When most people think about emergency funds, they picture young families or working professionals setting aside cash for unexpected car repairs or job loss. But here’s...

Budgeting can feel like a never-ending balancing act for families. Between the mortgage, kids’ activities, rising grocery bills, and saving for the future, money often feels...

No one likes to think about what happens when they’re gone, but the truth is unavoidable: debt doesn’t die with you. If you pass away owing...

If you’re a millennial, chances are you think estate planning is something for your parents or grandparents. After all, you’re still building your career, paying off...

Growing older doesn’t mean financial stress has to grow with you. In fact, your later years should be about peace of mind, not worrying about credit...

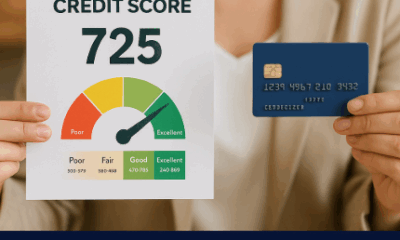

Most people think they have a credit score. One number that decides if you get approved or denied. But that’s not the truth. In reality, you...

You walk into a dealership confident. Credit Karma says 720. The salesman smiles, runs your credit, and suddenly you’re at 660. What gives? The answer lies...

Why Mortgages Are Different Most mortgage lenders still use old FICO models (2, 4, and 5), not the shiny new versions. Why? Because Fannie Mae and...

Credit card companies care about one thing above all: how you handle revolving debt. That’s why the Bankcard model weighs factors like utilization (your balances vs....

Millions of Americans are what lenders call “credit invisible.” They don’t have enough history to generate a traditional FICO score, yet they pay rent, utilities, phone...