Rent, Groceries, Gas: What’s a Reasonable Amount for Each Category on a $X Income?

By Article Posted by Staff Contributor

The estimated reading time for this post is 320 seconds

One of the most common questions people quietly Google late at night is:

“How much should I be spending on rent? On groceries? On gas?”

You’re not looking for perfection. You just want to know if you’re completely off the rails.

The problem is, most advice is either:

- Unrealistic (“Just keep housing under 25% in a city where studios are $2,200”), or

- Uselessly vague (“Spend less eating out!”).

Let’s put some actual numbers on the table—for three real-world paychecks:

- $3,000 take-home per month

- $4,500 take-home per month

- $6,000 take-home per month

And let’s walk through what “reasonable” rent, grocery, and gas numbers look like for each.

Not perfect. Not Instagram-worthy. Just reasonable.

First, Some Guardrails: What the Data Says vs. What’s Ideal

The Bureau of Labor Statistics tracks how households actually spend:

- Housing takes about 33% of the typical household budget.

- Transportation takes around 17%.

- Food is roughly 13%.

Those are averages, not ideals. They include high-income households, people with paid-off homes, folks deep in debt, and everything in between.

On the other side, you’ve got rules of thumb like:

- Housing cost ≤ 30% of income.

- The 50/30/20 rule: 50% needs, 30% wants, 20% savings/debt.

For most middle-class households trying to save, pay debt, and not feel squeezed 24/7, I like the following targets for take-home pay:

- Rent/Housing: Aim for 25–30% of take-home (lower is better).

- Groceries (at home, not restaurants): About 10%.

- Gas/Transportation fuel: Around 6–8%, assuming a normal commute and one car payment already counted elsewhere.

These are not commandments. They’re guardrails—something to push against while you figure out what’s realistic in your city.

Now let’s put numbers to it.

