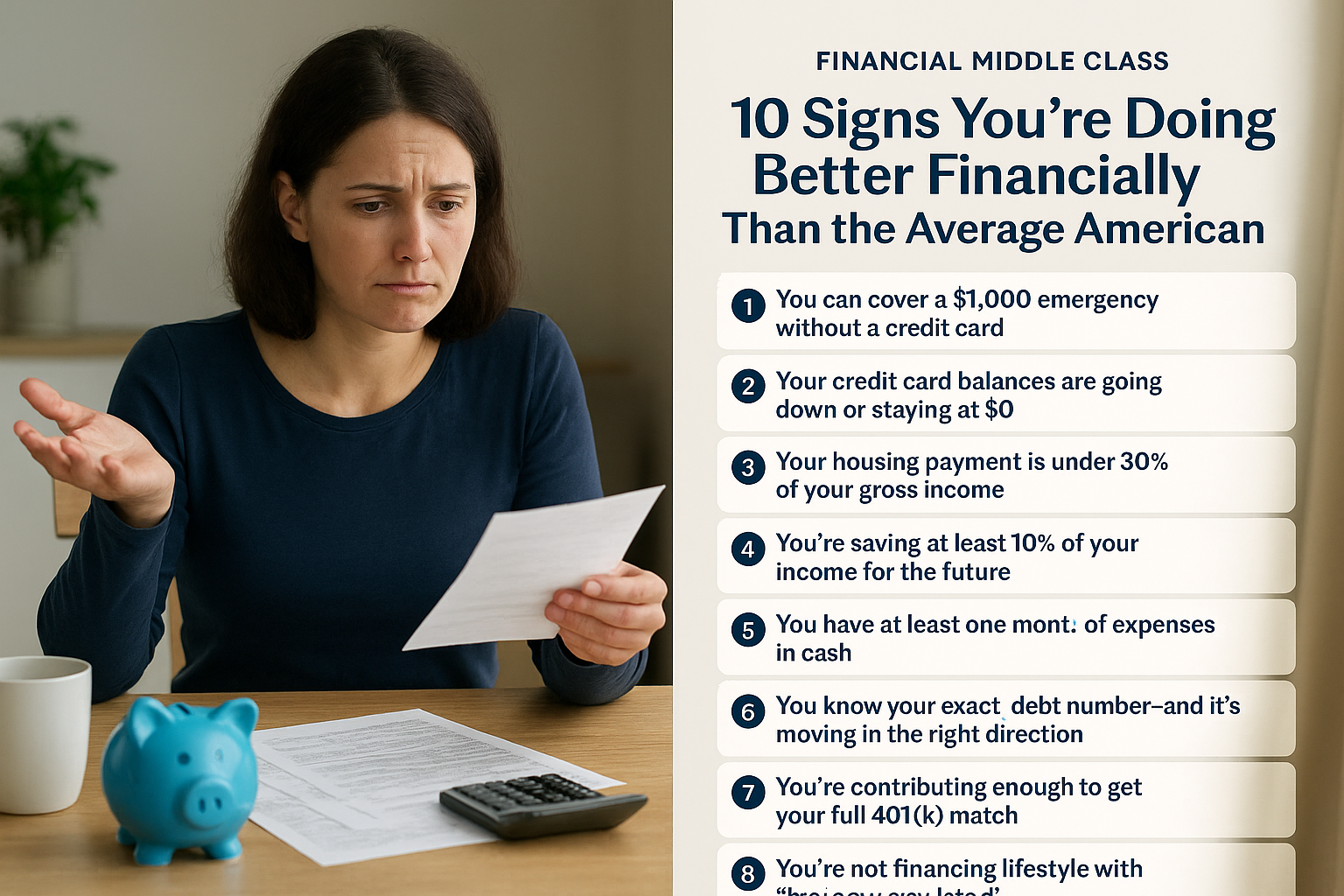

10 Signs You’re Doing Better Financially Than the Average American (Even If It Doesn’t Feel Like It)

By Article Posted by Staff Contributor

The estimated reading time for this post is 537 seconds

Middle-class Americans are going through it right now.

The affordability crisis is real. Inflation is real. Groceries, childcare, rent, car insurance—everything feels like it’s quietly raising its hand for a pay raise from your wallet. Your dollar is stretching thin, and if you scroll headlines long enough, you start to feel like everyone is drowning and you’re somehow the only one who didn’t get the manual.

But here’s the problem: consumer sentiment is often more pessimistic than the actual numbers. You can feel broke in a country where almost everything is financed, leased, or put on a payment plan. You can feel behind even while you’re actually doing better than the “average.”

So let’s reset the lens.

Here are 10 signs you’re doing better financially than the average American—even if your brain is telling you otherwise.

1. You can cover a $1,000 emergency without a credit card

Start here, because this is the quiet line between constant crisis and basic stability.

