Skip to main content Holiday Debt Detox: What to Do in January A 30-day plan to wipe balances, fix your budget, and reset habits after the...

Try a 30-day No-Spend January that actually works—rules, exceptions, and a plan for the savings. Start your January Freeze today.

Stop surprise bills. Automate sinking funds for holidays, school, and repairs—save weekly and stress less. Start your plan today.

How much car can you afford? Use real middle-class math—payment, insurance, debt, stress-test. Avoid traps. Read before you buy.

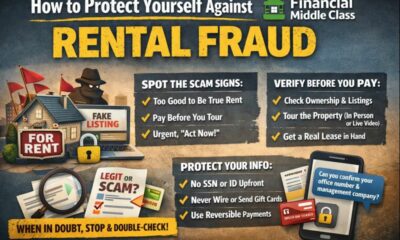

Avoid rental scams fast. Verify listings, protect your deposit & ID, and use copy/paste scripts. Read before you rent.

Stop overpaying for car insurance. Compare coverage right, use discounts, and lower your premium at renewal—read the FMC playbook.

Can student loans be discharged in bankruptcy? Learn the real rules, who qualifies, and next steps. Read before you file.

Is a $2,000 tariff check real in 2026? Learn what’s confirmed, what’s missing, and how to avoid scams. Read before you budget.

Where will home values rise in 2026? See top markets, red flags, and a buyer-first checklist. Read before you move.

ABLE account vs 401(k)/IRA: learn SSI & Medicaid-safe saving rules, limits, and mistakes to avoid. Read the guide.