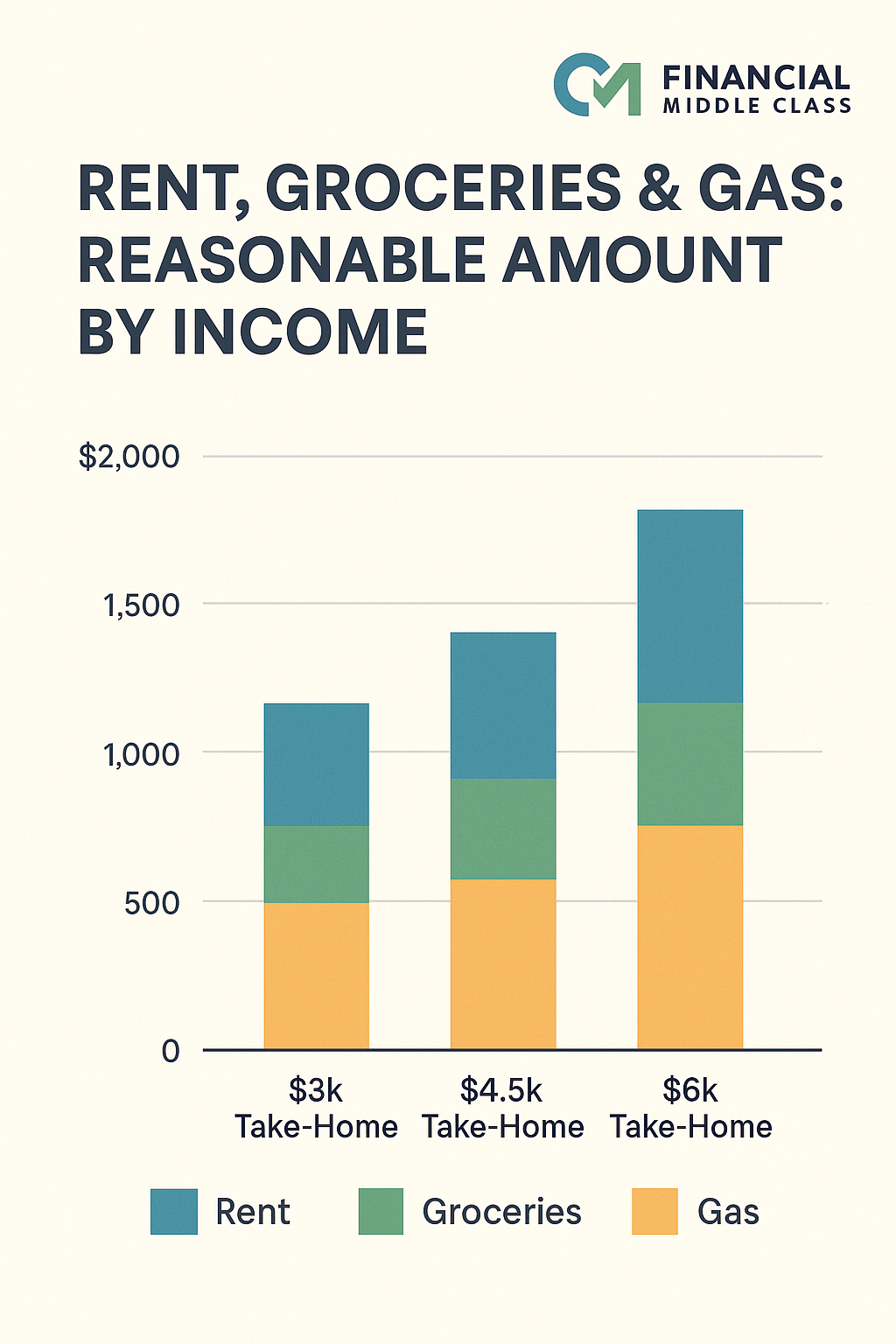

Side-by-Side: $3,000 vs. $4,500 vs. $6,000 Take-Home

We’ll use round numbers and assume you’re aiming at the upper end of “reasonable” for housing (30%), then 10% for groceries, 8% for gas.

Monthly Category Targets

| Take-Home Income | Rent/Housing (30%) | Groceries (10%) | Gas/Transportation Fuel (8%) |

|---|---|---|---|

| $3,000 | $900 | $300 | $240 |

| $4,500 | $1,350 | $450 | $360 |

| $6,000 | $1,800 | $600 | $480 |

Again, these are targets. Not judgments. Not pass/fail.

Let’s walk each scenario and what it feels like in real life.

If You Take Home $3,000 a Month

At $3,000, you’re not broke by default—but you don’t have unlimited room for “oops.”

- Rent around $900 keeps you in the game.

- If you’re paying $1,200 or $1,300, that’s 40–43% of take-home, and it will be hard to keep up savings and debt payoff.

- If you’re paying $1,200 or $1,300, that’s 40–43% of take-home, and it will be hard to keep up savings and debt payoff.

- Groceries at $300 means you’re at $75 a week.

- That’s doable for a single person or careful couple. If you’re feeding kids on this, you’ll need strict meal planning and limited convenience foods.

- That’s doable for a single person or careful couple. If you’re feeding kids on this, you’ll need strict meal planning and limited convenience foods.

- Gas at $240 is $60 a week.

- Manageable in many areas, tight if you have a long commute or drive for work.

- Manageable in many areas, tight if you have a long commute or drive for work.

If your numbers are higher, you have three levers:

- Housing: Roommate, smaller place, cheaper area, or negotiating a lease at renewal.

- Groceries: Switch to a strict list, more cooking, fewer brand-name luxuries.

- Transportation: Carpool, public transit where possible, combine errands.

At this income level, your 50% “needs” bucket fills up fast. You may not hit perfect 50/30/20 numbers—and that’s okay. Your first job is keeping needs under control so there’s anything left for saving and debt.

If You Take Home $4,500 a Month

This is a classic middle-class paycheck range for a lot of two-income households after taxes and benefits.

- Rent around $1,350 (30%) keeps your housing from eating everything.

- If you’re at $1,800–$2,000, you’re in “house rich, life poor” territory.

- If you’re at $1,800–$2,000, you’re in “house rich, life poor” territory.

- Groceries at $450 ($112 a week) can feed a couple or small family with intentional shopping.

- Gas at $360 ($90 a week) is generally comfortable for a normal commute, but it’s still worth watching.

Here, you have more room to make trade-offs.

If you insist on $1,600 rent because of school district or safety, fine—but know that extra $250 is borrowed from somewhere:

- Maybe you drop groceries from $450 to $400 by cutting convenience foods.

- Maybe you make a hard choice on streaming, subscriptions, and “doorstep shopping.”

The key is ownership: you choose where the squeeze lands.

If You Take Home $6,000 a Month

At $6,000 take-home, you’ve got enough income that your problem usually isn’t survival—it’s drift.

- Rent at $1,800 is still 30%. Many in this bracket are closer to $2,200–$2,500, especially in high-cost cities.

- Groceries at $600 ($150 a week) lets you buy more convenience and variety—but it will balloon if you stop paying attention.

- Gas at $480 ($120 a week) might include some weekend drives, kids’ activities, or a longer commute.

If you’re making this kind of money and still feel broke, it’s rarely because groceries are $50 too high. It’s usually:

- Housing quietly over 35–40% of take-home.

- Restaurants, delivery, and impulse shopping filling every leftover inch of the budget.

- Debt payments soaking up the 20% that was supposed to be savings.

The win at this level is not “I got rent under 30%.” It’s “I used the margin on purpose.”