If your car needs a $900 repair, your dog needs an emergency vet visit, or your kid breaks a pair of glasses and you can handle it without:

- Swiping a credit card and carrying the balance, or

- Borrowing from family and friends,

…you’re already ahead of a huge slice of the country.

That doesn’t mean you’re rich. It just means you’ve built something most people never get around to: a real, functioning emergency cushion. Even if it’s “only” $1,500 sitting in a boring savings account, that’s not a small thing. That’s a shock absorber for your life.

If you’ve got this covered, that’s Sign #1 you’re not as behind as you think.

2. Your credit card balances are going down or staying at $0

Credit cards are not evil. But credit card interest is absolutely a wealth leak.

Look at your last 12 months. Are your balances:

- Lower now than they were a year ago?

- Or at $0 most months because you pay in full?

If yes, you are quietly beating the game.

Millions of people are using credit cards just to survive the month—groceries, gas, utilities—and then carrying the balance for years. If you’re either holding the line (no new debt) or slowly shrinking what you owe, that’s a sign of discipline in a very undisciplined system.

You don’t have to be debt-free to be on the right track. You just have to be moving in the right direction.

3. Your housing payment is under 30% of your gross income

Housing is eating the middle class alive.

If your rent or mortgage payment is under about 30% of your gross income, you have something most people don’t: room to breathe.

For example, if your household brings in $6,000 a month before taxes and your rent is $1,600, that’s roughly 27%. It might still feel high, but in an economy where people routinely pay 40–50% of their income to landlords and lenders, you’re doing better than you think.

That gap between what you could be paying and what you are paying is where your savings, investing, and sanity live.

Is 30% a magic number? No. But if you’re under it—or even working your way down toward it—you’re in more stable territory than a lot of middle-class households.

4. You’re saving at least 10% of your income for the future

Here’s the part that feels impossible when everything is expensive: consistent saving.

If you are:

- Contributing to a 401(k), 403(b), or TSP at work,

- Putting money into an IRA, HSA, brokerage account, or

- Automatically moving money to a “future you” savings account…

…and that total adds up to around 10% or more of your income, you’re not average—you’re intentional.

Most people plan to start saving “when things calm down.” Spoiler: things never really calm down. So if you’ve figured out how to save in the middle of chaos, that habit is a superpower.

You might not see the payoff yet. But your future self will absolutely thank you.

5. You’ve got at least one month of expenses in cash

If you lost your job tomorrow, how long could you keep the lights on without a paycheck?

If the answer is at least one month, in actual cash (not credit), you are not behind.

Is one month enough? No, the ideal is three to six months. But a lot of people don’t even have one week. So if you’ve got:

- Rent or mortgage

- Utilities

- Groceries

- Car payment/insurance

…covered for 30 days without borrowing, you’ve built a foundation most households are still wishing for.

The real win? One month proves you can save. Going from one to two, then three, is just repetition—not reinvention.

6. You know your exact debt number—and it’s shrinking (even slowly)

Most people carry their debt as a feeling, not a number:

“Too much.”

“A mess.”

“A couple cards and a loan.”

If you can say, “I owe $18,400 total, down from $22,000 last year,” you’re in a different category.

Knowing your exact debt number means:

- You’ve looked it in the face,

- You’ve stopped pretending it’s fog, and

- You have some kind of plan (even if it’s not perfect).

If that total is moving in the right direction—$50, $100, $200 at a time—that’s real progress. You still might feel “in debt,” but numerically, you’re trending away from the average American, not toward it.

7. You’re getting your full 401(k) match at work

If your employer offers a match and you’re contributing enough to get every free dollar, that’s one of the most “above-average” moves you can make.

Example:

If your employer matches 50% of your contributions up to 6% of your salary, and you’re putting in the full 6%, you’re getting an automatic 3% raise in the form of retirement savings.

A surprising number of people leave this money on the table, either because they don’t understand it or feel they “can’t afford” to contribute.

If you’re grabbing the match, you’ve done what many never do: lined up your money with the benefits that already exist around you.

You don’t have to max out your 401(k). That’s a great goal, but if you’re at least capturing the match, you’re not behind—you’re building.

8. You’re not financing your lifestyle with “buy now, pay later”

We don’t talk about this enough: “buy now, pay later” is just debt hiding behind friendlier branding.

If Klarna, Afterpay, Affirm, in-store payment plans, and “0% for 6 months” offers are rare in your life—or you use them only for true big-ticket necessities and pay them off on time—you’re avoiding one of the fastest-growing traps.

The average American is surrounded by little monthly payments:

- $19.99 for a subscription here

- $43 bi-weekly for a gadget there

- Four payments of $29.75 for sneakers, clothes, or decor

Individually, they feel small. Together, they quietly lock in a lifestyle you can’t afford.

If most of your day-to-day spending is on things you can pay for today—not split into four—your money is healthier than you realize.

9. Money conversations in your home are honest—even if they’re uncomfortable

Here’s a financial metric nobody charts but everyone lives:

Can you talk about money with the people in your house without it turning into a disaster?

