Credit Card Grace Periods Explained: How to Borrow for Free (and the Mistakes That Cancel It)

By Article Posted by Staff Contributor

The estimated reading time for this post is 806 seconds

Credit Card Grace Periods Explained: How to Borrow for Free (and the Mistakes That Cancel It)

Financial Middle Class • Last updated: December 12, 2025 •

TL;DR

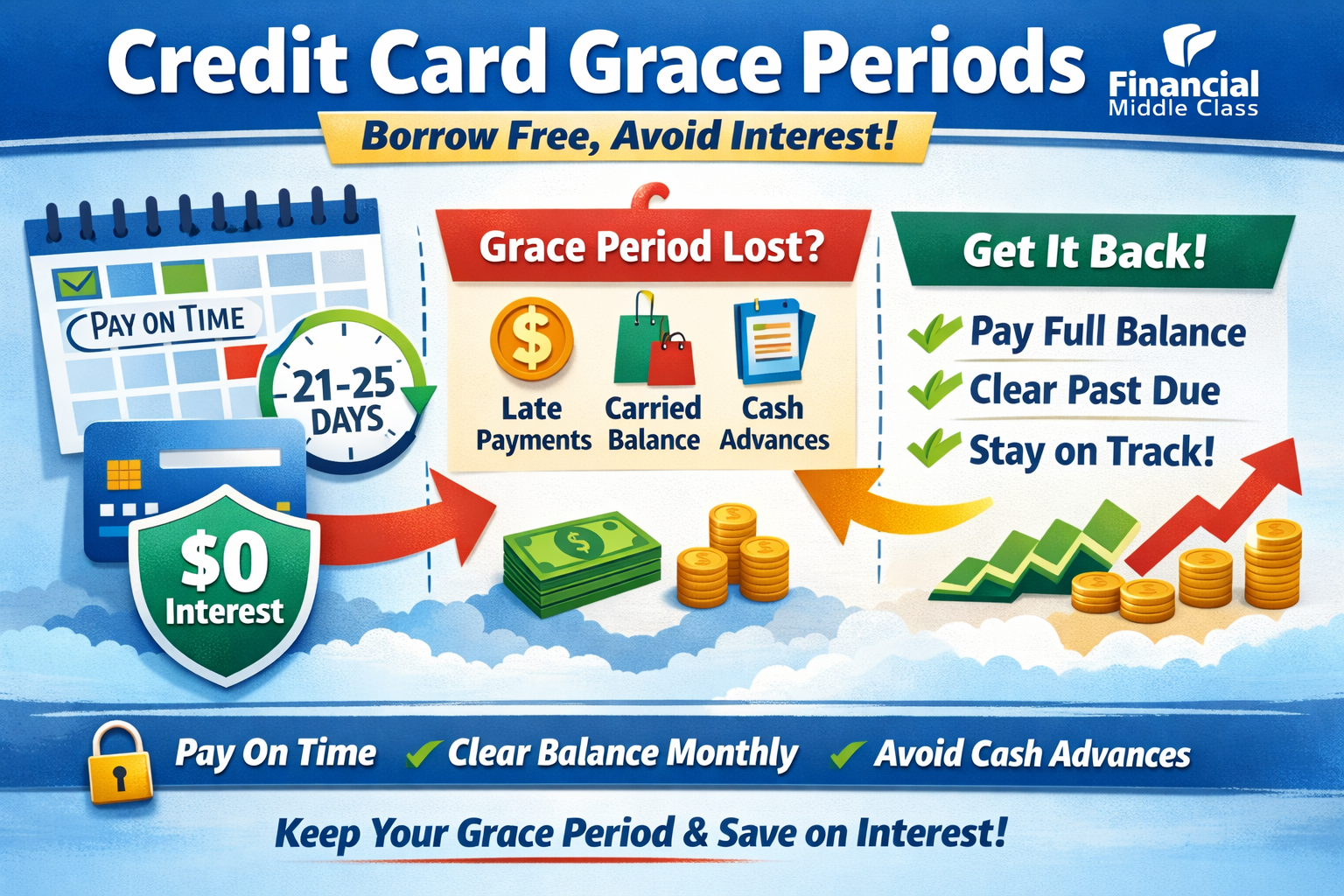

If you pay your statement balance in full by the due date, many cards won’t charge interest on purchases. That “interest-free window” is the grace period.