What If Your Reality Is Way Above These Numbers?

Let’s say your take-home is $4,500 and:

- Rent: $1,900

- Groceries: $650

- Gas: $400

You’re not a failure. You’re living in a real market, with real kids, real commutes, and real food prices.

But your budget is telling you the truth:

- Your needs are hogging more than 50%.

- That crushes your 20% savings and debt bucket.

- Something has to give, or the credit card will keep filling the gap.

Your options fall into three buckets:

- Short-term cuts

- Cheaper phone plan, simplified streaming, renegotiated insurance, fewer “pop-in” store trips.

- Cheaper phone plan, simplified streaming, renegotiated insurance, fewer “pop-in” store trips.

- Medium-term structural moves

- Smaller place at lease renewal, different neighborhood, car downgrade, serious meal planning.

- Smaller place at lease renewal, different neighborhood, car downgrade, serious meal planning.

- Income changes

- Overtime, side income, or career moves that lift your take-home over time.

- Overtime, side income, or career moves that lift your take-home over time.

You don’t fix structural problems with latte guilt. You fix them with structural decisions—housing, cars, career.

How to Use These Numbers Without Losing Your Mind

Here’s how I want you to use this:

- Calculate your actual percentages.

- Rent ÷ take-home.

- Groceries ÷ take-home.

- Gas ÷ take-home.

- Rent ÷ take-home.

- Compare to the guardrails.

- Housing near or under 30%? Good.

- Groceries around 10%? Fine.

- Gas near 6–8%? Reasonable.

- Housing near or under 30%? Good.

- Pick one category to attack first.

- The worst one. Not all three at once.

- The worst one. Not all three at once.

- Set a 3-month goal.

- “Move groceries from 14% to 11%.”

- “Get rent from 42% to 35% at next lease renewal.”

- “Move groceries from 14% to 11%.”

- Use the 50/30/20 rule as a compass, not a law.

- If you can’t hit 50/30/20 yet, fine. The direction matters.

- If you can’t hit 50/30/20 yet, fine. The direction matters.

What kills the middle class isn’t that your numbers are “off.” It’s that you never look, never decide, and never adjust.

So run your three numbers. Compare them to the table. Pick your battle.

Your budget doesn’t need to be perfect. It needs to be deliberate.

RELATED ARTICLES

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Jan 24, 2026

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

By FMC Editorial Team

American Middle Class / Jan 23, 2026

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

By FMC Editorial Team

American Middle Class / Jan 21, 2026

The government was about to take your paycheck. Then it hit pause.

Wage garnishment paused for defaulted student loans—what it means for your paycheck, tax refund, and next steps. Read before it restarts.

By Article Posted by Staff Contributor

American Middle Class / Jan 21, 2026

January Is Financial Wellness Month — and Your Boss Cares More Than You Think

January reset: budget, emergency fund, debt & accountability—plus an employer playbook. Use the tools and start today.

By Article Posted by Staff Contributor

American Middle Class / Jan 19, 2026

Trump’s 401(k) Down Payment Plan: A House Today, a Retirement Tomorrow?

Could Trump let you use 401(k) money for a down payment? Learn how it works, risks to retirement, and price impacts—read first.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

The One-Income Family Is Becoming a Luxury. Here’s the Salary It Takes Now.

How much must one parent earn so the other can stay home? See the real math, examples, and tradeoffs—run your number now.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

Credit Cards vs. BNPL: Which One Actually Works for the American Middle Class?

Credit cards vs BNPL: costs, risks, and the best choice for middle-class cash flow. Use this 60-second framework—read now.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

The Affordability Pivot: Can Trump’s New Promises Actually Lower the Middle-Class Bill?

Will Trump’s affordability proposals lower your bills—or backfire? Housing, rates, tariffs, gas, credit cards—explained. Read now.

By Article Posted by Staff Contributor

Business / Jan 13, 2026

Starting a Nonprofit Is Easy. Starting the Right Nonprofit Is the Hard Part.

The estimated reading time for this post is 880 seconds Last updatedJanuary 13, 2026 — Updated for IRS e-filing pathways (Pay.gov), the 501(c)(4) notice requirement, and...

By Article Posted by Staff Contributor

American Middle Class / Jan 12, 2026

America’s 25 Fastest-Growing Jobs—and the part nobody tells you

BLS lists 25 fast-growing jobs for 2024–2034. Learn what it means, avoid traps, and pick a lane that fits your life—read now.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jan 24, 2026

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and...

American Middle Class / Jan 23, 2026

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what...

American Middle Class / Jan 21, 2026

The government was about to take your paycheck. Then it hit pause.

Wage garnishment paused for defaulted student loans—what it means for your paycheck, tax refund, and...