Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what to do next. Read now.

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

Do big investors drive housing costs? A neutral, data-backed look at the evidence, tradeoffs, and what a ban could change. Read now.

How global conflict and trade shocks hit middle-class budgets in 2026—prices, jobs, rates. Get the evidence and outlook. Read now.

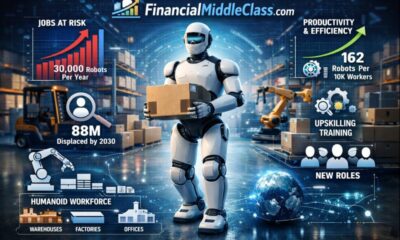

Humanoid robots are moving into workplaces. Here’s what it means for middle-class jobs—and how to adapt. Read the analysis.

Student-loan garnishment is back in 2026. Learn delinquency vs default, offsets, and how to stop collections fast. Read now.

Friends, siblings, cousins are buying homes together to beat high prices. Learn the risks, rules, and how to do it right—read now.

How the ACA reduced job lock—and why the 2026 subsidy cliff could reverse it. See the data, risks, and policy options.