The moment you carry a balance, many issuers start charging interest on new purchases right away (and your “free borrowing” disappears). Cash advances and some promos can also wreck the grace period logic.

This post shows you how grace periods work in real life, what cancels them, and a simple month-to-month “purchase buffer” strategy to keep interest at $0.

Jump to: Cost Ladder | Choose Your Lane | How It Works | What Cancels It | Purchase Buffer Strategy | Comparison Table | FAQ | One-Page Checklist

Credit card interest is one of those middle-class “quiet taxes” that hits you when you’re already juggling too much. Groceries up, insurance up, rent up, something on the car goes out—and suddenly you’re paying 20-something percent interest because your timing was off by a few weeks.

But here’s the part too many people don’t realize: if you understand the grace period and use it on purpose, you can basically borrow for free on everyday purchases. Not forever. Not irresponsibly. Just… strategically.

Let’s make it simple, practical, and real-world.

The “Grace Period” Cost Ladder (Cheapest → Most Expensive)

Same card. Different rules depending on whether you pay in full, carry a balance, or use cash-like transactions.

Cheapest

Grace period stays intact. Many people pay $0 interest on purchases this way.

Costs creep in

Many issuers start charging interest on new purchases immediately, because you lost the grace period.

Usually priciest

Often no grace period at all. Fees and fast-starting interest are common.

That’s the whole game. Keep the grace period alive, and you keep interest near zero. Lose it, and interest becomes a daily drip.

Choose Your Lane (60 seconds)

Pick the one that matches your reality this month.

Protect the free windowYou’re in the best lane. Your goal is to keep the grace period: autopay the statement balance (if possible), avoid cash advances, and don’t “accidentally” carry $20 into next month.

Middle-class move: use the card for purchases you already planned to make, then pay the statement in full.

Stop paying interest twiceIf you carry a balance, many issuers charge interest on new purchases immediately. Your first mission is to stop adding new purchase balances on that card—or use a separate card you’ll pay in full.

Middle-class move: choose one card to “pay to zero” so the grace period can come back.

Promo doesn’t mean “no interest on everything”Some promos (especially balance transfers or deferred-interest deals) can make new purchases start accruing interest right away if you’re carrying any balance. Don’t assume. Confirm.

Middle-class move: avoid mixing a promo balance with new purchases unless you fully understand the rules.

Treat cash advances like emergency-onlyCash advances often come with fees and may start accruing interest immediately. If you used one, that card might not behave like your normal “purchase + grace period” card for a while.

Middle-class move: confirm terms before repeating anything cash-like.

If your theme strips scripts, read the lane boxes as guidance.

What a grace period actually is (in plain English)

A grace period is the window between the end of your billing cycle and your payment due date. If your card offers a grace period and you’re not carrying a balance, you can avoid paying interest on new purchases by paying the balance in full by the due date.

That’s the clean version. The real-life version is even simpler: the grace period is what makes a credit card feel like a “free short-term loan” when you use it correctly. You swipe today, the statement closes later, and you pay by the due date—no interest on those purchases.

Important detail: not every card is required to offer a grace period. And not every type of transaction gets it, even when the card does. This is where people get cooked.

Quick Definitions (Bookmark This)

| Term | What it means in real life |

|---|---|

| Statement closing date | The day your billing cycle ends and the statement is generated. |

| Payment due date | The deadline to pay at least the minimum (but to keep grace, you usually aim for the full statement balance). |

| Statement balance | What you owe for that billing cycle. Paying this in full is the “no-interest” habit. |

| Current balance | Statement balance plus any new purchases since the statement cut. |

The mistakes that cancel the grace period

This is where the middle class gets hit with that “how am I paying interest when I paid something?” frustration. Because paying something and paying the statement balance are two different worlds.

