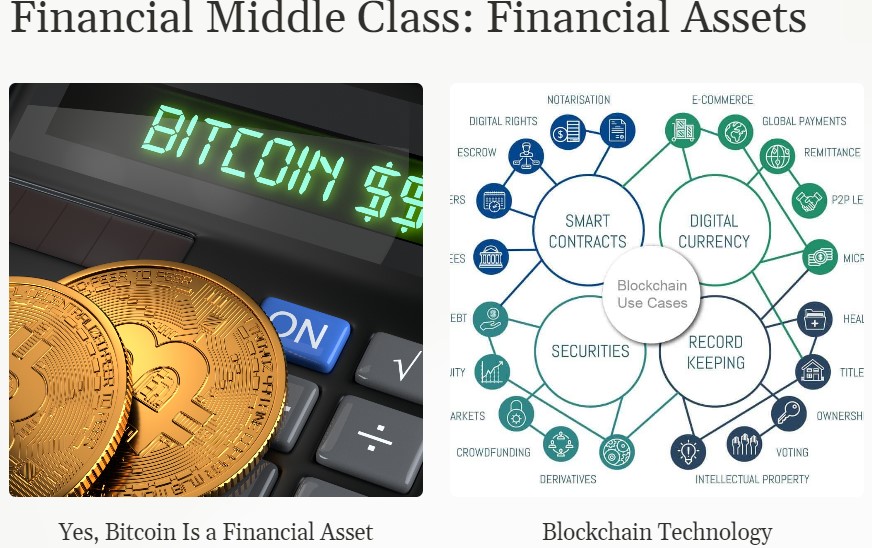

Yes, Bitcoin is a financial asset, but it’s not ready yet to be inside your 401(k), 403(b), and Traditional IRAs. If you know me, then you know that’s breaking news.

For years, I had similar comments about Bitcoin to Warren Buffet, who called it “Probably rat poison squared” and said, “ Cryptocurrencies basically have no value, and they don’t produce anything. If I could buy a five-year put on every one of the cryptocurrencies, I’d be glad to do it.”

Bitcoin has been around for nearly 15 years; it is the first and most valuable cryptocurrency. It was created in response to the 2007-09 financial crisis. Since then, it has gone through the 2014 Russian Financial Crisis, the COVID-19 recession, the lax monetary and fiscal policies that followed that recession, a weak global economy, and high inflation.

I know Buffet said that Bitcoin is worthless, risky, and highly speculative, but the mixed economic events that it has gone through solidify it as a financial asset that is here to stay. It is no longer worthless but still highly risky and speculative.

Let me say this: I first heard of Bitcoin in 2011. One of my favorite podcasts, Planet Money, did an episode on the digital currency. At that time, it was traded for about $14 and just a few cents the year before.

Whenever I tell my friends the story, I get the same “I feel sorry for you’ face with a timely phrase, “You could have been a gazillionaire.”

I dont regret not jumping on the cryptocurrency bandwagon a decade and a half ago because I did not believe in its core fundamental–an ultimate hedge against loose fiscal and monetary policies.

Cryptocurrency enthusiasts believe that government printing money guarantees to cause high inflation and the collapse of fiat currencies. And Bitcoin, because of its scarcity and non-government involvement, would save the day. Besides the separation of money and state doctrine adopted by its fervent supporters, it also has a mysterious founder.

Back in 2011, when Planet Money aired that episode, Bitcoin was mainly used on the Dark Web (a collection of websites that exist on an encrypted network and cannot be found using traditional search engines or visited by regular browsers).

I did not believe in its core fundamentals then and still don’t believe in them because monetary policies have changed drastically since the day Germans had to roll wheelbarrows of Marks to buy a loaf of bread.

Regardless of its resiliency as a digital currency, the United States government can and will undoubtedly dust up antiquated laws such as Article 1, section 8, clause 5 of The U.S. Constitution if it seems like it can rival the greenback. Bitcoin has yet to meet the test of a currency to rival one of the most powerful fiat currencies.

Where Do I Stand on Bitcoin Today

I probably would have embraced Bitcoin if I had understood the Blockchain, the underpinning technology that supports its users’ transactions. The Blockchain is an open ledger system that allows every transaction to be recorded for all to see.

Have I understood the Blockchain technology? I would be more open to learning more about it. Then again, even that is a stretch since Bitcoin and Blockchain were not released as an ecosystem similar to Ethereum.

Bitcoin has been more resilient than I thought it would be. The Federal Reserve and legislative actions responding to the COVID-19 pandemic and economic crisis were $7.2 trillion and $6.2 trillion, respectively. Laxed monetary and fiscal policies caused inflation as expected.

Since early 2022, The Federal Reserve has been raging a brutal economic war on inflation by raising rates 11 times. The digital currency sent mixed messages during that period. From January 2022 to the present, it has been traded as low as $18,000 and as high as $46,000. As of this writing, the live Bitcoin price is $44,395.

After reviewing Bitcoin’s fluctuations before inflation started rising and the Fed launched its inflation-fighting campaign, I conclude that it is still a risky and highly speculative financial asset with violent volatility regardless of the economic cycles or fiscal and monetary policies.

The Fed is approaching its 2% inflation mandate, so it might start cutting interest at its next Federal Open Market Committee (FOMC) meeting in 2024. Another new era of easy money will only add more volatility to cryptocurrencies.

Also, BlackRock, the world’s largest asset manager, Fidelity Investments, and numerous asset managers have filed paperwork with the Securities and Exchange Commission (SEC) for a spot bitcoin ETF, which would hold the cryptocurrency as the underlying asset and track its price.

I was even cautious about calling Bitcoin any asset, but its resiliency for the past 15 years convinced me that it is a financial asset. However, don’t add it to your 401(k), 403(b), Traditional IRAs, and other retirement accounts.