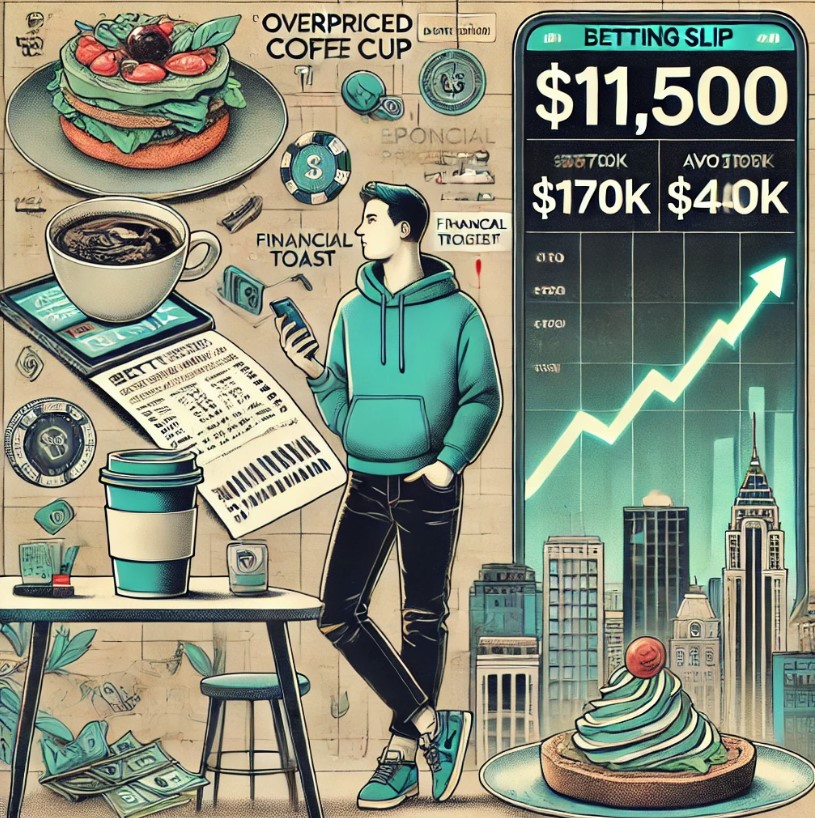

A few days ago, I saw a social media video of a guy who, not even 35 years old, spent a considerable amount of time in line at a Caesars betting window. When his turn finally came, he wagered $11,500 on the Kansas Chiefs to win Super Bowl LIX. Had the Chiefs won, he would have pocketed $21,500—a neat $10,000 profit, roughly an 86.96% return on his bet.

Needless to say, we all knew the outcome. The Chiefs were utterly obliterated by the Philadelphia Eagles—sorry, Chiefkindom—and the young man ended up $11,500 in the red.

Even if Kansas had won, that $10,000 profit—or roughly 86.96% return—would have been earned amid a whirlwind of volatility, given that the outcome was essentially a 50/50 proposition.

This raises a crucial question: why are so many young people willing to take such high risks for nominal rewards, chasing those rags-to-riches narratives? The purpose of this article is to unravel why so many young folks, especially millennials and Generation Z, seem to be nihilistic with their hard-earned money.

We’ll explore two primary causes behind this trend in our hyper-consumerist society: financial literacy and the legacy of Financial Crisis Babies.

Financial Literacy

Let’s start with financial literacy. Numerous surveys show that close to 50% of U.S. adults have only a basic understanding of personal finance—a level that has stubbornly persisted over the years. This means that a vast majority of Americans lack the fundamental financial knowledge needed to make sound decisions. A financially literate person would recognize the binary risk involved in a 50/50 bet and think twice before placing such a wager.

But risky betting isn’t the only imprudent financial decision young Americans are making. They are also forgoing investments in retirement accounts, neglecting savings for a new home, and skipping the crucial step of building an emergency fund for rainy days. Instead, they prefer spending on experiences and convenience.

Experience—I get that. But convenience? Think about Doordash, where a burrito from Chipotle might cost $25, compared to the $15 it would have been if they had picked it up.

Whether it’s a fancy latte, avocado toast, or a trendy Stanley cup, these expenses might not be the sole reason millennials and Generation Z are slower to hit major milestones compared to previous generations, but they certainly add up. The real culprit, however, is that both generations are essentially Financial Crisis Babies.

Financial Crisis Babies – Millennials

The oldest and youngest millennials graduated college in 2003 and 2018, respectively. In 2003, when the oldest millennials received their degrees, the U.S. economy was just recovering from the Dot.com bust and the subsequent recession.

Fast forward to 2018, the youngest millennial graduated into a world that was still feeling the aftershocks of the Great Recession (2007–2009), with employment never quite reaching its former peak. Less than two years after their graduation, a global pandemic struck, threatening to upend everything.

Moreover, life has become increasingly expensive, making those once-achievable milestones even more elusive. Take homeownership, for example. In 2003, when the oldest millennials graduated, the median home price was around $170,000, and a household earning roughly $50,000 annually could comfortably afford it.

Today, the median home price has soared to $450,000, and a buyer would need an annual salary of about $130,000 to manage the purchase—a staggering 165% increase in the median price and a 160% increase in the required annual salary. Yet, the median household income in the United States is estimated to be just $78,171.

Millennials and Generation Z have become nihilistic with their money because they see no hope of reaching these milestones—they’re simply too expensive. Ordering Crumbl cookies on UberEats is not nihilistic; it’s a protest.