Mistake #1: Carrying even a small balance. Once you don’t pay the balance in full, many issuers start charging interest not only on the leftover balance, but also on new purchases from the date you make them. That’s the grace period disappearing. And it’s why “I’ll just pay most of it” can still be expensive.

Mistake #2: Mixing a 0% balance transfer with new purchases. A lot of people assume a 0% transfer means “no interest anywhere.” Not necessarily. If you carry a balance month to month, purchases may accrue interest immediately—even when another balance on the card is at 0%.

Mistake #3: Getting trapped in deferred interest. This is the store-card special: “no interest if paid in full within 12 months.” If you miss the terms, you can get hit with interest you thought you avoided. And carrying that promo balance can mess with grace period behavior on new purchases.

Mistake #4: Cash advances and cash-like transactions. Many issuers don’t give a grace period for cash advances. Interest can start right away, and fees can apply. That’s not “free borrowing.” That’s emergency borrowing.

Do This / Not That (Grace Period Edition)

Do thisPay the statement balance in full (or set autopay to do it), then use the card like a tool—not like extra income.

If you can’t pay in full this month, consider pausing new purchases on that card.

Not thatDon’t mix promos with fresh spending unless you’ve confirmed how interest is calculated on new purchases.

“0% somewhere” can still mean “interest over here.”

Red Flags You’re About to Pay Interest (Even If You “Pay On Time”)

- You’re paying the minimum (or “most of it”) instead of the full statement balance.

- You don’t know your statement closing date, so your timing is always accidental.

- You moved a balance at 0% and kept using the same card for new purchases.

- You accepted a “no interest if paid in full” promo and assumed it works like a normal grace period.

- You took a cash advance and expected it to behave like a purchase.

If any of these are true, your card may start charging interest on new purchases immediately.

Call/Chat Script: Confirm Your Grace Period Rules

You’re not being annoying. You’re saving money.

“Hi—can you confirm: (1) whether my card has a grace period on purchases, (2) what transactions don’t qualify, (3) what happens if I carry a balance, and (4) what I need to do to restore the grace period if I’ve lost it?”

The “purchase buffer” strategy (month-to-month, no math required)

This is the simplest middle-class system I’ve seen work for real people: you use your credit card as a timing tool, not a debt tool.

Step 1: Pick one card to be your “pay-in-full” card. That card is where you put normal purchases you already planned to buy—groceries, gas, phone bill, basics. The rule is non-negotiable: you pay the statement balance in full every month.

Step 2: Automate the win. If your budget can handle it, set autopay to “statement balance.” If that feels too risky, set autopay to the minimum (for safety) and manually pay the statement balance a few days before the due date. Either way, you’re building a habit that protects the grace period.

Step 3: Don’t let one bad month poison future months. If you have a tight month and can’t pay in full, don’t keep swiping on the same card like nothing changed. That’s how you lose the grace period and start paying interest on everything. Pause new purchases on that card until you’ve paid it down and your grace period behavior returns.

Step 4: Keep promos in their own lane. If you have a 0% balance transfer or a deferred-interest promo, treat that card like a “locked drawer.” Don’t mix it with new purchases unless you are 100% sure how the issuer allocates payments and how purchases are treated when any balance is carried.

The point of the buffer is not to “float forever.” The point is to stay in the $0-interest zone while you navigate the month you actually live in.

Side-by-side: when interest starts (the part nobody explains clearly)

Grace Period Scenarios Compared

| Scenario | What you do | When interest usually starts | Best move |

|---|---|---|---|

| Grace period intact | Pay statement balance in full by due date | Typically $0 on purchases during the grace period | Keep doing this. Automate it if possible. |

| Grace period lost | Carry a balance month-to-month | Often on new purchases from the date you buy | Pause new purchases; pay down to restore grace period behavior. |

| 0% balance transfer | Carry a promo balance while still spending | Purchases may start accruing interest right away | Separate cards or confirm the issuer’s rules before mixing. |

| Cash advance | Pull cash from card | Often immediately, plus fees | Emergency-only. Confirm terms before repeating. |

FAQ

FAQ: Grace Periods Without the Confusion

Are card companies required to offer a grace period?

No. Many cards do offer a grace period on purchases, but it’s not guaranteed. Always confirm in your card terms.