If you and your partner (or you and yourself) are:

- Checking in about bills and income,

- Agreeing on what gets paid first,

- Talking about goals (debt payoff, a house, retirement, kids’ activities),

…you’re already in a stronger position than couples and households that avoid money talks completely.

Avoidance is expensive. Late fees, overdrafts, surprise balances, missed opportunities—those are all the price of “we’ll deal with it later.”

If you’ve shifted from avoidance to honesty, you’re not just above average financially—you’re building financial resilience.

10. Your net worth is positive—or steadily becoming less negative

Net worth sounds like something only rich people have, but everyone has one.

It’s simply:

What you own – what you owe

If you add up:

- Cash

- Retirement accounts

- Savings

- Equity in your home or car

…and subtract:

- Credit cards

- Personal loans

- Student loans

- Auto loans

…and the number is positive, that’s a big deal. You may not feel wealthy, but mathematically, you’re ahead of many households that look “successful” on the outside.

Even if your net worth is still negative, but that negative number is shrinking year over year, that’s another sign you’re doing better than you feel. You’re moving toward stability instead of drifting away from it.

The key isn’t perfection. It’s direction.

Why It Still Feels Like You’re Losing

So you’re checking several of these boxes, but emotionally you feel broke. Why?

Because you’re living in:

- A high-cost economy

- A comparison culture (social media, lifestyle content, flex culture)

- A constant news cycle screaming crisis

You’re comparing your real life to other people’s highlight reels and to an economy that was very different 20–30 years ago.

The point of this list isn’t to gaslight you into feeling “lucky” when you’re tired and stretched. It’s to remind you that progress and stability don’t always feel dramatic.

Sometimes “doing better than average” looks like:

- Saying no to a trip you can’t afford

- Driving the older car that’s paid off

- Living in the smaller apartment that lets you save

- Paying down debt $75 at a time

- Choosing boring index funds over shiny get-rich-quick schemes

Those choices are not signs of failure. They’re signs you’re playing the long game.

What to Do If You Only Check 2–3 of These Boxes (So Far)

If you read through this and only saw a few wins, that’s not a reason to spiral. It’s a roadmap.

Pick one or two moves you can work on over the next 6–12 months:

- Build a $1,000 starter emergency fund.

- Get your full 401(k) match.

- Kill one credit card balance and stop using it.

- Get your housing cost down at your next renewal.

- Start tracking your net worth four times a year, even if it’s negative.

You don’t fix a middle-class affordability crisis by skipping lattes. But you also don’t build financial stability by doing nothing because “everything is rigged.”

You focus on the levers you can pull, in your house, with your numbers.

And if you’re already checking most of these boxes? Give yourself credit. You’re not just surviving a tough economy—you’re quietly building the kind of financial life most people wish they had, even if they don’t say it out loud.

RELATED ARTICLES

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs. Read now.

By FMC Editorial Team

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market isn’t the economy—read now.

By MacKenzy Pierre

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan to escape 25% APR debt.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

What To Do If You Get Fired With an Outstanding 401(k) Loan

Fired with a 401(k) loan? Avoid taxes, offsets, and deadline traps with this step-by-step checklist. Read now.

By Article Posted by Staff Contributor

American Middle Class / Feb 09, 2026

The Real Math of Money in Relationships

Split finances without resentment. Any couple, any income ratio. Use the worksheet + rules—start today.

By Article Posted by Staff Contributor

American Middle Class / Feb 03, 2026

Investing or Paying Off the House?

Invest or pay off your mortgage? See a $500k example with today’s rates, dividends, and peace-of-mind math—then choose your plan.

By Article Posted by Staff Contributor

American Middle Class / Jan 30, 2026

Gold, Silver, or Bitcoin? Start With the Job—Not the Hype

Gold, silver or Bitcoin? Learn what each is for—and how to size it—before you buy. Read the framework.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Florida Homeowners Pay the Most in HOA Fees

Florida HOA fees are surging. See what lawmakers changed, what’s next, and how to protect your budget—read before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 29, 2026

Why So Many Homebuyers Are Backing Out of Deals in 2026

Why buyers are backing out of home deals in 2026—and how to avoid costly surprises. Read the playbook before you buy.

By Article Posted by Staff Contributor

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

Latest Reviews

American Middle Class / Feb 18, 2026

How Wealth Is Passed Across Generations in the United States: Mechanisms, Evidence, and the Policy Debate

How wealth passes between generations—trusts, taxes, and the debate. Get the facts, figures, and tradeoffs....

American Middle Class / Feb 16, 2026

The S&P 7,000: How Wall Street Disconnects from Main Street

S&P 7,000 can rise while wages, benefits, and towns fall behind. See why the market...

American Middle Class / Feb 16, 2026

The “Resilient Consumer” Is Real—But So Is the Interest Bill

Credit card balances are rising as savings fall. See what it means—and the 30/60/90 plan...