Do I get a grace period on every kind of transaction?

Usually not. Purchases often qualify. Cash advances often don’t. Balance transfers and promos can have different rules.

What happens if I don’t pay the statement balance in full?

You can lose the grace period. Many issuers will then charge interest on new purchases from the date you make them (not just after the due date).

How do I get my grace period back?

Policies vary by issuer, but typically you’ll need to pay down what you owe and then pay your statement balance in full on time for consecutive billing cycles. If you want the exact rule, ask your issuer directly.

Why did I get charged interest even though I paid by the due date?

If you were already carrying a balance, some issuers keep charging interest until they receive payment, and the timing/interest rules can differ by company. Confirm the details with your issuer.

One-page action checklist (save this)

Grace Period Protection Checklist

- I know my statement closing date and due date (timing is the whole game).

- I pay the statement balance in full (or I’m actively working back toward that).

- I don’t mix 0% promos/deferred-interest balances with new purchases unless I’ve confirmed the rules.

- I avoid cash advances and cash-like transactions unless it’s truly emergency-only.

- If I lost my grace period, I’m not swiping blindly—I’m paying down to restore normal behavior.

Printing strips buttons automatically.

Sources & further reading

• CFPB: What is a grace period for a credit card? Read

• CFPB: Interest rules when carrying a balance Read

• CFPB: Balance transfer + new purchase interest Read

• CFPB: Deferred interest (“no interest if paid in full”) explained Read

Final word: The grace period is one of the few “middle-class friendly” features left in consumer finance. But it only works when you use it on purpose. If you want, tell me whether you currently pay in full or carry a balance, and I’ll help you set up a clean two-card system that protects the grace period while you pay down debt.

RELATED ARTICLES

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

Leave Comment

Cancel reply

Gig Economy

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read the framework and start today.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what to do next. Read now.

By FMC Editorial Team

American Middle Class / Jan 25, 2026

Selling Your Home Isn’t a Chore. It’s a Power Test.

Avoid costly seller mistakes—price smart, negotiate, handle appraisals, and protect your equity. Read the full seller playbook.

By Article Posted by Staff Contributor

American Middle Class / Jan 24, 2026

Home Equity’s Comeback—and the Data Problem Behind the Headlines

Home-equity borrowing is rising fast. See what the data says, what “consumer credit” excludes, and how to evaluate the risks. Read now.

By FMC Editorial Team

American Middle Class / Jan 23, 2026

The Local Rules That Quietly Shape Home Prices

How zoning, delays, and mandates push home prices up. See what “restrictive” looks like—and what reforms work. Read now.

By FMC Editorial Team

American Middle Class / Jan 21, 2026

The government was about to take your paycheck. Then it hit pause.

Wage garnishment paused for defaulted student loans—what it means for your paycheck, tax refund, and next steps. Read before it restarts.

By Article Posted by Staff Contributor

American Middle Class / Jan 21, 2026

January Is Financial Wellness Month — and Your Boss Cares More Than You Think

January reset: budget, emergency fund, debt & accountability—plus an employer playbook. Use the tools and start today.

By Article Posted by Staff Contributor

American Middle Class / Jan 19, 2026

Trump’s 401(k) Down Payment Plan: A House Today, a Retirement Tomorrow?

Could Trump let you use 401(k) money for a down payment? Learn how it works, risks to retirement, and price impacts—read first.

By Article Posted by Staff Contributor

American Middle Class / Jan 18, 2026

The One-Income Family Is Becoming a Luxury. Here’s the Salary It Takes Now.

How much must one parent earn so the other can stay home? See the real math, examples, and tradeoffs—run your number now.

By Article Posted by Staff Contributor

Latest Reviews

American Middle Class / Jan 28, 2026

How Money Habits Form—and Why “Self-Control” Is the Wrong Villain

Learn how money habits form—and how to rewire spending and saving using behavioral science. Read...

American Middle Class / Jan 25, 2026

What to Do If the Home Seller Files Bankruptcy Before You Close

Seller filed bankruptcy before closing? Learn how to protect escrow, fees, and your timeline—plus what...